What Should Your Adviser Do in Times of Market Volatility?

Positioning your investments—and educating you—to cope with all market environments should be Job One.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The headline above poses a trick question. The short answer is: nothing that he or she shouldn’t be doing already to help you prepare for the future and be well positioned for the present.

Market volatility tests everyone’s nerves. It’s a recurring phenomenon, a symptom of larger concerns making themselves felt in the markets. The proverbial “wall of worry” includes the current unease with the state of the global economy and today’s turbulent geopolitics. Historically, volatile periods in the markets eventually sort themselves out.

In building a portfolio to meet your goals and needs, your adviser should have taken potential episodes of volatility into account. The point is to support your ability to live your life in ways that are satisfying and rewarding—without undue worry about the market’s short-term gyrations.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

So what risk-control techniques should your adviser have in place to achieve all this? What should be your attitude toward market volatility?

Philosophy and Strategy

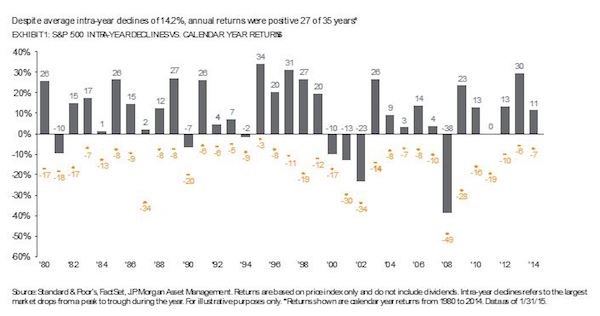

First, please consider the graphic below. Many people have short-term memories for market volatility, often erroneously recollecting recent rides as relatively smooth. Think again: Since 1980, in the majority of years in which the U.S. stock market has turned in positive returns, there have been significant interim downdrafts.

I can’t emphasize enough that, over the long term, market participants earn more, on average, than those who sit apprehensively on the sidelines in cash or other low-risk instruments. During recent months in the equity markets, stocks have been lunging fairly dramatically between highs and lows. How do you manage volatility risk when volatility increases? This must engage both philosophy and strategy:

Philosophy: One of the most meaningful aspects of your adviser’s role should be in educating and preparing you for times like these. Your responsibility as a client is to choose an adviser whose investment philosophy you understand and find consistent with your own beliefs. Your adviser is responsible for understanding your goals and attitude toward risk, implementing a strategy consistent with these, and communicating this so you both understand it and feel comfortable with it.

Working with the right adviser isn’t meant to guarantee that you’ll feel great when the markets take a precipitous turn. But if you’re well diversified and plan to remain invested for the long term, you should have the confidence in your adviser’s strategy to be able to say, “It’s going to be okay.”

Strategy: Your adviser’s strategy, in helping to shore up your economic ability to bear volatility risk, plays a huge role in why “It’s going to be okay.” The first step is helping you ascertain how much you need in reserves to support your cash flow for the next three years. Your adviser should have allocated that money in instruments that are more defensive during periods of volatility. So that if, for whatever reason, you need cash in the near term, you won’t pay a heavy price: No need for forced sales at the bottom.

Goal Matching

Obviously, selling when the markets are down can be damaging to a portfolio’s long-term performance. For those who need to sell holdings to fund immediate financial needs, this may be unavoidable. The traditional way of dampening volatility—holding long-dated, high-quality bonds—not only depresses earnings, but also presents a different risk: exposure to bubble pricing in bonds.

At Halbert Hargrove, we address these risks through clients’ direct ownership of bonds, so that maturing issues, invested in a “ladder” sequence, can provide cash flow if needed. This tactic can help market volatility to have a reduced effect on both personal cash flow and portfolio performance. Depending on a client’s life situation, the proceeds from maturing bonds can be reinvested. If interest rates rise, you can then reinvest at higher rates. But the funds are there if needed.

Diversification

But what about investing for longer-term goals? Diversification is key. When you’re diversified, you’re holding different types of assets with separate and distinct return patterns that reflect different potential states of the world—including volatility. Investment characteristics such as value, small cap, momentum, and low beta, as well as the diversification effects of, say, managed futures, do work over time, but not at all times.

I like to say that diversification means always having to say you’re sorry. Holding a truly diversified portfolio with risk characteristics appropriate for both your risk appetite and your needs for investment returns means that some elements will not be working at any given time. The objective is a harmonious whole that will meet your investment goals over a long time horizon.

Patience and Perspective

There are many other volatility-addressing tactics in a skilled planner’s toolbox. Rebalancing, for example, is the process of bringing portfolio allocations back to target weights, thus buying low and selling high as asset returns revert to their average relationships. This should be executed with added consideration for taxes, trading costs, and the effect of volatility on relative valuations.

Another important discipline you and your adviser should be participating in together is the regular review of your values, long-term goals and risk tolerance. This should serve you well during the tough periods, providing perspective, and reinforcing all those important reasons why, in the long run, you’re remaining on the right track.

Trying to predict or react to volatility just doesn’t carry good odds for success. Disciplined investing on the other hand—particularly diversification—has historically helped those long-term investors who remain invested to capture good performance when it (unpredictably) occurs. This requires both patience and perspective, as we hold on during those exasperatingly rough rides until the markets find their bearings once again.

Russ Hill CFP®, AIFA® is CEO and Chairman of Halbert Hargrove, based in Long Beach, CA. Russ specializes in investing, financial planning and longevity-awareness solutions.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Russ Hill CFP®, AIFA® is CEO and Chairman of Halbert Hargrove Global Advisors LLC, an independent registered advisory firm based in Long Beach, CA. He has led the firm for more than 40 years, specializing in investing, financial planning and longevity-awareness solutions. Russ is heavily involved with Stanford University's Center on Longevity, and has helped to launch the Center's symposiums and Design Challenges on aging-related challenges.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

Are You Honest With Your Financial Adviser? Why Hiding the Truth Can Cost You

Are You Honest With Your Financial Adviser? Why Hiding the Truth Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

5 Actions to Set Up Your Business With Your Exit in Mind, From a Wealth Adviser

5 Actions to Set Up Your Business With Your Exit in Mind, From a Wealth AdviserWhen you're starting a business, it may seem counterintuitive to begin with exit planning. But preparing will put you on a more secure footing in the long run.

-

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial Planner

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial PlannerIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)The administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

AI-Powered Investing in 2026: How Algorithms Will Shape Your Portfolio

AI-Powered Investing in 2026: How Algorithms Will Shape Your PortfolioAI is becoming a standard investing tool, as it helps cut through the noise, personalize portfolios and manage risk. That said, human oversight remains essential. Here's how it all works.

-

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save Them

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save ThemLarge unrealized capital gains can create a serious tax headache for retirees with a successful portfolio. A tax-aware long-short strategy can help.

-

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)Separating facts from fiction is an important first step toward building a retirement plan that's grounded in reality and not based on incorrect assumptions.

-

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You Think

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You ThinkTalking to heirs about transferring wealth can be overwhelming, but avoiding it now can lead to conflict later. Here's how to start sharing your plans.