11 Ways to Cut the Cost of College Tuition

There are lots of smart ways to save for college — including tax-advantaged 529 plans and Coverdell accounts.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

There are lots of smart ways to save for college — including tax-advantaged 529 plans and Coverdell accounts. But the best way to pay less for college is also the most obvious solution: Find ways to cut your tuition bills.

Depending on where you’re willing to take classes and how hard you’re willing to work to earn the breaks, you can trim your annual tuition costs by as little as $500 (by winning a small scholarship) or in full (by attending a tuition-free school). Take a look.

Attend a Tuition-Free College

Several colleges offer free tuition — yes, free tuition — although you’ll still need to budget for room and board and miscellaneous fees, such as textbooks and transportation.

At Berea College in Kentucky, students work 10 hours a week and receive a tuition scholarship worth $97,200 over four years. Room and board, fees, and books and incidentals bring the actual student expense to around $10,000 per year, but students can apply for financial aid to cover those costs. Other tuition-free schools include Alice Lloyd College, in Kentucky; the College of the Ozarks, in Missouri; the Curtis Institute of Music, in Pennsylvania; and the Webb Institute, in New York State.

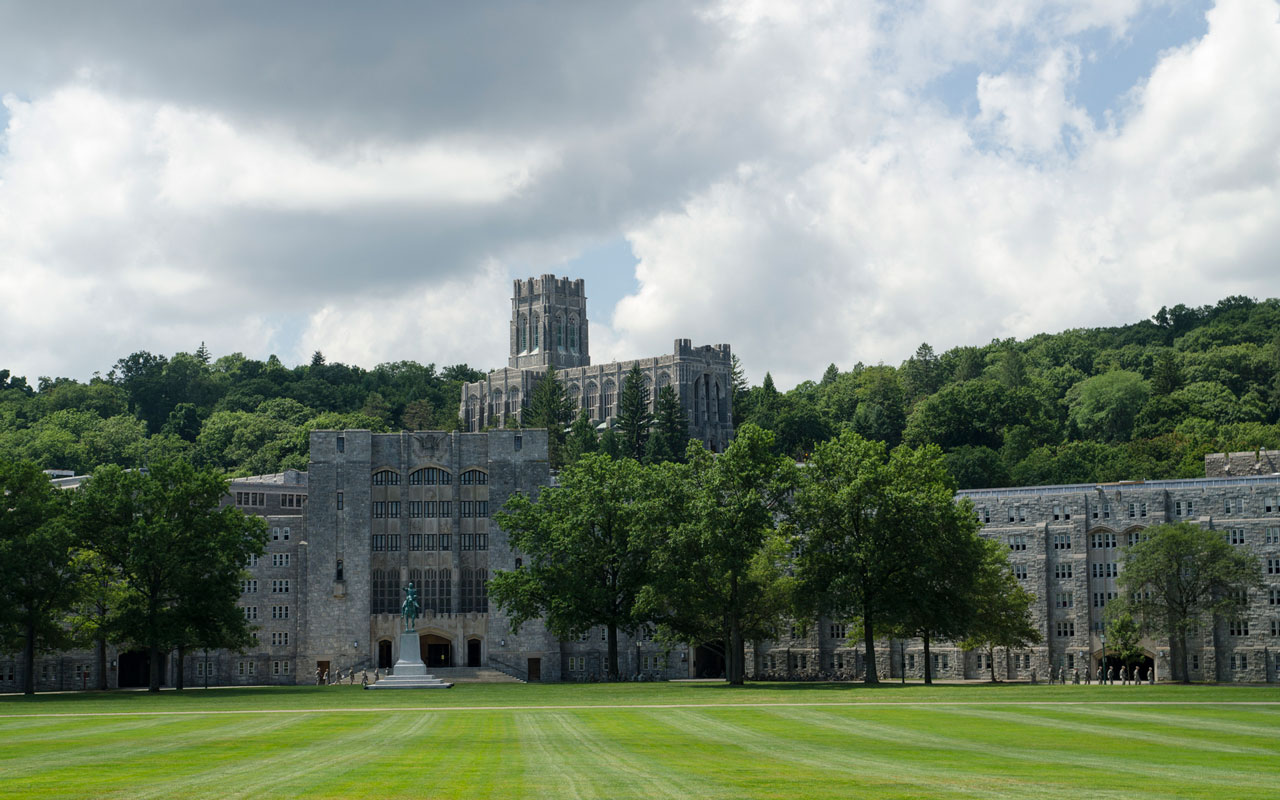

Also consider the U.S. military service academies — the U.S. Military Academy (West Point, pictured at left), the Naval Academy, the Air Force Academy, the Coast Guard Academy and the Merchant Marine Academy — all of which offer free tuition and room and board. However, graduates must serve in the military for a minimum of five years after graduation. Unless you truly want to join the military, there are other ways to cut college costs.

