Value Added: 7 Top Stocks for 2019

Making money in the stock market this year is going to take all the skill and luck you can muster.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Making money in the stock market this year is going to take all the skill and luck you can muster. The global economy is slowing, a trade war with China still lingers despite negotiations, and the Federal Reserve remains likely to raise short-term interest rates, albeit slowly.

But you still can find promising investments. To identify some of the top stocks right now, I interviewed Jerome Dodson, manager of Parnassus Endeavor Fund (PARWX) and founder of the Parnassus funds. Based in San Francisco, Parnassus is the largest U.S. fund firm focused on buying good stocks that are also, in the firm’s view, good corporate citizens in terms of the environment, social and corporate governance issues.

More to the point, Dodson’s fund has a first-class record. Endeavor returned an annualized 16.3% over the past 10 years – an average of 3.1 percentage points per year better than the Standard & Poor’s 500-stock index. Dodson, 75, is a contrarian investor who loves to pounce on stocks that have been pummeled.

Given the selloff, this is precisely Dodson’s kind of market. Read on for his seven top stocks for 2019.

Data is as of Jan. 8, 2019. Dividend yields are calculated by annualizing the most recent quarterly payout and dividing by the share price. Steve Goldberg writes a regular column, “Value Added.”

Apple

- 52-week low/high: $142.00/$233.47

- Market value: $715.4 billion

- Trailing P/E ratio: 13

- Dividend yield: 1.9%

- Apple (AAPL, $150.75) is a classic Dodson pick. Apple, of course, did a round trip, cresting around $233 before collapsing. It went from being everyone’s favorite stock to everyone’s most hated stock – with almost all the decline taking place in just the last three months of 2018. Then in early January, a fresh announcement of flagging sales of its signature iPhones, mainly in China, caused further damage to its stock price.

For Apple to turn around, Dodson says, it needs one big thing to happen: The U.S. and China must settle their trade differences without the U.S. putting big tariffs on imports of iPhones, which are assembled in China from parts manufactured in other Asian countries. Tariffs would force Apple to raise prices, trim profit margins, undertake a major revamping of its supply chain or, perhaps, all of the above.

“I’m assuming the trade spat will be settled,” Dodson says. “If Trump raises tariffs, that’d be really scary.”

Assuming common sense prevails, Dodson believes growth in Apple’s Services division – which includes iCloud, Apple Music, Apple Watch and iPay – will help make up for the longer periods users are holding onto their older iPhones, rather than buying newer, shinier models. But make no mistake: What Dodson really likes is Apple’s lower price. Shares trade at a level not seen since mid-2017. It’s not often a stock like Apple sells at a price-earnings ratio as low as 13.

Apple’s genius is that it sells products that really aren’t too dissimilar from everyone else’s. But once you own an iPhone, buying an Apple computer that so easily integrates with that phone is a no-brainer. Before you know it, you also own an iPad, an Apple Watch … and on it goes even though Apple’s prices are higher than most competitors. (By the way, I don’t own the stock, although several clients do. But I do own virtually all the Apple toys.)

