The Best Semiconductor Stocks to Buy

When considering the best semiconductor stocks, there's Nvidia and then there's everyone else. Here, we look at the mega-cap chipmaker and a few of its peers.

Semiconductors are at the heart of the artificial intelligence (AI) boom, powering everything from advanced chatbots and sprawling data centers to smart devices and edge computing.

As AI becomes more embedded in how we work and live, the hardware behind the scenes is becoming just as critical as the algorithms themselves.

A recent forecast from IDC underscores the scale of this transformation: Global spending on AI is projected to soar from about $235 billion in 2024 to roughly $630 billion by 2028, marking an average annual growth rate close to 30%.

Why are semiconductors such a linchpin in this story? Simply put, they make modern AI possible.

Whether it's GPUs crunching massive datasets, AI-specific chips accelerating machine learning tasks, or the sophisticated equipment that produces these chips, semiconductors determine how fast, efficient, and scalable AI can be.

For investors with a long-term view, this trend represents a powerful growth engine.

The demand for high-performance, AI-ready chips is rising fast – driven by cloud providers, enterprises, government technology initiatives, and the broader push toward smarter, more autonomous systems.

With high barriers to entry, deep technical know-how, and dominant market positions, chipmakers are well positioned to benefit as AI continues to expand.

With that in mind, here are five semiconductor stocks well positioned to ride this wave.

Data is as of June 25.

Nvidia

- Market value: $3.8 trillion

- Dividend yield: 0.0%

Nvidia (NVDA, $154.31) stock has been on a tear – and there’s little reason to think the momentum won’t continue.

The company sits at the center of the AI boom, thanks to a well-rounded ecosystem that’s tough to match.

At the core are its high-performance GPUs, the proprietary CUDA software stack, and seamless integration with major AI frameworks.

No other company has assembled a platform so finely tuned for AI workloads.

And, while U.S. restrictions on advanced chip exports to China present a challenge, Nvidia’s financial performance hasn’t missed a beat.

In its latest quarter, Nvidia posted $44.1 billion in revenue, representing a 69% year-over-year jump.

The data center business – which now accounts for the lion’s share of sales – grew 73% to $39.1 billion, fueled by heavy spending from cloud giants like Microsoft (MSFT), Meta Platforms (META) and Google parent Alphabet (GOOGL).

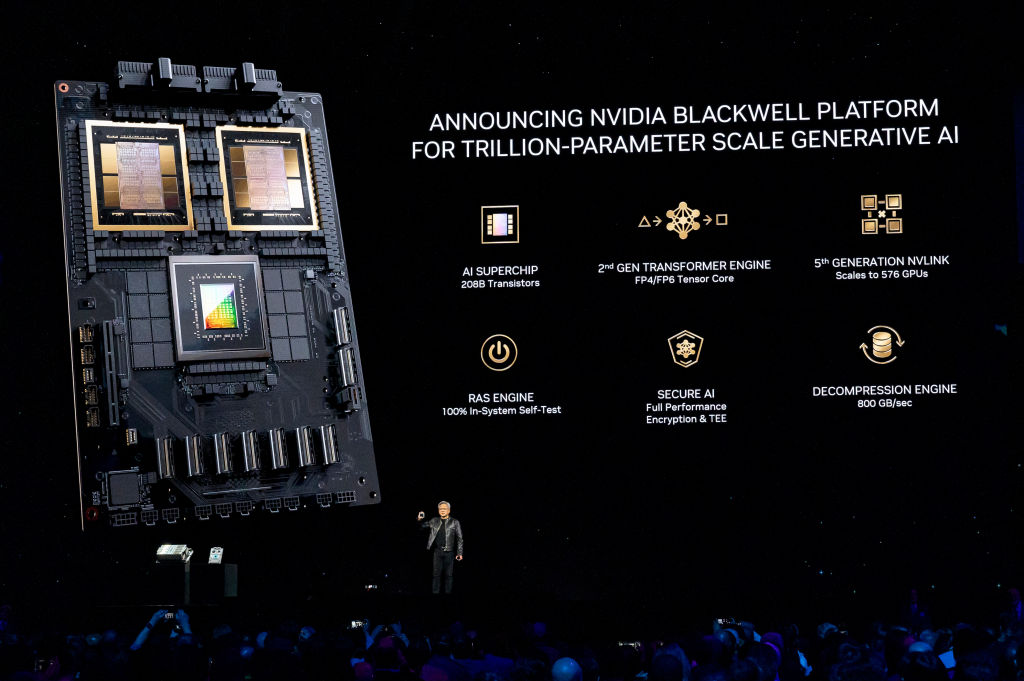

Looking ahead, the company is gearing up for more growth.

