How to Use DSTs and 1031 Exchanges for Diversification

This hypothetical case study shows how an investor used Delaware statutory trusts (DSTs) to build a diversified 1031 DST portfolio and avoid a $2 million tax bill.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Kay Properties & Investments has helped thousands of investors use Delaware statutory trusts (DSTs) to complete their 1031 exchanges. However, we recently worked with a client who discovered how DSTs can be incredibly valuable when it comes to building a diversified portfolio.

What are Delaware statutory trusts (DSTs)?

For those readers who are not familiar with DSTs: They are a legal real estate ownership structure that allows multiple investors to each hold an undivided beneficial interest in the trust. The term “beneficial interest” means that investors hold a percentage of the ownership, and no single owner can claim exclusive ownership over any specific aspect of the real estate. The DST sponsor company is responsible for handling all of the maintenance, distributions and other active management responsibilities. DSTs are particularly relevant to investors because the IRS has blessed them to qualify as “like-kind” investment property for the purposes of a 1031 exchange.

Enter Southern California real estate investor Tom

So now, let me introduce you to Tom, a seasoned real estate investor who grew tired of active property management and the headaches of increasing rent-control regulations. For several decades, Tom built a portfolio of multifamily apartment buildings in Southern California. Over the years, he painstakingly managed the properties himself, growing the portfolio to an estimated $5 million estate.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

However, as Tom approached retirement, he realized the hands-on management of dealing with tenants, toilets and trash, along with the increasing local rent-control regulations, was just too much for him.

As a result, Tom decided to relinquish his portfolio, which he sold for $5 million. The excitement surrounding the sale of his portfolio that he had worked so hard to build over many years quickly faded when his CPA calculated that the capital gains tax and depreciation recapture taxes would eliminate nearly 40% of the portfolio’s value. Surrendering this money to the government would significantly impact Tom’s retirement plans.

The challenge: Find a suitable replacement property for a 1031 exchange

Tom quickly recognized he needed to complete a 1031 exchange to help defer taxes and find a replacement property that would require less hands-on management.

Tom at first considered a triple net lease, or NNN, property in which the tenant agrees to pay the property expenses as an option for his 1031 exchange. However, Tom quickly realized he did not want to put such a large amount of capital into a single NNN property. He always remembered his grandmother using the expression "never keep all your eggs in one basket." Placing most of his net worth into a single NNN property would put Tom in a precarious position, especially if the tenant closed the location or, even worse, went bankrupt, as the property’s value would be negatively impacted and his monthly rental payments would cease. He needed a strategy that would spread risk across multiple investments, in multiple locations, with multiple tenants and multiple asset classes.

Tom also knew he didn’t want to purchase more apartment buildings. He would then have to continue to manage them as well as be subject to rent-control restrictions. He thought about buying apartments out of state but then quickly realized that managing a management company would likely be worse than just doing the work himself.

The solution: Tom's CPA recommended he consider DSTs

After telling his CPA he was not interested in a NNN property or other apartments, Tom’s CPA recommended that he look into DSTs for his 1031 exchange.

After presenting a thorough overview of the DST structure — including both benefits and risks — and conducting a comprehensive review of Tom’s needs, we were able to help him curate a tailored real estate portfolio solution to potentially meet his goals of passive income, diversification and risk mitigation.

