I Still Like the Trillion-Dollar Stocks

Unlike the highfliers of the late 1990s, these trillionaires make tons of money.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

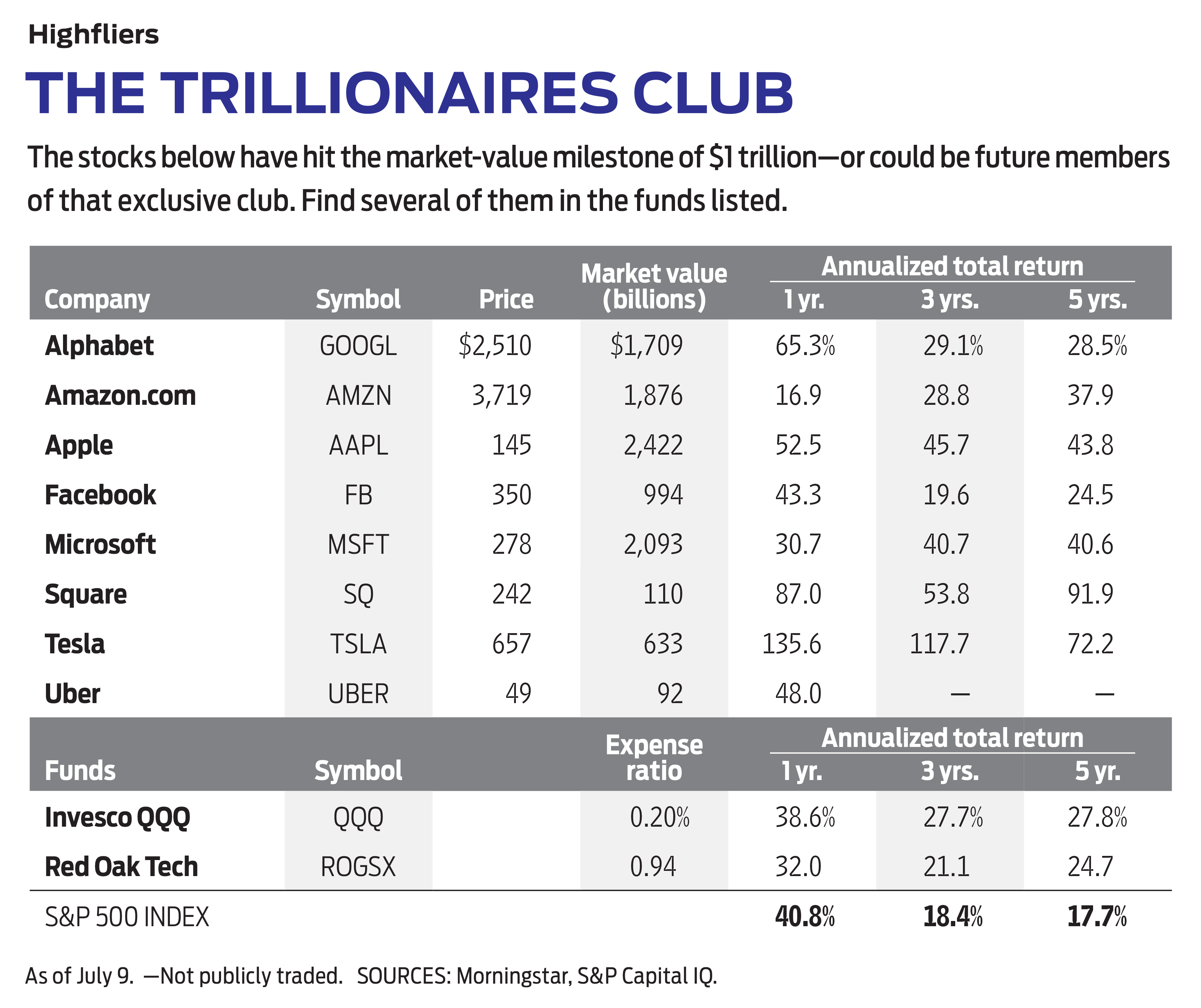

"It may be a matter of months, or more likely a few years," I wrote in September 2017, "but sometime soon a U.S. company will breach the trillion-dollar mark." By June 2021, to my pleasant surprise, all five companies I highlighted had become trillionaires.

