Low Rates Are Here to Stay

The smart money sees powerful economic forces, which transcend the power of the Fed, pushing interest rates downward.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

In the early 1980s, economist Ed Yardeni coined the term “bond vigilantes” to describe fixed-income investors who scrutinize government policies and push bond prices down, and interest rates up, at the first hint that those policies are sending the country on an inflationary course.

During the 1990s, Clinton political adviser James Carville claimed that if he were reincarnated, he’d like to come back as the bond market because of its power to scare other markets and intimidate politicians. At that time, most economists and policymakers conceded that the government had no real control over long-term interest rates because savvy bond traders would always demand rates that took full measure of the inflationary consequences of government actions.

Today the pendulum has swung in the opposite direction. Now critics blame the Federal Reserve for artificially propping up the bond market and keeping both short- and long-term interest rates far below the levels appropriate for this stage of an economic recovery.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Where are the bond vigilantes who are supposed to punish the Fed’s easy-money policies by shunning bond purchases and sending yields skyward? Have they thrown up their hands, conceded that they can’t fight the power of the central bank and fled the market?

Downward pressure.The answer is no, the bond vigilantes have not fled the market. The truth is that the smart money sees powerful economic forces, which transcend the power of the central bank, pushing interest rates downward. Though the Fed has the ability to set short-term rates, it has only marginal influence on long-term rates, which are driven largely by economic forces—notably, economic growth, inflation and how investors feel about risk. Today, all those variables are moving in a direction that keeps interest rates low.

For starters, the Congressional Budget Office predicts that growth in real potential gross domestic product will slow to about 2% per year over the next decade as a result of the slowdown in the growth of the labor force. That estimate is about 1.5 percentage points lower than the average annual real GDP growth that we experienced in the post–World War II period prior to the financial crisis of 2008.

Second, core inflation—which excludes the volatile food-and-energy sector—has sunk to among the lowest levels in more than a half-century. Even the Fed is having difficulty pushing inflation up to its 2% target, and that is another downward force on interest rates.

Finally, the aging of the population, combined with the trauma of the most recent bear market, has pushed investors to settle for bonds, even though future returns are likely to be skimpy. Furthermore, tighter rules about funding corporate pensions have persuaded many firms to “de-risk” their investments by moving into bonds, pushing yields still lower.

The impact of these forces is substantial. The slowdown in economic growth alone could lop off one to two percentage points from long-term interest rates, and the de-risking of pension portfolios combined with baby-boomers’ risk aversion could subtract another percentage point. At less than 3%, the recent yield on the benchmark ten-year Treasury bond is fully consistent with low inflation and slow economic growth.