- SEE ALSO: 64 Valuable Things You Can Get for Free

Enroll at a Community College

For some students, attending community college for two years before transferring to a four-year institution is the ideal way to cut costs. According to the College Board, the average annual tuition and fees at a community college amount to $3,440, versus $9,410 at a public school for in-state students. You can also save on room and board if you live at home and commute to your local school.

Understand your state’s requirements for community-college students to gain admission to four-year institutions. For example, graduates of any of Virginia's 23 community colleges are guaranteed entry into top schools, such as the University of Virginia and the College of William and Mary, as long as they earn a minimum grade point average.

Stick to In-State Public Universities

Attending a public college in your state remains an effective way to keep college costs in check — especially if you may not qualify for significant financial aid at private institutions. In 2015-16, the average annual sticker price for in-state students at a four-year public school was $19,548 (including tuition, fees, and room and board), according to the College Board. Compare that with the total average sticker price of $43,921 at private colleges for 2015-16.

There are other financial advantages to attending an in-state school. In-state schools tend to be closer to your hometown, which means lower transportation costs throughout the year. If you live close enough to your college, you could even opt to live at home to eliminate room and board fees.

- SEE ALSO: 10 Best Values in Public Colleges, 2016

Look to “No-Loan” Colleges

About six dozen schools offer “no-loan” financial aid packages that consist of grants, scholarships and work-study programs to limit what you’ll pay out of pocket. The list includes Ivy League schools, as well as top values such as Davidson College, Stanford University and Swarthmore College. In some cases, you need to be a low-income student (typically, this means an average household income of below $40,000 to $60,000) to qualify for a loan-free financial aid package. At other schools, all admitted students are eligible for such awards.

The programs don’t necessarily eliminate loans altogether. The financial aid package is based on a school’s estimate of what the family can afford to pay. Some families can’t or choose not to pay the full amount, which means the student must borrow to make up the difference. And some students borrow to cover costs that aren’t included in the budget covered by their financial aid packages, such as health insurance and laptop computers.

Maximize Financial Aid

Now that you’ve picked colleges that are great values, maximizing financial aid is your next step to reduce college costs. Fill out the Free Application for Federal Student Aid and, if necessary, the CSS Profile and school-specific applications. For the 2016-17 school year, a student can submit his or her FAFSA as early as October 1. Applying for financial aid as early as possible remains important. Most schools dole out financial aid on a first-come, first-served basis, and a college’s free money runs out fast.

Income, not assets, is by far the biggest factor in awarding financial aid. “Generally, every $10,000 increase in parent income will cause about a $3,000 decrease in need-based financial aid,” says Mark Kantrowitz, publisher and vice president of strategy at Cappex.com, a college planning website. If possible, parents should hold off on taking distributions from retirement plans or realizing capital gains because the money will count as income on the FAFSA.

The financial aid formula excludes assets held in retirement accounts, the cash value of life insurance policies, and the value of a home and other personal property (including cars, clothing and furniture). So parents should consider directing a larger portion of their paychecks to their retirement accounts during FAFSA-filing years.

A fat savings account can also lower financial aid because the federal financial aid formula considers up to 5.6% of parents’ assets to be available to pay for college. 20% of a student’s assets are also counted in the EFC calculation. If your parents are planning to use cash to buy a new car, do a home-renovation project or make some other large purchase — even to pay down debt — they should do so before you file the FAFSA.

Apply for Scholarships

Chip away at your remaining tuition bill after financial aid with private scholarships. Students don’t need to be incoming college freshmen to qualify for scholarships, says Kantrowitz. Some scholarships are only open to students already in college, and others, like Jif’s Most Creative Sandwich Contest, are for younger students.

Potential scholarship sources include the college you’re attending (for example, the University of Virginia offers a full ride to its Jefferson Scholars), various companies and philanthropic foundations, and your community. Kantrowitz suggests applying for as many scholarships as possible, from full-tuition offers to smaller awards. There’s less competition for $500 awards, he says, and “small scholarships do add up.”

- SEE ALSO: 11 Top Sources of College Scholarships

Become a College Employee

Campus workers and their children can save big on tuition bills, with nearly every private and public college offering some form of tuition benefits to full-time employees. The perk could be a difference-maker for job hunters comparing competing job offers.

At Boston University, employees are eligible for as many as eight free credits per semester. At Northwestern University, employees can qualify for as much as $12,000 in tuition discounts each year. And at the University of Missouri, 75% of tuition fees are waived for as many as six credit hours per semester.

