3 Reasons to Consider Making Changes During Medicare Open Enrollment

Between Oct. 15 and Dec. 7, Medicare participants can make changes to their plan(s). Here are a few reasons you may want to take advantage of this open enrollment period.

Every fall, Medicare health and drug plan providers publish information on changes that will take effect the following year. As a result, people on Medicare have the opportunity to make the following types of changes to their plans during the open enrollment period, which runs from Oct. 15 to Dec. 7:

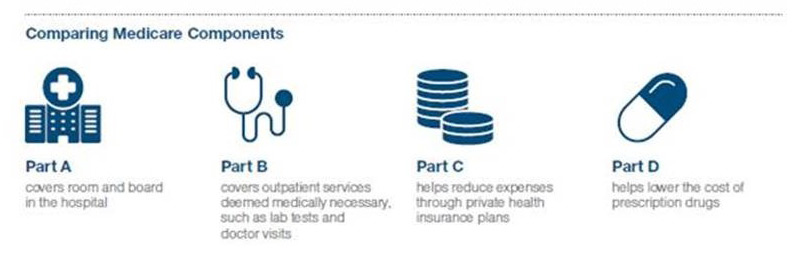

- Switch from Original (Traditional) Medicare (Parts A and B) to Medicare Advantage (Part C), or vice versa.

- Switch from one Medicare Advantage plan to another.

- Switch from one drug plan (Part D) to another.

You’ll notice this list does not mention Medicare Supplement (Medigap) policy changes. The open enrollment period for Medigap is the six months following your enrollment in Medicare Part B. After this period, insurance companies generally are not required to sell you a Medigap policy. If they do offer coverage after your open enrollment period, they may charge you higher premiums. Keep in mind that Medigap policies are only available to people who have Medicare Parts A and B, not those with Medicare Advantage.

There is also an open enrollment period from Jan. 1 to March 31, when you can change your Medicare Advantage plan. During that period, however, you can’t switch from Original Medicare to Medicare Advantage, or make changes regarding drug plans. For complete details, go right to the source — the Medicare website.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Every Medicare participant should review their coverage at least annually. Here are three reasons you may want to seriously consider making changes:

1. You have Original Medicare and want to save money.

People enrolled in Medicare Advantage plans, on average, spend less on health care than those with Original Medicare. This includes a combination of premiums and out-of-pocket costs, along with drug coverage.

Estimated Annual Health Care Expenses for Individuals Ages 65 and Above

| Header Cell - Column 0 | Original Medicare (Parts A and B) and a Prescription Drug Plan (Part D) | Medicare Advantage HMO Plan That Includes Prescription Drug Coverage | Original Medicare (Parts A and B), a Prescription Drug Plan (Part D), and Medigap |

|---|---|---|---|

| 25th Percentile | $2,500 | $2,200 | $4,700 |

| 50th Percentile | $3,200 | $2,900 | $5,800 |

| 75th Percentile | $5,000 | $4,300 | $7,300 |

| 90th Percentile | $7,300 | $6,400 | $10,200 |

Source: Sudipto Banerjee. “A New Way to Calculate Retirement Health Care Costs,” T. Rowe Price, February 2019. Estimates based on projected 2019 Medicare premiums and data from the Health and Retirement Study (HRS). All costs are rounded to the nearest hundred. Percentile refers to the percentage of individuals with estimated expenses below these levels. For example, the 90th percentile line indicates that only 1 in 10 retirees with Medicare Advantage has estimated annual health care expenses above $6,400.

Medicare Advantage plans aren’t for everyone. Availability and costs vary widely by geographical area. Medicare Advantage plans generally restrict your choice of service providers. It’s also important to note that the expense differences above may reflect different levels of health care consumption across the three groups. Even considering these caveats, enrollment in Medicare Advantage plans has increased sharply in recent years because of the associated potential cost savings. If available in your area, they are worth considering.

2. You enrolled in a Medicare Advantage plan and realize you made a mistake.

As mentioned earlier, the downside to a Medicare Advantage plan is the limited provider network. You may not have fully appreciated the limitations when you chose your plan. Or you may have developed a new medical issue that requires specialists who aren’t available under your plan. Out-of-network medical care can be very expensive.