Production is ramping for its next-generation Blackwell chips, which promise major performance gains.

Meanwhile, large-scale AI infrastructure deals in places like Saudi Arabia and the UAE are opening new doors and helping to diversify Nvidia’s customer base.

Even after its meteoric rise, Nvidia shares don’t look overly expensive. The stock trades at 29 times forward earnings – modest, considering Wall Street expects 45% revenue growth over the next year.

Compared to slower-growing tech peers with similar valuations, Nvidia still looks like a standout in the AI gold rush.

Advanced Micro Devices

- Market value: $232.5 billion

- Dividend yield: N/A

Advanced Micro Devices (AMD, $143.40) is bracing for a $1.5 billion revenue hit in 2025 due to tightening U.S. export restrictions to China.

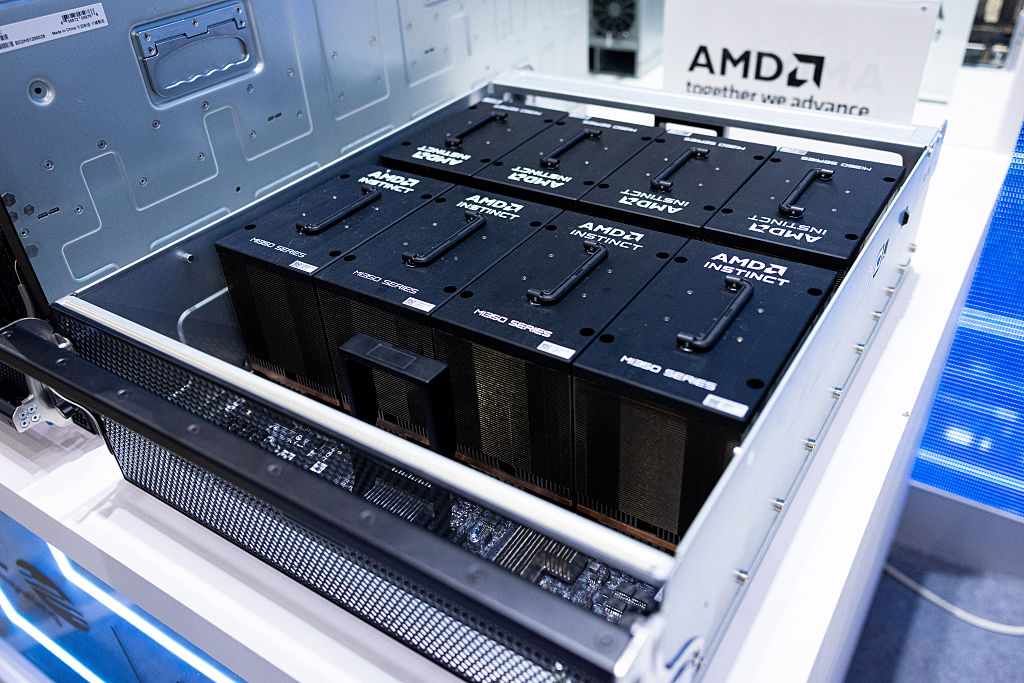

But even with that drag, the chipmaker’s broad product lineup – ranging from CPUs and GPUs to software and full-rack AI systems – offers a resilient foundation as it targets the booming AI market.

One of AMD’s key strengths is a strong product roadmap.

The recently launched MI350 accelerator boasts a 35-fold improvement in inferencing performance over its predecessor and quadrupled compute capacity.

Early signs suggest strong customer traction.

Looking further ahead, AMD has the MI400 and the Helios rack system slated for 2026, with the MI500 series expected to follow in 2027.

These next-generation platforms will combine MI400 GPUs with Venice and Verano CPUs and Pensando Vulcano networking gear – part of a rack-scale architecture designed to compete with Nvidia.

Meanwhile, partnerships like the new agreement with Saudi Arabia’s HUMAIN highlight the global appetite for AMD’s AI systems.

