Earn Up to 6% From Our Fund Portfolios

Our mutual fund and ETF portfolios deliver attractive yields while helping to lower risk.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you own a mix of stocks and bonds, you may expect the stocks to cause you periodic bouts of anxiety. But it’s bonds that have been acting up lately, and in coming years they may not live up to their reputation as a portfolio sedative.

After benefiting from declining interest rates for decades, bond investors are now bracing for rates to rise over the next few years as the economy heats up. That prospect has sent bond yields soaring and pushed down prices (which move in the opposite direction). From July 8, 2016, through the end of the year, the yield of the benchmark 10-year Treasury note rose from less than 1.4% to 2.5%—a stunning jump. Over that period, investment-grade U.S. bonds slumped by 3.2% on a total-return basis. And that could be just the start of a long, painful period for bond investors. “By the next presidential election, we’ll see the 10-year Treasury at 6%,” predicts Jeffrey Gundlach, comanager of DoubleLine Total Return Fund, a member of the Kiplinger 25.

Rising yields aren’t entirely bad; you’ll pocket more income as rates increase. But you could lose money along the way. Buying a 30-year Treasury bond, for example, would get you a yield of 3.1%. But if market rates were to increase by one percentage point, the bond’s price would likely fall by nearly 20%, wiping out more than six years’ worth of interest income.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Go short

So how do you invest for income in this climate? Start by playing it safe, says Scott Schwartz, a money manager with Bleakley Financial Group, in Fairfield, N.J. Because long-term bonds look risky now, Schwartz recommends swapping them for bonds with shorter maturities, which should hold their value better if rates continue to rise. “In fixed-income now, everyone is playing defense,” he says.

Even with rates increasing in recent months, high-grade short-term bonds don’t pay much. But you can supplement your income in other ways. For instance, the average floating-rate bank loan yields 4.7% and would benefit from higher short-term rates, which bump up the loans’ payouts. Junk bonds, although risky from a credit-quality perspective, should fare relatively well if rates keep climbing. They yield an average of 6.1%.

The stock market offers some appealing income plays, too. Energy-related master limited partnerships, which own pipelines, storage facilities and processing plants, are getting a lift from strengthening oil prices; these MLPs yield a healthy 7.1%, on average. Property-owning real estate investment trusts yield an average of 4%. Rising rates have pressured REITs, which lost an average of 14% from August 1 through November 10. But property owners can lift their income through acquisitions and rent increases. That should help boost REITs’ earnings—allowing them to raise dividends—and help to support the stocks.

Of course, the more yield you strive for, the more risk you take. Junk bonds could sink if the economy were to weaken, pushing up default rates among borrowers with low credit ratings. MLPs would slump if oil prices were to dive again. “Being patient and diversified is so important in this market,” says Amy Magnotta, a money manager with Brinker Capital, in Berwyn, Pa. “You don’t want to reach purely for yield.”