The question now is how high these stocks can go. Big is not beautiful to many regulators and elected officials (of both parties), and President Biden is developing an executive order to rein in businesses that dominate their sectors. The Federal Trade Commission (FTC) lost an antitrust case against Facebook (FB) in June, but the setback merely convinced many in Congress that tougher laws are needed.

Another constraint is a sort of law of financial gravity. It's not hard to imagine a stock with a market capitalization (stock price times shares outstanding) of about $100 billion becoming what the great mutual fund manager Peter Lynch called a four-bagger – that is, quadrupling in value.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That could happen with Uber (UBER), Square (SQ) or Zoom Video Communications (ZM). But Apple (AAPL)? As a four-bagger, it would have a market cap of $9 trillion, roughly the same as the gross domestic products of Germany and Japan combined. Investing in giant companies may considerably limit your upside.

Then again, a few years ago the whole concept of a trillion-dollar stock was alien, even nutty. Now, we have Amazon.com (AMZN), which hit the mark just a year after my 2017 column, and Alphabet (GOOGL), the parent of Google, which exceeded $1 trillion in January 2020. Facebook hit the milestone in June. Although it has since retreated some (based on data calculated for this column as of July 9), we're including it in the trillionaires club for now. Plus, there are two stocks whose market caps have breached two trillion dollars: Apple and Microsoft (MSFT).

I've now disclosed the punch line to this column in the boldfaced names (as usual, stocks I like are in boldface). I'm doubling down and recommending them all. As for the trustbusters: If the worst happens, and Google is forced to divest YouTube, Facebook has to shed Instagram, or Amazon has to spin off its cloud business, well, so what? As a shareholder, you will get stock in the new stand-alone companies, too.

The most important fact about these trillionaires is that, unlike the highfliers of the late 1990s, they are making tons of money. Their profit margins are spectacular. For every three dollars in revenues, for example, Microsoft and Facebook drop about a dollar to the bottom line.

Hand Over Fist

The trillionaires are so profitable that they can make massive capital investments that keep them far ahead of competitors, whether actual or potential. Last year, Amazon pumped $40 billion back into its own business, making the company by far the largest capital investor in the U.S. Alphabet and Microsoft rank first and second among U.S. companies in spending on research and development.

All five trillionaires have exceptional balance sheets. Microsoft is one of only two U.S. firms – the other being Johnson & Johnson (JNJ) – with a credit rating of AAA from Standard & Poor's. That's higher than the U.S. government is rated. Alphabet has $135 billion in cash and securities and $28 billion in debt.

Only two trillionaires pay dividends: Microsoft and Apple, both components of the Dow Jones industrial Average. Neither yields more than 1%, but you don’t invest in stocks like these for the payout. They can earn far more by investing their profits than you can. Apple's return on common equity over the past 12 months was 103%.

Let's take a deeper dive on Alphabet. Its main business is selling highly effective, targeted advertising. Revenues took a modest hit because of the 2020 pandemic, so they rose 13% for the year – which for most companies would be sensational. Alphabet is now recovering smartly, with revenues jumping 34% in the first quarter of 2021 compared with the same period a year ago. Google's sales this year will easily exceed $200 billion, up from $38 billion 10 years ago.

The consensus estimate is that profits will rise roughly 50% this year, then settle down to something that has become normal for Alphabet: about 20% annualized. That means close to $100 in earnings per share for the next 12 months. At $2,510 a share, the stock is underpriced. Where else can you buy such consistent growth?

The answer is other trillion-dollar stocks, of course. They're all increasing their profits by double digits. For the year ahead, Apple is forecast to earn $5.12 a share, for a forward price-earnings ratio of 28. Like Alphabet and Apple, Facebook has a P/E in the high 20s. That's not that much more than the average for the S&P 500 as a whole, currently 24. Amazon is the outlier, at nearly 65, but that’s down considerably from 186 four years ago, and Amazon deserves a high P/E. Analysts foresee annual average earnings growth of 38% for the next five years.

Flexibility Pays Off

Amazon was a huge beneficiary of the change in retail shopping behavior, reinforced by the pandemic. The company's U.S. e-commerce sales increased 44% in 2020, and its market share is forecast to rise just above 40% this year; Walmart (WMT) is second in share at 7%.

