Is My Bank Safe?

Here's how to know whether your money still will be there if your financial institution fails.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

How can I find out whether I need to worry if my bank is at risk of going under?

Five banks have already failed this year -- including IndyMac July 11 -- and others are having troubles. But you don't need to worry about your money as long as your balance stays below the Federal Deposit Insurance Corp. limits.

| Row 0 - Cell 0 | QUIZ: How Safe Is Your Money? |

| Row 1 - Cell 0 | When a Bank Closes |

If you have less than $100,000 at that bank, you definitely will be covered. And if you have several types of accounts, you can have as much as $450,000 -- or more -- in FDIC coverage. Stay within those limits, and there's absolutely no need for a run on the bank.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

First, make sure your bank is covered by the FDIC, the U.S. government agency that protects your deposits if the bank fails. Don't just take the bank's word for it. Look up its status using the FDIC's BankFind tool or by calling the FDIC at 877-275-3342 (from 8 a.m. to 8 p.m. Eastern time). Credit unions are insured through the National Credit Union Share Insurance Fund. You can find out your credit union's status at www.ncua.gov.

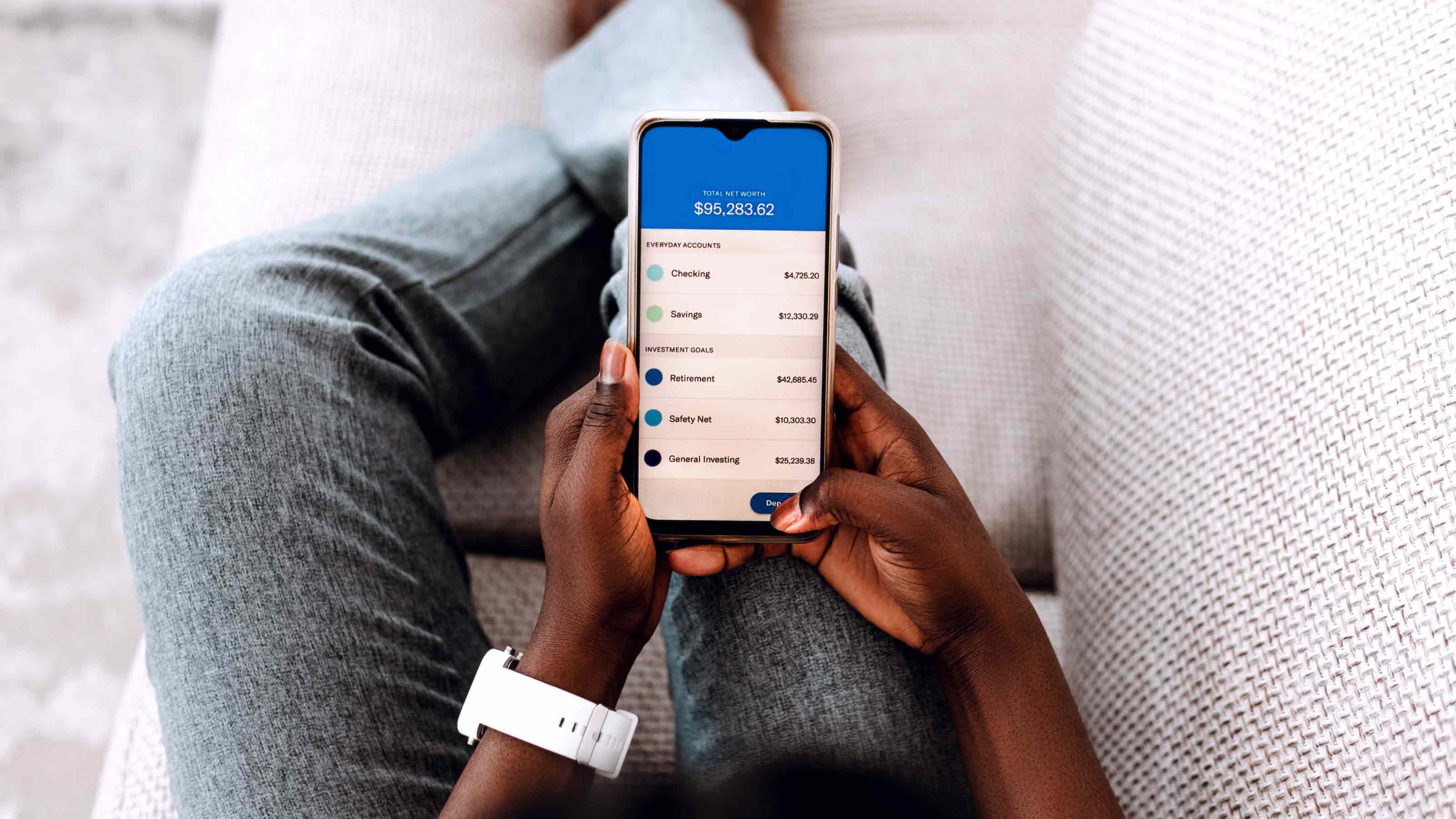

Then, calculate your FDIC limits. You have a $100,000 FDIC limit for single accounts, $100,000 for your share of joint accounts, and up to $250,000 for certain types of retirement accounts, including IRAs. You can check your coverage limits by using the FDIC's Electronic Deposit Insurance Estimator (EDIE).

