6 Champagne Problems Successful Retirees Face

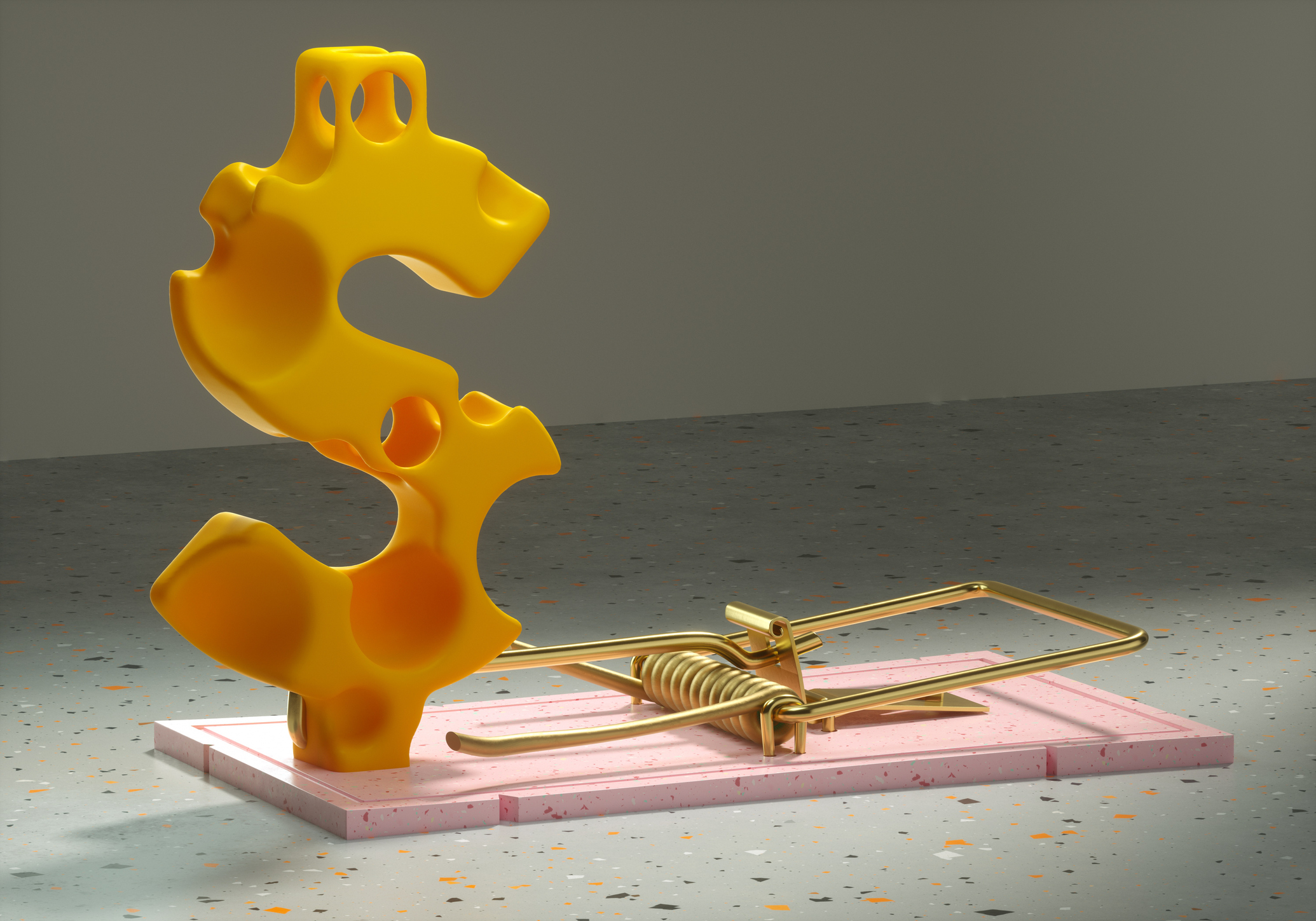

What do you do if your biggest financial threat is simply having too much of a good thing — money?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Life isn't easy just because you make money; you have to pay taxes on that hard-earned cash. And sometimes you're penalized because of it. Known in some circles as the "rich-man tax" or chalked up as "first-world problems," these are the hidden costs that high earners face.

You can find them everywhere, from Medicare surcharges to the taxes your children face from an inheritance. Left unchecked, these costs can be devastating for you and your beneficiaries.

The good news is that many of these penalties are avoidable, and you don't have to skirt the law to do it. Read on to learn how.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Freedom at a cost

After decades of being the most important person in the room, or at least having a role to play, you finally get to let go in retirement. No more structured life, where your days and hours are accounted for.

- The problem: You spent your adult life with a mission to accomplish and a place to be. Now you have a lot of time on your hands with nothing to focus on. You can be anywhere, at any time, and that is hard to get used to.

- The pain: You love your hobbies, but they aren't giving you the fulfillment you desire. You went from being one of the most important people in the room to another guy at the driving range.

- The rich person solution: Don't retire from your career, retire to a new one. That could mean embarking on a new profession or becoming a board member, an angel investor, or a philanthropist. Don't view retirement as the end but the next chapter.

