7 Outrageous Ways Retirees Can Invest Their Money in 2026

Stocks and bonds aren't the only ways to invest your retirement "fun money."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

When it comes to investing, retirees know the drill: maintain a balanced portfolio of stocks and bonds — not too risky, not too conservative. After all, it has to last twenty or even thirty years.

But some retirees can afford to put their money to work beyond that and may be looking for a way to invest 'outside the box.' If so, options abound.

There are several out-of-the-ordinary ways to invest in retirement. Some require little capital, some require a lot. None are slam dunks, and you’re more likely to lose money than to make it without the guidance of a professional.

Article continues belowFrom just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But for those who can afford the gamble, or want to live vicariously through those who can, here are seven outrageous ways retirees are investing beyond run-of-the-mill stocks and bonds.

1. Own a piece of a professional sports team

The stock market may have been on a two-decade-plus bull run, but professional sports teams have done even better, outperforming stocks over the past thirty years.

But accessing those returns doesn't come cheap. A minority stake in a professional sports team ranges from around $21.5 million to over $300 million, depending on the franchise.

The Dallas Cowboys have a $10.1 billion valuation, which means 3% stake will set you back $303 million. Meanwhile, the same stake in the Phoenix Suns is only $21.5 million.

If a major league team is too steep, you can trade down to the minors. A 5% stake in a local Single-A minor league baseball team might only set you back $500,000, while the same piece of a Triple-A team like the Sacramento River Cats would cost closer to $4.5 million.

2. Become the bank

No, you can't become the next JPMorgan Chase, but you can be a peer-to-peer or hard money lender, and depending on who you choose to lend money to, you can make some cash along the way. Plus, it doesn't require as much upfront capital as buying a stake in a professional sports team.

To become a peer-to-peer lender, you have to open an account at an online lending marketplace like Prosper or LendingClub, select 'notes' to fund, and bam!, you are now a one-person bank. If you fund these loans through a self-directed IRA, you can earn interest that grows tax-free. However, be aware of the risks of using a self-directed IRA.

If you'd rather have a physical asset backing your money than just a person's word, you can become a hard money lender instead. You act as the bank for real estate flippers who need cash to renovate a house and sell it quickly.

In exchange for the speed at which you are supplying the money, you can charge higher-than-average double-digit interest rates, plus upfront fees. If they default on the loan, you get the property. This one is risky, complicated and requires an attorney to protect you from foreclosures and lawsuits.

3. A shot of whiskey for the ultimate "liquid" asset

It doesn't get any more liquid than whiskey, and if you have the patience, a finely aged single malt not only tastes smooth going down, but it can also reward you with returns that have historically beaten the S&P 500.

Rare whiskey has returned about 280% over the past decade, leaving the stock market in its wake. However, over the past 3 years, prices have stagnated or even dipped.

You can secure a bottle of rare whiskey through an auction or by purchasing an entire maturing cask, which ranges from a few thousand dollars for a single bottle to multi-millions for a cask, depending on its age and the distillery.

4. Become an arbiter of talent

Every time you stream your favorite tune, a song plays during a scene in a tv series or a snippet from a beloved movie score shows up in a commercial, somebody is getting paid.

That somebody could be you, if you buy the future rights to a song, movie score or even a book. Hey, you never know which book will be the next blockbuster trilogy.

Ideal for those retirees who lack the talent or never struck it big, buying the royalties to a piece of art isn't too hard, but it can be expensive.

