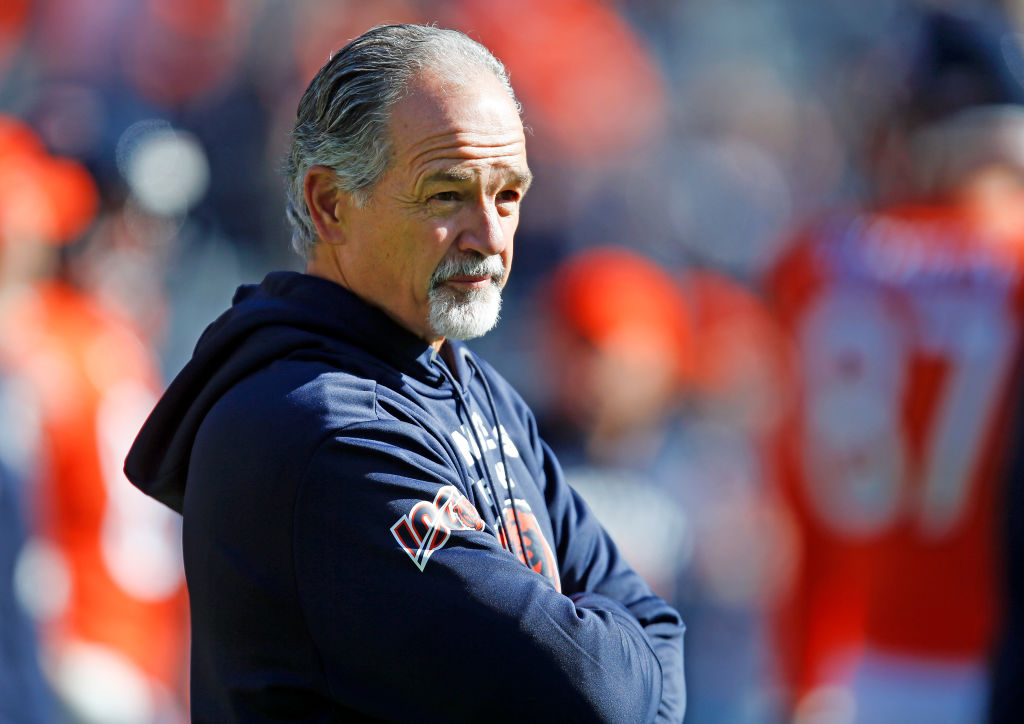

Coach Chuck Pagano Is 'Unretiring' — What About You?

Chuck Pagano is joining the Baltimore Ravens after retiring four years ago. Here's what it takes to unretire.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Football fans are abuzz with the news that Chuck Pagano is coming out of a four-year retirement, returning to the Baltimore Ravens next season as the team’s senior secondary coach. That's right — the practice of "unretiring" has made it onto the football field.

After coaching with the Ravens from 2008 to 2011, Pagano was the head coach of the Colts for six years before becoming the Bears' defensive coordinator for two years. In 2021, Pagano announced his retirement to spend more time with his family.

This isn’t the first time the Ravens have coaxed a coach out of retirement. Last year, Dean Pees returned as a senior advisor to the team after nine months of retirement. The kicker? Pees had already retired twice before.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In recent years, this concept of coming out of retirement to reenter the workforce, also known as “unretiring,” has become more prevalent among coaches, players, celebrities, and musicians. It’s also become a trend among non-celebrities, with 33% of retired Americans leaving or considering leaving retirement, according to F&G’s second annual retirement survey. So why is it so alluring?

Longer lifespans

According to the National Center for Health Statistics, the average life expectancy in the U.S. is 74.8 for males, 80.2 for females, and 77.5 for both sexes. Retiring at the Social Security full retirement age (FRA), between 65 and 67, depending on when you were born, leaves roughly 10 or more years for those retirement funds to last. However, according to the U.S. Census Bureau, it’s estimated that the number of Americans living to 100 and beyond will quadruple in the next 30 years. Retirement savings could need to last up to 20, 30, or even 40 years, depending on when you retire.

Longer lifespans mean more years to afford post-retirement; earlier planning is necessary to meet savings goals. If you retire with the minimum amount to fund your post-retirement life and live longer than expected, you'll need to fund those years somehow. Returning to the workforce is certainly one option.

Cost of living increases

Even if you’ve meticulously planned for retirement, it’s true that the dollar just doesn’t stretch as far as it once did. Inflation has increased in recent years, and it costs more to make the same purchases. One recent study found that 44% of Americans are worried about inflation and how it impacts their retirement. Even if you have more than enough money saved for retirement, you may be burning through it faster than anticipated.

According to the National Council on Aging, 80% of older adults are either financially struggling now or will be at risk for economic insecurity in retirement. If that’s the case, returning to the workforce, even part-time, may be alluring to make some extra cash.

A sense of purpose

After working for 30, 40, or even 50 years, the thought of not having to go to work each day may seem freeing. For others, the idea is frightening. So many working adults have their identities wrapped up in their jobs, especially after spending most of their lives doing so. Not having the job to take up their time and mental energy may lead to boredom, depression, and the itch to go back to work.

The F&G study found that 27% of those considering returning to the workforce would do so because they loved what they did for work, while 45% miss the intellectual stimulation they got from working.

This is one of the main reasons why those retired find a full- or part-time job, to fulfill their sense of purpose and belonging.

Things to consider before unretiring

If you’re thinking about unretiring, whether for financial reasons, to find fulfillment, to ease boredom, or to make more social connections, keep these factors in mind.

How unretiring will impact your benefits and taxes

If you are retired and receive Social Security and Medicare benefits, tread carefully. You’ll want to understand how returning to work may impact these benefits. If you aren’t at full retirement age when you start collecting Social Security benefits but decide to return to work, some of your benefits will be withheld depending on how much you make. This is called the Retirement Earnings Test. Be sure to understand how this may impact your benefits before you start working again.

Returning to work may also mean higher Medicare premiums and taxes. When in doubt, consult with a financial adviser.

Finding fulfillment elsewhere

It can be easy to fall into old habits, regardless of whether it’s the right choice for us or not. But if you don’t need the money, consider whether returning to work makes sense. There are many ways to find happiness, fulfillment, and purpose in your retired life without a job. Learning a new language or hobby, volunteering, joining a sports league, or adopting a pet can bring your life joy and meaning in retirement. A combination of leisure and purpose will satisfy you once your working days are done. If you're feeling stuck, you migh hire a retirement coach to help with the non-financial side of shaping your retirement.

Whether you decide to unretire or not, ensuring your financial future is secure is essential. Financial planning before and during retirement will help ease the stress as you plan for and enter the next well-deserved chapter of life.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Katie Oelker is a freelance writer specializing in retirement, insurance, investments, saving, budgeting, and overall financial health and well-being. She holds an economics and management degree and a graduate-level business education teaching license. Her industry experience includes auditing for a large bank, teaching high school business courses, and working as a financial advisor before becoming a personal finance writer.

Katie's work has been featured in Business Insider, The Balance, Bankrate, CNN Underscored, LowerMyBills, MarketWatch, and Investing Answers. You can connect with her on her website or LinkedIn.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial Planner

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial PlannerRetirement planning is less about hitting a "magic number" and more about an intentional journey — from understanding your relationship with money to preparing for your final legacy.