Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

With endless tales of hacking, from computer networks to email servers, it may be time to take note of what by now should be the obvious: What’s in your email?

I spoke with cybersecurity experts for guidance on what not to put in an email – ever. Recommendations ranged from the specific to the wholesale. Brian Krebs of KrebsOnSecurity.com, the website that blew the lid off Target’s data breach in 2013, went so far as to advise only including information in emails that “you don't mind getting read by someone else or potentially on the front page of the paper.”

Adds security expert Adam Levin, chairman of IDT911.com, which provides ID-theft protection programs for consumers through employers and banks: “Assume anything you put in email is the equivalent of skywriting for anyone and everyone to see or for our friends at WikiLeaks to decide to index and publish.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Yet, if you’re like many of us – still fairly cavalier about what you write in an email – some of these tips may surprise you.

Social Security numbers. Obvious, yes. Falling into the wrong hands, you or whoever’s Social Security number is captured, could be targeted for identity theft. But there could be times where you’re tempted to forward those nine digits. Your kid in college may have forgotten their number and suddenly need it, for example. Just…don’t. Provide the information in person or over the phone – via voice, not text – instead.

“It’s the skeleton key to your life,” says Levin. And remember, if you get an email from someone claiming to be the IRS in search of your Social Security number, don’t fall for this common tax scam. The IRS never asks for that kind of information via email or over the phone.

Computer log-ins, passwords and PINs. These could be personal or these could be company. If, for instance, a fellow employee working from home forgets the sign-in and password to your company’s computer system, it’s not a good idea to forward that information via email, which others could possibly access. Sensitive information is best delivered by phone or in person.

Credit card information. “Definitely don’t give up the expiration date and the last three digits on the back of the card,” says Christopher Elliott, a consumer advocate and founder of advocacy website Elliott.org. “An individual could wreak havoc with that information. Then you really have screwed yourself.”

There’s a reason your full credit card number isn’t on your monthly statement. Why casually give it out in an email?

“Credit card numbers, your frequent flyer number, any record locator, transaction number, all of these things, unless specifically asked of you, shouldn’t be in an email,” says Elliott. “There may be a way of exploiting those vulnerabilities.”

And it should go without saying the “specifically asked of you” part means make sure you know who you’re dealing with. Is the person seeking the information legit? And did you reach out to them? A stranger calling out of the blue asking for any personal info, especially if they pressure you to provide it immediately, is a sure red flag.

Your checking account and routing number. You rarely need to send this off to anyone, but there are times. Does your HR director need it to direct deposit your paycheck? While I’m sure you trust your HR director and the security of your company’s email system, that’s best done in person, say by handing over a voided check (which, I know, is very old school, but I do occasionally write checks).

In fact, says Levin, separate email accounts can add an extra layer of personal protection. Consider using one account for your personal email, a second for your correspondence with financial institutions and a third for contact with retailers (regarding online shopping).

Complaints about your coworkers. You really don’t want your snarky remarks to end up in the wrong hands – especially those of the colleague you’re complaining about. Best advice: Keep it offline (or just be nice).

Plus, hurt feelings could be the least of your problems. Be aware complaining about your coworkers via email is starting a paper trail – one that could lead back to you, and perhaps not in a good way. Always assume your employer can and will read your work emails , which could even go public if a legal dispute ever arises.

“On a business level, if you’re going to say something about someone that’s other than glowing, pick up the phone or walk next door – or keep it to yourself,” says Levin. “It could come back to haunt you, get you fired, create terrible PR issues for your organization or cause your company to lose consumer trust.”

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Bob was Senior Editor at Kiplinger.com for seven years and is now a contributor to the website. He has more than 40 years of experience in online, print and visual journalism. Bob has worked as an award-winning writer and editor in the Washington, D.C., market as well as at news organizations in New York, Michigan and California. Bob joined Kiplinger in 2016, bringing a wealth of expertise covering retail, entertainment, and money-saving trends and topics. He was one of the first journalists at a daily news organization to aggressively cover retail as a specialty and has been lauded in the retail industry for his expertise. Bob has also been an adjunct and associate professor of print, online and visual journalism at Syracuse University and Ithaca College. He has a master’s degree from Syracuse University’s S.I. Newhouse School of Public Communications and a bachelor’s degree in communications and theater from Hope College.

-

Farmers Brace for Another Rough Year

Farmers Brace for Another Rough YearThe Kiplinger Letter The agriculture sector has been plagued by low commodity prices and is facing an uncertain trade outlook.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAA

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAATax Breaks A new tax deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

When Tech is Too Much

When Tech is Too MuchOur Kiplinger Retirement Report editor, David Crook, sounds off on the everyday annoyances of technology.

-

I Let AI Read Privacy Policies for Me. Here's What I Learned

I Let AI Read Privacy Policies for Me. Here's What I LearnedA reporter uses AI to review privacy policies, in an effort to better protect herself from fraud and scams.

-

What Is AI? Artificial Intelligence 101

What Is AI? Artificial Intelligence 101Artificial intelligence has sparked huge excitement among investors and businesses, but what exactly does the term mean?

