Americans Are Retiring Later: Will This Trend Last?

Given a host of pressures to keep working, Americans are retiring later in life. Will regulatory and economic forces encourage you to work longer?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Retirement is not coming as quickly for many Americans. In fact, new data from the Center for Retirement Research shows the average retirement age is now around three years later than it was in the 1990s.

For the 59% of Americans replying to a 2024 YouGov poll indicating they want to retire before 65, this is bad news. However, CRR identified many factors that prompted Americans to retire later, including significant changes in women's labor force participation, as well as shifts in what work looks like for men and women alike.

The Center for Retirement Research also examined whether the factors prompting Americans to retire later would continue to encourage older Americans to stay in the workforce longer or whether they had largely played themselves out.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Trends in the average retirement age

Between 1880 and 1980, the number of older men in the workforce declined sharply. This was first driven by pensions for Civil War veterans, providing income in old age, and then by higher incomes, allowing Americans to buy more leisure time at the end of life. A shift from most men working in agriculture to working for companies that didn't want to employ older workers also played a role, as did the introduction of Social Security, Medicare, and workplace pensions.

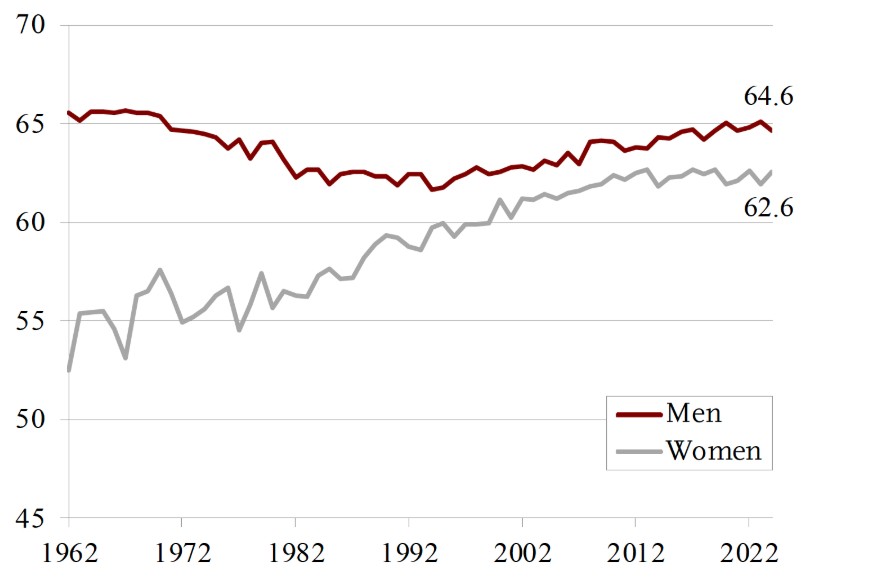

Things began to turn around in the mid-1980s, and since the 1990s, the labor force participation rate of men aged 55 and older has increased. Both men and women actually began working longer in the 1990s for a variety of reasons, eventually pushing the average retirement age out to 64.6 — up three years from the average retirement age in 1990 and almost back to where it was in the 1960s.

Why are Americans retiring later?

The Center for Retirement Research identified multiple factors prompting older workers to continue on the job for longer. These include:

- Incentives to delay Social Security. The phasing in of a later retirement age prompted many older Americans to delay retirement, as workers born in 1943 or later could no longer claim full benefits at 65. Full retirement age (FRA) is between 66 and 67 for anyone born after that time, and claiming benefits before FRA results in early filing penalties that reduce monthly income.

- Type of pension. Employers began to shift from defined benefit plans, which offer guaranteed income, to defined contribution plans, such as 401(k)s, that require workers to invest to support themselves. This change alone may be responsible for one-fifth of the increase in work among people aged 65 to 69, as many Americans delay retirement due to insufficient savings.

- Education. Dramatic increases in college attendance resulted in a more educated workforce. These educated workers can work longer because their jobs are often less physically demanding. They often want to work longer as their careers pay more, more opportunities are available and their jobs are more fulfilling.

- Improved health and longevity. A 3.2-year increase in the average life expectancy for men at 65 meant workers had to support themselves for longer. Until 2010, Americans were also getting healthier. There is a strong correlation between better health and working until an older age, as people tend to work longer when they're disability-free and not suffering from physical decline.

- Rising healthcare costs and reduced insurance. Health insurance costs have risen steeply, while the number of employers offering private health insurance to retirees has declined. Older Americans — especially those who haven't yet reached 65 and become eligible for Medicaid — may need to continue working to maintain their coverage.

- A change in the nature of work. Manufacturing jobs have been waning, and a knowledge-based economy in the U.S. means more opportunities for older workers who often can't do physically demanding jobs.

- Joint decision-making. Since women entered the workforce and many households are now two-income households, there is an increased incentive for spouses to coordinate their retirements. Because wives are, on average, three years younger than their husbands, a husband who waits for a wife to retire and claim benefits at Social Security's earliest eligibility age of 62 would now retire at 65.