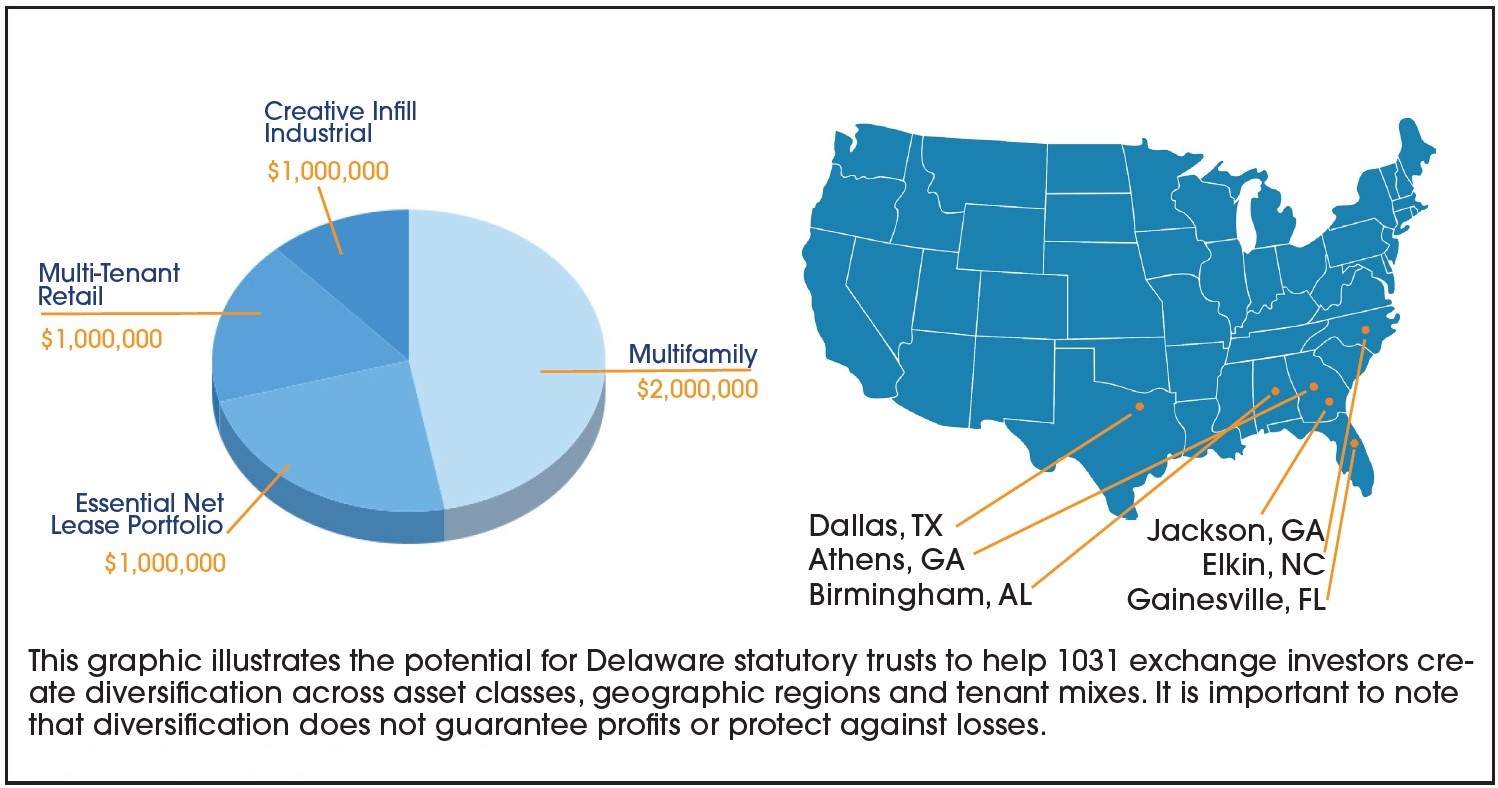

This plan involved him diversifying his $5 million of equity into multiple DST properties. Although diversification does not guarantee profits or protection against losses, Tom felt confident because his $5 million was spread out among multiple properties, asset classes, locations and tenants. By doing this, Tom achieved a level of diversification that significantly reduced reliance on any single property or tenant. Additionally, the portfolio was entirely debt-free, eliminating the risk of lender foreclosure or cash flow sweeps.

The portfolio of DST investments for Tom’s 1031 exchange included:

- A multifamily DST investment. This debt-free 159-unit apartment community is in the Dallas market and provides the opportunity for a value-add investment strategy with the potential to increase the net operating income (NOI) of the property along with monthly distributions. This investment is sometimes called a “buoy” investment because it can adjust with time and potentially increase value as NOI is grown through a value-add strategy.

- A multitenant retail DST investment. This debt-free multi-tenant retail property is located in Birmingham, Ala., and has an occupancy rate of 96% including national tenants. The property was acquired at below replacement cost at an attractive basis. In addition, the property sees more than 3.4 million annual visits from shoppers.

- Essential net lease portfolio DST. This debt-free investment is a portfolio of single-tenant net lease essential tenants in one DST that is located across multiple geographic locations. The entire portfolio is 100% leased with high-quality tenants with corporate-backed net leases. This type of DST investment is sometimes described as an “anchor” investment, because it is designed to potentially deliver predictable income throughout the hold period.

- Creative infill industrial DST. This debt-free property is a multitenant industrial building with long-term leases in place. The asset was purchased below replacement cost and is in the employment, cultural, educational and business center of Athens, Ga.

Tom's results

Tom was able to successfully leverage the DST structure to achieve his investment goals of a 1031 exchange into passive management, portfolio diversification and the possibility for regular monthly cash flow distributions.

Thanks to the DST and 1031 exchange solution, Tom was able to transition from intensive active property management into truly passive investing. The predictable income stream potential from his diversified DST portfolio supports his retirement lifestyle while freeing him from the stress of hands-on management and equity-squeezing rent control regulations. (Note: Diversification does not guarantee profits or protection from losses.)

Tom now enjoys the flexibility and freedom he worked so hard to achieve, knowing that his investment portfolio is designed to align with his financial goals and risk tolerance through the 1031 exchange into DST investments.

If you would like to speak with one of the thousands of clients like Tom who have chosen to have Kay Properties help them with their 1031 exchange and DST investments, please just call us at (855) 899-4597 or visit www.kpi1031.com.

This material is not tax or legal advice. Please consult your CPA/attorney for guidance. Past performance does not guarantee or indicate the likelihood of future results. Diversification does not guarantee returns and does not protect against loss. Potential cash flow, potential returns and potential appreciation are not guaranteed. There is a risk of loss of the entire investment principal. Please read the Private Placement Memorandum (PPM) for the offerings business plan and risk factors before investing. Securities offered through FNEX Capital LLC member FINRA, SIPC.

Related Content

- Four Ways Savvy Investors Use DSTs for Their 1031 Exchanges

- Three Tax-Smart Strategies for Real Estate Investing

- Why Investing in Debt-Free DST Properties Makes Sense Today

- Three Asset Classes Delaware Statutory Trust Investors Should Avoid

- Three Key Items to Evaluate When Choosing a 721 Exchange

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dwight Kay is the Founder and CEO of Kay Properties and Investments LLC. Kay Properties is a national 1031 exchange investment firm specializing in Delaware statutory trusts. The www.kpi1031.com platform provides access to the marketplace of typically 20-40 DSTs from over 25 different sponsor companies. Kay Properties team members collectively have over 340 years of real estate experience, have participated in over $39 billion of DST 1031 investments, and have helped over 2,270 investors purchase more than 9,100 DST investments nationwide.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.