- Students of university employees also often qualify for tuition discounts. At the University of Pennsylvania, dependents get 75% off tuition and technology fees. At Ohio State University, dependents receive as much as 50% off the cost of instructional and general fees. If both of your parents work at OSU, the discount increases to 75%.

Take Advantage of Military Benefits

Attending a military academy or enrolling in the Reserve Officers’ Training Corps (ROTC) could cut your college costs to almost nothing. Students at the five U.S. military academies — West Point, the Naval Academy, the Air Force Academy, the Coast Guard Academy and the Merchant Marine Academy — receive free tuition and room and board in exchange for a minimum of five years of military service. If you sign up to serve a tour of duty without attending a military academy, you’ll be eligible for substantial tuition assistance through the Montgomery GI Bill and branch-specific funds.

If you would rather enroll in ROTC, which allows you to complete military science and army training courses at the same time as your other coursework, you can apply for two-, three- and four-year scholarships that cover all tuition and fees. Scholarship recipients must serve eight years (split between the army and Individual Ready Reserve or part-time with the Reserve or National Guard while pursuing a civilian career), while those who do not receive scholarships may serve three years on active duty and five years in the Individual Ready Reserve (sometimes called the Inactive Ready Reserve).

- Dependents of military veterans also qualify for generous aid. The Survivors’ and Dependents’ Educational Assistance Program provides up to 45 months of education benefits, including apprenticeships and funds for university costs, to the children or spouses of veterans who have died or been disabled in service. There are also smaller awards for military families, including the Military Commanders' Scholarship Fund and the AMVETS Scholarships.

- SEE ALSO: 10 Best Financial Benefits for Military Families

Take Advanced Placement Courses

Many high school students take AP or International Baccalaureate (IB) courses, which offer the chance to skip (but receive credit for) introductory college courses if you receive a high score on year-end exams. It’s typically free to take AP and IB courses, but you may need to pay for the exams.

According to the College Board, a student with qualifying scores on two AP exams can save $2,000 a year, on average, at a public college and $6,000 at a private school. You won’t have to buy textbooks and supplies for the classes you would’ve taken without AP or IB credits. More significantly, Kantrowitz points out, the advance credits will give you a head start toward graduating on time, avoiding a costly additional year or two of school.

Note: Some colleges, such as Brown University and Dartmouth College, do not accept AP test scores for credit. Check your school’s policy here.

Tap Employer Tuition Assistance

If you’re a younger student with a part-time job or an older worker looking to go back to school, ask your employer about tuition assistance. Employers can provide their workers with as much as $5,250 tax-free per year to cover tuition and miscellaneous fees. In return, employers may ask you to continue working for them for a set period of time or meet a minimum grade requirement.

You can also check if your parents’ employers offer assistance or scholarships to dependents. For example, the state of Tennessee gives a 25% discount on all courses taken by dependents of executive, judicial and legislative branch employees.

Solicit Funds From the Crowd

Consider creating fund-raising pages on popular websites, such as GoFundMe, to ask friends and family to help cover your college costs. In 2014, 140,000 GoFundMe education campaigns raised $17.5 million.

To create a successful campaign, follow a few key steps: Set a realistic goal, such as $5,000 to pay for costs your federal loans don’t cover. Write a detailed explanation of why you’re appealing for help, and be clear about how the money will help you. If friends and family choose to donate, keep them updated on your progress and be sure to thank them.

Several crowdfunding sites are geared specifically to students. At GiveCollege, friends and family can contribute to a 529 college-savings plan on your behalf, and PigIt lets students exchange their skills, such as graphic design, for donations from an online community.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

New Ways to Use 529 Plans

New Ways to Use 529 PlansTax-free withdrawals from 529 plans could help you sharpen your job skills.

-

I Want to Help Pay for My Grandkids' College. Should I Make a Lump-Sum 529 Plan Contribution or Spread Funds out Through the Years?

I Want to Help Pay for My Grandkids' College. Should I Make a Lump-Sum 529 Plan Contribution or Spread Funds out Through the Years?We asked a college savings professional and a financial planning expert for their advice.

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

How Intrafamily Loans Can Bridge the Education Funding Gap

How Intrafamily Loans Can Bridge the Education Funding GapTo avoid triggering federal gift taxes, a family member can lend a student money for education at IRS-set interest rates. Here's what to keep in mind.

-

How an Irrevocable Trust Could Pay for Education

How an Irrevocable Trust Could Pay for EducationAn education trust can be set up for one person or multiple people, and the trust maker decides how the money should be used and at what age.

-

UTMA: A Flexible Alternative for Education Expenses and More

UTMA: A Flexible Alternative for Education Expenses and MoreThis custodial account can be used to pay for anything once the beneficiary is considered an adult in their state. There are some considerations, though.