The company is also reinforcing its full-stack software strategy with ROCm 7 and continued investment in the AMD Developer Cloud.

All of this supports AMD’s push into a data-center AI market that could top $500 billion by 2028.

Analysts at Melius Research expect the company’s AI-driven revenue to surge nearly 50% in 2026, surpassing $9 billion, a sign AMD’s layered approach – from the MI350 to the MI500 – could be a winning strategy.

Qualcomm

- Market value: $171.2 billion

- Dividend yield: 2.3%

Qualcomm (QCOM, $155.93) is pushing well beyond its mobile roots with a series of strategic moves aimed at capturing growth across AI, edge computing and next-generation connectivity.

In early June, the company announced a $2.4 billion deal to acquire Alphawave Semi, an acquisition that brings high-speed wired connectivity intellectual property (IP) under Qualcomm’s roof and sharpens its focus on data-center AI.

Alphawave’s expertise in serializer/deserializer (SerDes) technology, chiplet subsystems, and interconnect technology fits neatly with Qualcomm’s Oryon CPUs and Hexagon NPUs.

The combination gives Qualcomm a clearer shot at the AI inferencing market, where it’s now poised to take on more established players in the data-center space.

Hot on the heels of that announcement, Qualcomm also opened a new AI R&D center in Vietnam.

The facility will focus on generative and agent-based AI across a range of platforms – from smartphones and PCs to XR, automotive, and IoT. It also highlights Qualcomm’s forward-looking investment in emerging technology.

At the Augmented World Expo, Qualcomm showed off the Snapdragon AR1+ platform, which powers the new RayNeo X3 Pro smart glasses. The glasses can run generative AI on-device, without needing a smartphone tether, an early but notable step into the growing spatial computing market.

These moves come amid a strong second quarter for Qualcomm. Smartphone chip shipments rose about 12% year over year, while the IoT and automotive businesses jumped 27% and 59%, respectively.

But it’s the Alphawave acquisition that may prove the linchpin of Qualcomm’s long-term data-center ambitions.

By integrating compute, connectivity, and AI into a unified stack, the company is positioning itself for broader relevance across data-center, edge, and extended reality ecosystems.

It’s a multifront strategy – one that could help fuel Qualcomm’s next chapter of growth.

ASML

- Market value: $320.6 billion

- Dividend yield: 1.0%

You may not see ASML (ASML, $815.24) splashed across headlines, but this Dutch firm plays a critical – almost irreplaceable – role in today’s semiconductor landscape.

ASML is the sole provider of extreme ultraviolet (EUV) lithography machines, the sophisticated tools used to manufacture the world’s most advanced chips.

These machines are engineering marvels. Each one takes about a year to build, includes more than 100,000 individual parts and carries a price tag of about $200 million.

Despite the cost, major chipmakers such as Taiwan Semiconductor (TSM), Intel (INTC) and Samsung are eager buyers.

The reason is that EUV lithography is essential for producing chips with tiny 3-nanometer features and below – the kind needed to power high-performance processors and AI systems.

ASML’s monopoly in this niche gives it a towering competitive edge. Decades of research and development have built a technological lead that competitors have yet to close.

In its latest earnings report for the first quarter of 2025, ASML posted net sales of EUR7.7 billion, with new bookings coming in at EUR3.9 billion. While those figures can vary quarter to quarter, the more telling number may be its backlog – EUR39 billion worth of future orders as of the end of 2024.

This is a strong signal that demand for ASML's tech remains resilient.

Marvell Technology

- Market value: $65.5 billion

- Dividend yield: 0.3%

Marvell Technology (MRVL, $75.93) is quietly becoming a key player in the AI infrastructure arms race.

The semiconductor company, best known for its custom chips and networking gear, is gaining traction among cloud giants such as Google and Microsoft as well as Amazon.com (AMZN) and Amazon Web Services.

These hyperscalers increasingly rely on Marvell’s integrated platforms to power their cloud and AI workloads.

What sets Marvell apart? Its extensive IP in high-speed networking, accelerators and application-specific integrated circuits (ASICs) gives it a leg up in designing performance-optimized, energy-efficient solutions.

For cloud customers juggling scale and speed, Marvell’s one-stop-shop approach is proving attractive. The company’s latest results reflect that momentum.

