15 Believe It or Not Tax Breaks

Your fellow taxpayers have successfully claimed write-offs for many things that most of us wouldn't even imagine.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As you struggle with your tax return, trying to come up with some extra deductions to pump up your refund or reduce what you owe, don't you sometimes think about taking a few flights of fancy? We've all done it, conjuring up in our heads miraculous tax write-offs until we're brought back to reality. "Can I claim a deduction for all those blood donations at the Red Cross?" Nope. "How about a charitable contribution for all the time I donate to the church?" No, again. "What about claiming a home office deduction for my home movie theater?" No way. "Can I claim my dog as a dependent?" (This was asked years ago by the author's mom.) Come on!

On the other hand, your fellow taxpayers have successfully claimed write-offs for many things that most of us wouldn't even imagine, such as cat food, the cost of installing a swimming pool, genetic testing kits, and body oil used by a professional bodybuilder.

Here are 15 of our favorites.

Cats

A couple who owned a junkyard was allowed to write off the cost of cat food they set out to attract wild cats. The feral felines did more than just eat. They also took care of snakes and rats on the property, making the place safer for customers. When the case reached the Tax Court, IRS lawyers conceded that the cost was deductible.

In another case, a woman used her own money to care for feral cats that she fostered in her home for a charity that specialized in the neutering of wild cats. She spent more than $12,000 of her own money paying for vet bills, food and other items. The Tax Court ruled that she can claim a charitable deduction for a portion of her expenses that she could substantiate.

Barking Dogs

A self-employed consultant who worked in her condominium sued her neighbors and the condo association, alleging that her work was disrupted by noise from faulty construction and barking dogs. Also, in connection with the litigation, she was charged with a criminal misdemeanor. She deducted $26,000 of attorney fees associated with both of these proceedings as business expenses.

The IRS said the legal fees were personal costs. But the Tax Court OK'd half of the write-off because she used 50% of the condo for business, and the IRS failed to prove that the noise didn't adversely affect her business use of the residence.