The Medicare surcharge: IRMAA

The Income-Related Monthly Adjustment Amount (IRMAA) is the classic high-income penalty. It’s a direct tax on your financial success that manifests as a dramatically increased monthly premium for Medicare Part B and Part D. The maximum surcharge in 2026 is $6,936: an extra $5,844 for Part B and an extra $1,092 for Part D.

- The problem: Your modified adjusted gross income (MAGI) — which includes taxable income from investments, pensions, and traditional retirement accounts — is simply too high.

- The pain: The government uses your income from two years ago to determine your current premium. A large capital gain, a significant Roth conversion, or a big business sale in one year can trigger a massive healthcare premium spike two years later, costing you thousands annually for the same coverage.

- The rich person solution: Strategically executed Roth conversions during low-income years, qualified charitable distributions (QCDs) from IRAs (once eligible), and meticulous timing of capital gains to stay below the next, much higher income bracket.

The Social Security tax trap

This is the ultimate irony: the Social Security benefits you paid into your entire working life become a taxable liability because you saved so well.

The Social Security tax trap occurs because the thresholds for taxing benefits are low and are not indexed for inflation. Since high-net-worth retirees generally exceed these thresholds easily, their strategy shifts entirely to generating income from sources that do not count toward provisional Income.

- The problem: If your provisional income (a formula that includes your MAGI plus half of your Social Security benefits) exceeds certain low thresholds, up to 85% of your Social Security benefits are subject to federal income tax.

- The pain: The mandatory income from RMDs and large capital gains often guarantees that the wealthy retiree will hit the 85% taxable cap. It’s a classic compounding tax effect, where a decision to take money from your IRA creates a tax liability on your health care premiums and your Social Security check simultaneously.

- The rich person solution: The strategy is simple in concept, complex in execution. The solution to the Social Security (SS) tax trap is to control and minimize the component of income that the IRS uses to calculate the tax, known as provisional income (PI). You would spend down your tax-free money (Roth IRA/Roth 401(k)) before your tax-deferred money (traditional IRA, 401(k)), and use the non-taxable income to shield your Social Security benefits.

The healthcare double dip

Medicare covers eighty-percent of retirees' health care expenses through a network of approved medical providers. But for some of us, they need more.

- The problem: Some high earners feel the level of care provided through Medicare isn't enough and that they need more than the in-network providers have to offer.

- The pain: To maintain their preferred standard of care, some high earners opt for a layered approach, paying their Medicare premiums and IRMAA surcharges while also paying out-of-pocket for concierge medicine or private physicians. Sure, they are paying twice, but can you really put a price on your health?

- The rich person solution: You can’t stop the double pay, but you can cushion the blow if your income has dropped since you retired. If so, you can appeal your IRMAA surcharges, and/or, if you have any money in a Health Savings Account, use it to pay for medical services the doctor performs.

The ill-intended gift

You've amassed a small fortune, but your kids don't need it. They are doing well all on their own. From a tax perspective, you may be leaving them more of a liability than a legacy.

- The problem: Thanks to the IRS's 10-Year Rule, your heirs are required to empty any pre-tax account, such as an IRA, within a decade of your passing.

- The pain: If your children are already in their peak earnings years, this "gift" is actually a tax bomb. Forced distributions get stacked on top of their high salaries, often resulting in 40% or more of the inheritance going to the government.

- The rich person solution: Act now before it's too late and use Roth Conversions to pay the tax bill in advance. You move the money from your IRA into a Roth, pay the income tax at your current rate, and let the balance grow tax-free. Your heirs will still have to empty the account within a decade, but they won't owe the IRS a single cent when they do.

The forced distribution: RMDs

Required minimum distributions (RMDs) are the government's way of finally getting its tax money from your decades of diligent, tax-deferred savings in traditional 401(k)s and IRAs.

- The problem: At the required beginning date (currently age 73 or 75, depending on your birth year), the IRS demands you withdraw a percentage of your balance every year, whether you need the money or not.

- The pain: RMDs create a new, unwanted, and often substantial flow of taxable ordinary income. This income spike acts as a catalyst, pushing retirees over the thresholds for Social Security taxation and the Medicare IRMAA surcharge. The result is a triple burden: you are forced to liquidate assets, settle a higher tax bill, and manage the resulting surplus cash.

- The rich person solution: You can make use of aggressive Roth conversions before the RMD date to shrink the pre-tax account balance, or use qualified charitable distributions (QCDs) to satisfy the RMD without having the income count as taxable MAGI.

Don't wait for it to happen to you

Just because you earn money doesn't mean you should be penalized — and you won't if you plan and prepare for how you'll handle your riches.

Whether you are determining your Social Security claiming strategy or figuring out how to split your fortune among your heirs, the secret is to be proactive, flexible and open-minded. Remember, life changes when you retire, but you can use that to your advantage even if you are on track to pay more than your share.

Get expert financial strategies and lifestyle insights delivered to your inbox every Monday and Thursday. Subscribe to our free newsletter, Retirement Tips.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Donna joined Kiplinger as a personal finance writer in 2023. She spent more than a decade as the contributing editor of J.K.Lasser's Your Income Tax Guide and edited state specific legal treatises at ALM Media. She has shared her expertise as a guest on Bloomberg, CNN, Fox, NPR, CNBC and many other media outlets around the nation. She is a graduate of Brooklyn Law School and the University at Buffalo.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.