The Truth About Index Funds

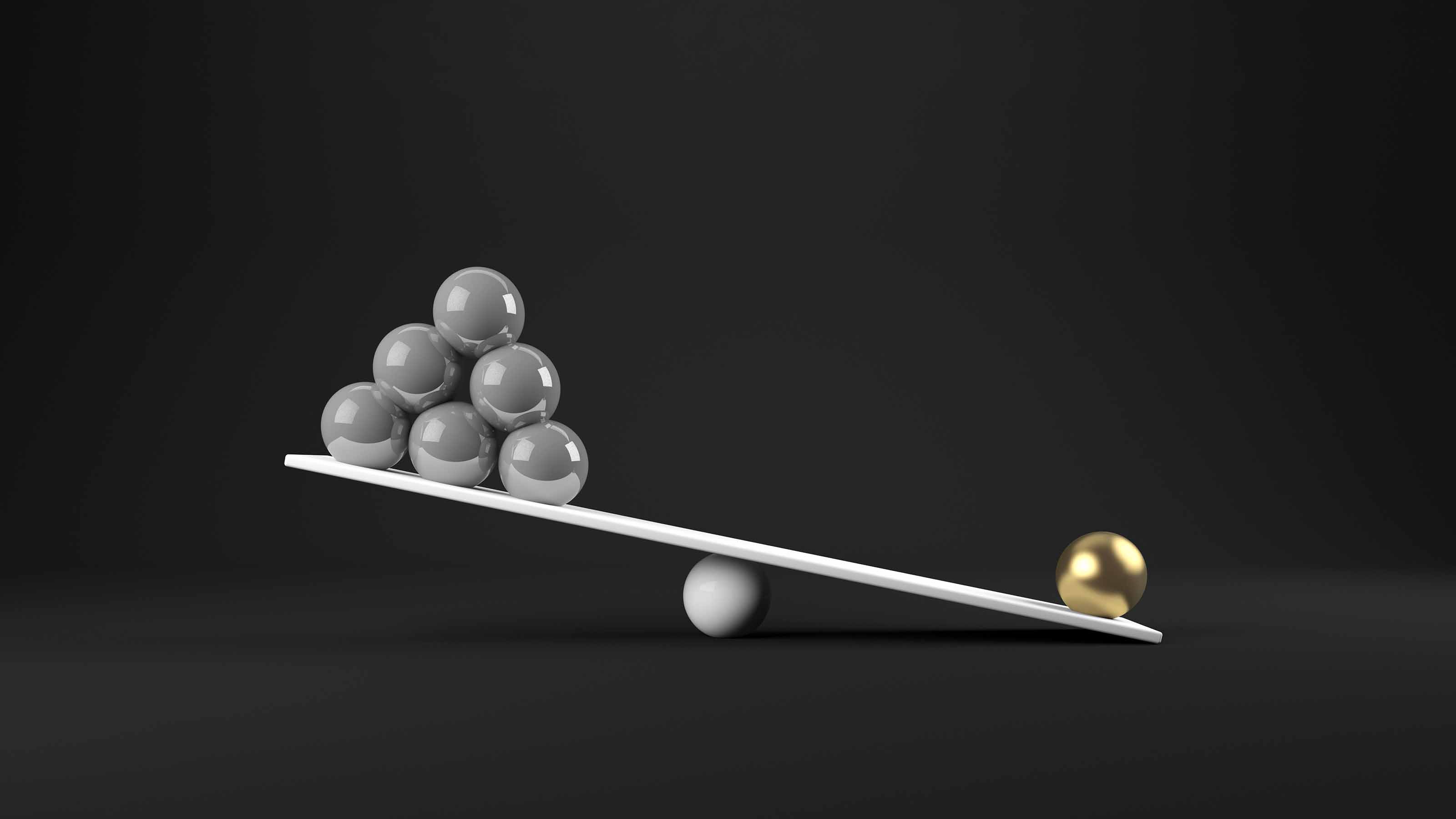

You may think you're diversified by buying an S&P 500 Index fund, but you're making a substantial wager on a handful of stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Index funds, which are designed to mimic the ups and downs of a specific index, from the S&P 500 Index to the Barclays Capital California Municipal Bond Index, have become a runaway success. Index investing was introduced to the public with mutual funds in the 1970s. The strategy got a big boost in the 1990s with the rise of exchange-traded funds (ETFs), which can be bought and sold like shares of stock.

It wasn't until the turn of the millennium, however, that index funds really caught on. Between 2010 and 2020, they grew from 19% of the total fund market to 40%, and two years ago, the total assets invested in U.S. stock index funds surpassed the assets of funds actively managed by human beings. The 13 largest stock funds all track indexes.

No wonder: Compared with managed funds, index funds offer better average returns, in large part because their expenses are lower. According to fund-tracker Morningstar, the 10-year return of Vanguard S&P 500 (VOO), an ETF linked to the most popular benchmark and carrying an expense ratio of just 0.03%, exceeded the return of 87% of its 809 peers in the large-cap blend category. The index has beaten a majority of those peers in every single one of the past 10 calendar years.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also, because only a few of their constituent stocks change each year (the annual turnover rate for the Vanguard fund is just 4%), index funds incur minimal capital gains tax liabilities. (Returns and other data are as of Aug. 6; index funds I recommend are in bold.)

