I Walked Away from a Stable Mid-Career Job — Here’s the Retirement Math Behind that Decision

Life is short. Should you quit your job for a more satisfying career? Or were you laid off? Here's how I learned to protect my retirement after leaving a steady job.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

I can’t think of two words that generate more excitement and fear at the same time than “I quit.”

If you’re leaving for a better job, starting a business or stepping into retirement, the words can be thrilling. But if all you have is a dream and a blank calendar, they feel very different.

That’s the position I found myself in. After 10 years in a finance job, I took a leap and decided to write full-time. In this job market, I fully understand why people reacted with some version of concern or disbelief, as U.S. layoffs hit their highest October level since 2003.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Still, I’d rather know I took the risk than wonder for the rest of my life what might have happened if I hadn’t.

Behavioral researchers have long found that people regret what they don’t do more than what they do. And throughout history, leaps like these have preceded many well-known success stories. Jimmy Iovine left a stable career in recording studios to launch Interscope and eventually Beats. Howard Schultz left a rising corporate career to buy a small Seattle coffee shop.

Of course, not everyone ends up in a bestselling biography or on a magazine cover. Most people are just trying to build a stable life, save for retirement and avoid getting blindsided.

As someone who covers retirement professionally, I wanted to understand what this choice might mean for my long-term finances, especially my retirement prospects.

What happens when you step out of full-time work, whether by choice or by circumstance?

The financial impact of leaving work

The first reality is that leaving a job, even for a short period, can create long-term financial consequences.

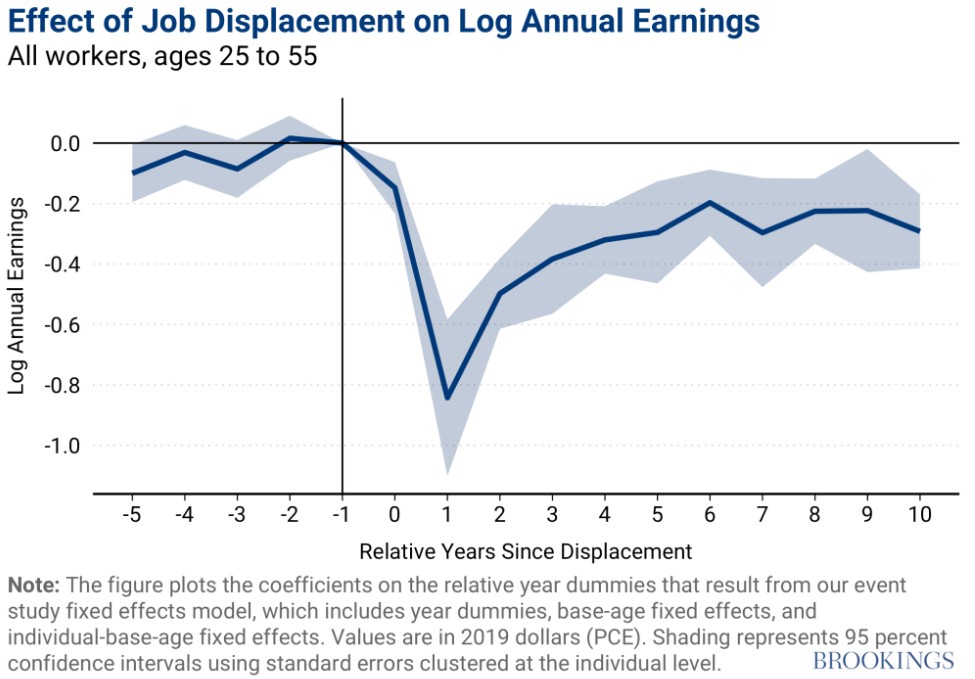

Economists have studied this for decades, and the impact can be significant. For instance, research from the Brookings Institution shows that workers who lose a job see their earnings fall sharply, dropping by more than half in the first year after displacement. Earnings do recover over time, but not fully. Even ten years later, displaced workers earn roughly 25% less than similar workers who weren’t displaced.

Wealth takes a hit as well. A Department of Labor report found that household wealth remains about 8% lower six years after a job loss.

As advisor Melissa Caro, CFP® and founder of My Retirement Network, told me, "A break from steady employment hits you in two ways: lost contributions and lost compounding. You’re not just trying to replace a missed deposit; you’re trying to replace years of growth you never got."

I’m moving into freelance work, which means inconsistent income while I build up my client base. Until the work steadies, I’ll rely on my emergency fund as needed. If things become too tight, I may have to entertain tapping retirement funds. That’s something I know the numbers strongly discourage, yet it is relatively common.

A survey from the Transamerica Center for Retirement Studies shows that 37% of workers have taken a loan, an early withdrawal or a hardship withdrawal from a retirement account such as an IRA or 401(k). Across generations, the most common reason was a financial emergency.

