The Folly of Market Timing

If you want to make money in the stock market, you have to be in—all the time.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Market timing for fun and profit! Now that sounds good, right? Who wouldn’t want to have fun while making a profit? In the investment world, that’s the siren song of the market timer. They ask the obvious question, “Why would you want to invest in the market when it’s going down?” Of course no one would.

As a consequence, there is an overwhelming temptation to follow the guru who promises to help you avoid bear markets by trying to ride market updrafts and avoid drops. That approach of beating the market is an overwhelming temptation for many investors.

A simple analysis of market history would show that if you called the market correctly every year you’d be rich. If you were correct in calling the market even half the time, your return wouldn’t be too bad, either. Given those odds, why wouldn’t you give market timing a shot?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The problem is that, as in many cases, simple statistics can be very misleading—like the stories of the man who drowned in a lake with an average depth of 3 feet, or the man who thought he’d be comfortable with his head in an oven and his rear in the refrigerator.

Assuming returns based on the concept of flipping a coin can be very misleading. What matters is the actual annual sequence of returns. Remember, a market timer has to be right twice – when to get out AND when to get back in. Consider the following example:

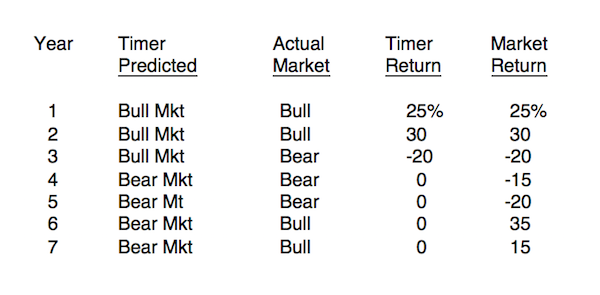

The timer correctly called the bull markets in years 1 and 2 but missed the first bad market in year 3. He then redeemed himself by calling the serious bear markets in years 4 and 5, avoiding a 35% loss. Unfortunately, while waiting for confirmation that the market had turned, he missed the dramatic bull markets in years 6 and 7 (remember, you have to decide when to get back in as well as when to get out). The result: Patient investor, 4.6% annual return; Timer, 3.9%.

How likely is it that this will happen to a market timer? Over time, it’s just about guaranteed. Consider the grand recession. From November ‘07 to March ‘09, the market fell 46.7%. The subsequent one-year return was 53.6%!

Still not convinced? If I asked you to name the top 10 artists of all time or the top 10 baseball players or the top 10 presidents, we’d all have our own list and happily debate our choices. Now, let me ask you, name the top 10 market timers of all time? Having trouble? How about the top 5? Still stuck? How about the top 1? I’m sure you’re still having trouble.

My point is, if anyone had successfully timed the market over an extended period of time we would know his or her name as they would be one of the richest people in the world. The fact that we don’t know any names should be a warning sign not to chase the illusion of market timing.

Research has shown that when you factor in transaction costs you would have to be correct almost 70% of the time. And that assumes instantaneous switching from stock to cash and back. The real world doesn't work that way. If you factor in a time delay for switching to look for a market “confirmation,” you would have to be correct almost all of the time to beat the buy-and-manage alternative.

The moral? If you want to make money in the market, you have to be in the market – all of the time.

Harold Evensky, CFP is Chairman of Evensky & Katz, a fee-only wealth management firm and Professor of Practice at Texas Tech University. He holds degrees from Cornell University. Evensky served on the national IAFP Board, Chair of the TIAA-CREF Institute Advisor Board, Chair of the CFP Board of Governors and the International CFP Council. Evensky is author of The New Wealth Management and co-editor of The Investment Think Tank and Retirement Income Redesigned.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Harold Evensky, CFP® is Chairman of Evensky & Katz, a fee-only investment advisory firm and Professor of Practice in the Personal Financial Planning Department at Texas Tech University. Evensky served as Chair of the TIAA-CREF Institute Advisor Board, Chair of the CFP Board of Governors and the International CFP Council. He is on the advisory board of the Journal of Retirement Planning and is the Research Columnist for Journal of Financial Planning. Evensky is co-author of The New Wealth Management and co-editor of The Investment Think Tank and Retirement Income Redesigned. Mr. Evensky has received numerous awards over the years. The most recent is Investment Advisor Magazine, 2015 IA 35 for 35 recognizing the advisor advocates, investors, politicians and thought leaders have stood out over the past 35 years and will influence financial services for decades to come. Don Phillips of Morningstar called Mr. Evensky the dean of financial planning in America.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.