3 Tips for Trading ETFs

Even the cognoscenti among you may find these suggestions useful.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

We introduced the Kiplinger ETF 20 last month. Because the process of buying and selling ETFs may be unfamiliar to some of you, we’re following up with some tips for trading ETFs.

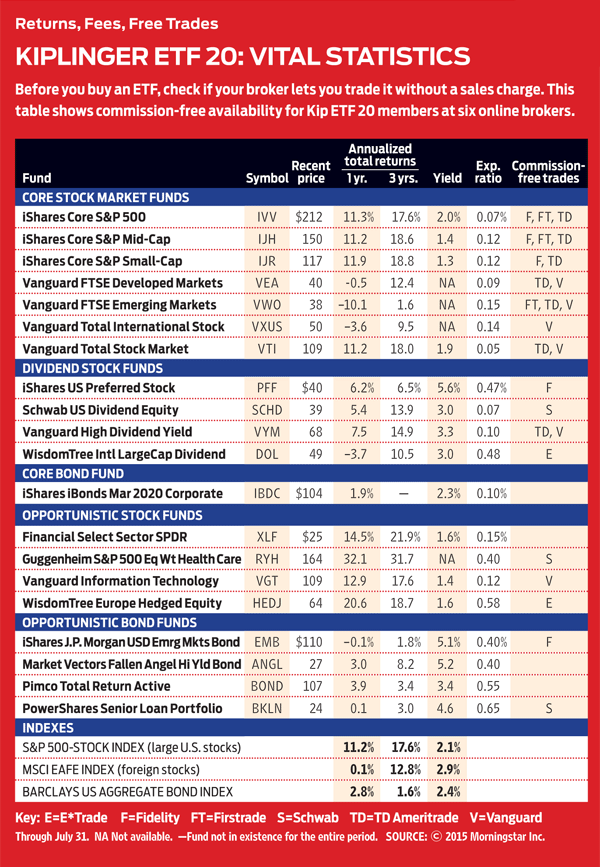

Buy commission-free. Because ETFs trade like stocks, you typically incur a brokerage commission whenever you trade a fund. Fortunately, all of the major discount brokerages let you buy and sell certain ETFs without commissions if you trade online. The table to the right tells you which brokers let you trade our favorite ETFs free.

Use limit orders. Limit orders allow you to specify the price at which you are willing to buy and sell shares. Enter an ETF’s symbol on your broker’s Web site and you’ll see a bid price (the highest price a buyer is willing to pay) and an ask price (the lowest price a seller is willing to accept). Because most of the funds in the Kip ETF 20 are popular, the gap between the bid and ask prices is usually narrow. On one recent day, for instance, the bid-ask spread for iShares Core S&P 500 was just 2 cents, or 0.01% of the share price. But less widely traded ETFs are likely to sport wider spreads, says Max Chen, of ETFTrends.com. For example, the bid-ask spread for Vanguard Russell 1000 ETF (VONE) was recently 0.10%. By using a limit order, you’ll lessen the risk of getting an unfavorable price on your transaction.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Limit orders can protect you during runaway markets, too. Between 2:40 p.m. and 3 p.m. eastern time on May 6, 2010, more than 300 securities, including many ETFs, traded at prices that were off by 60% or more from their levels before 2:40 p.m., even though the market fell far less. The “flash crash” was a freakish event, but it underscored the need to use limit orders when trading ETFs, especially when markets are volatile.

Watch for pricing anomalies. ETF share prices sometimes diverge from the value of the securities held inside an ETF. When buying an ETF, you want to avoid paying much more than the fund’s net asset value, or NAV, per share, and when selling, you want to make sure that the share price is not far below NAV.

You can eyeball whether a fund is trading at, above or below its NAV by comparing a fund’s current share price with its intraday NAV, known as the intraday indicative value. Go to Morningstar.com and enter a symbol for an ETF. On one recent day, for instance, the intraday indicative value of Market Vectors Vietnam (VNM) was $17.94, but the ETF traded at a share price of $17.78, or a 0.9% discount to the fund’s NAV.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

What Fed Rate Cuts Mean For Fixed-Income Investors

What Fed Rate Cuts Mean For Fixed-Income InvestorsThe Fed's rate-cutting campaign has the fixed-income market set for an encore of Q4 2024.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

The Final Countdown for Retirees with Investment Income

The Final Countdown for Retirees with Investment IncomeRetirement Tax Don’t assume Social Security withholding is enough. Some retirement income may require a quarterly estimated tax payment by the September 15 deadline.

-

Dividends Are in a Rut

Dividends Are in a RutDividends may be going through a rough patch, but income investors should exercise patience.

-

Municipal Bonds Stand Firm

Municipal Bonds Stand FirmIf you have the cash to invest, municipal bonds are a worthy alternative to CDs or Treasuries – even as they stare down credit-market Armageddon.

-

High Yields From High-Rate Lenders

High Yields From High-Rate LendersInvestors seeking out high yields can find them in high-rate lenders, non-bank lenders and a few financial REITs.

-

Time to Consider Foreign Bonds

Time to Consider Foreign BondsIn 2023, foreign bonds deserve a place on the fringes of a total-return-oriented fixed-income portfolio.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.