2 Ways Retirees Can Defuse a Tax Bomb (It’s Not Too Late!)

If you’re retired and find yourself sitting on a “tax bomb,” you may think there’s nothing you can do. But two strategies could seriously reduce your taxes in retirement.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you’re recently retired, it’s not too late to implement planning strategies that can dramatically reduce taxes in retirement and taxes on what you leave your heirs.

A seven-part series I recently published on Kiplinger.com on “retirement tax bombs” was a huge hit with readers. I heard directly from many of you, who expressed that you were always worried about these issues but hadn’t ever heard anyone talk about them or give practical advice.

If you haven’t read the series, I’d suggest you first start with Part 1: Is Your Retirement Portfolio a Tax Bomb? You can find links to the other parts in the series at the bottom of this article.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Many investors expressed worries that because they had already retired, it’s too late to do anything to defuse their retirement tax bomb. However, while the first of the three strategies I discuss, shifting retirement contributions from pretax to after-tax Roth, is no longer available to you, the remaining two strategies, asset location and annual Roth conversions, likely are, and could be worth implementing.

Let’s look at a case study of a married couple who just retired at age 63. They have a total investment portfolio of $3 million, of which $1.5 million is tax deferred, $1 million is taxable, and $500,000 is Roth. Their investments are not asset located, with the same asset allocation in each tax bucket. I assume expected returns of 4% for bonds and 9% for stocks. They’re invested in a conservative growth portfolio with a 60% stock, 40% bond allocation that has an expected annual return of 7%.

They each plan to file for Social Security at age 67 with a combined benefit of $68,000, and a 2% annual cost of living adjustment. They have no other sources of income.

Let’s look first at what their current retirement tax bomb looks like.

Early in retirement, they’ll meet their expenses through dividend income and harvesting long-term gains from their taxable investments.

The Base Case: A Big RMD Problem

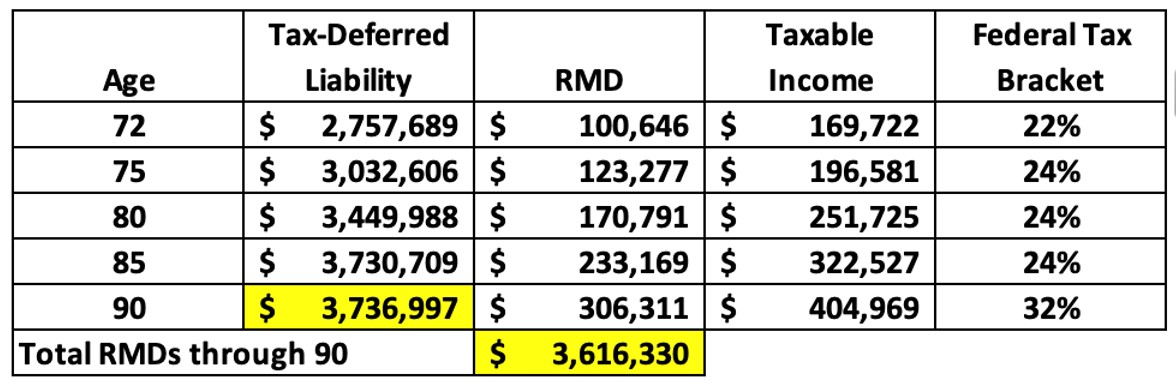

They are projected to have more than $3.6 million in required minimum distributions (RMDs) through age 90. Recall that RMDs are taxed as ordinary income. Below, you can also see their annual RMDs at certain ages, their taxable income based on RMDs and Social Security income, and their projected federal tax bracket using current tax tables.

They are also projected to have $78,000 in Medicare means testing surcharges through age 90, which isn’t bad, but remember that you can think of these as avoidable taxes with proper planning.

The couple’s kids are projected to inherit $3.7 million in tax-deferred assets by the time the couple is age 90. The kids will have 10 years in which to completely drain the inherited IRAs, with all distributions being taxed as ordinary income at the kids’ marginal tax rate.

