The Paradox Between Money and Wealth: How Do You Find the Balance?

Money can buy ease, but it can't buy meaning. Wealth reflects a life organized around relationships, health, contribution and time — qualities that compound differently than a mutual fund.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you ask 10 people what it means to "retire well," most will begin by talking about money. They'll mention savings, investments, portfolios or the confidence of living without a paycheck.

Financial security tends to dominate the conversation because it's tangible, measurable and often seen as the gatekeeper to freedom.

Yet, beneath that conversation lies another, quieter one that rarely gets equal attention — the discussion about what wealth really means once the daily rush of earning has ended.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Money and wealth appear to be contradictory, but in fact, they're complementary and synergistic. The paradox between them is simple to describe and difficult to live out: Focusing on one without the other can leave us either cash-rich but impoverished emotionally or loved but insecure.

In other words, money and wealth aren't the same. Money can buy ease, but it can't buy meaning. Wealth, by contrast, reflects a life organized around relationships, health, contribution and time — qualities that compound differently than a mutual fund.

About Adviser Intel

The author of this article is a participant in Kiplinger's Adviser Intel program, a curated network of trusted financial professionals who share expert insights on wealth building and preservation. Contributors, including fiduciary financial planners, wealth managers, CEOs and attorneys, provide actionable advice about retirement planning, estate planning, tax strategies and more. Experts are invited to contribute and do not pay to be included, so you can trust their advice is honest and valuable.

When the narrative changes

During our working years, money often serves as a measure of progress. It rewards effort, validates achievement and promises safety.

Yet, when retirement arrives, the narrative changes. Those external benchmarks gradually fade, and the question, "Do I have enough?" subtly transforms into "Who am I now?" This is the pivot point in the psychology of retirement — the moment when security naturally gives way to significance.

Some people enter retirement financially secure yet unprepared for the psychological transition that awaits them. They have the means to live comfortably but often lack the mindset to navigate the loss of structure and purpose that once defined their days.

Time — previously managed in fragments — now stretches unbounded, confronting them with nagging questions about identity and worth. What was imagined as freedom can, paradoxically, feel confining.

Without a renewed sense of direction (identity and purpose), the absence of professional demands leaves space that emotional readiness must learn to fill.

Emotionally wealthy but financially exposed

Others come to retirement with deep relationships, strong community ties and generous spirits — yet they live with underlying anxiety about their financial footing. They're emotionally wealthy but financially exposed. Both sides of the paradox create stress, and each demands reconciliation.