Specialized index funds – ETFs such as the iShares MSCI Brazil (EWZ) or the TIAA-CREF Small-Cap Blend Index (TRHBX) – are straightforward. They let you own a country, region, investing style or industry without having to choose individual stocks or bonds. But what if you want to own the market as a whole, or a big chunk of it? The choices can be overwhelming – and not necessarily what they seem.

Begin with the S&P 500, consisting of roughly the 500 largest U.S. companies by market capitalization (number of shares outstanding times price). Like most indexes, the S&P 500 is weighted by capitalization: The bigger the market cap a company has, the more its influence on the performance of the index. Apple (AAPL), for instance, has about 60 times the impact of General Mills (GIS).

Any cap-weighted index fund is a heavy bet on larger companies. Lately, that bet has become extremely heavy because a few stocks have become gigantic. In 2011, for example, the total market cap of the 10 biggest S&P 500 stocks was $2.4 trillion. Currently, it’s $13.7 trillion. Apple itself has a cap as large today as all 10 of the largest S&P stocks combined a decade ago.

Or consider simply the five trillionaire stocks I highlighted recently. All by themselves, Alphabet (GOOGL), Amazon.com (AMZN), Apple, Facebook (FB) and Microsoft (MSFT) represent 22% of the value of the S&P 500. In recent years, those stocks have been on a tear, and the index has benefited.

Targeted Bet

You may think you are getting broad diversification by buying an S&P 500 Index fund, but you are actually making a substantial wager on a handful of stocks in the same sector. As of July 31, information technology, Apple's category, and communications services, the sector of Facebook and Alphabet, Google's parent, represent a whopping 39% of the S&P 500. By contrast, energy represents just 2.6%.

Most of the other popular broad indexes are similarly top-heavy and focused on technology. Consider the MSCI U.S. Broad Market Index and other gauges that measure all, or nearly all, of the approximately 4,000 stocks listed on U.S. exchanges.

The five trillionaire stocks represent about 18% of the asset value of Vanguard Total Stock Market (VTI), the most popular of the ETFs based on such indexes; that's only a few percentage points less than the trillionaires' weight in the S&P 500. The iShares Russell 1000 (IWB) is an ETF whose portfolio is based on an index of the 1,000 largest stocks. It has about 20% of its assets in the trillionaires; 36% in tech and communications.

I still like the trillionaires, and I like technology, but I have decided no longer to deceive myself by thinking that most index funds tracking the S&P 500 are the best way to own the U.S. market.

Most advisers – me included – urge a balanced approach. For example, I have a personal program of putting the same amount of money every month into each of the dozen or so diversified stocks I own. Then, I rebalance at the end of each year by buying and selling so that each stock is valued roughly the same. Such a strategy makes sense for investing in the broad market as well, but most of the popular index funds don't provide it.

Also, although technology is hot now, sector weightings shift back and forth over time. Don't you want your portfolio tilted toward sectors and stocks that are out of favor?

Between 2014 and 2020, technology ranked in the top four of 11 sectors in all but one year, and it ranked number one in three years. By contrast, energy has ranked last in five of the past seven years, and consumer staples stocks such as Procter & Gamble (PG) have finished in the bottom half of the sector rankings for five years in a row. When you buy the S&P 500, you get a lot of tech but little energy and consumer staples – which is the opposite of what bargain-hunting investors want.

The Equal-Weight Solution

There are, however, ways to avoid loading up on a few stocks, or any one sector.

One is the S&P 500 Equal Weight Index. Each stock represents roughly 0.2% of total assets (there are actually 505 stocks in the S&P 500 Index), with rebalancing at the end of each quarter. As a result, every time the index is rebalanced, the trillionaires account for about 1% of assets; technology and communications, 20%. Over the past 10 years, the S&P 500 has beaten its equally weighted cousin by about one percentage point, annualized, but that's hardly unexpected in a great decade for big growth stocks.

Invesco S&P 500 Equal Weight (RSP), an ETF with an expense ratio of 0.2%, offers an easy way to buy the index. Be warned that its turnover, at 24%, is much higher than a standard broad market index fund's turnover, so it's best to own it in a tax-deferred account such as an IRA.

A second index alternative is my old favorite, the Dow Jones Industrial Average, composed of just 30 large-cap stocks. The Dow is price weighted. In other words, the higher the price of a share of a stock, the more the company's influence on the value of the index.

As weird as price weighting sounds, it enhances the diversification of the portfolio because stocks whose price runs up quickly tend to split, and new companies take their place leading the index. (Many large tech companies, especially, rarely split their shares. But as a result, the Dow won't let them in.)

You can buy the Dow through the SPDR Dow Jones Industrial Average ETF (DIA), nicknamed Diamonds, with an expense ratio of 0.16%. The fund's 10-year annual average return is nearly two points below the S&P 500's, but that’s not bad considering that tech and communications represent just 22% of the portfolio.

I'm not telling you to avoid conventional broad-market funds. Notice that I am still recommending them. I'm just saying there are other ways to get better diversification and come close to really owning the U.S. stock market.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.