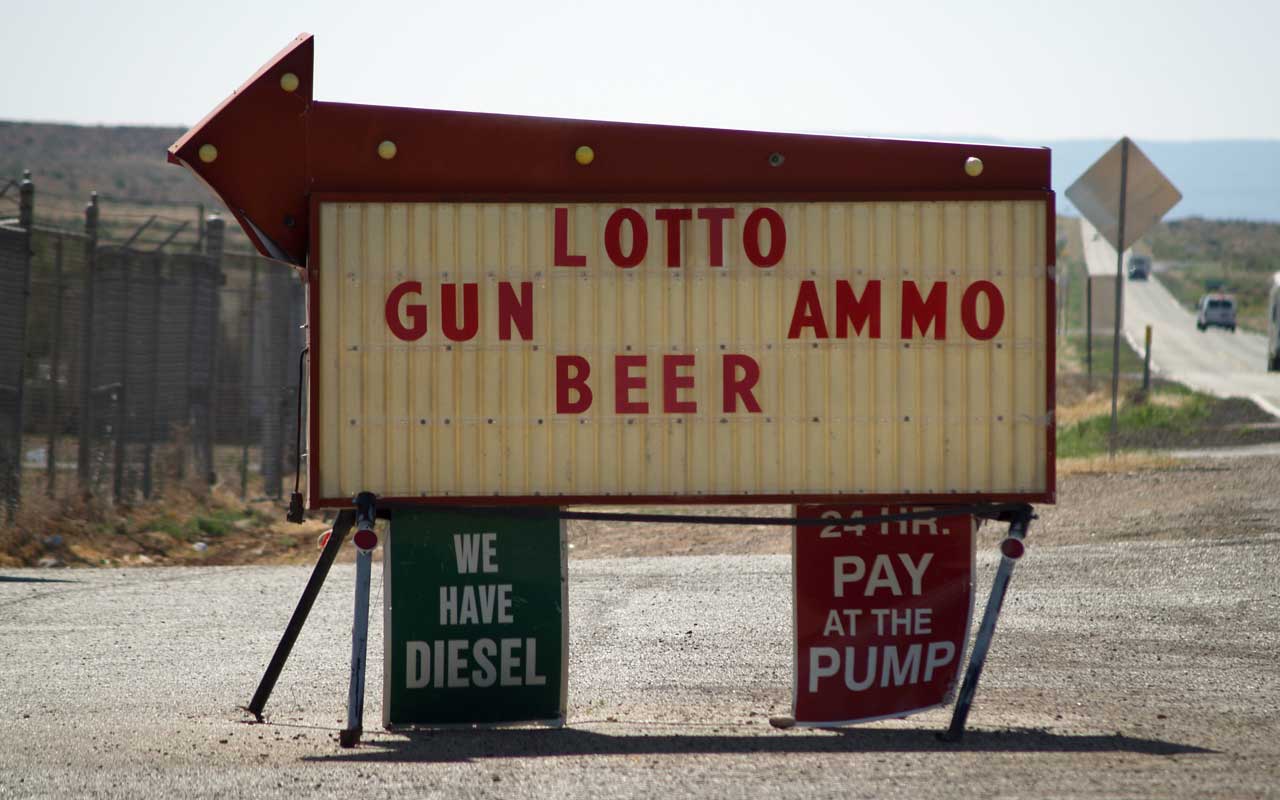

Free Beer

In a novel promotion, a service-station owner offered his customers free beer with a fill-up. Not surprisingly, his station's gasoline sales increased significantly. Proving that alcohol and gasoline do mix—for tax purposes—the Tax Court allowed the owner to deduct the cost of the beer as a business expense.

Devilish Donations

Donating to charity can help people feel all warm and fuzzy inside. Charitable donations are also a great tax write-off for those who itemize on Schedule A of the 1040. But did you know you can get a tax write-off for donating to The Satanic Temple in Salem, Massachusetts? In 2019, the IRS blessed The Satanic Temple as a 501(c)(3) tax-exempt church. So, if you're feeling charitable, you can go on the organization's website and make a tax-deductible contribution of $666 or any other amount to The Satanic Temple.

Genetic Testing Kits

Many people nowadays use a DNA ancestry company to find out not only the regions and ethnicities of their ancestry, but also for genetic testing.

And here's some good news if you buy a kit from 23 and Me: The IRS said that part of the price of the combined health and ancestry kit produced by the company may be treated as a deductible medical expense. People who buy the DNA collection kit and pay extra to include the genetic testing can allocate the kit's price between the nondeductible ancestry services and the deductible health testing (generally treated as a medical expense deductible by itemizers on Schedule A to the extent total medicals costs exceed 7.5% of adjusted gross income). People who buy the cheaper kit only for ancestry services won't get a deduction.

You can also use flexible health spending account funds or your health savings account to pay for the genetic health services.

Swimming Pools

A taxpayer with emphysema put in a pool after his doctor told him to develop an exercise regime. He swam in it twice a day and improved his breathing capacity. Turns out he swam in the pool more than his family did. The Tax Court allowed him to deduct the cost of the pool (to the extent the cost exceeded the amount it added to the value of the property) as a medical expense because its primary purpose was for medical care. Also, the cost of heating the pool, pool chemicals and a proportionate part of insuring the pool area are treated as medical expenses.

Phones, Phones and More Phones

A self-employed attorney with his own law practice worked out of his home. He had a designated office which he used regularly and exclusively as his principal place of business. He claimed many deductions related to his home office, including the cost of utilities. He had five business telephone lines and a cell phone. Though the Tax Court denied some of his other deductions on Schedule C, it did allow him a $6,500 tax write-off for the telephone expenses.

Body Oil

A pro bodybuilder used body oil to make his muscles glisten in the lights during his competitions. The Tax Court ruled that he could deduct the cost of the oil as a business expense. Lest it be seen as a softie, though, the Court nixed deductions for buffalo meat and special vitamin supplements to enhance strength and muscle development.

Tax Return Preparation Fees

Prior to 2018, people who itemize on Schedule A could deduct the cost of the fees they paid for tax preparation or tax software, but only to the extent that those fees and all other miscellaneous itemized deductions exceeded 2% of their adjusted gross income. Then came the 2017 tax reform law, which eliminated all miscellaneous deductions from 2018 through 2025 that were previously subject to the 2% of AGI threshold.

But did you know that if you file Schedule C, Schedule E or Schedule F with your return, you can still write off part of your tax return preparation fees. That's because the IRS said in 1992 public guidance that tax return preparation expenses incurred in preparing Schedules C (sole proprietors), E (rentals, royalties, partnership, S corporations) or F (farmers) are deductible in calculating AGI, meaning they are above-the-line deductions. People filing any of these three schedules are thus able to claim an allocable proration of their total tax preparation expenses on the corresponding schedule.

Hee Haw

Horse breeding losses are often disallowed by the hobby loss rules. But every once in a while, a taxpayer can get a win on breeding losses. In one instance, a wealthy investment manager with annual adjusted gross income of over $20 million deducted tens of thousands in annual losses over nine years from a donkey breeding venture. The IRS challenged the loss deductions, claiming the activity was a hobby. But the Tax Court ruled for the millionaire, surprisingly noting the activity was still in the start-up phase.