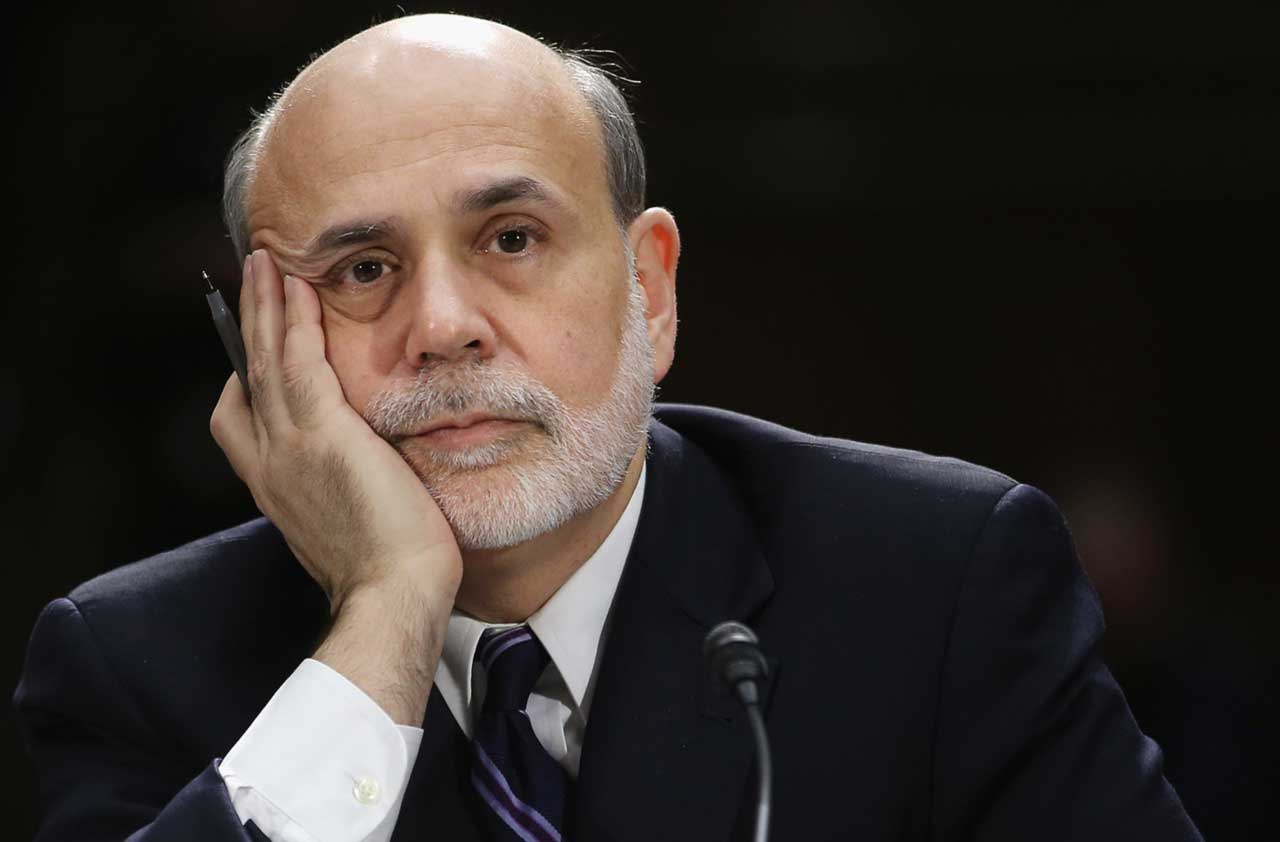

Bottom line: Don’t blame the Fed for low interest rates. It will raise short-term rates, currently near zero, eventually—probably next year. But if the Fed’s policy were truly inflationary, investors would send rates on long-term bonds much higher today. Barring an unforeseen crisis, low long-term rates will be with us for quite some time.

Columnist Jeremy J. Siegel is a professor at the University of Pennsylvania’s Wharton School and the author of Stocks for the Long Run and The Future for Investors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

A Preview of the Fed Under Trump

A Preview of the Fed Under TrumpEconomic Forecasts John Taylor, a former Treasury official in the Bush administration, is a top candidate to replace Fed chair Janet Yellen.

-

Investors, Don't Fear Higher Rates

Investors, Don't Fear Higher Ratesinvesting Although interest rates will rise modestly in coming months, that should not derail the bull market.

-

Why Investors Shouldn't Be Afraid of Inflation

Why Investors Shouldn't Be Afraid of InflationEconomic Forecasts An inflation rate of 2% to 3% is good for stocks because it gives companies the power to raise prices, which helps boost profits.

-

A Positive Outlook for U.S. Interest Rates

A Positive Outlook for U.S. Interest RatesEconomic Forecasts Instead of the threat of deflation from weak growth and falling prices, the U.S. is facing the opposite: accelerating inflation.

-

Can the Fed Save the Stock Market?

Can the Fed Save the Stock Market?Markets In retrospect, it was ill-timed for the Federal Reserve to start hiking short-term interest rates. But that can easily be fixed.

-

Bernanke's Ultimate Legacy

Bernanke's Ultimate Legacyinvesting The former Fed chairman's decisions in 2008 were an act of courage that averted an economic collapse far worse than we experienced.

-

Worries About China’s Economy Are Overblown

Worries About China’s Economy Are OverblownEconomic Forecasts Among the consequences of China's slowdown: lower commodity prices, which actually benefit the U.S.

-

Surviving the Greek Financial Crisis

Surviving the Greek Financial CrisisEconomic Forecasts Despite the recent friction, I believe the eurozone is stronger after putting down the Greek rebellion.