Name Your Plan – Select Both Retirement Income & Legacy Target

You know how much income you need and what kind of legacy you want to leave, but what you don’t know is if you might be able to hit those targets. Here’s one way to find out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Everyone has retirement goals, but the big question is, are they attainable?

Take the 70-year-old woman I wrote about recently. She has $2 million in retirement savings, and she’d like to use those savings to generate $70,000 in annual income increasing by 2% a year early in retirement, but still be able to leave her heirs a $2 million legacy at age 90. Can she do it?

That’s a question many financial advisers might have trouble answering, but after seeing the results of many, many plans over the years, I believe I’ve created a method that can answer her question using Income Allocation planning. While her legacy results will depend on market returns, this planning method incorporates annuity payments into the mix and lowers costs and taxes to deliver reliable income.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Happily, with technology and experience, that analysis is now available to you, too. After considering your personal and plan data, my team will enable you to Name Your Plan by using our tools at Go2Income to solve for the plan design and market return that achieves both your income and legacy objectives.

Our Retiree Names Her Plan

How does it work? To begin, you provide plan data, including your age and gender, marital status, your retirement savings, percentage of savings in your rollover IRA, desired inflation protection and your risk tolerance as measured by the percentage to be invested in stocks. Then we sift through (electronically, that is) the millions of possibilities.

The key driver of achieving both of your objectives is the long-term return in the stock market.

Now we zero in on the plan that will get you what you want. And you may be surprised that the stock market returns affect your results less than you might expect. When they do affect the plan, the impact will be on the legacy you leave, instead of your annual income.

How We Enable You to Name Your Plan

Here is how our retiree refined her objectives to set her twin goals for income and legacy:

- She revealed that 50% of her $2 million in savings is in a rollover IRA, and the balance is in personal after-tax savings.

- With her annual income goal of $70,000 growing by 2% per year, together with a Social Security check that also grows, she believes she will be able to live comfortably.

- Regarding her $2 million legacy goal, she understands that market results and plan design may prevent her from achieving that goal in every year and so is setting that legacy target at her approximate life expectancy of 90.

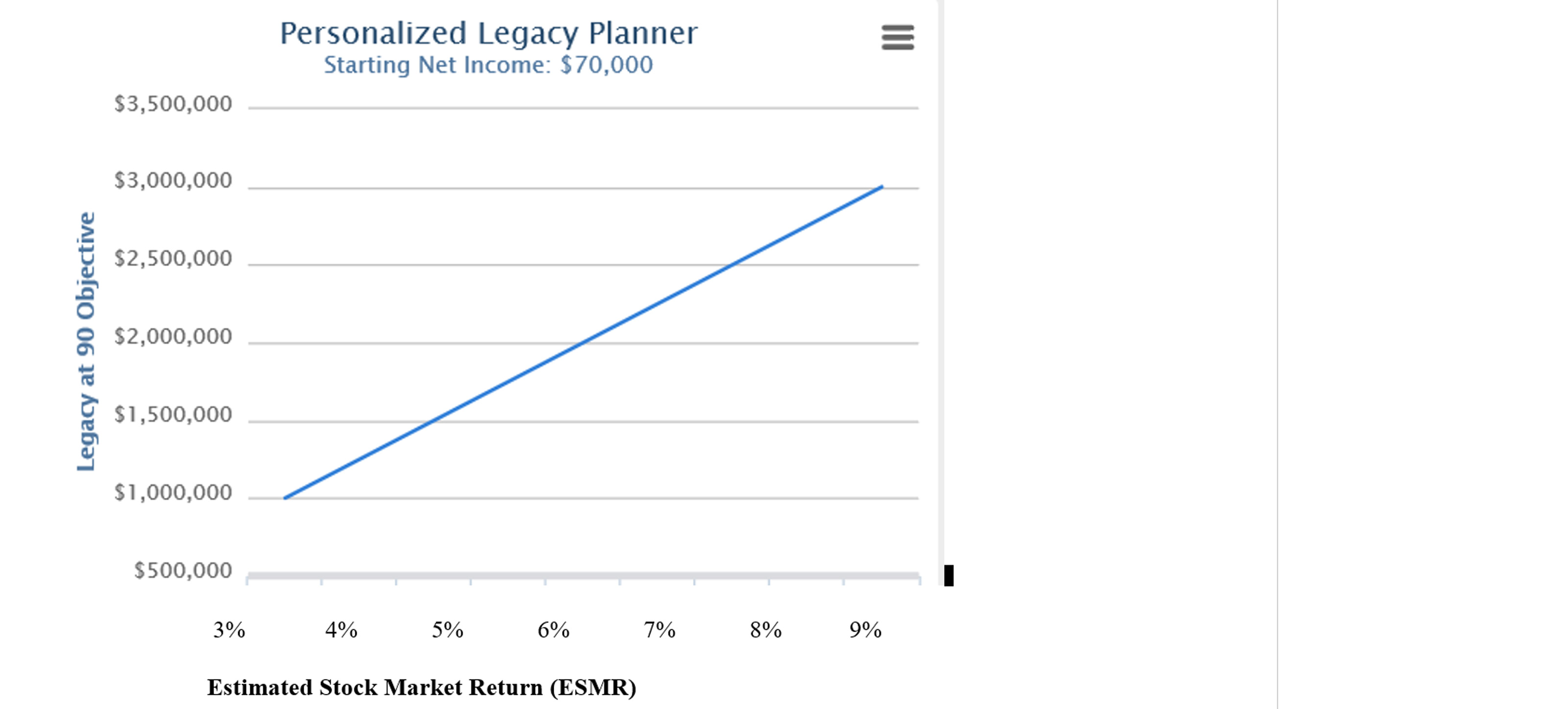

Recent studies would suggest that her twin goals are just not possible in today’s market. However, after using the Go2Income Income Allocation tool to create her income plan, she can now use the Legacy Planner below to estimate what stock market return it would take to deliver both her income and legacy targets.

Keep in mind that because her personal situation and plan objectives are unique to her, the Legacy Planner is personalized and developed results just for our retiree. (Sharing a “one-size-fits-all” planning tool just can’t get the best results for you.)

ESMR is based on a sampling of plan. A counselor can create your plan.

Balance Your Needs

The Legacy Planner shows that it would take a long-term stock market return of between 6% and 7% to meet her legacy objective — and maintain her income goal. If returns fall short by the time of her passing, remember that her kids/grandkids will have their lifetimes for markets to recover.

In other words, my legacy-income planning method matched the targets of a “live off interest and leave the principal” plan from yesteryear — one that no longer works, given today’s low interest and dividend rates — without putting her retirement at risk.

You can do the same. Visit Go2Income for more information on how Income Allocation can help you reach your income and legacy goals, or contact me to discuss your situation.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

The Tool You Need to Avoid a Post-Divorce Administrative Nightmare

The Tool You Need to Avoid a Post-Divorce Administrative NightmareLearn why a divorce decree isn’t enough to protect your retirement assets. You need a QDRO to divide the accounts to avoid paying penalties or income tax.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain Why

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain WhyEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly Mistakes

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)February gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.