5 Best American Funds for Retirees

Until a few years ago, the American Funds family of mutual funds was available to individual investors only through intermediaries such as brokers and advisors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Until a few years ago, the American Funds family of mutual funds was available to individual investors only through intermediaries such as brokers and advisors. But now they’re available to anyone through online brokers, such as Fidelity and Schwab.

That’s a huge deal because, in my view, the best American Funds are among the top actively managed, large-company funds you can find anywhere. The funds haven’t attracted much attention from individual investors because they had been marketed solely through intermediaries and because the “American” name is shared by at least two other fund firms.

But these mutual funds demand your attention. American Funds’ products aren’t flashy, but they have provided long-term, index-beating results. What’s more, the funds have held up especially well during bear markets, which is critical to retirement investors. All of American Funds’ U.S. stock mutual funds lost substantially less than the Standard & Poor’s 500-stock index in the 2007-09 meltdown. “All 11 funds with at least a 20-year track record are ahead of their most relevant benchmark over that time period, which included two severe bear markets,” says Alec Lucas, a senior analyst at Morningstar who covers a dozen American Funds products.

American Funds aren’t perfect. The company’s mutual funds are too big to invest meaningfully in stocks of small companies. Returns on the firm’s bond funds have been uninspiring, although the firm has made several new hires designed to remedy that problem. But for large-cap stocks, both here and abroad, they’re hard to beat.

Today, we’ll look at five of the best American Funds for retirees – and teach you more about what the fund provider does best.

Data is as of May 28, unless otherwise noted. Three- and five-year returns are annualized. Yields represent the trailing 12-month yield, which is a standard measure for equity funds. American’s no-load F1 shares can be bought through online brokerages such as Fidelity and Schwab.

American Funds Fundamental Investors F1

- Market value: $96.5 billion

- Yield: 1.5%

- Expenses: 0.67%

One key to American Funds’ continued success – even as it has grown into one of the largest fund firms in the country – is its unique multi-manager system. Each fund is guided by several managers, each of whom is assigned a portion of the fund’s assets to manage independently. Much of his or her compensation depends on how well that slice of the pie performs over rolling periods of one, three, five and eight years – with the emphasis on five and eight years.

- Fundamental Investors F1 (AFIFX, $57.09), for instance, uses six managers to provide investors with growth and income … albeit “with an emphasis on growth over income,” as the fund’s page states.

AFIFX is often the most aggressive of the American funds, yet it’s still slightly less volatile than the S&P 500. The fund has topped the index by an average of 76 basis points (a basis point is one one-hundredth of a percent) per year over the past 15 years.

It currently has 5% of assets in cash and 16% in foreign stocks, both of which have muted recent returns. As a result, the fund’s 10.4% year-to-date performance is more than three percentage points worse than the S&P 500. However, retirees will appreciate that the fund did hold up better than the S&P 500 during both of 2018’s market selloffs.

The fund has a flexible mandate, but it has an unmistakable growth tilt. Technology stocks, at 21% of assets, are the fund’s biggest weighting by a lot. And its top four holdings – Microsoft (MSFT), Broadcom (AVGO), Facebook (FB) and Amazon.com (AMZN) – are either in the technology sector or are tech-heavy members of other sectors.

American Funds American Mutual F1

- Market value: $54.6 billion

- Yield: 1.9%

- Expenses: 0.67%

The best American Funds are also helped by relatively low expenses. F1 shares – the share class available without a sales charge to individual investors through online brokers – aren’t as cheap as Vanguard funds. But they typically charge less than most competitors’ actively managed funds.

- American Mutual F1 (AMFFX, $40.11) is just such a fund, with its 0.67% annual expense ratio well below the category average fee of 1.09%.

American Mutual also could win a prize for having the most boring fund name imaginable. That’s fitting, given that it’s one of the provider’s least volatile pure stock funds. It strives to keep risks low and focuses on not losing money – ideal for conservative investors.

Boring, after all, can be good when it comes to investing your hard-earned cash. Over the past 10 years, the fund has lagged the S&P 500 by an average of a little less than two percentage points per year. But it has been 20% less volatile, holding up better than the benchmark during crummy markets.