Caro says, "It’s possible to catch up, but it almost always requires either a higher savings rate once you’re working again or a meaningful reset of lifestyle expectations." Even if your income eventually matches or exceeds your previous job, she notes, you still have to contend with "the gap: the months or years when you didn’t contribute to retirement accounts and missed out on growth."

Tom Geoghegan, CFP® and founder of Beacon Hill Private Wealth, agrees. To stay on track, he suggests people "roll over old employer plans if it improves investment access or lowers fees. And if you pick up contract or consulting work, remember that a solo 401(k) can offer extremely high contribution limits and help you close the gap faster."

These are the risks you should weigh when you're considering a voluntary break. Because timing also plays a role.

Timing matters — sometimes more than the decision itself

I can’t pretend my timing was perfect.

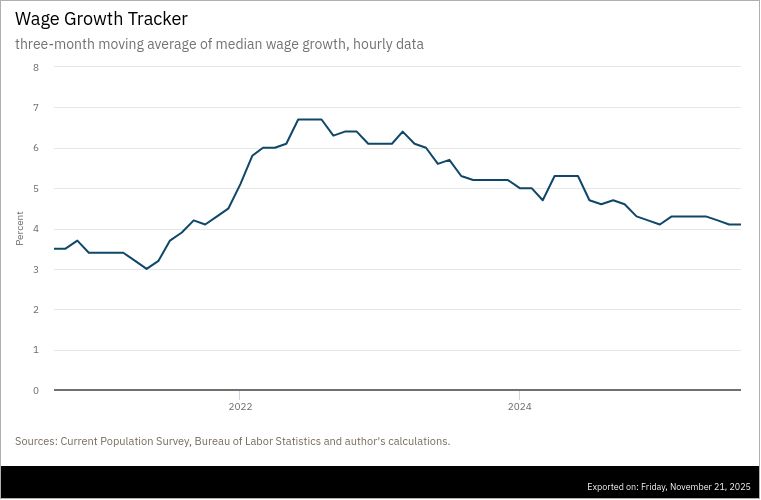

Research consistently shows that the impact of leaving an employer depends heavily on what’s happening in the job market. In strong labor markets, wage growth for job switchers (gray) often outpaces that of workers who stay put (red), as tracked by the Federal Reserve Bank of Atlanta. In weak markets, that flips: displaced workers take longer to find new roles and earn less when they do.

Age also plays a major role. Research from the Urban Institute has found that workers in their 50s experience longer unemployment spells and steeper earnings losses than younger workers. Expertise, it turns out, doesn’t always insulate you. In some cases, it makes you more expensive to replace.

I’m in my 40s, which gives me a bit more room. But the rapid rise of AI and automation means even workers with secure jobs may find their industries shifting faster than expected. That thought is both discouraging and oddly reassuring — change is coming for everyone, not just the people who step off the treadmill voluntarily.

Whether you quit or get laid off, it typically pays to hope for the best but prepare for the worst. As Caro points out, “The people who manage voluntary breaks well are the ones who model it years in advance and run worst-case numbers, not just the optimistic ones.”

The emotional and practical fallout

The financial math matters, but it’s only part of the story. Losing or leaving a job also affects health, habits, confidence and identity in ways that aren’t visible on a spreadsheet.