If you have more money in that bank than the FDIC limits, just shift the extra money to another bank. The limits apply to each institution where you have an account. So, for example, if you had single accounts at three different banks, up to $100,000 would be protected at each bank -- for a total of $300,000 that's covered.

As long as your balance is under the FDIC coverage limits, then you'll have continuous access to your money and may just lose some services temporarily during the transition. IndyMac was closed by the FDIC on Friday, July 11, and some branches were closed early for the day. Customers lost access to online and phone banking services over the weekend but could still withdraw insured deposits through ATMs. All banking services resumed for insured depositors by Monday morning, July 14. See the FDIC's IndyMac information page for details and contact information.

The situation gets trickier if you have uninsured deposits -- which is affecting about 10,000 IndyMac customers who have as much as $1 billion in total uninsured deposits. The FDIC gave them access to 50% of their uninsured money right away, and they will gradually receive more money as the FDIC sells the bank's assets.

The FDIC typically recovers about 80% to 90% of uninsured deposits in the end, but that process can take a while. When NetBank failed on September 28, 2007, customers maintained access to their insured deposits plus 50% of their uninsured deposits through ING Direct, which took over the accounts. The FDIC recovered more money for uninsured depositors over the following months -- an additional 21.3% by December 18, 2007, and another 6.32% by April 2, 2008. So far, former NetBank customers have recovered 77.65% of their uninsured deposits.

For updates about failed banks and to see and how much money has been recovered, see the FDIC's Failed Bank List. Click on "Dividend History" for each bank to see how much the FDIC has recovered so far.

For more information see When a Bank Closes and Is Online Banking Safe?, which explains what happened to NetBank customers after the FDIC took over.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

As the "Ask Kim" columnist for Kiplinger's Personal Finance, Lankford receives hundreds of personal finance questions from readers every month. She is the author of Rescue Your Financial Life (McGraw-Hill, 2003), The Insurance Maze: How You Can Save Money on Insurance -- and Still Get the Coverage You Need (Kaplan, 2006), Kiplinger's Ask Kim for Money Smart Solutions (Kaplan, 2007) and The Kiplinger/BBB Personal Finance Guide for Military Families. She is frequently featured as a financial expert on television and radio, including NBC's Today Show, CNN, CNBC and National Public Radio.

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

5 Actions to Set Up Your Business With Your Exit in Mind

5 Actions to Set Up Your Business With Your Exit in MindWhen you're starting a business, it may seem counterintuitive to begin with exit planning. But preparing will put you on a more secure footing in the long run.

-

Best One-Year CD Rates

Best One-Year CD RatesSavings The best 1-year CD rates are a smart way to achieve short-term savings goals.

-

What Is a High-Yield Savings Account?

What Is a High-Yield Savings Account?A high-yield savings account is essentially the same as a traditional account with one key difference — it pays a higher-than-average APY on deposits.

-

Trusting Fintech: Four Critical Moves to Protect Yourself

Trusting Fintech: Four Critical Moves to Protect YourselfA few relatively easy steps can help you safeguard your money when using bank and budgeting apps and other financial technology.

-

Four Steps to Prepare Your Finances for Divorce

Four Steps to Prepare Your Finances for DivorceDivorce is rarely easy, but getting financial paperwork in order, working with professionals and making tough decisions now can take some of the stress out of it.

-

How to Open a Savings Account Online

How to Open a Savings Account OnlineYou may be wondering how to open a savings account online. The process is usually simple and straightforward — with just a few steps you’ll be able to start saving your hard-earned cash.

-

10 Easily Fixable, But Often Overlooked, Financial Planning Items

10 Easily Fixable, But Often Overlooked, Financial Planning Itemspersonal finance It’s easy to let important financial tasks slip your mind, so take a minute to check this list for any to-do items you may have forgotten. It could make a big difference in your bottom line.

-

How to Keep Your Savings Safe

How to Keep Your Savings Safesavings If you want to keep your savings safe but they exceed FDIC and NCUA limits, it's time to open multiple accounts, preferably ones with high yields.

-

Money Market Account or Money Market Fund? How to Choose

Money Market Account or Money Market Fund? How to Choosemoney market accounts Whether you choose a money market account or money market fund largely depends on the money's purpose.