AMFFX invests primarily in undervalued dividend-paying stocks. When opportunities are scarce, the fund turns to cash and bonds – right now, 12% of assets are in the former, and just 1% in the latter. Health care is top dog at more than 15% of the fund’s assets, with AbbVie (ABBV), Amgen (AMGN), Abbott Laboratories (ABT) and Procter & Gamble (PG) all earning top-10 weights.

American Funds New Perspective F1

- Market value: $85.0 billion

- Yield: 0.9%

- Expenses: 0.82%

The corporate culture at American Funds is, in my view, a crucial ingredient in its success. Managers typically stay at the firm for their entire careers. The average manager has 27 years of industry experience, including 22 years at American Funds itself.

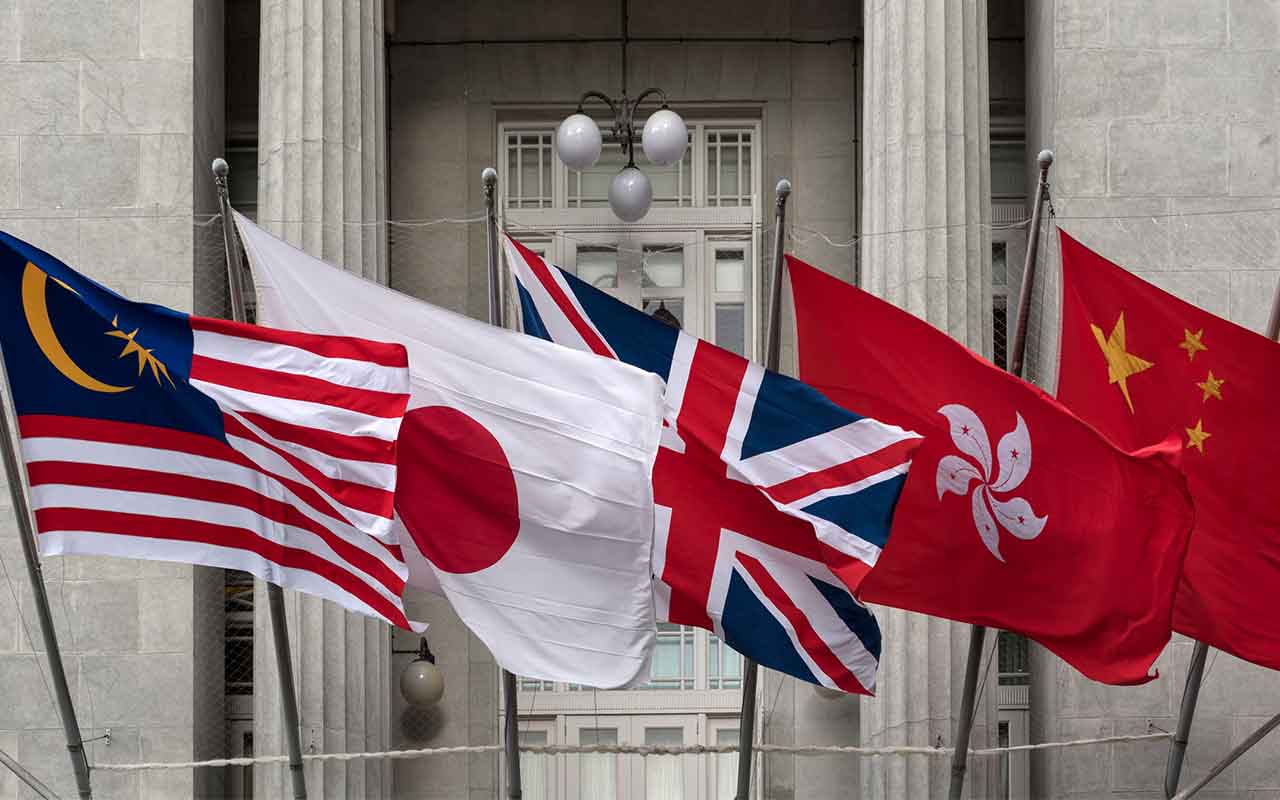

- New Perspective F1 (NPFFX, $42.12) isn’t just among the best American Funds – in my estimation, it’s at the top of the mountain. This is a global fund, meaning it invests in U.S. and foreign stocks. That gives the fund’s seven experienced managers – averaging 28 years of investment industry each – freedom to invest wherever they see opportunity.

When I think I’ve found a good manager or managers, I like to give them the ability to look anywhere for mispriced stocks.