Finally, recall that their Roth IRAs are going to be untouched early in retirement to allow the tax-free account to grow as much as possible. Assuming no withdrawals from the Roth accounts through age 90, their tax-free Roth money grows from $500,000 to more than $3.3 million, though they could certainly make tactical Roth withdrawals in some years to reduce taxes (say, to avoid bracket creep).

So, what do you think of their situation? It could certainly be worse, and at least they remain in a reasonably low 24% tax bracket through most of retirement. But could they meaningfully improve on their situation by implementing asset location and annual Roth conversions? Let’s see.

Scenario 1: Implement Asset Location

“Asset location” refers to putting your assets where they will do the most good for you, specifically:

- Placing asset classes with lower expected returns (think bonds and dividend stocks) in tax-deferred accounts to limit their growth.

- Putting asset classes with the higher expected returns (think small value and emerging market stocks) in Roth accounts so the tax-free money grows the fastest.

- And putting asset classes that derive a lot of their growth from capital gains (think growth stocks) in taxable accounts.

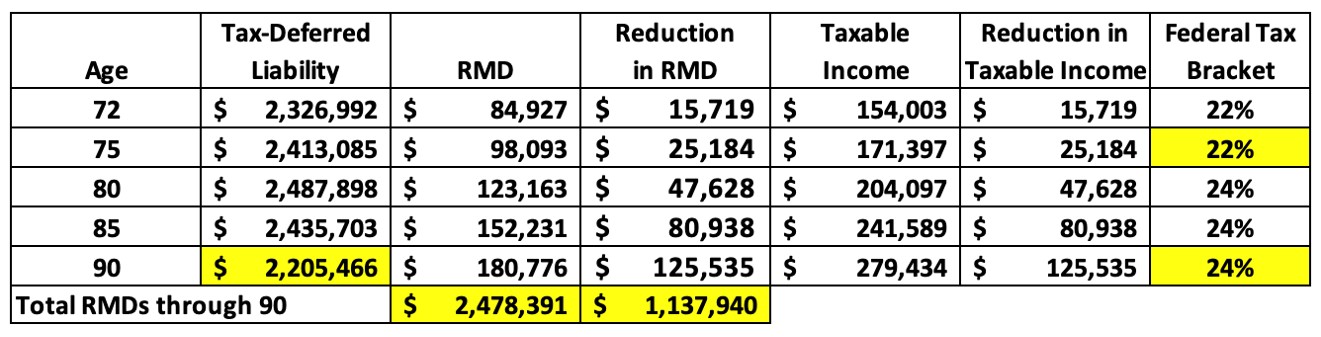

By using asset location, we expect to put 100% of their bonds in their tax-deferred accounts, which will earn a lower expected return of 5% rather than the 7% assumed in the base case. Let’s look at the impact.

Through age 90, their total taxable RMDs fall by more than $1.1 million, and they’re in a lower federal tax bracket for many years. In addition, the tax liability passed to their kids falls by more than $1.5 million, and all $78,075 of Medicare means testing surcharges have been eliminated.

Meanwhile, let’s assume they can continue to live off of Social Security, RMDs and harvesting gains from their taxable accounts so they don’t need to withdraw money from their Roth accounts. Assuming the Roth accounts are asset located to hold more aggressive investments with an expected return of 9% instead of 7% from the base case, their Roth accounts grow to $5.6 million by age 90, an increase of more than $1.5 million from the base case.

Those are pretty impressive benefits from simply implementing asset location.

