9 Dividend Aristocrats of the Future

The Dividend Aristocrats – members of the Standard & Poor’s 500-stock index that have increased their annual dividend payments for 25 years or longer – aren’t just useful as sources of income.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The Dividend Aristocrats – members of the Standard & Poor’s 500-stock index that have increased their annual dividend payments for 25 years or longer – aren’t just useful as sources of income. They’re powerful performers that have delivered 44% more in total returns on an annualized basis than the S&P 500 over the past decade.

These consistent dividend growers typically have durable, conservatively managed businesses, resulting in not only excellent long-term total returns but also fast-growing dividend income. The ProShares S&P 500 Dividend Aristocrats ETF (NOBL) – an exchange-traded fund that tracks these stocks – grew its payout by 15% in 2016 and 25% in 2015.

Income investors likely are familiar with many of the current Dividend Aristocrats – companies such as Coca-Cola (KO) and Procter & Gamble (PG). But they might not know about some of the high-quality dividend growth stocks that are on track to join this exclusive group over the next few years. Many of these stocks aren’t as widely followed – yet – but the consistency and resiliency of their businesses make them worth some attention.

Here are nine stocks that are on pace to become Dividend Aristocrats within the next three years.

Data is as of Nov. 6, 2017. Dividend yields are calculated by annualizing the most recent quarterly payout and dividing by the share price. Stocks are listed in alphabetical order. Click on ticker-symbol links in each slide for current share prices and more.

Albemarle

- Dividend yield: 0.9%

- Consecutive years of dividend hikes: 23

- Albemarle (ALB, $141.97) is a specialty chemicals conglomerate of sorts, manufacturing everything from lithium compounds used in batteries to bromine and hydroprocessing catalysts needed to refine oil. The company’s engineered chemicals are used in the consumer electronics, lubricants, construction and automotive industries, among others. Albemarle’s business is also global in nature, with more than 65% of revenue derived outside of North America in 2016.

The company’s durability, which has enabled it to increase its dividend every year since it was spun off from the Ethyl Corporation in 1994, is driven by its leading process technologies, scale, customer relationships and low-cost reserves in bromine and lithium. As a result, Albemarle enjoys No. 1 or No. 2 global ranks in each of its business segments. Albemarle’s mixture of mature and growth-oriented businesses also have provided the company with positive free cash flow each year for more than a decade, adding further support to the dividend’s safety profile.

However, the company’s best days could still be ahead of it. Albemarle targets 7% to 10% annual sales growth through 2021, with margins on adjusted EBITDA (earnings before interest, taxes, depreciation and amortization – a useful measure of operating performance that backs out accounting and other considerations) expected to rise from 28% in 2016 to 32% to 35% in that time. While Albemarle’s dividend has grown at a low- to mid-single-digit annual pace in recent years, that pace could accelerate from here if management hits their projections.

Either way, Albemarle looks like a lock to become a Dividend Aristocrat in a couple of years.

Essex Property Trust

- Dividend yield: 2.8%

- Consecutive years of dividend hikes: 23

- Essex Property Trust (ESS, $253.81) is a real estate investment trust (REIT) with roots dating back to 1971. Today, Essex has ownership interests in 248 apartment communities located along the West Coast. Its rental business is attractive thanks to the high cost of home ownership and high incomes in these areas.

The technology boom has only enhanced these qualities in recent years. The top 10 largest public technology companies are all headquartered in Essex’s markets, and their collective employee count has grown 10% annually over the past decade. Morningstar analyst Brad Schwer also notes that “over the past several years, robust job and income growth, coupled with inadequate new housing supply, has driven pricing power for apartment landlords and has allowed Essex to maintain high levels of occupancy and strong rent growth.”

These factors have combined to help Essex raise its payout each year since going public in 1994, recording nearly 320% cumulative dividend growth. Thanks to healthy trends in its markets and a dividend payout ratio below 60% during the past 12 months, Essex is well-positioned to continue increasing its payout and join the ranks of the Dividend Aristocrats in two years.

SEE ALSO:

p>

Expeditors International

- Dividend yield: 1.4%

- Consecutive years of dividend hikes: 23

Founded in 1979 and headquartered in Seattle, Expeditors International (EXPD, $57.49) is a service-based logistics company that helps businesses move their physical goods around the world in a timely and cost-effective manner. Expeditors International does not own any aircraft or ships, but instead uses its robust technology platform to purchase cargo space in bulk from carriers, reselling that space to its customers. Its range of services spans order management and warehousing to time-sensitive transportation and cargo insurance.

