ESG Gives Russia the Cold Shoulder, Too

MSCI jumped on the Russia dogpile this week, reducing the country's ESG government rating to the lowest possible level.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The environmental, social and governance (ESG) rating firm MSCI downgraded Russia’s ESG Government rating this week, from B to the lowest rating possible, CCC.

Many ESG fund managers rely on MSCI ratings for portfolio construction and for ETF indexes. Thus, many Russian companies could end up being cycled out of funds that rely on maintaining a minimum ESG ratings bar for inclusion.

The downgrade acts as yet another hit to Russian investments, many of which have been flattened since the country’s invasion of Ukraine. It's not the first one, either; MSCI ESG Research originally downgraded Russia at the end of February.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

“Since the downgrade to B on Feb. 28, we have observed further heightening of Russia’s ‘Economic Environment’ and ‘Financial Governance’ risks based on the widening domestic impact of international sanctions and financial isolation on Russia’s economy,” the MSCI notice said.

Many firms have halted new investments in Russia. JPMorgan Chase, BlackRock and State Street have all announced that they are exiting Russia as able, and JPMorgan also removed Russian debt from its tracking indexes.

You can thank an increasingly untenable financial situation for both the country and its investments alike. Debt rating agencies S&P, Fitch and Moody’s lowered Russia’s credit rating to at or near junk status as of March 3, a full five days before MSCI made its latest downgrade.

ESG was at least part of the conversation. These debt rating agencies incorporate environmental, social and governance considerations when they are believed to be “material,” or important to a company’s financial performance.

Fitch, for example, cited its incorporation of country-level World Bank Governance Indicators for political risk and rights in its credit assessment. Moody’s considers a country’s inability to repay debt an ESG criterion, also pointing to Russia’s poor governance and corruption.

ESG Not Exactly Hot on Russia in the First Place

A Bloomberg analysis found that only about 300 of 4,800 ESG funds held Russian companies. Bloomberg noted that several ESG funds invested in Russia in search of green or responsible companies to meet intense demand from investors. These ESG investors might have waived human-rights concerns to further goals like renewable energy.

Other ESG investors, Bloomberg noted, steered clear of Russia.

Morningstar’s Jon Hale found that ESG funds held fewer Russian companies than conventional funds.

“Sustainable emerging-markets equity funds have, on average, just 1.8% exposure to Russian equities, nearly two-thirds less than the overall category average.” Hale notes that in most cases, Russian companies are ESG laggards and don’t meet fund criteria.

The question going forward is whether future ESG criteria will take a longer, harder look at investments in autocracies.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ellen writes and edits retirement stories. She joined Kiplinger in 2021 as an investment and personal finance writer, focusing on retirement, credit cards and related topics. She worked in the mutual fund industry for 15 years as a manager and sustainability analyst at Calvert Investments. She earned a master’s from U.C. Berkeley in international relations and Latin America and a B.A. from Haverford College.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Is JPMorgan Chase Stock a Buy, Hold or Sell After Earnings?

Is JPMorgan Chase Stock a Buy, Hold or Sell After Earnings?JPMorgan Chase is trading higher after the big bank topped fourth-quarter earnings expectations, but is the stock a Buy? Here's what you need to know.

-

Is A Recession Looming? Two Big Bank CEOs See It That Way

Is A Recession Looming? Two Big Bank CEOs See It That WayRecession is likely, Citi's CEO told a Senate panel today, a sentiment echoed by JP Morgan's chief executive last week.

-

Stock Market Today: S&P 500 Joins Nasdaq in Correction Territory

Stock Market Today: S&P 500 Joins Nasdaq in Correction TerritoryThe Nasdaq managed to hold higher into the close thanks to a strong earnings reaction for mega-cap stock Amazon.

-

Stock Market Today: Stocks Finish Mixed as Q3 Earnings Season Kicks Off

Stock Market Today: Stocks Finish Mixed as Q3 Earnings Season Kicks OffThe main markets opened higher thanks to solid bank earnings but sentiment fizzled into the close.

-

Bond Basics: How to Reduce the Risks

Bond Basics: How to Reduce the Risksinvesting Bonds have risks you won't find in other types of investments. Find out how to spot risky bonds and how to avoid them.

-

Bond Ratings and What They Mean

Bond Ratings and What They Meaninvesting Bond ratings measure the creditworthiness of your bond issuer. Understanding bond ratings can help you limit your risk and maximize your yield.