This fund focuses on global trade patterns, making it about as timely as any fund you can find. The only constraint on the managers: Each holding must receive at least 25% of revenues from outside their home country. Right now, 52% of companies are domiciled in the U.S., 23% in Europe, 14.2% in Asia/Pacific Basin and 4.7% in “other.” Top holdings are a who’s who of big tech-minded companies including Amazon.com, Facebook, Microsoft and Taiwan Semiconductor (TSM).

Returns have been terrific. NPFFX beat the MSCI ACWI ex-USA Index (a major international benchmark) over the trailing 15-year period by three percentage points annually, the 10-year by 5.6 points and the five-year by 6.6 points. In fact, New Perspective F1 has beaten the index in every significant time period. And the fund has finished in the top half among its world stock competitors every year but one since 2009.

American Funds EuroPacific Growth F1

- Market value: $153.4 billion

- Yield: 1.1%

- Expenses: 0.85%

Can anyone run a $154 billion fund successfully?

Well, the nine managers at EuroPacific Growth F1 (AEGFX, $49.89) – each responsible for a portion of its assets – have put up sparkling numbers. Over the past 10 and 15 years, it has beaten the MSCI ACWI ex-USA Index by an average of more than one percentage point per year. It has also topped the benchmark in the trailing three- and five-year periods.

American Funds’ emphasis is always on long-term results, which is the name of the game in retirement. Stocks are typically held four or five years. The managers and analysts are patient investors, who spend most of their time picking good companies at attractive prices, rather than on the macro environment. No surprise, then, that stocks in AEGFX are typically held for about four years.

EuroPacific Growth F1, unsurprisingly, focuses on growth stocks – more than 17% of the portfolio is invested in financials such as pan-Asian life insurance company AIA Group (AAGIY) and Indian baking firm HDFC Bank (HDB), with another 14% in consumer discretionary and 12% in technology.

AEGFX isn’t afraid of emerging markets, either, allocating a third of its assets to EM stocks.

American Funds New World F1

- Market value: $38.0 billion

- Yield: 0.82%

- Expenses: 1.01%

- New World F1 (NWFFX, $63.22) offers a unique approach to emerging markets investing – and one that’s been remarkably successful. You could call it a chicken’s approach to emerging markets, but that’s been best way to invest in this tricky sector for the past seven years, which have seen EM equities badly lag U.S. stocks.

New World invests in the stocks of EMs, but also developed countries. In fact, NWFFX is only required to have 35% of assets in pure emerging markets stocks. Other stocks can be selected, so long as they do a lot of business (“generally 20% or more,” according to the prospectus) in merging markets.

NWFFX currently has nearly 43% of its assets wrapped up in emerging markets, with more than 18% in the U.S. and another roughly 26% in other developed markets (the rest is in cash or invested in fixed income). Top holdings include American powerhouses such as Google parent Alphabet (GOOGL) and Mastercard (MA), but also India conglomerate Reliance Industries and Chinese e-commerce giant Alibaba (BABA).

Consider the record. Over the past 15 years, the fund has beaten the MSCI Emerging Markets Index, the MSCI ACWI ex-USA Index and the S&P 500. Over the past 10 years, New World has trailed the S&P 500 but topped the two foreign indexes. The same goes for the past one, three and five years.

Don’t expect this fund to beat its peers during a bull market in emerging markets stocks. But the rest of the time, this is one of the best American Funds offerings you can buy.

Steve Goldberg is an investment adviser in the Washington, D.C., area.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?

-

Best Mutual Funds to Invest In for 2026

Best Mutual Funds to Invest In for 2026The best mutual funds will capitalize on new trends expected to emerge in the new year, all while offering low costs and solid management.

-

What Fed Rate Cuts Mean For Fixed-Income Investors

What Fed Rate Cuts Mean For Fixed-Income InvestorsThe Fed's rate-cutting campaign has the fixed-income market set for an encore of Q4 2024.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

The Final Countdown for Retirees with Investment Income

The Final Countdown for Retirees with Investment IncomeRetirement Tax Don’t assume Social Security withholding is enough. Some retirement income may require a quarterly estimated tax payment by the September 15 deadline.

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

12 Great Places to Retire in the Midwest

12 Great Places to Retire in the MidwestPlaces to live Here are our retirement picks in the 12 midwestern states.