Making Movies

A lawyer faced a challenge from the IRS as she sought to deduct losses during the six years she spent making a documentary film on the musical group Up With People. The IRS claimed the long series of annual losses indicated that her filmmaking activities were a hobby, asserting the project was essentially a high-cost home movie because her husband once was a member of that group.

Furthermore, at one point during hearings, the judge reviewing the case suggested that documentary filmmaking is by nature not-for-profit—a musing that so alarmed the film industry that a number of well-known filmmakers filed friend-of-court rulings to say, in essence, that you can make money with documentaries.

Ultimately, the court ruled in her favor, allowing her deduction of six-figure losses. It noted that she acted in a businesslike manner, hiring staff such as a bookkeeper, buying insurance, consulting experts, changing the story line to make the film more marketable, blogging about it, and taking it on tour to movie festivals.

Landscaping

A sole proprietor who regularly met clients in his home office was allowed to deduct part of the costs of landscaping the property, on the grounds that it was a part of the home being used for business, according to the Tax Court. The court also allowed a deduction for part of the costs of lawn care and driveway repairs.

Helping Your Child's Career

A father owned a profitable real estate development business. His teenage son was a local celebrity for his successful motocross racing, so the father decided to have the company become a sponsor for his son's racing activity. Over a two-year period, the firm paid $160,000 for motorcycles, equipment and other costs. The funding ceased when the son turned pro.

The Tax Court said that most of the $160,000 was a deductible business expense because the firm obtained new business connections, favorable construction financing deals and other similar benefits from its sponsorship.

Airplanes

Rather than drive five to seven hours to check on their rental condo or be tied to the only daily commercial flight available, a couple bought their own plane. The Tax Court allowed them to deduct their condo-related trips on the aircraft, including the cost of fuel and depreciation for the portion of time used for business-related purposes, even though these costs increased their overall rental loss on the condo.

King of Pop

Not many people have to pay federal estate taxes. That's because the federal estate and gift tax exclusion is so high ($12,920,000 for decedents who die in 2023). And those few estates that are subject to the tax can afford lawyers to help them with all sorts of legal planning techniques to help them minimize the amount of tax they owe. And then there's Michael Jackson, the pop star who died in 2009. His estate claimed that the value of Jackson's name and image on death was $3 million. The IRS thought that was way too low, first arguing the value was $434 million and later cutting it to $161 million. The estate disputed the IRS's adjustments in Tax Court in a case that took nearly 10 years from start to finish. In a major win for the pop star's estate, the Tax Court valued Michael Jackson's name and likeness at death at $4.15 million.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Joy is an experienced CPA and tax attorney with an L.L.M. in Taxation from New York University School of Law. After many years working for big law and accounting firms, Joy saw the light and now puts her education, legal experience and in-depth knowledge of federal tax law to use writing for Kiplinger. She writes and edits The Kiplinger Tax Letter and contributes federal tax and retirement stories to kiplinger.com and Kiplinger’s Retirement Report. Her articles have been picked up by the Washington Post and other media outlets. Joy has also appeared as a tax expert in newspapers, on television and on radio discussing federal tax developments.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

How to Open Your Kid's $1,000 Trump Account

How to Open Your Kid's $1,000 Trump AccountTax Breaks Filing income taxes in 2026? You won't want to miss Form 4547 to claim a $1,000 Trump Account for your child.

-

In Arkansas and Illinois, Groceries Just Got Cheaper, But Not By Much

In Arkansas and Illinois, Groceries Just Got Cheaper, But Not By MuchFood Prices Arkansas and Illinois are the most recent states to repeal sales tax on groceries. Will it really help shoppers with their food bills?

-

7 Bad Tax Habits to Kick Right Now

7 Bad Tax Habits to Kick Right NowTax Tips Ditch these seven common habits to sidestep IRS red flags for a smoother, faster 2026 income tax filing.

-

New Plan Could End Surprise Taxes on Social Security 'Back Pay'

New Plan Could End Surprise Taxes on Social Security 'Back Pay'Social Security Taxes on Social Security benefits are stirring debate again, as recent changes could affect how some retirees file their returns this tax season.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Can I Deduct My Pet On My Taxes?

Can I Deduct My Pet On My Taxes?Tax Deductions Your cat isn't a dependent, but your guard dog might be a business expense. Here are the IRS rules for pet-related tax deductions in 2026.

-

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your Bill

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your BillTax Tips Is your income tax bill bigger than expected? Here's how you should prepare for next year.

-

Will IRS Budget Cuts Disrupt Tax Season? What You Need to Know

Will IRS Budget Cuts Disrupt Tax Season? What You Need to KnowTaxes The 2026 tax season could be an unprecedented one for the IRS. Here’s how you can be proactive to keep up with the status of your return.