7 Dow Stocks at a Reasonable Price

Stocks might be hitting all-time highs, but there still are bargains to be found, especially among the blue-chip stocks in the Dow Jones Industrial Average.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks might be hitting all-time highs, but there still are bargains to be found, especially among the blue-chip stocks in the Dow Jones Industrial Average. The exclusive club of 30 Dow stocks is bristling with names that remain reasonably priced even as the industrial average approaches its own all-time closing high of 26,616.71 set on Jan. 28, 2018.

Whether they’re beaten-down value plays or stocks that don’t adequately reflect their companies’ long-term earnings growth, plenty of Dow Jones stocks are on sale.

The Standard & Poor’s 500-stock index currently trades at 16.6 times expected earnings, according to data from Thomson Reuters. With that as our starting point, we screened the Dow for stocks with forward price-to-earnings multiples of less than 16.6. Next, we looked at projected earnings growth rates, historical valuations, analyst commentary and broker recommendations. Lastly, we looked at dividend yields, which are an important component of future total returns.

After applying those criteria, these names stand out as great Dow stocks trading a reasonable price.

Data is as of Aug. 29, 2018. Companies are listed alphabetically. Dividend yields are calculated by annualizing the most recent quarterly payout and dividing by the share price. Forward price-to-earnings (P/E) multiples provided by Thomson Reuters. Analysts’ opinions provided by Zacks Investment Research.

Apple

- Market value: $1.1 trillion

- Dividend yield: 1.4%

- Forward P/E: 16.5

- Analysts’ opinion: 10 strong buy, 1 buy, 13 hold, 0 underperform, 0 sell

- Apple (AAPL, $222.98) became the first U.S. company to top $1 trillion in market value in August, but there’s still value to be found in the iPhone maker.

Just ask Warren Buffett, chairman and CEO of Berkshire Hathaway (BRK.B). The world’s greatest value investor pumped another $12 million into the the world’s most valuable company in the second quarter.

Apple shares trade at 16.5 times expected earnings – ever so slightly cheaper than the S&P 500. Analysts say that’s a reasonable price to pay for a company with Apple’s long-term growth rate. On average, analysts expect the tech titan to generate average annual earnings growth of 13% for the next five years.

Analysts at Canaccord Genuity write that there are currently 635 million iPhones in use around the globe. “This impressive installed base should drive strong iPhone replacement sales and earnings, as well as cash flow generation to fund strong long-term capital returns,” say the analysts, who rate shares at “Buy.”

Caterpillar

- Market value: $83.4 billion

- Dividend yield: 2.5%

- Forward P/E: 11

- Analysts’ opinion: 9 strong buy, 1 buy, 8 hold, 0 underperform, 0 sell

Shares in Caterpillar (CAT, $141.86) are having a tough 2018, hurt by trade-war anxiety. But with CAT stock off 9.7% for the year-to-date through Aug. 29, some analysts say it’s a bargain.

Analysts at Credit Suisse, who rate shares at “Outperform” (buy), note that Caterpillar saw no impact on demand because of tariffs in the most recent quarter. “We believe CAT’s stock is set up well and that peak concerns will fade,” Credit Suisse says.

The analysts add that Caterpillar is funneling cash back to shareholders. The company expects to buy back $1.25 billion of its own stock in the second half of 2018 and will start a new $10 billion buyback program, effective Jan. 1, 2019.

Shares in Caterpillar trade at just 11 times expected earnings, and yet analysts see profit growth increasing at an average rate of 26% a year for the next five years.

Chevron

- Market value: $230.4 billion

- Dividend yield: 3.8%

- Forward P/E: 13.7

- Analysts’ opinion: 10 strong buy, 1 buy, 3 hold, 0 underperform, 0 sell

The market might be setting all-time highs, but Chevron (CVX, $120.22) stock sure isn’t. It was off 6% for the year-to-date through Aug. 29. The Dow, by way of comparison, was up almost 5% during the same period.

The oil-and-gas giant might be lagging the broader market badly this year, but that just makes the valuation too good to ignore, analysts say. Jefferies Equity Research has CVX on its “Franchise Pick” list – a roll call of buy-rated stocks in which Jefferies analysts have the most confidence. They cite Chevron’s “strong growth profile driven by high-margin projects tied to oil prices,” including its Australian liquid natural gas operations and industry-leading position in Texas’ Permian Basin, as being undervalued by the market.

At just 13.7 times expected earnings, Chevron is much cheaper than the S&P 500. It also happens to be a dividend stalwart, having raised its payout every year for 31 consecutive years.

Cisco Systems

- Market value: $221.5 billion

- Dividend yield: 2.9%

- Forward P/E: 14.5

- Analysts’ opinion: 14 strong buy, 2 buy, 3 hold, 0 underperform, 0 sell

Analysts expect Cisco Systems (CSCO, $47.48) to generate average annual earnings growth of nearly 9% for the next five years. Add in the generous dividend yield, and they say that CSCO stock – trading at just 14.5 times expected earnings – looks like a good value.

William Blair Equity Research, which rates shares at “Outperform,” notes that revenue growth has accelerated for three straight quarters. Product orders for the quarter ended July 31 grew at their fastest clip in six years.

The analysts like Cisco’s risk-reward profile at the current share price, citing a healthy global economic environment, successful new products and the return of cash to shareholders through dividends and buybacks.