Expeditors International has been able to increase its dividend for 23 straight years largely because of the network effects its business model enjoys. With more than 250 offices located across six continents, Expeditors International has built a sizable reach in the highly fragmented third-party logistics industry. Its large customer base allows it to command attractive rates from carriers, which makes its service all the more attractive for new customers looking for logistics partners.

Morningstar analyst Matthew Young writes that Expeditors “can usually procure air and ocean capacity more efficiently and at lower rates than small and midsize shippers can secure on their own.” Young also says “flexible capacity access is an increasingly sought-after attribute," and that “a deep carrier network can be a key differentiation.”

Expeditors’ asset-light business model has helped the company consistently grow its dividend at a double-digit annual pace for more than two decades. With no debt and a payout ratio below 40%, the company should have no trouble achieving Dividend Aristocrat status in two years.

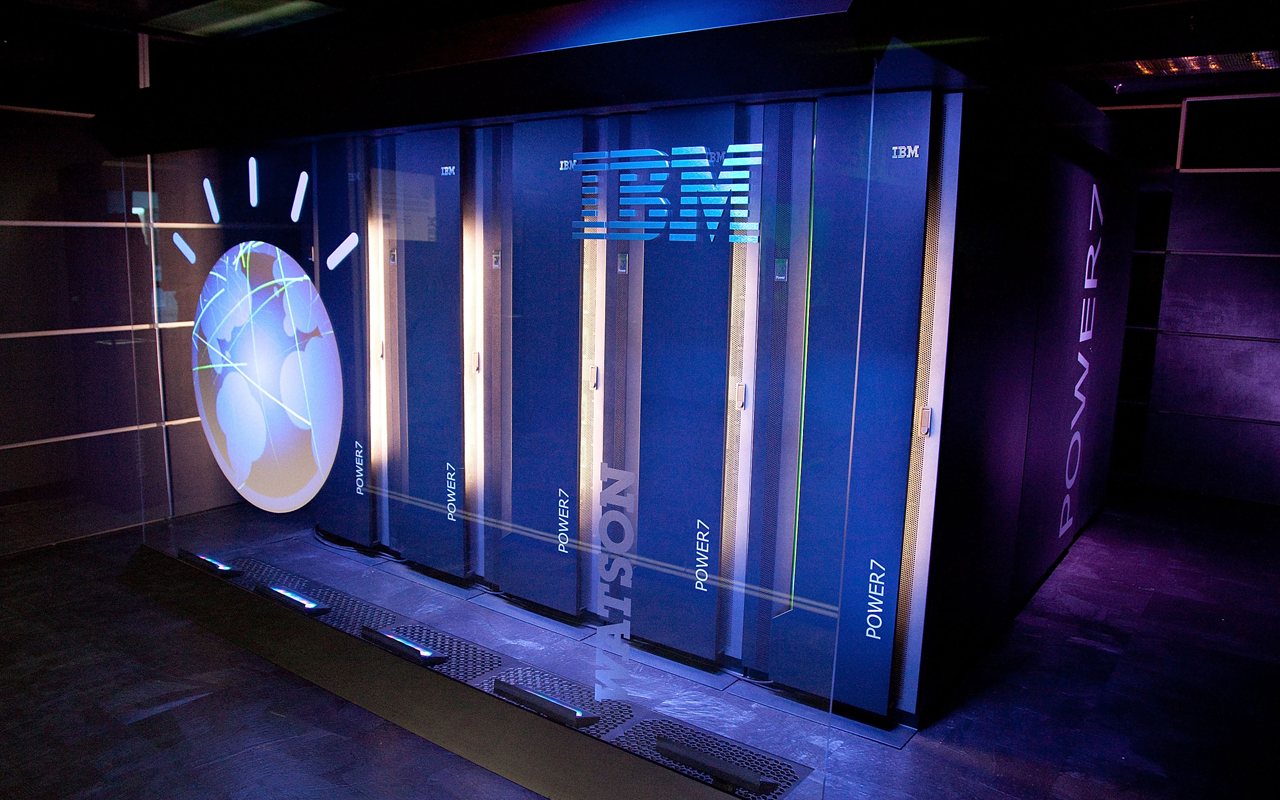

International Business Machines

- Dividend yield: 4%

- Consecutive years of dividend hikes: 22

While International Business Machines (IBM, $150.84) has struggled to generate top-line growth since 2012, the company has remained financially healthy enough to continue doling out dividend increases, which it has done for 22 consecutive years.