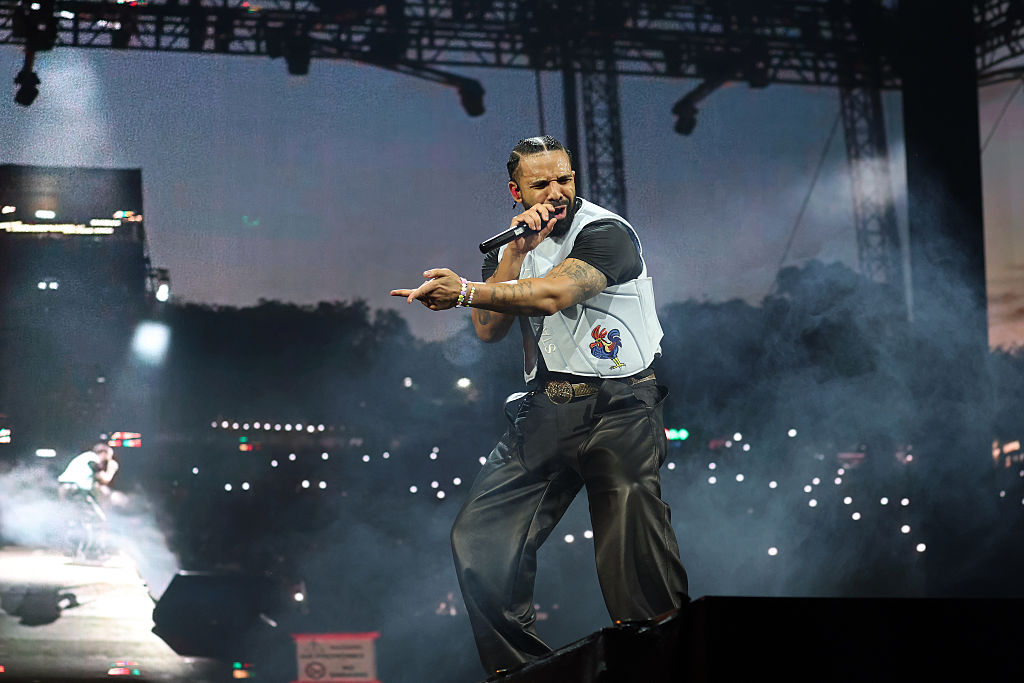

Royalties will cost you as little as $10 to multi-millions of dollars. The recent auction price paid for a multi-platinum hip-hop collection featuring tracks by Drake and 50 Cent: $900,000.

Several online platforms allow you to purchase fractional shares or full catalogs of songs and movies, providing you with royalty payments for the duration of the copyright.

5. Ready, set, own your own racehorse

Here's an investment you can cheer about: your very own racehorse that could win the Kentucky Derby and take home the $3.1 million winner's share of the $5 million purse.

You will need a lot of money to bankroll this "outrageous" but potentially rewarding endeavor, especially if owning a thoroughbred was a childhood dream.

A horse that has the potential to win a race, let alone the Derby, ranges from $30,000 to as much as $3.4 million. Then there are the costs for trainers, stables, vet bills, food, and blacksmiths — you get the idea.

6. Bankroll lawsuits

Move over Matlock, there's a new attorney in town. You can play armchair lawyer and potentially make cash by being part of the money behind a lawsuit. How? Through Third Party Litigation Funding (TPLF) or "lawsuit investing."

Here's how it works: pick a case through a funding platform, invest your money to cover the legal fees and collect a percentage of the final settlement if the plaintiff wins. If you lose, you're out of luck.

Don't think you can strike it big? Just look at 3M. In a jaw-dropping resolution, the company recently agreed to pay $6 billion to settle lawsuits over defective military earplugs. Imagine if you bankrolled a portion of that!

7. Say cheers to the winery

Sipping on a glass of wine overlooking the rolling hills of Napa is what retirement dreams are made of. What's even better? If the bottle you uncorked is your own.

Owning a vineyard is the ultimate alternative investment, and it's more common than you think. At last check, there were more than 11,000 wineries in the U.S., some of which are owned by retirees.

So, how much does it cost to own a wine business, and how much could you make?

Anywhere from $500,000 to multi-millions of dollars in startup costs, but for those who get it right, the payoff could be about $300,000 a year in profits. Now that's something to toast!

Eyes wide open

A balanced and diversified portfolio in retirement is important in ensuring you don't outlive your savings.

But if you have some "fun money" on the side, the advice of trusted professionals and a taste for the unconventional, these alternative investments offer another place to stash your cash.

While they may seem outrageous or over-the-top, many of these investments — from fractional music royalties to stakes in a law firm’s next big case — don't require a million-dollar buy-in. What these investments demand is a healthy risk appetite, a willingness to be patient, and the ability to perform meticulous due diligence.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Donna Fuscaldo is the retirement writer at Kiplinger.com. A writer and editor focused on retirement savings, planning, travel and lifestyle, Donna brings over two decades of experience working with publications including AARP, The Wall Street Journal, Forbes, Investopedia and HerMoney.