Scenario 2: Implement Asset Location and Annual Roth Conversions

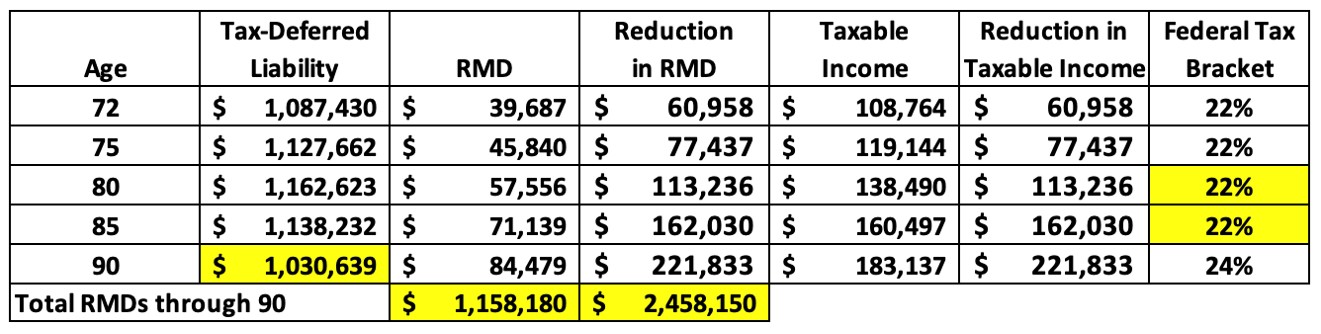

Now, let’s add annual Roth conversions to the strategy. Recall that Medicare means testing starts at age 65, but it is based on income from two years prior (two-year look-back), and that they plan to take Social Security at age 67. Let’s plan on annual Roth conversions of $150,000 from age 63 to 66 and then $75,000 per year from age 67 to 71, for a total of $975,000 in Roth conversions. These amounts are small enough to avoid any further Medicare means testing surcharges, although some investors may find that triggering a few years of means testing to convert more to Roth may be worthwhile.

Let’s look at the results compared to the base case. Through age 90, their taxable RMDs fall from $3.6 million to $1.1 million, a reduction of $2.4 million. In addition, they remain in the 22% tax bracket for at least 10 more years, so they benefit from both lower taxable income and lower tax rates in most years.

Meanwhile, the inherited tax liability for their heirs falls from $3.7 million to $1 million, a reduction of $2.7 million.

Finally, thanks to the Roth conversions early in retirement and nearly 30 years of compound growth, the tax-free Roth money grows to a whopping $14 million.

One additional consideration to bear in mind is what may happen to future tax rates. Current tax rates are near historical lows and may be the lowest we'll see for the rest of our lives. Consider solvency issues with Social Security and Medicare, chronic infrastructure issues, exploding deficits, climate change, and pandemics. Each of these issues in isolation will require a lot of money. And that doesn’t even account for the income and wealth redistribution agenda being pursued by some in Congress.

Simply put, paying taxes today may be a bargain compared with deferring (and growing) your tax liability into the future.

I hope this article shows that even if you’ve recently retired (or are about to retire), you can still implement planning strategies that can dramatically reduce your taxes in retirement and the tax liability you leave your heirs.

Here are the links to the previous articles in the series:

- Part 1: Is Your Retirement Portfolio a Tax Bomb?

- Part 2: When It Comes to Your RMDs, Be Very, Very Afraid!

- Part 3: Watch out! RMDs Can Trigger Massive Medicare Means Testing Surcharges

- Part 4: Will Your Kids Inherit a Tax Bomb from You?

- Part 5: How to Defuse a Retirement Tax Bomb, Starting With 1 Simple Move

- Part 6: Using Asset Location to Defuse a Retirement Tax Bomb

- Part 7: Roth Conversions Play Key Role in Defusing a Retirement Tax Bomb

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David McClellan is a partner with Forum Financial Management, LP, a Registered Investment Adviser that manages more than $7 billion in client assets. He is also VP and Head of Wealth Management Solutions at AiVante, a technology company that uses artificial intelligence to predict lifetime medical expenses. Previously David spent nearly 15 years in executive roles with Morningstar (where he designed retirement income planning software) and Pershing. David is based in Austin, Texas, but works with clients nationwide. His practice focuses on financial life coaching and retirement planning. He frequently helps clients assess and defuse retirement tax bombs.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.