Is a Rental Property the Best Way to Grow Your Wealth?

A rental real estate investment can seem like a great way to build your wealth (and maybe generate a little extra income), but how often does it really work out that way?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Owning a rental property in addition to your primary residence can be a way for you to build wealth, especially if you may be averse to investing in the stock market. Data released in 2017 shows that 47% of rentals were owned by individual investors. In theory, it seems to make sense. With a rental property, someone else pays your mortgage, and over time your equity grows. You can eventually own a physical piece of property outright that also produces income. However, rental property investments aren’t always a sure thing.

The first home my wife and I bought was a condo in 2004 in Stamford, Conn., which we then in turn rented out when we bought our first single-family home. Our situation didn’t work out for a number of reasons, mainly because 1) the property, after a rising as high as 30%+ over our purchase price, ended up selling for only a 5% gain. 2) We needed to make updates (kitchen countertops and floors) and repairs (HVAC system) that ate away at our profit. 3) With the great recession rental prices dropped and lowered my expected return, and we also had a few months where the property was empty.

So, as you can see, things that seem too good to be true often are. So, before you decide to invest in a rental property, consider calculating the return on your investment to see if investing in a rental property is really the deal you thought.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

How to Calculate the Return on Investment of a Rental Property

Like any investment, you need to understand the expected return on investment (ROI). ROI = (Net Profit/Cost of Investment) x 100. Therefore, before you purchase a rental property, ask what return is reasonable to expect on your money, and what do you need to earn in order for the investment to be worthwhile?

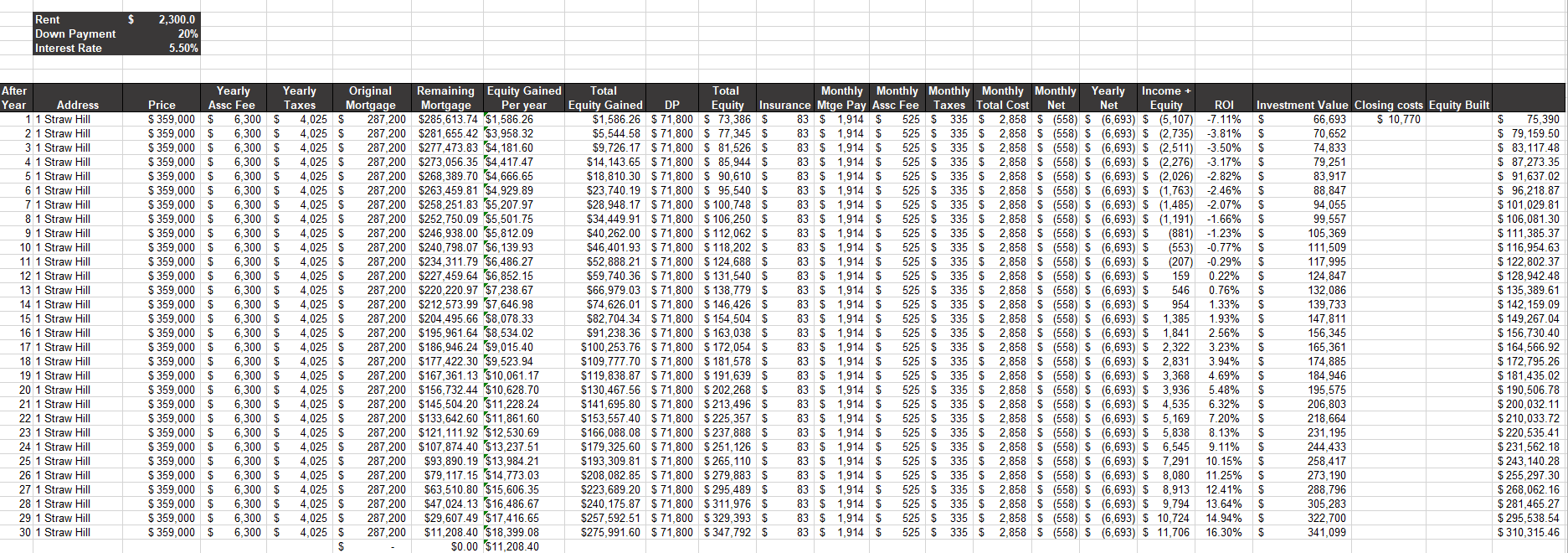

Calculating the ROI of a rental property can be complex. While there are many different ways to do this, the point of this exercise is to provide you with a “back of the envelope” calculation to help you quickly assess whether or not a rental property has a return potential that is worth pursuing. If your calculation reveals that the return is small on paper, it’s likely going to be small in reality, too.

Before you can calculate the true ROI of a rental property, you have to factor in all the costs associated with holding that property, not just the purchase amount.

For illustrative purposes, I’ve put together a rental property ROI calculation to demonstrate how complex this mathematical exercise actually is.

What to Factor into a Rental Property ROI Calculation

While the initial cost of investment should be straightforward (purchase price, closing costs, renovations to get it ready), determining your net profit (revenue — expenses) can get tricky. When calculating your own net profit, don’t forget these variables:

Revenue

- Rental Income: How much you can charge for rent each month.

- Mortgage paid down: How much of the property you own.

- Change in property value: How much additional equity you have beyond the amount of the mortgage you have already paid down, based on current housing and rental market prices.

Expenses

- Financing: If you didn’t buy the property with cash and took out a mortgage, the amount you pay per month in principal and interest.

- Homeowner’s association dues: Fees you pay for community amenities.

- Property insurance: The insurance you carry on your property.

- Property taxes: What you pay in state and local taxes. And remember, property taxes don’t typically stay the same each year. They typically continue to rise unless an economic downturn allows you to have the property reassessed (typically for a fee) and readjusted downward.

- Vacancy: The amount of cash you need to cover expenses when you don’t have a tenant. The standard vacancy rate is 5% to 8%, meaning that’s the percentage of the year that the property can be expected to sit empty.

- Your time: The one item many people forget to account for is the cost of their own time. Whether it’s time spent as the handyman or finding a renter, your time is money, and anytime you put into managing the property reduces the return on your investment.

My “back of the envelope” calculation doesn’t even account for any management or maintenance costs of the property. Properties always require maintenance. This number is hard to generalize, as every property is different, but just know that something will break, appliances will need to be upgraded, and ongoing resources will be required to keep your property maintained and competitive in the rental market.

In addition, this calculation should be done for every year you anticipate owning the property, as your return will change over time.

Conclusion

Rental properties can generate income, but the return on investment doesn’t typically happen right away. Rental property investments are also risky because of how many variables can affect its performance, like the housing market or your ability to keep it rented. So, if you are wondering if you should invest in real estate, really consider how appropriate this type of investment would be for you and your situation first.

As with any investment, rental properties should be viewed as a long-term investment, not an instant cash cow. If your goal is to grow wealth, I will tell you that there are other ways to generate a return on your income with less risk and headache, like investing in a globally diversified portfolio of stocks and bonds.

What has been your experience with rental properties and being a landlord? Do you agree that, as an investment, it takes a while to reap a reward, or has your experience been different? Write to me at paul@lakeroadadvisors.com and tell me about it!

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Paul Sydlansky, founder of Lake Road Advisors LLC, has worked in the financial services industry for over 20 years. Prior to founding Lake Road Advisors, Paul worked as relationship manager for a Registered Investment Adviser. Previously, Paul worked at Morgan Stanley in New York City for 13 years. Paul is a CERTIFIED FINANCIAL PLANNER™ and a member of the National Association of Personal Financial Advisors (NAPFA) and the XY Planning Network (XYPN).

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.