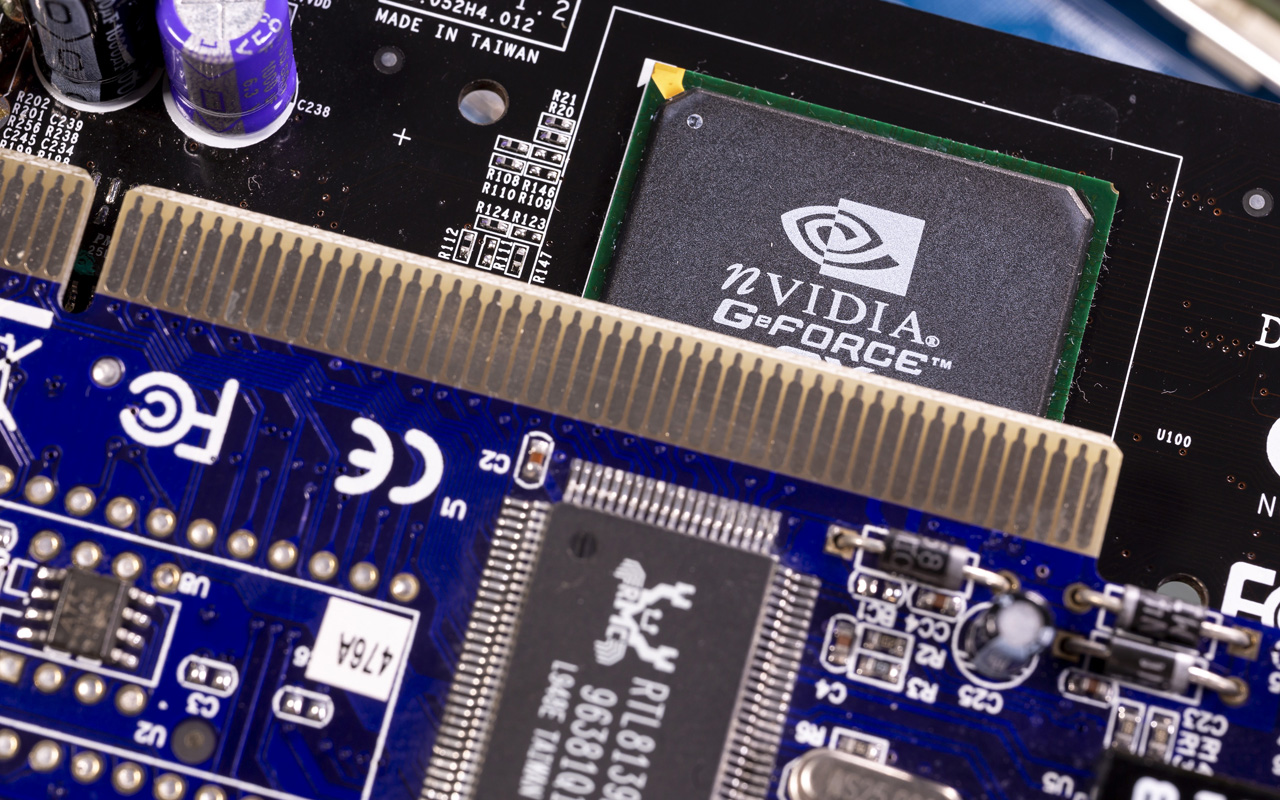

Nvidia

- 52-week low/high: $124.46/$292.76

- Market value: $85.3 billion

- P/E ratio: 22

- Dividend yield: 0.5%

Did I mention that Dodson likes to pick up the pieces after a stock crashes? Consider Nvidia (NVDA, $139.83), a leading designer of cutting-edge graphics processing units, which are used in a variety of high-end computer applications, especially for complex gaming software.

Nvidia became a cult stock because its chips were also widely used in computer mining of cryptocurrencies, such as Bitcoin. When the cryptocurrencies cratered, demand for some of Nvidia’s chips fell too, and failed to recover quickly. CEO Jensen Huang told a conference call in November that the company was suffering from a “crypto hangover.”

Nvidia’s future, thankfully, isn’t in cryptocurrency mining. Demand for its chips comes not just from gaming applications, but also from data centers and automotive infotainment centers. Nvidia’s chips also are increasingly being used in artificial intelligence and self-driving applications.

Dodson likes Nvidia’s P/E of 22. On an absolute basis, that’s fairly high, but Dodson likes to compare a forward P/E to a stock’s five-year history. Nvidia’s five-year average P/E is 33; looked at that way, NVDA is dirt-cheap.

Cummins

- 52-week low/high: $124.40/$194.18

- Market value: $22.0 billion

- P/E ratio: 9

- Dividend yield: 3.3%

- Cummins (CMI, $137.20) is down 29% from its high; thus, it’s in Dodson’s sweet spot. Unlike Dodson’s tech stocks, Cummins is based in Indiana, far from Silicon Valley. The company makes and services diesel engines and components, as well as natural gas engines. It also makes standby electrical power generational systems used by hospitals, data centers and other users requiring uninterrupted electrical power. Almost half of Cummins’ sales are outside the U.S., so it’s another stock that could be hurt by trade disputes.

In recent years, Cummins has benefited from rising fuel efficiency standards and tighter emissions regulations. However, CMI shares could be hurt by the Trump administration’s rollback of those standards and its embrace of coal and other comparatively dirty fossil fuels. And because its engines are used primarily in trucks, the company’s sales are closely tied to the economy. Any slowing in the economy globally, which we’re already seeing, could hurt its sales and earnings.

Still, Cummins, which is 100 years old, has developed a reputation for producing superior and innovative engines and related products. And with a forward P/E of 9, compared to a five-year average P/E of 13, CMI looks like a winner.

