How to Maximize Your Social Security Now That the One Big Beautiful Bill Is Law

When applying for Social Security, consider the new enhanced deduction for people age 65 and older, as well as your health, family situation and other financial issues.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Clients frequently ask me about the best time to start taking Social Security benefits, with the hope that there's a golden rule or simple answer.

As with so many areas of financial planning, we need detailed facts on a client's financial situation to make the call. Now that the One Big Beautiful Bill (OBBB) is law, even more questions on this topic arise.

Impact of OBBB on Social Security

The new law temporarily adds an extra deduction of $6,000 for each qualifying individual age 65 and older for both itemizers and non-itemizers.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

It phases out when MAGI (modified adjusted gross income) exceeds $75,000 for single filers and $150,000 for married couples filing jointly.

The Kiplinger Building Wealth program handpicks financial advisers and business owners from around the world to share retirement, estate planning and tax strategies to preserve and grow your wealth. These experts, who never pay for inclusion on the site, include professional wealth managers, fiduciary financial planners, CPAs and lawyers. Most of them have certifications including CFP®, ChFC®, IAR, AIF®, CDFA® and more, and their stellar records can be checked through the SEC or FINRA.

As with so many other areas of financial planning, determining the best time to claim Social Security benefits depends on a client's financial situation.

Since the law was signed, we're revisiting financial plans with my retired 65-and-older clients who have already claimed their Social Security benefits or are planning to claim between this year and 2028 to see where their current income is relative to the phase-out range.

If they are at risk of being phased out of the deduction, we look at lowering their taxable sources of income by, for example, leaning on taxable investment accounts rather than tax-deferred accounts.

Some clients are also rethinking Roth conversions in the short term to avoid raising their income above the phase-out threshold. However, you should weigh the short-term benefits vs the long-term impact.

For example, a recent couple were both planning on retiring and claiming their Social Security benefits at their full retirement age of 67 in 2027.

However, given their other fixed income sources, their MAGI would then exceed the phase-out threshold.

One solution is for the wife to claim benefits, while the husband delays claiming until a later year when he would receive a higher benefit.

They would then withdraw from after-tax investment accounts through 2028 for the nominal amount of supplemental income they need in the short term.

Social Security benefits schedule

There's a sliding scale on the amount of Social Security benefits for Americans, starting with a discounted monthly rate you can take at age 62. The payment gradually increases each year if you wait to claim benefits until your full retirement age (FRA).

The FRA year is based on your birth year.

For instance, if you were born from 1955 to 1959, the full benefits are realized at age 66 plus two months each year. So, if you were born in 1955, your FRA is 66 years and two months; if you were born in 1959, it's 66 years and 10 months.

Your benefits continue to increase at a premium (8% a year) if you wait to claim them when you reach age 70.

If you haven't already, go to the Social Security Administration website to create your own account and review your benefit schedule for accuracy before you apply for Social Security benefits.

If you're pushed into early retirement

Most workers expect to retire at age 65 or older, but less than a third do so due to health issues, job termination and/or demands to care for others.

When one or more of these factors require someone to retire earlier than expected, we need to look at the bigger picture to determine the timing on when to file.

For instance, if genetics lean toward many family members passing in their 70s or earlier, there's a compelling reason to take benefits earlier rather than waiting to start at 70 for the maximum benefit.

If, however, there's good health and a family history of longevity, even if for just one spouse within a couple, it's a good idea to look at other resources to initially fund retirement and perhaps let the lower-income-earning spouse take benefits earlier, while the higher-income earner holds off until 67 or later.

This strategy helps preserve the maximum benefit for the surviving spouse.