As I pointed out four years ago, what makes a trillionaire like Amazon attractive is its flexibility. Its Web Services subsidiary, which sells cloud storage, contributed more to operating income in 2020 than did retail sales. In addition, Amazon produces movies and TV shows, and digital advertising is soaring.

Size attracts the attention of lawmakers, regulators and interest groups, but attempts to constrain the trillionaires have so far been unsuccessful.

The recent FTC suit against Facebook, said the judge in the case, did not provide enough support for claims of monopoly. After all, Facebook's share of the digital ad market is 25%, compared with 29% for Google and 10% for fast-rising Amazon. One of the FTC's allegations was that Facebook bought up potential rivals, including WhatsApp and Instagram, thus eliminating competition. But Instagram had just 30 million users in 2012 when Facebook, then with about 1 billion users, acquired the company for $1 billion. Today, Instagram has 1.3 billion users and Facebook has 2.8 billion. All of the trillionaires make acquisitions; some work out very well.

Will any other stocks join the trillionaires club? Currently, there's a big drop-off from Facebook, at $994 billion, down to the sixth-largest U.S. company, Tesla (TSLA), at $633 billion, followed by Berkshire Hathaway and Visa. I’m betting Tesla will make the club in the next two or three years.

If you want to buy the five trillionaires as a group, a good choice is Red Oak Technology Select (ROGSX), a managed mutual fund that owns just 27 stocks, with the five trillionaires accounting for the top five holdings and representing 33% of assets. For more concentration, consider Invesco QQQ Trust (QQQ), an exchange-traded fund that mimics the Nasdaq 100, the largest stocks on that exchange. The trillionaires represent roughly 40% of QQQ's assets – and you get Tesla to boot.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

QUIZ: Are You Ready To Retire At 55?

QUIZ: Are You Ready To Retire At 55?Quiz Are you in a good position to retire at 55? Find out with this quick quiz.

-

10 Decluttering Books That Can Help You Downsize Without Regret

10 Decluttering Books That Can Help You Downsize Without RegretFrom managing a lifetime of belongings to navigating family dynamics, these expert-backed books offer practical guidance for anyone preparing to downsize.

-

New Ways to Keep Online Accounts Safe

New Ways to Keep Online Accounts SafeAs cybercrime evolves, the strategies you use to protect yourself need to evolve, too.

-

Why I Trust These Trillion-Dollar Stocks

Why I Trust These Trillion-Dollar StocksThe top-heavy nature of the S&P 500 should make any investor nervous, but there's still plenty to like in these trillion-dollar stocks.

-

Stocks Close Out Strong Month With Solid Amazon Earnings: Stock Market Today

Stocks Close Out Strong Month With Solid Amazon Earnings: Stock Market TodayAmazon lifted its spending forecast as its artificial intelligence (AI) initiatives create "a massive opportunity."

-

Stocks Sink with Meta, Microsoft: Stock Market Today

Stocks Sink with Meta, Microsoft: Stock Market TodayAlphabet was a bright light among the Magnificent 7 stocks today after the Google parent's quarterly revenue topped $100 billion for the first time.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

Alphabet Stock Pops After Google Antitrust Ruling: What to Know

Alphabet Stock Pops After Google Antitrust Ruling: What to KnowGOOGL stock is soaring Wednesday after a judge ruled that Alphabet does not have to divest its Chrome browser.

-

Stocks Slip Ahead of July CPI Report: Stock Market Today

Stocks Slip Ahead of July CPI Report: Stock Market TodayThe latest inflation updates roll in this week and Wall Street is watching to see how much of an impact tariffs are having on cost pressures.

-

Nasdaq Ends the Week at a New High: Stock Market Today

Nasdaq Ends the Week at a New High: Stock Market TodayThe S&P 500 came within a hair of a new high, while the Dow Jones Industrial Average still has yet to hit a fresh peak in 2025.

-

Stocks Swing Lower as Eli Lilly, Fortinet Spiral: Stock Market Today

Stocks Swing Lower as Eli Lilly, Fortinet Spiral: Stock Market TodayThe main indexes finished well off their session highs after a disappointing batch of corporate earnings reports.