The Conversion of Bill Gross

It's good to see a long-term stock market bear concede that stocks are not overpriced.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Over the years, I have frequently clashed with Pimco founder Bill Gross about his bearish comments regarding the stock market. Gross writes monthly commentaries that generate considerable buzz in the investment community. In September 2002, almost at the bottom of the bear market that followed the tech bubble, Gross posted a shocking column entitled “Dow 5000.”

“Stocks stink and will continue to do so until they’re priced appropriately … around Dow 5000,” wrote Gross, or about 3,000 points below the Dow’s level at the time. A few weeks later, the Dow Jones industrial average bottomed at 7286, and the index nearly doubled over the next five years.

Ten years later, in August 2012, with the Dow at 12,000, Gross wrote an article entitled “Cult Figures.” In that piece, he asserted that the “cult of equity” was dying, and he singled me out as its major booster. My research had calculated a long-term real return (after inflation) for U.S. stocks of 6.6% a year. But Gross claimed that was a “historical freak, a mutation likely never to be seen again,” and asserted that stock investors were in for a major disappointment. Instead, the market sprinted up another 4,000 points.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

No bubbles. Given Gross’s long-term antipathy to stocks, I was floored when I read his May 2014 newsletter. As the Dow was flirting with 17,000, or 5,000 points higher than the level at which he had pronounced that equities were dying, Gross wrote that in the new environment of low interest rates, assets such as stocks and real estate are fairly priced and that “current fears of asset bubbles would be unfounded.” Furthermore, investors could adjust to the low-interest-rate environment by investing in “a higher proportion of stocks versus bonds.”

What a turnaround! A bit longer than a decade after Gross declared that Dow 5000 was the right level for stocks, he now claimed the market was fairly priced at Dow 17,000.

Gross’s new view of stocks stems from his current view of financial markets, which he calls the “new neutral.” The term neutral is used by central banks to describe an interest-rate environment that encourages neither expansion nor contraction. In their quarterly economic forecasts, Federal Reserve policymakers have been projecting a long-term neutral federal funds rate (the interest rate at which banks lend excess reserves to each other) of about 4%. But both Gross and I believe that the neutral rate is closer to 2%. As I explained in my previous column, lower rates are a consequence of slower growth and lower inflation. Gross and I agree that lower rates should raise the valuation of assets such as stocks, bonds and real estate.

But this is where our agreement ends. I disagree with Gross’s expectations for stock returns, which he puts at only 4% before inflation. Although the bond market has adjusted to the “new neutral,” the stock market has not. The stock market’s current price-earnings ratio, at 16 times estimated 2014 earnings, is very near its historical average. That means stocks should nearly match their long-term real return of 6.6% annually. If we add the 2% that the Fed has targeted for the long-term inflation rate, that corresponds to a return in excess of 8%.

It’s good to see a long-term stock market bear like Bill Gross concede that stocks are not overpriced at today’s levels (although that in itself could be a bearish indicator). But he is still far too pessimistic about stocks’ future returns. Even if future corporate earnings do not rise any faster than inflation, the returns on stocks will swamp returns on fixed-income assets over the next decade. The “new neutral” doesn’t just mean that stocks are fairly priced. They’re actually undervalued if, as I expect, interest rates remain below 4%.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

A Preview of the Fed Under Trump

A Preview of the Fed Under TrumpEconomic Forecasts John Taylor, a former Treasury official in the Bush administration, is a top candidate to replace Fed chair Janet Yellen.

-

Investors, Don't Fear Higher Rates

Investors, Don't Fear Higher Ratesinvesting Although interest rates will rise modestly in coming months, that should not derail the bull market.

-

Why Investors Shouldn't Be Afraid of Inflation

Why Investors Shouldn't Be Afraid of InflationEconomic Forecasts An inflation rate of 2% to 3% is good for stocks because it gives companies the power to raise prices, which helps boost profits.

-

A Positive Outlook for U.S. Interest Rates

A Positive Outlook for U.S. Interest RatesEconomic Forecasts Instead of the threat of deflation from weak growth and falling prices, the U.S. is facing the opposite: accelerating inflation.

-

Can the Fed Save the Stock Market?

Can the Fed Save the Stock Market?Markets In retrospect, it was ill-timed for the Federal Reserve to start hiking short-term interest rates. But that can easily be fixed.