- Non-financial factors. Since older workers are often healthier and wealthier than their peers, non-monetary factors such as increased job satisfaction may be causing workers to extend their careers.

Average retirement age for U.S. men and women

With so many reasons to stay on the job, it's not a surprise that the average retirement age has moved later for men. It's also moved later for women, for all of the reasons mentioned above and because of a change in women's place in the workforce.

With more women taking jobs out of financial necessity, naturally, they began staying in those jobs for longer. In fact, data show that throughout the 20th century, each generation of women spent more time working than the previous one, which in turn makes it more likely that they will work at an older age.

Will these trends continue?

Although many forces have pushed Americans to retire later, an analysis by the Center for Retirement Research suggests those trends are likely played out and not likely to continue.

For all people born in 1960 or later, full retirement age is now 67. The Social Security retirement age won't be raised again unless lawmakers pass politically difficult legislation, which is likely to be unpopular. Even if lawmakers change the FRA in the future, the shift would likely be gradual, as it has been in the past, and would not take effect until all but the youngest current workers reach their retirement years.

The shift from pensions to defined contribution plans has also mostly been completed, with very few private sector workers now receiving pensions; and the number of college grads has largely been stable since 2000. Progress on extending life expectancy has stalled, and the vast majority of employers have already declined to offer health insurance in retirement as a workplace benefit.

For all these reasons, researchers concluded that: "The factors contributing to the reversal in the labor force participation of older workers appear to have run their course. Their impact will remain, so it is unlikely the average retirement age will decline. On the other hand, they will provide little impetus for increases in the average retirement age."

What's the right age for you to retire?

Many people are affected by the factors identified by the CRR, which explains why there has been such a significant shift in the average retirement age.

However, deciding when to retire is a very personal choice. For example, some highly educated Americans may prefer to retire well ahead of schedule, while others with guaranteed pensions may enjoy their jobs and work until 70.

One wild card in current retirement planning is stock market volatility and the risk of a recession. For those near retirement with a significant portion of their money invested in equities, the sequence of risk return could hinder their future retirement income if they sell holdings in a down market.

Ultimately, the best retirement age depends on when you are financially ready to retire and have a plan for how to spend your days. Only then should you give notice and leave the workforce for good.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Christy Bieber is an experienced personal finance and legal writer who has been writing since 2008. She has been published by Forbes, CNN, WSJ Buyside, Motley Fool, and many other online sites. She has a JD from UCLA and a degree in English, Media, and Communications from the University of Rochester.

-

3 Smart Ways to Spend Your Retirement Tax Refund

3 Smart Ways to Spend Your Retirement Tax RefundRetirement Taxes With the new "senior bonus" hitting bank accounts this tax season, your retirement refund may be higher than usual. Here's how to reinvest those funds for a financially efficient 2026.

-

5 Retirement Tax Traps to Watch in 2026

5 Retirement Tax Traps to Watch in 2026Retirement Even in retirement, some income sources can unexpectedly raise your federal and state tax bills. Here's how to avoid costly surprises.

-

Trump's New Retirement Plan: What You Need to Know

Trump's New Retirement Plan: What You Need to KnowPresident Trump's State of the Union address touched upon several topics, including a new retirement plan for Americans. Here's how it might work.

-

3 Smart Ways to Spend Your Retirement Tax Refund

3 Smart Ways to Spend Your Retirement Tax RefundRetirement Taxes With the new "senior bonus" hitting bank accounts this tax season, your retirement refund may be higher than usual. Here's how to reinvest those funds for a financially efficient 2026.

-

Trump's New Retirement Plan: What You Need to Know

Trump's New Retirement Plan: What You Need to KnowPresident Trump's State of the Union address touched upon several topics, including a new retirement plan for Americans. Here's how it might work.

-

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning Strategy

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning StrategyOnce you're retired, your focus should shift from maximum growth to strategic preservation and purposeful planning to help safeguard your wealth.

-

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just Valuables

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just ValuablesLegacy planning integrates your values and stories with legal and tax strategies to ensure your influence benefits loved ones and good causes after you're gone.

-

4 High-End Experiences Worth the Splurge After 50

4 High-End Experiences Worth the Splurge After 50These curated date ideas provide the perfect backdrop for couples ready to enjoy the very best that the world has to offer.

-

My Grandkids Want Me to Donate to Their Teams and School Fundraisers. I Adore Them, but I'm on a Budget.

My Grandkids Want Me to Donate to Their Teams and School Fundraisers. I Adore Them, but I'm on a Budget.When your heart says "yes" but your wallet says "no," there is still a way forward. Here's what financial pros say.

-

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'Becoming "work optional" is about control — of your time, your choices and your future. This seven-step guide from a financial planner can help you get there.

-

It's Time to Bust These 3 Long-Term Care Myths (and Face Some Uncomfortable Truths)

It's Time to Bust These 3 Long-Term Care Myths (and Face Some Uncomfortable Truths)None of us wants to think we'll need long-term care when we get older, but the odds are roughly even that we will. Which is all the more reason to understand the realities of LTC and how to pay for it.