-

Five Ways to Save on Vacation Rental Properties

Five Ways to Save on Vacation Rental PropertiesTravel Use these strategies to pay less for an apartment, condo or house when you travel.

-

How to Avoid Annoying Hotel Fees: Per Person, Parking and More

How to Avoid Annoying Hotel Fees: Per Person, Parking and MoreTravel Here's how to avoid extra charges and make sure you don't get stuck paying for amenities that you don't use.

-

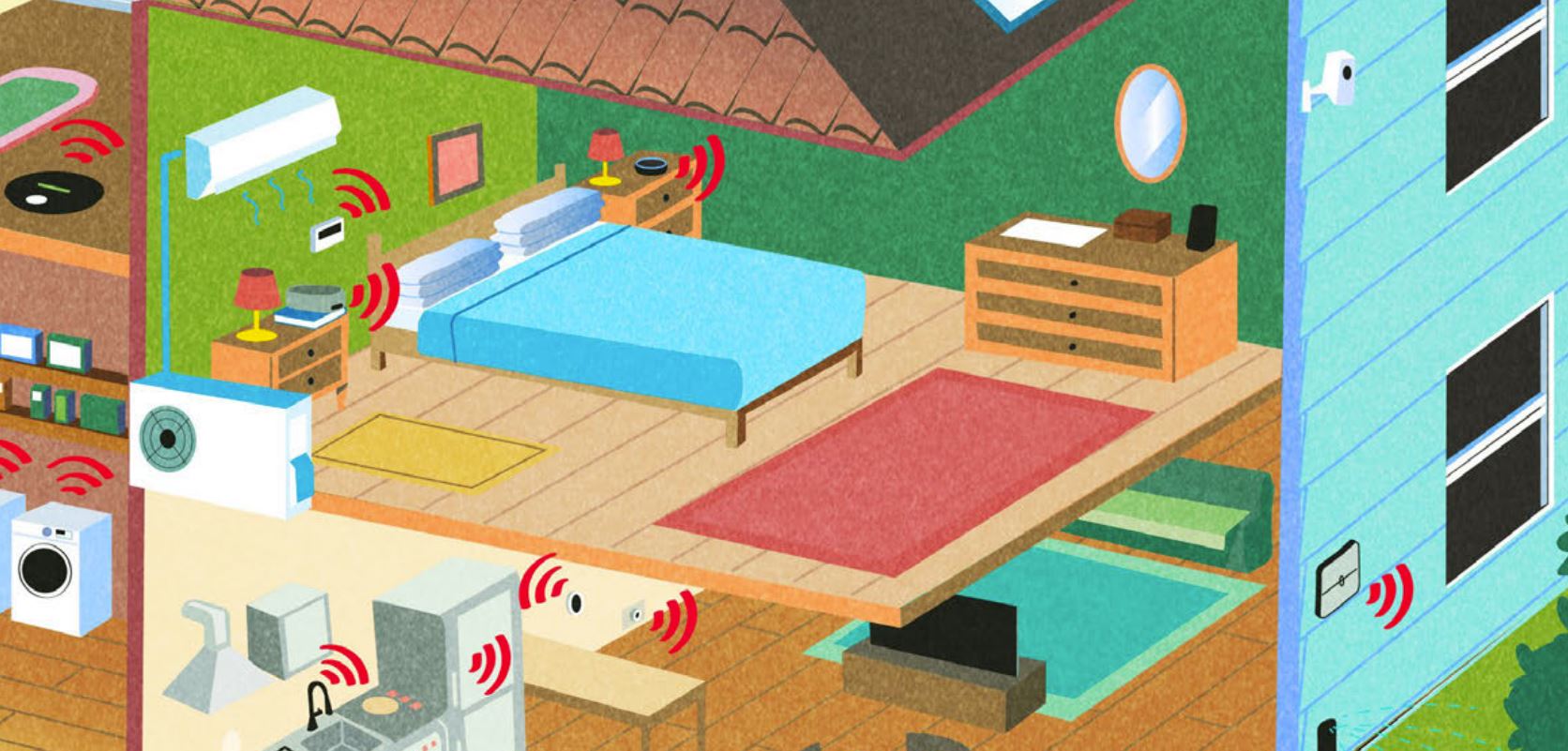

The 27 Best Smart Home Devices

The 27 Best Smart Home Devicesgadgets Innovations ranging from voice-activated faucets to robotic lawn mowers can easily boost your home’s IQ—and create more free time for you.

-

How to Appeal an Unexpected Medical Bill

How to Appeal an Unexpected Medical Billhealth insurance You may receive a bill because your insurance company denied a claim—but that doesn’t mean you have to pay it.

-

Amazon Prime Fees Are Rising. Here’s How to Cancel Your Amazon Prime Membership

Amazon Prime Fees Are Rising. Here’s How to Cancel Your Amazon Prime MembershipFeature Amazon Prime will soon cost $139 a year, $180 for those who pay monthly. If you’re a subscriber, maybe it’s time to rethink your relationship. Here’s a step-by-step guide to canceling Prime.