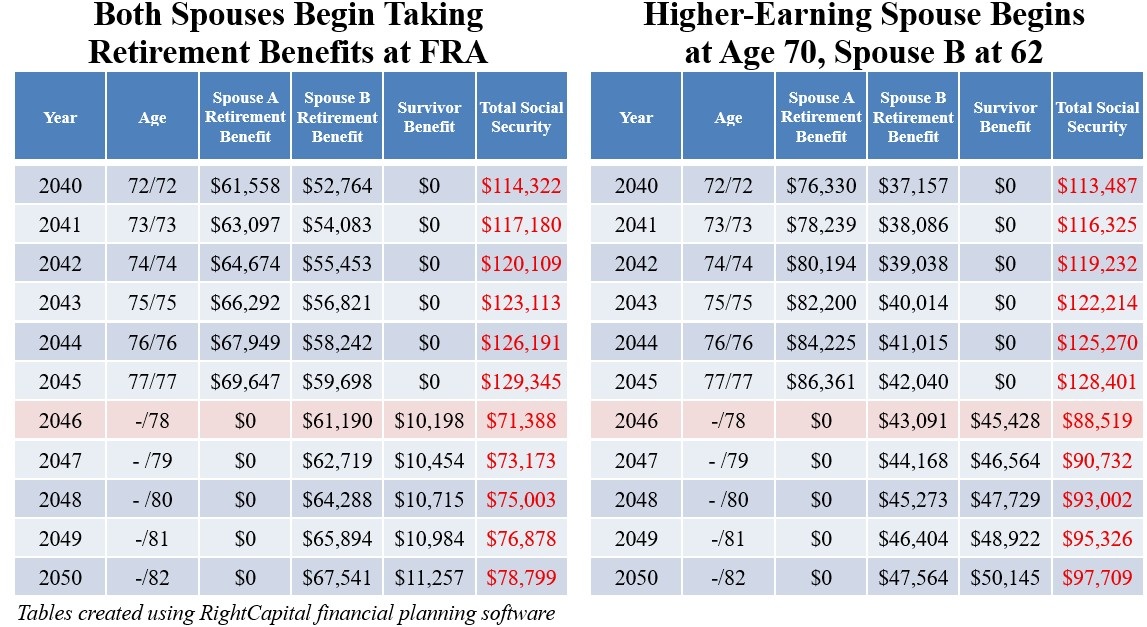

The table comparison below illustrates the projected benefits for a couple of the same age, both born after 1960, so their FRA is 67. The higher-income earner has a monthly benefit at 67 of $3,542, and the lower-income earner's benefit at 67 is $3,036.

The tables reflect their annual benefits several years after claiming benefits from the years 2040 through 2050, with the higher-income-earning spouse passing away at 77.

Note that there is an annual inflationary rate assumption of 2.5%. If the lower-income-earning spouse delays claiming benefits, the annual combined benefit for the years both spouses are living is increased.

Looking for expert tips to grow and preserve your wealth? Sign up for Building Wealth, our free, twice-weekly newsletter.

If one of them passes, the surviving spouse receives income that's adjusted through survivor benefits to equate to what the higher-income earner would have received if they continued to live.

Timing is everything

As they close in on that two-to-five-year window of their retirement date, we advise clients to work with their financial and legal team to assess all assets and income sources for retirement.

Those considering retirement in the near term who have not claimed Social Security benefits should look closely at taxable income. MAGI is calculated by adding the full Social Security benefit amount.

For some, a delay in claiming benefits for the higher-income earner could make the difference in whether the benefit claimed by the other spouse is phased out of receiving the extra $6,000 deduction.

Now more than ever, retirees should apply tax-planning strategies and a holistic view of their overall financial situation in deciding which assets should be drawn upon for retirement income.

Related Content

- Longevity Illustrator: Find Out How Long You Might Live

- Maximizing Retirement: Seven Types of Tax-Free Income in 2025

- What if You Could Increase Your Retirement Income by 50% to 75%? Here's How

- I'm 62 and Worried About Social Security's Future. Should I Take It Early?

- Eight Strategies for Deciding When to File for Social Security

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kim is a Senior Wealth Manager in New York City at SAM Wealth Management, a leading boutique firm that specializes in serving high-net-worth and ultra-high-net-worth investors. She graduated Magna Cum Laude with a B.B.A. in Finance from Sam Houston State University and post-graduate studies at the University of Georgia, Terry College of Business. She is a fiduciary of over $200 million in client AUM at SAM and is skilled in portfolio management, investment strategies, tax planning, estate and financial planning and has over 12 years of experience in the financial services industry.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.