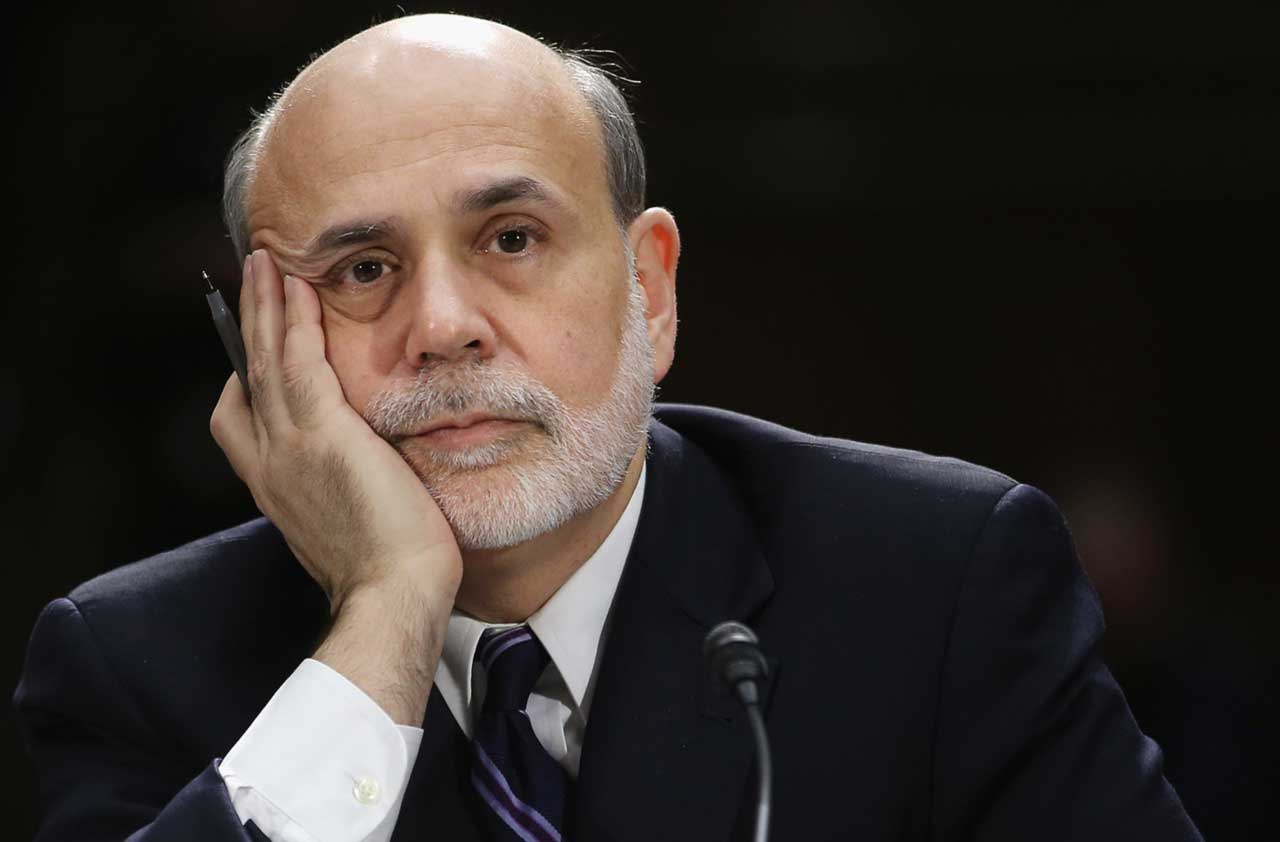

Bernanke's Ultimate Legacy

The former Fed chairman's decisions in 2008 were an act of courage that averted an economic collapse far worse than we experienced.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Ben Bernanke was the Federal Reserve’s most controversial chairman. He is revered by some, who claim that he saved the world from financial collapse, and despised by others, who criticize his Wall Street bailouts and his policy of keeping short-term interest rates near 0% for years. He saved investment bank Bear Stearns, yet six months later he let Lehman Brothers fail—only to flip-flop less than 48 hours after that and bail out insurance giant American International Group. So it’s not surprising that both the investment and academic communities eagerly awaited Bernanke’s recently published memoir, The Courage to Act, to explain what motivated his actions.