International Business Machines

- 52-week low/high: $105.54/$171.13

- Market value: $108.9 billion

- P/E ratio: 9

- Dividend yield: 5.2%

- International Business Machines (IBM, $119.83) is a lumbering giant whose best years were decades ago. But it’s still a behemoth in IT with more than a century in business behind it. IBM has operations in more than 170 countries, and much of its revenue comes from long-held contracts with the largest multi-national companies. These long-term contracts tend to lead companies to sign up with IBM for new services and products.

Last fall, IBM announced its acquisition of Red Hat for $34 billion – a 63% premium over Red Hat’s share price. The deal – the largest software acquisition ever – is all about building a bigger market in cloud computing. IBM CEO Ginni Rometty said: “IBM will become the world’s No. 1 hybrid cloud provider, offering companies the only open cloud solution that will unlock the full value of the cloud for their business.”

Becoming a big player in the cloud business could revive enthusiasm around the stock, Dodson says. IBM trades at 9 times trailing earnings, versus a five-year average of 10, and Dodson argues it doesn’t require much positive news to make it an attractive stock.

Applied Materials

- 52-week low/high: $28.79/$62.40

- Market value: $31.5 billion

- P/E ratio: 9

- Dividend yield: 2.4%

- Applied Materials (AMAT, $32.91) is one of the world’s largest makers of tools and equipment used to make virtually every type of semiconductor. Its products are used in almost every chip-manufacturing facility in the world, Morningstar says. It spends $2 billion per year on research and development to keep up with innovative technologies.

Since peaking in price last March, AMAT has been on a bumpy road down. As we all discovered in the tech bubble and burst of 2000-02, the tech industry is subject to vicious boom-and-bust cycles. The question for investors: Are we near the bottom of the cycle? Applied’s price has fallen from its $62.40 high to a low of about half that. It currently trades at nearly $33 per share and has a P/E of 9. Its five-year average P/E is 16.

“At this price it’s a bargain,” Dodson says. “You have to buy it when things look bad. If you’re making semiconductors, you almost have to use Applied Materials equipment.”

Like most cyclicals, AMAT is a stock you may be better off “renting” for a year or two rather than holding for the long term.

Biogen

- 52-week low/high: $249.17/$388.67

- Market value: $65.4 billion

- P/E ratio: 12

- Dividend yield: N/A

- Biogen (BIIB, $324.44) has several blockbuster medications on the market for multiple sclerosis and cancer, as well as as a robust pipeline of drugs in clinical trials for neurological and neurodegenerative diseases, including Alzheimer’s.

A cure for Alzheimer’s, which afflicts millions of people worldwide, has long been the Holy Grail for biotechnology researchers. So far, all the drugs developed have fallen far short of becoming effective treatments. But, if and when breakthroughs come, Cambridge, Mass., based Biogen might well be part of the solution.

Much as pharmaceutical companies are forced to lower their prices when their exclusive-use patents expire and cheaper generics come to market, biosimilars offer price competition to biotechnology medications from Biogen and other biotech companies. But biosimilars are more complicated to develop and bring to market than generic drugs. How that process unfolds will depend partly on science, but also on legislation and regulation.

Biogen’s stock peaked last July, but it has bounced much farther and faster than the market since the U.S. stock rally began Dec. 26. It currently trades near $324, roughly 12 times trailing earnings.

“We think it’s a terrific company,” Dodson says. “It’s highly profitable, and the floor for its P/E has been 17 in recent history.”

Gilead Sciences

- 52-week low/high: $60.32/$89.54

- Market value: $88.0 billion

- P/E ratio: 10

- Dividend yield: 3.3%

- Gilead Sciences (GILD, $68.09) is highly profitable largely because of sales of two drugs for HIV and another drug for Hepatitis C. The Hepatitis C drug, Dodson says, would be more profitable except that it requires only short-term treatment to cure almost all cases of what was an often fatal disease. The HIV drugs need to be taken for many years.

Gilead is working on new and better drugs for HIV and Hepatitis C, as well as other infectious diseases. Through acquisitions, Gilead has broadened its focus to include cancer and pulmonary and cardiovascular diseases. “The company has a history of discovering new drugs and of acquiring drugs developed by other firms,” Dodson says.

Gilead peaked in price more than a year ago. Like Biogen, it took off the day after Christmas with the rest of the market, then kept on climbing. Both companies drew buyers on word of Bristol-Myers Squibb’s (BMY) deal to acquire biotech firm Celgene (CELG).

The stock currently trades near $68. Its P/E is 10, compared to a five-year P/E of 9.

Steve Goldberg is an investment adviser in the Washington, D.C., area.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.