No Reason to Fear a Housing Bubble

Look for recent price spikes to ease as new construction picks up and more homes come on the market.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Worries that there’s an out-of-control housing price run-up in the works are overblown. There are huge differences between what’s happening now and the crises of last decade, and there’s little reason to see immediate danger even in the most torrid of today’s real estate markets.

The current heat in the housing market is a short-term phenomenon. There has been a noticeable pickup in demand. The slowly improving economy and better job growth mean more would-be homeowners in the market, while cash-paying investors continue to comb listings for properties they can rent for a few years before selling at a profit. For both groups, low interest rates are also alluring.

But supply is constrained, with many homes still stuck in the foreclosure process plus droves of owners who managed to stay current on mortgage payments, but whose homes aren’t worth what they owe on them, reluctant to sell at a loss. And new-home construction is only slowly recovering; it’s still running at just half the pre-boom level.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

As supply and demand come into better balance, the pace of price hikes will ease. Figure that on average, nationwide, the increase in 2014 will be about 4% or so, roughly half the 8.5% increase likely to be racked up in this unusual year. After that, look for a gradual return to the historical norm — average home values rising by about one percentage point more than the inflation rate each year.

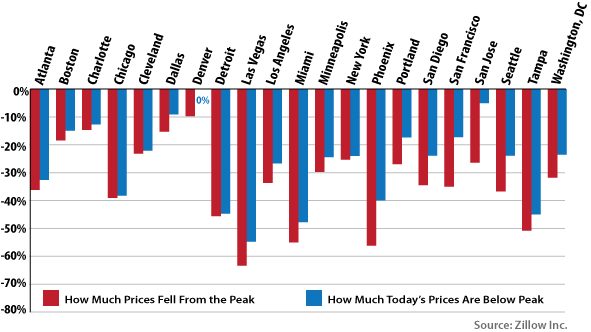

Meanwhile, a closer look at the situation today in cities around the country is revealing. Yes, some have experienced strong, even extreme price hikes. But consider the starting point. Existing homes in Las Vegas and Phoenix, up 22% from early 2012 to early 2013, are still more than 40% below those cities’ peak housing prices. In San Francisco, L.A., Atlanta, Detroit and other metro areas experiencing strong appreciation, home values remain well below the high points of last decade.

Only a few major metro areas are at or close to previous peaks in prices. Denver, for example, is there, but the Mile High City never experienced the extremes of the bubble and bust. San Jose, Calif., the heart of Silicon Valley, is 5% off its high.

What’s more, homes, on the whole, remain affordable. Only 13% of median family income is typically being chewed up by mortgage payments. Compare that with 24% in 2006. Interest rates are likely to stay low for some time, edging toward 4% by January, then climbing by no more than a percentage point or so in 2014. So homeownership won’t zoom out of reach. Even after the Federal Reserve decides to put an end to its easy-money policy, spurring inflation expectations and higher long-term rates, it will do so gradually. There will be a slow adjustment to the housing market rather than a shock.

Even more important: Only truly creditworthy borrowers are getting loans. The no-documentation, interest-only loans that made it easy for anyone to buy in the 2000s, facilitating a home-buying frenzy across the socio-economic spectrum, have entirely disappeared. This time, lenders are keeping a tight rein on credit.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Federal Debt: A Heavy Load

Federal Debt: A Heavy LoadEconomic Forecasts The debt continues to grow, but record-low interest rates could ease the long-term damage.

-

U.S. Manufacturing Is Already Ailing from Coronavirus

U.S. Manufacturing Is Already Ailing from CoronavirusEconomic Forecasts Supplies are hard to come by, and in the longer-term demand may be at risk.

-

Is a Recession Imminent?

Is a Recession Imminent?Economic Forecasts Shoppers will have to carry the load for now because weak business investment shows no sign of perking up anytime soon. Odds are, they’ll be able to.

-

Will You Have to Pay More Sales Taxes on Your Online Purchases?

Will You Have to Pay More Sales Taxes on Your Online Purchases?business One thing’s for sure: Consumers who live in one of the five states without a sales tax won’t be affected by the Supreme Court’s ruling.

-

3 Factors That Could Drive the Next Recession

3 Factors That Could Drive the Next RecessionEconomic Forecasts The economy is humming along nicely, but how long can the good times continue?

-

What to Expect From the New Fed Chief

What to Expect From the New Fed ChiefEconomic Forecasts By and large, Jerome Powell will move along the path set by his predecessor.

-

How a Border Tax Would Affect You

How a Border Tax Would Affect YouBusiness Costs & Regulation A plan to limit imports could raise prices but also create more jobs.

-

A Housing Shortage Looms: Builders Can’t Keep Up

A Housing Shortage Looms: Builders Can’t Keep Upbusiness Starter homes especially are becoming scarce.