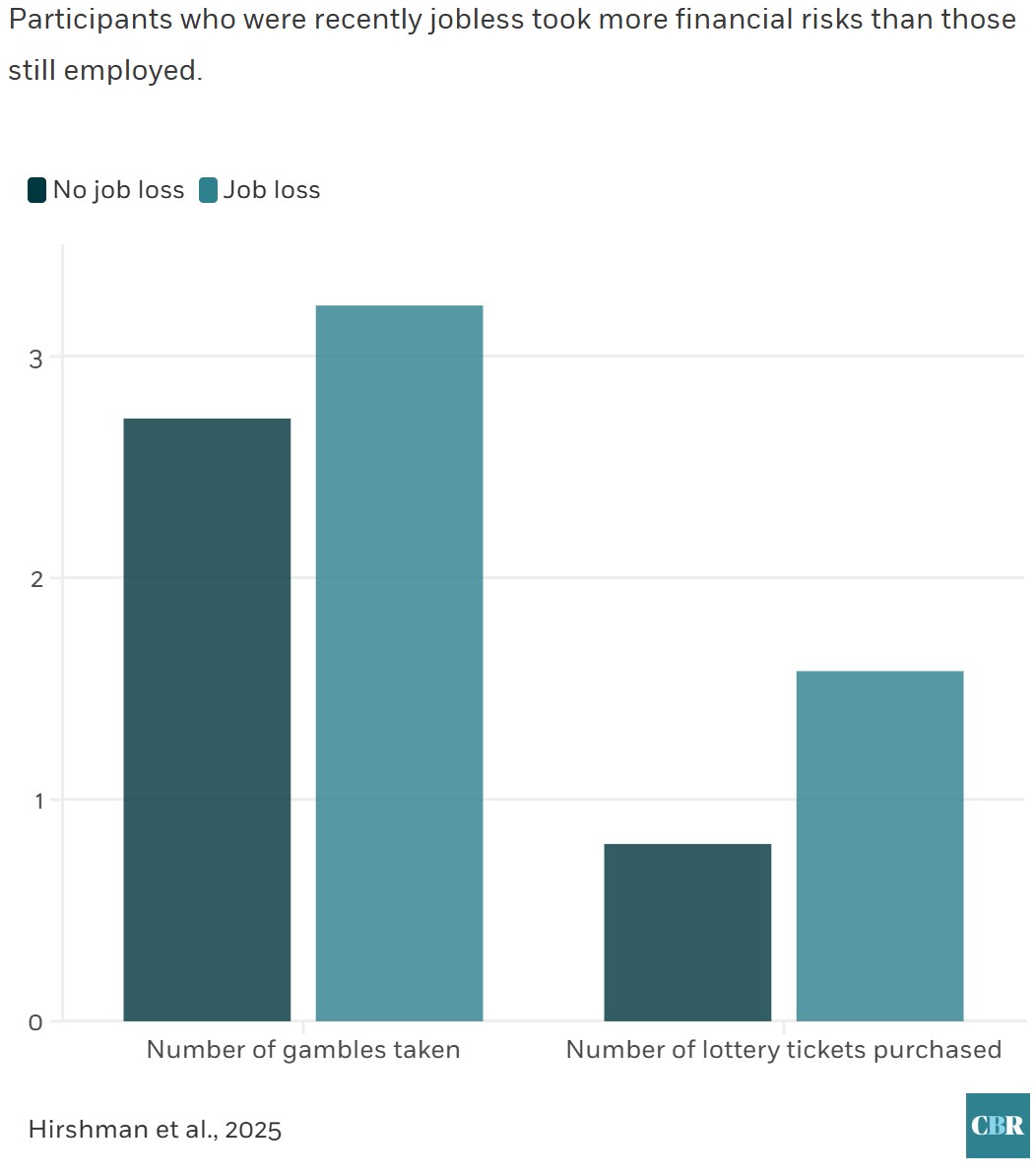

A wide body of research shows that job loss correlates with worse mental health outcomes and higher mortality risk. Without a work structure, people’s routines and social ties often fall away. Studies have documented increases in risky behaviors such as gambling and substance abuse following job displacement.

Caro told me the first emotional hurdle for many people isn’t financial at all. “Work becomes a proxy for stability, competence and purpose,” she said. “Losing it, especially without warning, feels like your foundation cracked overnight.”

The practical side can be overwhelming, too. The moment someone loses a job, their benefits clock starts ticking.

Jim Shagawat, CFP® and partner advisor at AdvicePeriod, described a client navigating this recently. Before anything else, he helped her assess cash flow and estimate how long her reserves could last while she planned her next move. “Before benefits ended, I advised her to complete any medical or dental visits and review health insurance options, including COBRA, a spouse’s plan and marketplace coverage,” he added.

In my case, I'm lucky that my wife is fully employed, so the plan is to join her benefits. Still, what has surprised me most about leaving a job is just how many balls you suddenly have to juggle. Caro calls this phase “financial triage,” in which the goal is to strip spending down to essentials, protect cash and avoid letting emergency measures, like using credit cards, turn into long-term habits.

Moving forward — the part you can control

The advisers I spoke with said the biggest determinant of long-term recovery isn’t just income or age, it’s mindset.

Geoghegan said something that stuck with me: “Behaviorally, momentum is just as important as math.” He says small wins, such as restarting contributions, consolidating accounts and clarifying next steps, can help restore confidence and build structure again.

For me, the choice to leave a steady job wasn’t made blindly. I have a plan, a path and a body of work I’m committed to building. Still, I understand exactly how large the bet is. It could blow up in my face. Or it could lead to something far more meaningful.

Retirement math rewards discipline, but life rewards courage. And in money as in life, rewards only follow risks if you take them.

The key, I remind myself, is to keep playing the game, even when the rules change.

There are two other powerful words that matter just as much as “I quit.” When you hear that the top regret of the dying is “I wish I’d had the courage to live a life true to myself, not the life others expected of me,” the goal becomes simple.

I want to be able to say, at the end of all this, “I tried.”

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jacob Schroeder is a financial writer covering topics related to personal finance and retirement. Over the course of a decade in the financial services industry, he has written materials to educate people on saving, investing and life in retirement.

With the love of telling a good story, his work has appeared in publications including Yahoo Finance, Wealth Management magazine, The Detroit News and, as a short-story writer, various literary journals. He is also the creator of the finance newsletter The Root of All (https://rootofall.substack.com/), exploring how money shapes the world around us. Drawing from research and personal experiences, he relates lessons that readers can apply to make more informed financial decisions and live happier lives.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.