IBM has been around since 1911, growing to become one of the largest information technology products and services providers in the world. The company’s scope of operations encompasses everything from cloud services and analytics platforms to business consulting services and mainframe computers. However, IBM's current focus is its “Strategic Imperatives” businesses, which management believes are the future of technology, including industries such as artificial intelligence, big data analysis, cloud computing, cyber security and subscription-based infrastructure-as-a-service. Strategic Imperatives grew 10% during the third quarter to account for 45% of IBM’s revenue, with the rest attributed to legacy hardware and business services.

While IBM remains a large position in Warren Buffett’s dividend portfolio, the Oracle of Omaha started selling down his stake earlier this year. IBM failed to respond quickly enough to the shift taking place in its legacy market away from physical hardware and toward infrastructure-as-a-service. The company is busy playing catch-up for now and has yet to demonstrate it can return to growth.

The good news is that, for the moment, IBM is growing its dividend while shareholders wait for a potential turnaround. IBM boosted its dividend by 7% earlier this year, good for its 22nd consecutive annual increase. Despite its problems, IBM's low payout ratio below 50%, reasonable balance sheet and solid free cash flow generation makes the company likely to become a member of the Dividend Aristocrats in three years.

SEE ALSO:

Warren Buffett’s High-Yield Stocks

p>

Praxair

- Dividend yield: 2.1%

- Consecutive years of dividend hikes: 24

- Praxair (PX, $147.47) was founded in 1907 and is one of the largest global producers of industrial gases such as argon, hydrogen, nitrogen and oxygen. The company’s gases typically are delivered via pipeline and are mission-critical to customers’ operations and manufacturing processes, which span markets such as energy, chemicals, healthcare and electronics.

Praxair’s business has enabled it to pay higher dividends for 24 consecutive years because it generates such predictable cash flow. Industrial gases represent a small portion of a customer’s overall manufacturing cost and often are provided under long-term contracts. Furthermore, Praxair this year announced plans to merge with Linde to become the world's largest global industrial gas supplier and boast even greater portfolio diversification. The company expects to achieve $1.2 billion in annual cost and capital expenditure synergies while improving its balance sheet and cash flow generation to support growth investments and higher dividends.

Morningstar analyst David Silver notes that “the industrial gas industry has consolidated significantly since the late 1990s, which has limited overcapacity.” Praxair’s merger with Linde would further enhance the firm’s competitive positioning and should position it nicely to qualify as a Dividend Aristocrat in 2018.

Realty Income

- Dividend yield: 4.6%

- Consecutive years of dividend hikes: 23

- Realty Income (O, $55.26) has paid 568 consecutive monthly dividends, earning its nickname as “The Monthly Dividend Company.” The real estate investment trust (REIT) has delivered 4.6% compound annual dividend growth since going public in 1994, raising its payout every year to put the company just two years away from joining the Dividend Aristocrats list.

Realty Income’s appeal extends far beyond its solid dividend track record. The company enjoys stable rental cash flow from its portfolio of more than 5,000 freestanding commercial properties. Management has been careful to keep the business diversified, with Walgreens (WBA) the largest tenant at just 6.6% of rental revenue, and clients’ operations extending to 47 industries. The company’s focus on securing the best retail locations has resulted in excellent occupancy levels over the past 20 years that have never dipped below 96%.

Realty Income also maintains a conservative capital structure, enjoying an investment-grade credit rating and a 7.9-year weighted average duration of its unsecured notes and bonds, which provides financial flexibility. These qualities should help Realty Income continue paying higher dividends for many months and years to come.

Realty Income also is a high-dividend stock, with a 4.6% yield that's tops among this group of future Dividend Aristocrats.

