U.S. Manufacturing Growing Steadily

Cheaper domestic energy, rising wages overseas and industries that use high-tech to make high-tech products are making producing goods on American soil attractive again.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

U.S. manufacturing continues to step it up, with another solid gain in output this year—3.5% or better. Nearly five years after the Great Recession ended, it continues to outpace the rate of overall GDP growth. New business and goods-out-the-door are up. There’s more optimism and more hiring. For seven months in a row, the number of factory jobs has increased. By year-end, 100,000 more workers will be added to payrolls. There’s growth in every region of the country, and it’s cutting across a swath of industries.

Aviation manufacturers are sitting on a backlog of orders. With car and light-truck sales (including imports) likely to top 16 million this year, assembly lines will hum. Chemicals—everything from paint thinner to plastic resins—are expanding on cheaper petroleum. Pharmaceutical companies continue to chug ahead. Biotech is likely to see double-digit growth again in 2014. Gains in the U.S. for medical equipment are steady, and prospects of increased export sales are bright. Next-generation computer chips have semiconductor makers going strong. Even heavy equipment is thriving, with rising global demand for building, energy exploration and drilling equipment, and more.

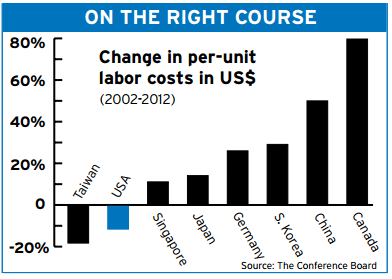

The broad expansion is partly just the pendulum swing after recession cutbacks. (From 2008 to 2009, factory output fell 20% and 2 million workers were laid off.) But it also reflects some big shifts in the global business environment. First, the relative cost of producing on U.S. soil compared with overseas is declining. Productivity improvements—automation, etc.—are shearing per-unit labor costs here while rising wages elsewhere in the world shove them up. Domestic energy supplies are abundant, thanks to the fracking boom. And lower shipping expenses help as well.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But a slew of less obvious cost benefits to operating in the U.S. are increasingly garnering recognition, too: Fewer worries about intellectual property and technology theft. More-timely delivery. Political stability. Legal and regulatory systems that are clearer and more easily navigated.

If you’re skeptical about how much value such intangibles have, consider these figures from a recent World Bank study on just one of the factors: the potential difference in settling a typical contract dispute over the sale of goods. In the U.S., that might take 370 days and cost 14% of the claim’s value to resolve. In East Asia, the same dispute would likely chew up 522 days and a whopping 49% of the claim’s value. In Latin America, the tally would be 727 days and 31% of the value. In South Asia, it would typically take three years to tie up. And the U.S. compares favorably even with other highly developed nations. There, resolution of such a dispute would typically require 510 days and cost the company 20% of the claim’s value in legal and other fees.

Another factor favoring the growth of U.S. manufacturing in the years ahead is the growing use of advanced technology and processing, an area in which the U.S. has a significant competitive advantage. Much basic manufacturing—making products such as glass, steel, textiles, apparel and furniture that require little processing—has fled the U.S. for lower-wage sites overseas.

With the exception of computers and electronics—the one advanced tech category that benefits from lower labor costs—industries requiring more sophisticated processing are more likely to stay put. They include aviation, automaking, biotechnology and industrial machinery. Indeed, 37% of U.S. manufactures and 45% of exported goods are advanced tech: Medicines and medical devices, power generation and transmission equipment, communications gear, navigational instruments, magnetic and optical media, etc. All told, such products account for nearly 5% of GDP. Add on related services, such as software design, and the total rises to about 13%. Over the next decade, those shares will climb even higher, even faster.

As a result, the long slide in manufacturing’s share of GDP may be ending. After dipping sharply during the Great Recession, it will approach 13% this year—roughly the same share as in 2004 to 2007. Look for factories’ share of employment, however, to continue to slide as automation, including robots, takes on a larger role.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David is both staff economist and reporter for The Kiplinger Letter, overseeing Kiplinger forecasts for the U.S. and world economies. Previously, he was senior principal economist in the Center for Forecasting and Modeling at IHS/GlobalInsight, and an economist in the Chief Economist's Office of the U.S. Department of Commerce. David has co-written weekly reports on economic conditions since 1992, and has forecasted GDP and its components since 1995, beating the Blue Chip Indicators forecasts two-thirds of the time. David is a Certified Business Economist as recognized by the National Association for Business Economics. He has two master's degrees and is ABD in economics from the University of North Carolina at Chapel Hill.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Trump Reshapes Foreign Policy

Trump Reshapes Foreign PolicyThe Kiplinger Letter The President starts the new year by putting allies and adversaries on notice.

-

Congress Set for Busy Winter

Congress Set for Busy WinterThe Kiplinger Letter The Letter editors review the bills Congress will decide on this year. The government funding bill is paramount, but other issues vie for lawmakers’ attention.

-

The Kiplinger Letter's 10 Forecasts for 2026

The Kiplinger Letter's 10 Forecasts for 2026The Kiplinger Letter Here are some of the biggest events and trends in economics, politics and tech that will shape the new year.

-

What to Expect from the Global Economy in 2026

What to Expect from the Global Economy in 2026The Kiplinger Letter Economic growth across the globe will be highly uneven, with some major economies accelerating while others hit the brakes.

-

Amid Mounting Uncertainty: Five Forecasts About AI

Amid Mounting Uncertainty: Five Forecasts About AIThe Kiplinger Letter With the risk of overspending on AI data centers hotly debated, here are some forecasts about AI that we can make with some confidence.

-

Worried About an AI Bubble? Here’s What You Need to Know

Worried About an AI Bubble? Here’s What You Need to KnowThe Kiplinger Letter Though AI is a transformative technology, it’s worth paying attention to the rising economic and financial risks. Here’s some guidance to navigate AI’s future.

-

Will AI Videos Disrupt Social Media?

Will AI Videos Disrupt Social Media?The Kiplinger Letter With the introduction of OpenAI’s new AI social media app, Sora, the internet is about to be flooded with startling AI-generated videos.

-

What Services Are Open During the Government Shutdown?

What Services Are Open During the Government Shutdown?The Kiplinger Letter As the shutdown drags on, many basic federal services will increasingly be affected.