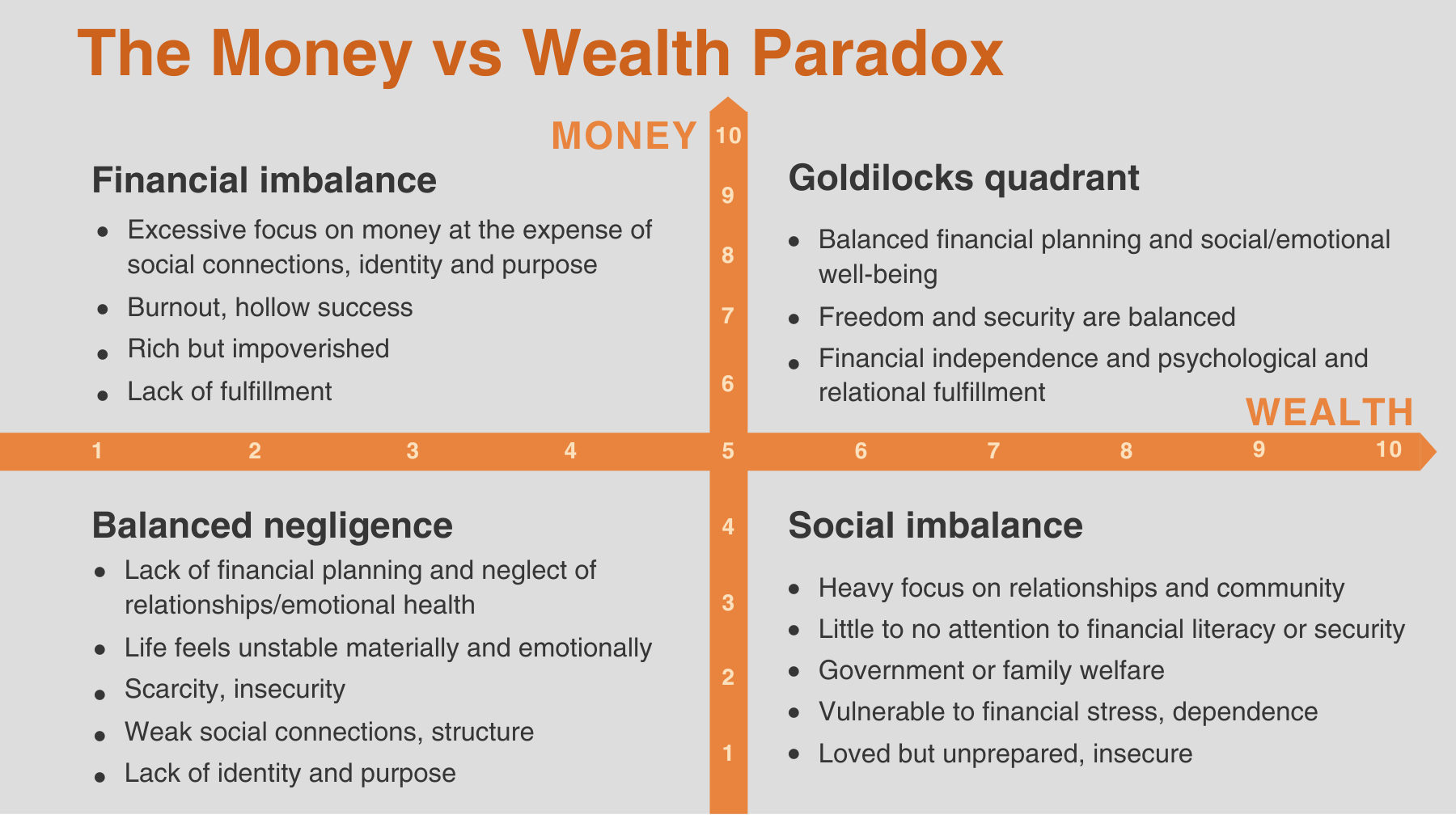

The Money-Wealth Paradox serves as a visual to illuminate this (im)balance:

The vertical (y) axis represents money: financial planning, preparedness and material security. The horizontal (x) axis represents wealth: relationships, emotional health, meaningful time and a sense of belonging.

The upper-right quadrant — the Goldilocks zone, where both are strong — is the space of flourishing, the place in which financial freedom supports emotional abundance.

The lower left, where both are weak, is a zone of scarcity — financially fragile and emotionally thin.

The two remaining quadrants express imbalances: One dominated by achievement without connection ("rich but impoverished"), the other by warmth without stability ("loved but insecure").

Time to evaluate

The purpose of this paradox awareness is not to judge but to reveal. It asks you to evaluate whether your resources — emotional, social and financial — work together or compete against one another.

Many people unconsciously sacrifice one dimension while pursuing the other, believing they can strengthen the weaker side later. As the years pass, the imbalance tends to deepen.

The irony is that most of what we call "financial planning" was never about money. It was about emotion — security, control and freedom from fear. Investors chase returns because they want peace of mind, not because they crave numbers on a statement.

Likewise, when relationships falter or purpose is elusive, no portfolio can replace the feeling of belonging or contribution. The deeper psychology of retirement rests on uniting these inner and outer forms of capital.

Money is the language of certainty, while wealth is the dialect of meaning. Too much of the first creates pressure; too much of the second, without planning, creates anxiety. The healthy life — and the fulfilling retirement — lives in the creative tension between the two.

Integrating money and wealth

It helps to think of money as the tool and wealth as the experience. Money builds the structure; wealth fills it with life. Money can buy time; wealth determines how that time feels and is filled.

In our working years, these two often compete, but in retirement, they must integrate. Without money, experiences collapse under stress. Without wealth, financial success rings hollow.

Looking for expert tips to grow and preserve your wealth? Sign up for Adviser Intel, our free, twice-weekly newsletter.

This paradox also reveals another fascinating shift: The transition from "should" to "ought." During the career phase, the script of life is filled with "shoulds" — what you should earn, how you should act, what you should accumulate.

Retirement challenges that external, subjective voice. It invites the language of "ought" — the inward compass that points toward meaning, contribution and alignment.

The balance between money and wealth can't emerge until "should" yields to "ought." Only then does choice replace obligation, and freedom begins to mature into purpose.

How do you begin to live inside this balance? The first step is awareness. Ask yourself two questions:

- How prepared am I financially?

- How prepared am I emotionally?

They might seem simple, but they measure very different currencies. Your financial preparation speaks to independence; your emotional preparation speaks to fulfillment. Every person's answer traces a different route through the paradox.

An invitation rather than a failure

If you discover strength on one side and strain on the other, take that as an invitation, not a failure. You don't need to choose between prosperity and peace. The challenge — and the beauty — of your Encore Years is learning how they can reinforce each other.

Sustained well-being requires both savings and belonging, just as a well-built house needs both structure and people to fill it.

For now, remember this: You can plan for your future without losing your soul to it, and you can pursue meaning without undermining your security. The art of retirement lies in keeping both in balance — the external numbers that safeguard your life and the internal values that make it worth living.

To learn more about this approach to retirement, pick up my new book, Your Encore Years: The Psychology of Retirement.

Related Content

- Eight Habits for a Happy Retirement

- Five Keys to Retirement Happiness That Have Nothing to Do With Money

- Financial Planning's Paradox: Balancing Riches and True Wealth

- Why Doing What You 'Ought' in Retirement Beats Doing Whatever You Want

- Money Won't Buy You Happiness in Your Life After Work

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dr. Richard Himmer is a seasoned professional with expertise in Emotional Intelligence (EI), Clinical Hypnotherapy and Workplace Bullying prevention. He holds an MBA, a master’s degree in psychology and a PhD in Industrial and Organizational Psychology. He combines academic knowledge with practical experience. His doctoral dissertation focused on the Impact of Emotional Intelligence on Workplace Bullying, showcasing his commitment to understanding and addressing complex workplace dynamics. Dr. Himmer leverages the subconscious (EI) to facilitate internal healing, fostering healthy interpersonal relationships built on trust and respect.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.