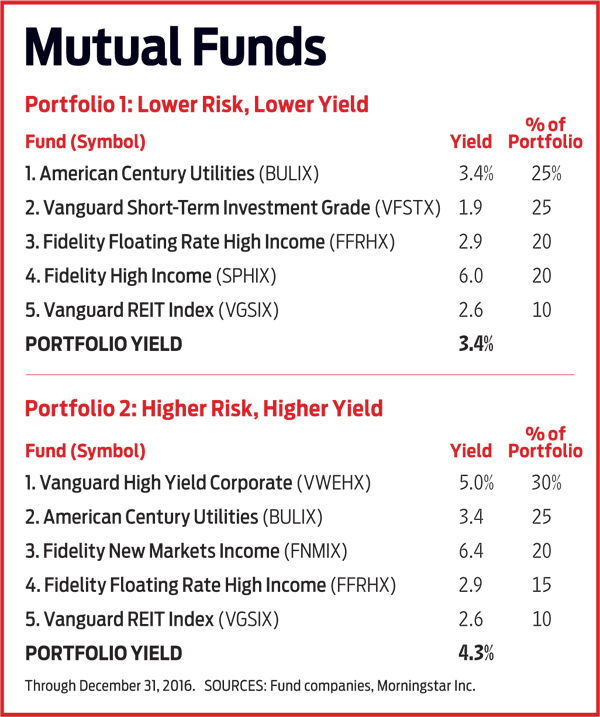

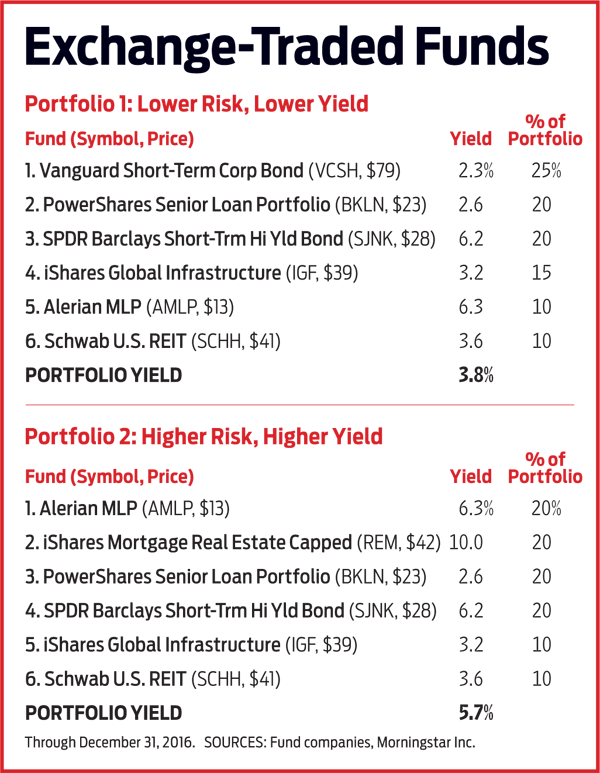

With these issues in mind, we built four income portfolios—two that deliver a moderate amount of cash (3.4% and 3.8%, to be precise) and two that produce more yield (4.3% to nearly 6%) and pose greater risks. Each pair contains one portfolio that consists exclusively of mutual funds and one that contains only exchange-traded funds (baskets of bonds or stocks that track a market index). You could mix and match funds and ETFs from each portfolio to create your own customized basket. Whichever way you go, you’ll help lower your risk by sticking with a broadly diversified lineup of investments in a variety of areas, some of which should stay afloat if others decline.

In our moderate portfolios, we put 25% in short-term corporate bonds. Their main mission is to provide stability and a bit of income. We then added funds to create a diverse income stream from investments such as junk bonds, utilities and floating-rate bank loans. Also in the mix are ETFs that focus on MLPs, REITs and infrastructure-related companies (such as railroads and toll-road operators).

Our two high-income portfolios don’t hold any short-term bonds. Rather, they focus on areas such as junk bonds and other nontraditional sources of income. The ETF package, for instance, includes a fund that owns mortgage REITs, which borrow money at short-term rates to buy mortgage-backed debt issued by real estate companies. It yields 10%. MLPs and mortgage REITs aren’t in the mutual fund package (because low-cost choices aren’t available), so we looked elsewhere to bolster that portfolio’s income, adding an emerging-markets bond fund with a hefty yield and increasing the proportion of junk bonds.

Beware the risks

A word of caution: The high-income portfolios could post heavy losses if investors dump stocks and other risky investments. If you choose either bundle, consider supplementing it with stable investments, such as short-term Treasuries, elsewhere in your portfolio.

Keep in mind, too, that ETFs generally charge lower annual fees than similar mutual funds. Lower fees translate to higher yields and more cash in your pocket. ETFs also tend to be more tax-efficient than mutual funds because ETFs distribute minimal, if any, capital gains (unlike stock-based mutual funds, which usually pay out a greater amount of capital gains). One way to lower your tax bill: Hold high-income ETFs and funds in a tax-advantaged retirement account, such as an IRA, in which distributions can accumulate tax-free.

A final note: Focus on how much income you need, not on what you’d ideally like to pocket. Sure, you may dream of spectacular returns. But if markets turn hostile, you’ll be glad you played it safe.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

What Fed Rate Cuts Mean For Fixed-Income Investors

What Fed Rate Cuts Mean For Fixed-Income InvestorsThe Fed's rate-cutting campaign has the fixed-income market set for an encore of Q4 2024.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

The Final Countdown for Retirees with Investment Income

The Final Countdown for Retirees with Investment IncomeRetirement Tax Don’t assume Social Security withholding is enough. Some retirement income may require a quarterly estimated tax payment by the September 15 deadline.

-

Dividends Are in a Rut

Dividends Are in a RutDividends may be going through a rough patch, but income investors should exercise patience.

-

Municipal Bonds Stand Firm

Municipal Bonds Stand FirmIf you have the cash to invest, municipal bonds are a worthy alternative to CDs or Treasuries – even as they stare down credit-market Armageddon.

-

Best Banks for High-Net-Worth Clients

Best Banks for High-Net-Worth Clientswealth management These banks welcome customers who keep high balances in deposit and investment accounts, showering them with fee breaks and access to financial-planning services.

-

High Yields From High-Rate Lenders

High Yields From High-Rate LendersInvestors seeking out high yields can find them in high-rate lenders, non-bank lenders and a few financial REITs.

-

Time to Consider Foreign Bonds

Time to Consider Foreign BondsIn 2023, foreign bonds deserve a place on the fringes of a total-return-oriented fixed-income portfolio.