In its fiscal 2026 first quarter, Marvell posted a record $1.895 billion in revenue, a 63% increase from the same period last year. Data-center sales surged 76% year-over-year and now make up nearly three-quarters of total revenue. On an annualized basis, that puts Marvell’s top line around $6.5 billion.

Looking ahead, Marvell sees even more upside in the booming market for custom AI chips. The company recently raised its total addressable market forecast for this segment to $55 billion by 2028, up from a prior estimate of $43 billion.

That bullish revision follows an investor update revealing 18 custom chip design wins – spread across more than 10 hyperscalers, compared with just four a year earlier.

Marvell aims to capture about 20% of this expanding pie, fueled by growing demand from both sovereign and commercial cloud initiatives.

If current trends hold, it’s a slice that could grow considerably in the years to come.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Tom Taulli has been developing software since the 1980s when he was in high school. He sold his applications to a variety of publications. In college, he started his first company, which focused on the development of e-learning systems. He would go on to create other companies as well, including Hypermart.net that was sold to InfoSpace in 1996. Along the way, Tom has written columns for online publications such as Bloomberg, Forbes, Barron's and Kiplinger. He has also written a variety of books, including Artificial Intelligence Basics: A Non-Technical Introduction. He can be reached on Twitter at @ttaulli.

-

Ask the Editor — Tax Questions on the New Senior Deduction

Ask the Editor — Tax Questions on the New Senior DeductionAsk the Editor In this week's Ask the Editor Q&A, we answer tax questions from readers on the new $6,000 deduction for taxpayers 65 and older.

-

These Summer 2025 Back-to-School Tax-Free Weekends Are Starting Now

These Summer 2025 Back-to-School Tax-Free Weekends Are Starting NowSales Tax Over a dozen states offer back-to-school shoppers a sales tax holiday this summer.

-

Do You Need Flood Insurance? I'm an Insurance Expert, and Here's Where You Can Get It

Do You Need Flood Insurance? I'm an Insurance Expert, and Here's Where You Can Get ItStandard homeowners insurance does not cover flood damage, so you might need separate flood insurance, which you can get either through FEMA or private companies. Here are the details.

-

I'm an Investment Professional: These Are the Three Money Tips I'm Giving My College Grad

I'm an Investment Professional: These Are the Three Money Tips I'm Giving My College GradCollege grads can help set themselves up for financial independence by focusing on emergency savings, opting into a 401(k) at work (if it's offered) and disciplined, long-term investing.

-

Stock Market Today: S&P 500, Nasdaq Hit New Highs on Retail Sales Revival

Stock Market Today: S&P 500, Nasdaq Hit New Highs on Retail Sales RevivalStrong consumer spending and solid earnings for AI chipmaker Taiwan Semiconductor Manufacturing boosted the broad market.

-

If You'd Put $1,000 Into Berkshire Hathaway Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Berkshire Hathaway Stock 20 Years Ago, Here's What You'd Have TodayBerkshire Hathaway is a long-time market beater, but the easy money in BRK.B has already been made.

-

New SALT Cap Deduction: Unlock Massive Tax Savings with Non-Grantor Trusts

New SALT Cap Deduction: Unlock Massive Tax Savings with Non-Grantor TrustsThe One Big Beautiful Bill Act's increase of the state and local tax (SALT) deduction cap creates an opportunity to use multiple non-grantor trusts to maximize deductions and enhance estate planning.

-

Know Your ABDs? A Beginner's Guide to Medicare Basics

Know Your ABDs? A Beginner's Guide to Medicare BasicsMedicare is an alphabet soup — and the rules can be just as confusing as the terminology. Conquer the system with this beginner's guide to Parts A, B and D.

-

I'm an Investment Adviser: Why Playing Defense Can Win the Investing Game

I'm an Investment Adviser: Why Playing Defense Can Win the Investing GameChasing large returns through gold and other alternative investments might be thrilling, but playing defensive 'small ball' with your investments can be a winning formula.

-

Stock Market Today: Powell Rumors Spark Volatile Day for Stocks

Stock Market Today: Powell Rumors Spark Volatile Day for StocksStocks sold off sharply intraday after multiple reports suggested President Trump is considering firing Fed Chair Jerome Powell.