-

Stock Market Today: Stocks Rise Ahead of Fed

Stock Market Today: Stocks Rise Ahead of FedBank headlines dominated another choppy day of trading on Wall Street.

-

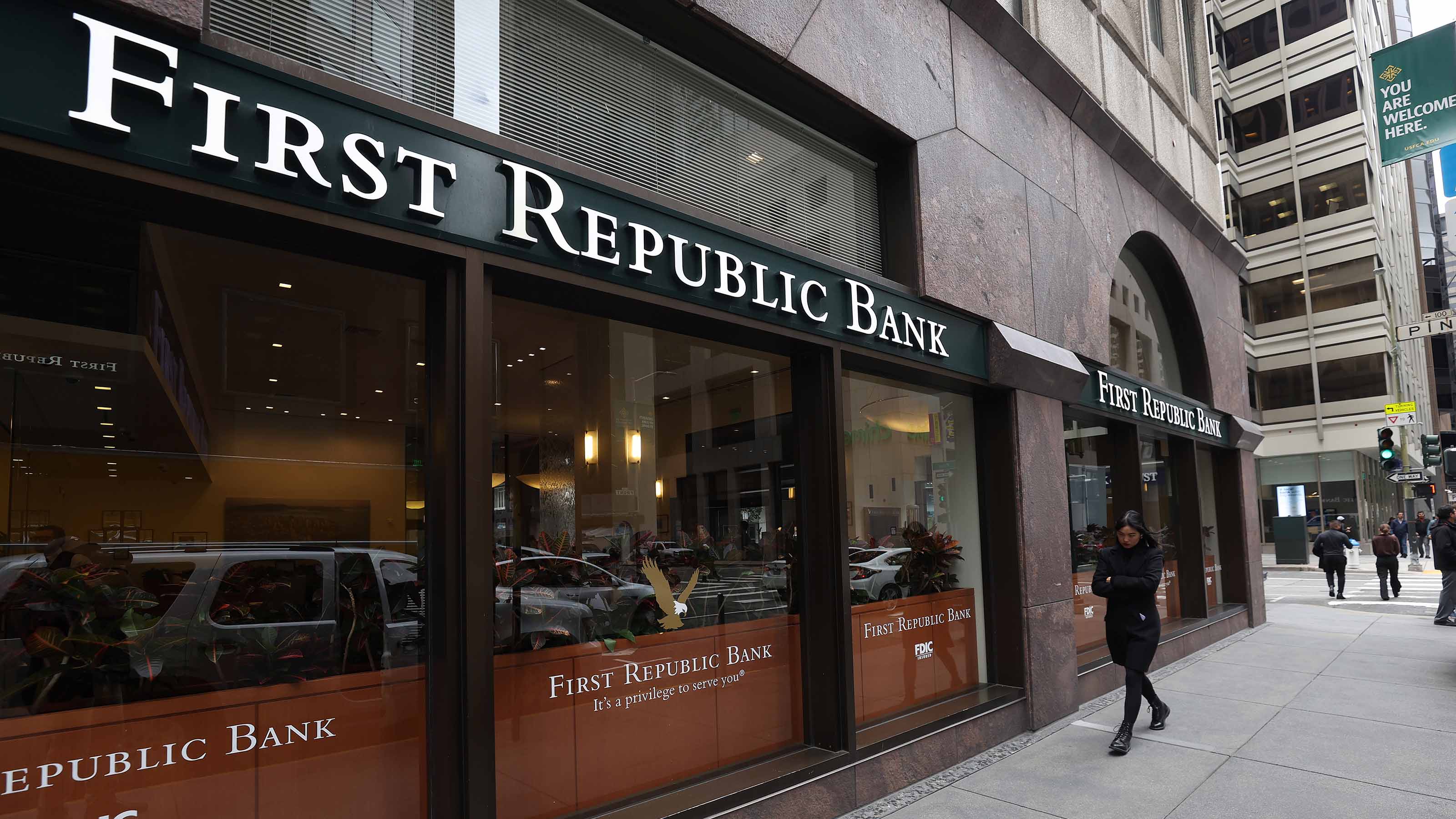

Stock Market Today: Stocks Rally on Credit Suisse, First Republic Bank Rescue News

Stock Market Today: Stocks Rally on Credit Suisse, First Republic Bank Rescue NewsReports that major U.S. banks would step in to help First Republic Bank helped stocks swing higher Thursday.