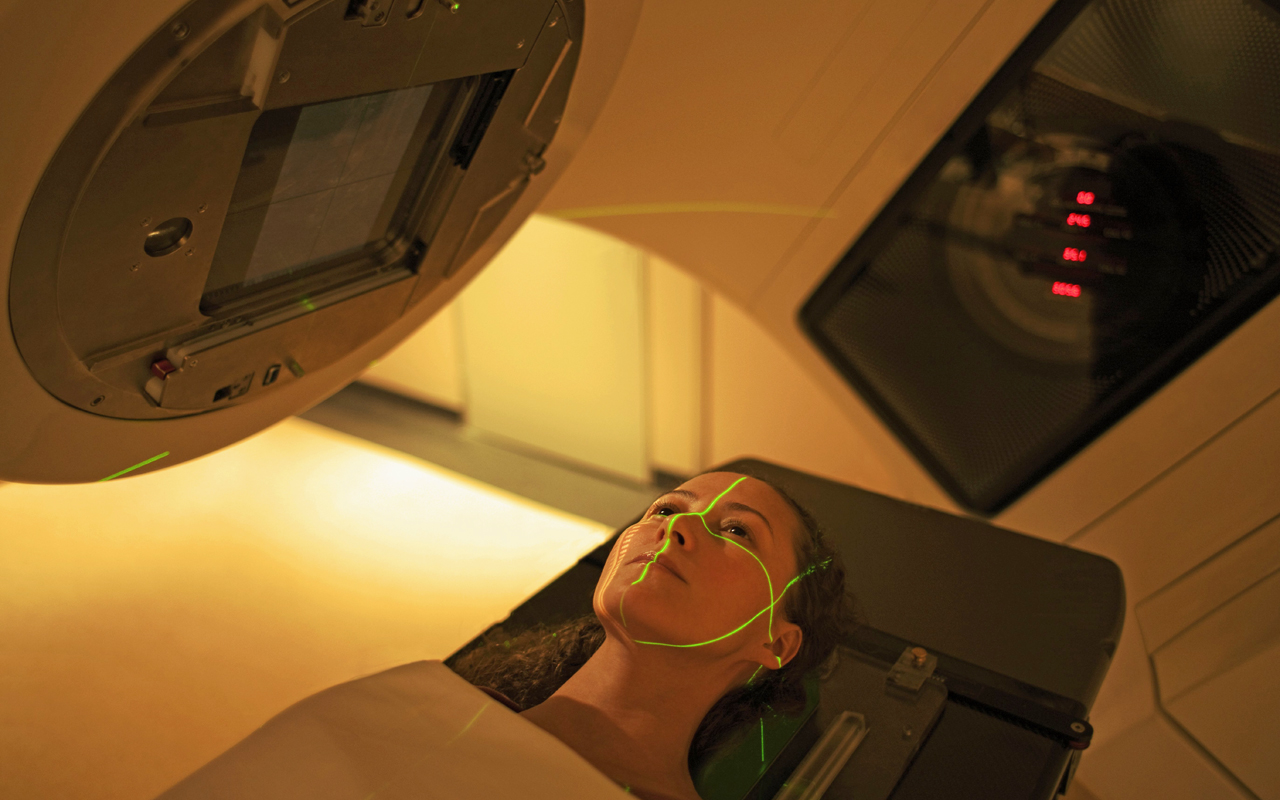

Roper Technologies

- Dividend yield: 0.5%

- Consecutive years of dividend hikes: 24

- Roper Technologies (ROP, $258.20) provides software and engineered products for a wide variety of niche markets, including energy, healthcare, food and transportation. This business model generates high amounts of recurring revenue, sticky customer relationships and excellent EBITDA margins in excess of 30% across each of Roper’s four business segments.

These qualities, along with the company’s disciplined acquisition strategy to continuously expand its portfolio (the company has invested $8.6 billion in M&A from 2011 to 2016), have created outstanding value for shareholders over time. In fact, Roper recorded a 19% compound annual shareholder return from 2003 to 2016, more than doubling the S&P 500’s 9% annualized gain.

Roper’s focus on asset-light businesses that can command leading share in niche markets has also resulted in an impressive dividend track record. The company last hiked its dividend by 17% in January 2017, marking its 24th consecutive year of payout increases. Argus analyst John Eade believes the company’s dividend “is secure and very likely to grow,” making Roper almost certain to become a Dividend Aristocrat after next year.

Ross Stores

- Dividend yield: 1.0%

- Consecutive years of dividend hikes: 23

- Ross Stores (ROST, $64.14) operates the largest off-price apparel and home fashion chain in the country with more than 1,300 locations across nearly 40 states. The company’s strategy revolves around selling name-brand, high-quality merchandise at discounts of 20% to 60% compared to regular department store prices.

A constant flow of fresh merchandise, combined with significant savings, provides a “treasure hunt” experience for consumers. This has helped Ross fare much better than traditional retailers in recent years, expanding its sales from $9.7 billion in 2012 to $12.9 billion in 2016.

Ross Stores began paying a quarterly cash dividend in 1994 and has raised it every year since, recording a compound annual growth rate of approximately 26% over the past 10 calendar years.

With a low payout ratio near 20%, more cash than debt on its balance sheet, and a long-term target to reach 2,500 locations in the U.S., Ross Stores has plenty of opportunity to continue its payout growth streak and join the Dividend Aristocrats by 2020.