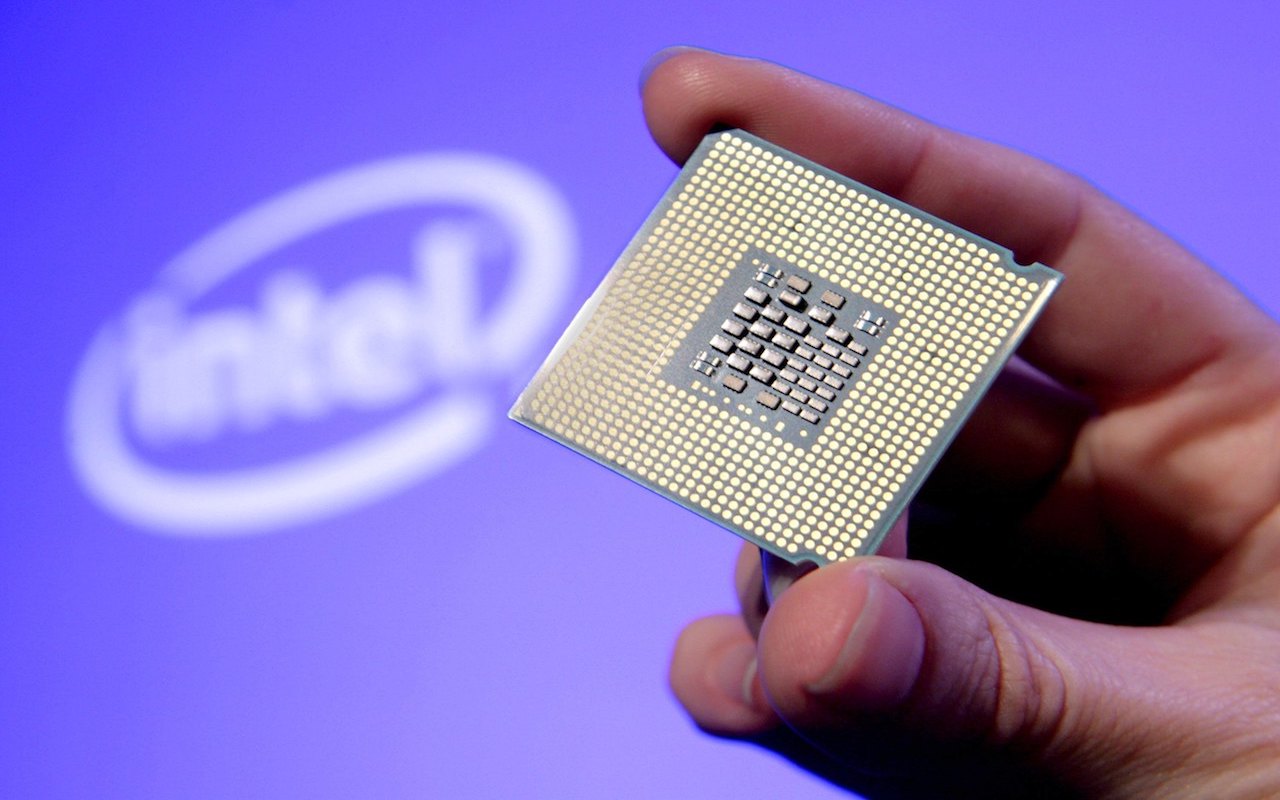

Intel

- Market value: $222.9 billion

- Dividend yield: 2.5%

- Forward P/E: 11.3

- Analysts’ opinion: 10 strong buy, 2 buy, 14 hold, 1 underperform, 2 sell

An expanding portfolio of products, as well as frequent product launches, is making Intel (INTC, $48.75) stock more attractive by the day, says Zacks Equity Research.

“The company’s leading position in PCs, strength in servers, growing influence in software and Internet of Things segments, along with headway in process technology, are all catalysts (for the stock),” Zacks says.

As for the price? With shares trading at just 11.3 times expected earnings, INTC looks like a bargain, the analysts note. That’s well below the industry’s average of 16.3, and it’s also much cheaper than the S&P 500. It’s even better when you consider that analysts forecast Intel to generate average annual earnings growth of 10.2% for the next five years.

Travelers

- Market value: $35.2 billion

- Dividend yield: 2.4%

- Forward P/E: 11.6

- Analysts’ opinion: 5 strong buy, 1 buy, 8 hold, 0 underperform, 3 sell

- Travelers (TRV, $132.66), which is one of America’s largest writers of commercial property casual insurance and personal insurance, remains reasonably priced based on its growth prospects and historical valuation.

Shares trade at 11.6 times expected earnings, well below the S&P 500 and at a slight discount to their own five-year average of 11.8. That’s despite analysts’ forecast for average annual earnings growth of 17.6% for the next five years, as well as solid quarterly results.

Analysts at Janney, who rate shares at “Buy,” note that the insurance giant reported strong growth, favorable pricing and lower expenses in the second quarter.

Verizon

- Market value: $225.5 billion

- Dividend yield: 4.3%

- Forward P/E: 11.5

- Analysts’ opinion: 12 strong buy, 1 buy, 7 hold, 0 underperform, 0 sell

The only telecommunications stock in the Dow has more going for it than just a hefty dividend. Analysts, on average, think Verizon (VZ, $54.57) offers superior upside at current levels.

That’s certainly been the case in the past. Indeed, Verizon has proven to be one of the 50 best stocks of all time. From 1984 to 2016, it delivered an annualized return of 11.2%, which created $165.1 billion in wealth.

If nothing else, you can depend on Verizon to squeeze blood out of the saturated U.S. telecom market, thanks to the virtual duopoly it shares with rival AT&T (T).

At 11.5 times expected earnings, Verizon stock trades at a discount to the broader market. It’s also a bargain compared to what investors usually pony up for the stock. Over the past five years, VZ has traded at an average of 12.7 times expected earnings, according to Thomson Reuters Stock Reports.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.