3 Reasons to Consider Making Changes During Medicare Open Enrollment

Between Oct. 15 and Dec. 7, Medicare participants can make changes to their plan(s). Here are a few reasons you may want to take advantage of this open enrollment period.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

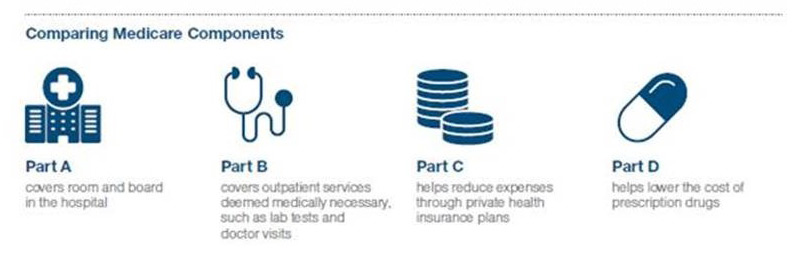

Every fall, Medicare health and drug plan providers publish information on changes that will take effect the following year. As a result, people on Medicare have the opportunity to make the following types of changes to their plans during the open enrollment period, which runs from Oct. 15 to Dec. 7:

- Switch from Original (Traditional) Medicare (Parts A and B) to Medicare Advantage (Part C), or vice versa.

- Switch from one Medicare Advantage plan to another.

- Switch from one drug plan (Part D) to another.

You’ll notice this list does not mention Medicare Supplement (Medigap) policy changes. The open enrollment period for Medigap is the six months following your enrollment in Medicare Part B. After this period, insurance companies generally are not required to sell you a Medigap policy. If they do offer coverage after your open enrollment period, they may charge you higher premiums. Keep in mind that Medigap policies are only available to people who have Medicare Parts A and B, not those with Medicare Advantage.

There is also an open enrollment period from Jan. 1 to March 31, when you can change your Medicare Advantage plan. During that period, however, you can’t switch from Original Medicare to Medicare Advantage, or make changes regarding drug plans. For complete details, go right to the source — the Medicare website.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Every Medicare participant should review their coverage at least annually. Here are three reasons you may want to seriously consider making changes:

1. You have Original Medicare and want to save money.

People enrolled in Medicare Advantage plans, on average, spend less on health care than those with Original Medicare. This includes a combination of premiums and out-of-pocket costs, along with drug coverage.

Estimated Annual Health Care Expenses for Individuals Ages 65 and Above

| Header Cell - Column 0 | Original Medicare (Parts A and B) and a Prescription Drug Plan (Part D) | Medicare Advantage HMO Plan That Includes Prescription Drug Coverage | Original Medicare (Parts A and B), a Prescription Drug Plan (Part D), and Medigap |

|---|---|---|---|

| 25th Percentile | $2,500 | $2,200 | $4,700 |

| 50th Percentile | $3,200 | $2,900 | $5,800 |

| 75th Percentile | $5,000 | $4,300 | $7,300 |

| 90th Percentile | $7,300 | $6,400 | $10,200 |

Source: Sudipto Banerjee. “A New Way to Calculate Retirement Health Care Costs,” T. Rowe Price, February 2019. Estimates based on projected 2019 Medicare premiums and data from the Health and Retirement Study (HRS). All costs are rounded to the nearest hundred. Percentile refers to the percentage of individuals with estimated expenses below these levels. For example, the 90th percentile line indicates that only 1 in 10 retirees with Medicare Advantage has estimated annual health care expenses above $6,400.

Medicare Advantage plans aren’t for everyone. Availability and costs vary widely by geographical area. Medicare Advantage plans generally restrict your choice of service providers. It’s also important to note that the expense differences above may reflect different levels of health care consumption across the three groups. Even considering these caveats, enrollment in Medicare Advantage plans has increased sharply in recent years because of the associated potential cost savings. If available in your area, they are worth considering.

2. You enrolled in a Medicare Advantage plan and realize you made a mistake.

As mentioned earlier, the downside to a Medicare Advantage plan is the limited provider network. You may not have fully appreciated the limitations when you chose your plan. Or you may have developed a new medical issue that requires specialists who aren’t available under your plan. Out-of-network medical care can be very expensive.

If you find yourself in this situation, open enrollment will give you the opportunity to consider other insurers’ Medicare Advantage plans, which may have better network options. In addition, if you switched from Original Medicare and Medigap within the past year, you have the option to switch back to your old Medigap plan. Just don’t wait more than a year — there’s no guarantee the Medigap insurance company will offer you a policy, especially if your health has worsened.

3. Your drug prescriptions (or coverage) have changed.

It is surprising how different the cost for a specific drug can be in two different drug plans. A plan that worked well for your prescription needs a year ago may be far costlier if you’ve added a new drug to your list. In addition, the plan can change its drug list (called a formulary). Formulary changes can take effect the next year, or sooner, such as when a generic equivalent is introduced. One positive change heading into 2020 is that the Part D “doughnut hole,” a confusing and potentially expensive coverage gap, will be completely eliminated.

The Medicare website offers a Plan Finder to help you shop for drug plans (Part D) and Medicare Advantage plans. It enables you to compare costs based on your specific prescriptions. You can also see what pharmacies are in-network, as well as plan “star ratings.” There’s a lot of information on the Medicare site, so be sure to set time aside to digest it all.

Medicare is a complex topic, and it’s important to understand your options. If you’re approaching Medicare eligibility age, or just want a refresher on your choices, check out our Planning for Medicare video.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Roger Young is Vice President and senior financial planner with T. Rowe Price Associates in Owings Mills, Md. Roger draws upon his previous experience as a financial adviser to share practical insights on retirement and personal finance topics of interest to individuals and advisers. He has master's degrees from Carnegie Mellon University and the University of Maryland, as well as a BBA in accounting from Loyola College (Md.).

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.

-

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial Planner

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial PlannerRetirement planning is less about hitting a "magic number" and more about an intentional journey — from understanding your relationship with money to preparing for your final legacy.

-

5 Mistakes to Avoid in the 5 Years Before You Retire, From a Financial Planner

5 Mistakes to Avoid in the 5 Years Before You Retire, From a Financial PlannerWhen retirement is in reach, financial planning gets serious — and there's a heightened risk of making serious mistakes, too. Here are five common slipups.