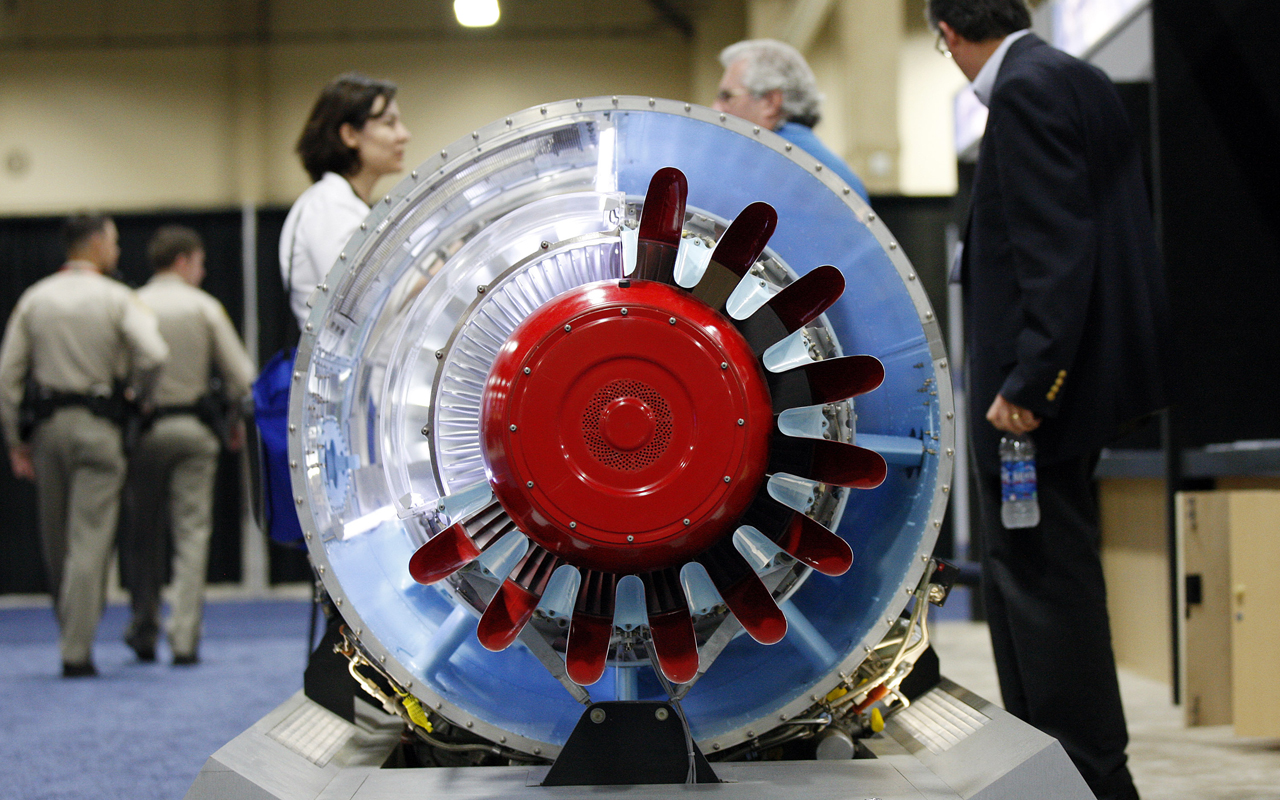

United Technologies

- Dividend yield: 2.3%

- Consecutive years of dividend hikes: 23

- United Technologies (UTX, $120.39) is a diversified industrial business that has paid dividends every year since 1936. The company sells a wide range of products and services primarily to the global aerospace and building systems industries. Aircraft engines and elevators are two key categories for the business, which has several competitive advantages.

Morningstar analyst Barbara Noverini wrote in September that “each of United Technoloiges’ businesses manufactures highly engineered equipment, with product innovation, durability, and reliability serving as key differentiators from competitors.” Noverini believes United Technologies is poised for growth as secular tailwinds support long-term expansion across its various business segments. The company’s plans to acquire Rockwell Collins (COL) for $30 billion will further bolster its commercial aerospace business.

Considering the company’s consistent free cash flow generation, investment-grade credit rating and moderate payout ratio, United Technologies should have no trouble continuing to increase its dividend, which has grown each year since 1994.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Brian Bollinger is President of Simply Safe Dividends, a company that provides online tools and research designed to help investors generate safe retirement income from dividend stocks without the high fees associated with many other financial products.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Relying on Real Estate in Retirement? Avoid These 3 Mistakes

Relying on Real Estate in Retirement? Avoid These 3 MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

These Small Money Habits Really Can Plant Roots

These Small Money Habits Really Can Plant RootsFebruary gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.