Bernanke’s ideas about monetary policy, along with those of many other economists, were heavily influenced by Milton Friedman’s highly regarded A Monetary History of the United States. Friedman concluded that the Fed’s failure to prevent the collapse of the banking system, and the subsequent contraction of the money supply and credit, was the most important cause of the Great Depression. Invited to speak at Friedman’s 90th birthday celebration in 2002, Bernanke, then a member of the Fed but not yet chairman, heartily praised the impact of A Monetary History. At the end of his introduction, he turned to Friedman and declared, “Regarding the Great Depression, you’re right. We did it. We’re very sorry. But thanks to you, we won’t do it again.”

Keeping his promise to Friedman, Bernanke acted to save Bear Stearns. But he didn’t anticipate the torrent of criticism from lawmakers. Both Congress and President Bush sternly instructed Bernanke and Treasury Secretary Henry Paulson: “No more bailouts!” Surprisingly, Bernanke claims this warning did not influence the Fed’s decision to let Lehman Brothers fail. In contrast to Bear Stearns, Bernanke asserts, Lehman was “deeply insolvent” and the Fed had no authority to inject capital or make a loan if the Fed was not reasonably sure the money could be fully repaid. Bernanke and Paulson held out a slim hope that the financial markets could weather the bankruptcy.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But the markets could not. The chaos unleashed on Monday, September 15, 2008, when Lehman filed for bankruptcy, was not contained. The flight to safety was so intense that creditors pulled their loans from major financial institutions, setting the stage for an epic financial collapse.

As panic spread, I was not surprised that Bernanke turned 180 degrees and bailed out AIG. Despite congressional opposition, Bernanke’s promise to Milton Friedman trumped the withering political criticism.

Political realities. Although Bernanke sticks with his story that he had no authority to bail out Lehman, the true reason for his decision was rooted in political realities. He writes, “In short, even if it had somehow been possible for the Fed on its own to save Lehman, and then perhaps even AIG, we would not have had either the capacity or the political support to undertake any future financial rescues. ... It seems clear that Congress would never have acted [to approve subsequent Fed bank loans] absent the failure of some large firm and the associated damage to the system” [emphasis added].

The Fed could have saved Lehman, but then it would have had to save not only AIG but Merrill Lynch and all the others. Congress would have risen up in anger and all but abolished the Fed. Even after Lehman’s failure and the resulting chaos, Bernanke barely mustered enough support to continue to lend to financial firms. When the final chapters of this crisis are written, they’ll conclude that Bernanke’s decisions were an act of courage that averted an economic collapse far worse than we experienced.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Executives Are Getting More Cash Bonuses. Here’s How to Avoid Spending It All.

Executives Are Getting More Cash Bonuses. Here’s How to Avoid Spending It All.Business Executives Looking to keep key employees, companies are handing out more cash bonuses. When deciding the best use of this money, ask yourself, “What matters most to my financial future?”

-

Don't Count on a Bonus or Recapturing Last Year's Pay Cut – Budget Around It Instead

Don't Count on a Bonus or Recapturing Last Year's Pay Cut – Budget Around It InsteadBusiness Executives If you are worried that your executive compensation may not meet your expectations in 2021, it’s best to prepare for the worst now. Here’s how.

-

3 Factors That Could Drive the Next Recession

3 Factors That Could Drive the Next RecessionEconomic Forecasts The economy is humming along nicely, but how long can the good times continue?

-

A Preview of the Fed Under Trump

A Preview of the Fed Under TrumpEconomic Forecasts John Taylor, a former Treasury official in the Bush administration, is a top candidate to replace Fed chair Janet Yellen.

-

Investors, Don't Fear Higher Rates

Investors, Don't Fear Higher Ratesinvesting Although interest rates will rise modestly in coming months, that should not derail the bull market.

-

Why Investors Shouldn't Be Afraid of Inflation

Why Investors Shouldn't Be Afraid of InflationEconomic Forecasts An inflation rate of 2% to 3% is good for stocks because it gives companies the power to raise prices, which helps boost profits.

-

A Positive Outlook for U.S. Interest Rates

A Positive Outlook for U.S. Interest RatesEconomic Forecasts Instead of the threat of deflation from weak growth and falling prices, the U.S. is facing the opposite: accelerating inflation.

-

Can the Fed Save the Stock Market?

Can the Fed Save the Stock Market?Markets In retrospect, it was ill-timed for the Federal Reserve to start hiking short-term interest rates. But that can easily be fixed.