If you find yourself in this situation, open enrollment will give you the opportunity to consider other insurers’ Medicare Advantage plans, which may have better network options. In addition, if you switched from Original Medicare and Medigap within the past year, you have the option to switch back to your old Medigap plan. Just don’t wait more than a year — there’s no guarantee the Medigap insurance company will offer you a policy, especially if your health has worsened.

3. Your drug prescriptions (or coverage) have changed.

It is surprising how different the cost for a specific drug can be in two different drug plans. A plan that worked well for your prescription needs a year ago may be far costlier if you’ve added a new drug to your list. In addition, the plan can change its drug list (called a formulary). Formulary changes can take effect the next year, or sooner, such as when a generic equivalent is introduced. One positive change heading into 2020 is that the Part D “doughnut hole,” a confusing and potentially expensive coverage gap, will be completely eliminated.

The Medicare website offers a Plan Finder to help you shop for drug plans (Part D) and Medicare Advantage plans. It enables you to compare costs based on your specific prescriptions. You can also see what pharmacies are in-network, as well as plan “star ratings.” There’s a lot of information on the Medicare site, so be sure to set time aside to digest it all.

Medicare is a complex topic, and it’s important to understand your options. If you’re approaching Medicare eligibility age, or just want a refresher on your choices, check out our Planning for Medicare video.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Roger Young is Vice President and senior financial planner with T. Rowe Price Associates in Owings Mills, Md. Roger draws upon his previous experience as a financial adviser to share practical insights on retirement and personal finance topics of interest to individuals and advisers. He has master's degrees from Carnegie Mellon University and the University of Maryland, as well as a BBA in accounting from Loyola College (Md.).

-

Aging: The Overlooked Risk Factor

Aging: The Overlooked Risk FactorSponsored Elder care is a personal and financial vulnerability many people fail to plan for.

-

AI vs the Stock Market: How Did Alphabet, Nike and Industrial Stocks Perform in June?

AI vs the Stock Market: How Did Alphabet, Nike and Industrial Stocks Perform in June?AI is a new tool to help investors analyze data, but can it beat the stock market? Here's how a chatbot's stock picks fared in June.

-

Eight Tips From a Financial Caddie: How to Keep Your Retirement on the Fairway

Eight Tips From a Financial Caddie: How to Keep Your Retirement on the FairwayThink of your financial adviser as a golf caddie — giving you the advice you need to nail the retirement course, avoiding financial bunkers and bogeys.

-

You Were Planning to Retire This Year: Should You Go Ahead?

You Were Planning to Retire This Year: Should You Go Ahead?If the economic climate is making you doubt whether you should retire this year, these three questions will help you make up your mind.

-

Are You Owed Money Thanks to the SSFA? You Might Need to Do Something to Get It

Are You Owed Money Thanks to the SSFA? You Might Need to Do Something to Get ItThe Social Security Fairness Act removed restrictions on benefits for people with government pensions. If you're one of them, don't leave money on the table. Here's how you can be proactive in claiming what you're due.

-

From Wills to Wishes: An Expert Guide to Your Estate Planning Playbook

From Wills to Wishes: An Expert Guide to Your Estate Planning PlaybookConsider supplementing your traditional legal documents with this essential road map to guide your loved ones through the emotional and logistical details that will follow your loss.

-

Your Home + Your IRA = Your Long-Term Care Solution

Your Home + Your IRA = Your Long-Term Care SolutionIf you're worried that long-term care costs will drain your retirement savings, consider a personalized retirement plan that could solve your problem.

-

I'm a Financial Planner: Retirees Should Never Do These Four Things in a Recession

I'm a Financial Planner: Retirees Should Never Do These Four Things in a RecessionRecessions are scary business, especially for retirees. They can scare even the most prepared folks into making bad moves — like these.

-

A Retirement Planner's Advice for Taking the Guesswork Out of Income Planning

A Retirement Planner's Advice for Taking the Guesswork Out of Income PlanningOnce you've saved for retirement, you'll need your nest egg to support you for as many as 30 years. For that, you need a clear income strategy, not guesswork.

-

Why Smart Retirees Are Ditching Traditional Financial Plans

Why Smart Retirees Are Ditching Traditional Financial PlansFinancial plans based purely on growth, like the 60/40 portfolio, are built for a different era. Today’s retirees need plans based on real-life risks and goals and that feature these four elements.