-

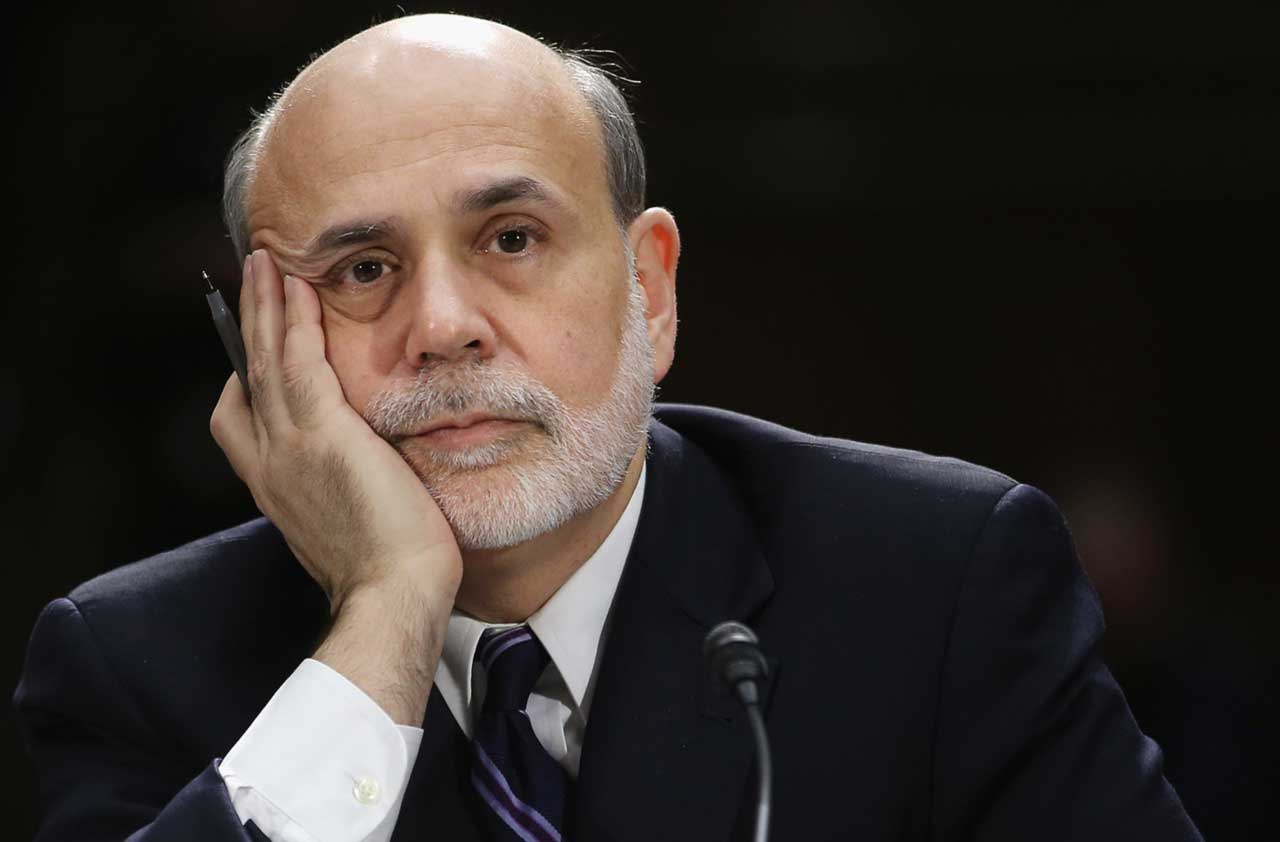

Bernanke's Ultimate Legacy

Bernanke's Ultimate Legacyinvesting The former Fed chairman's decisions in 2008 were an act of courage that averted an economic collapse far worse than we experienced.

-

Worries About China’s Economy Are Overblown

Worries About China’s Economy Are OverblownEconomic Forecasts Among the consequences of China's slowdown: lower commodity prices, which actually benefit the U.S.

-

Surviving the Greek Financial Crisis

Surviving the Greek Financial CrisisEconomic Forecasts Despite the recent friction, I believe the eurozone is stronger after putting down the Greek rebellion.