5 Bruce Springsteen Quotes Every Retiree Should Live By

The "Boss" of rock-and-roll has a lot to say about living and getting old gracefully.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Editor's note: This article is part of an ongoing series featuring the best retirement quotes and wisdom from top financial experts, leaders, and public figures. Other articles feature Warren Buffett, Michael Jordan, Mark Cuban, Jimmy Buffett and Dr. Seuss.

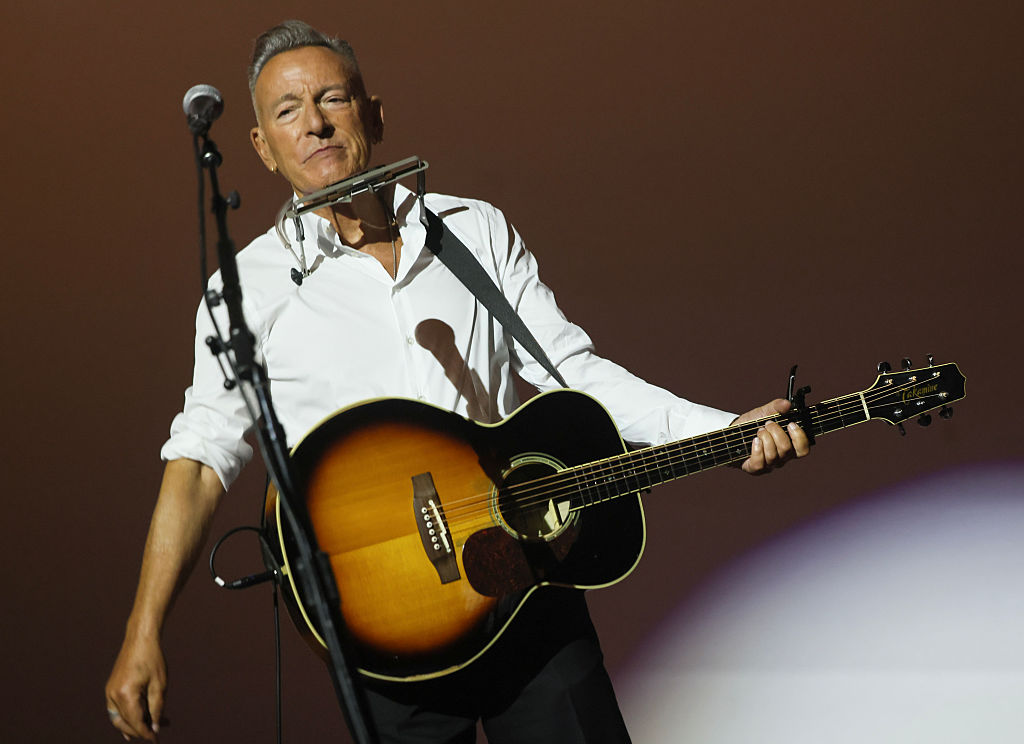

For half a century, Bruce Springsteen has taught us how to navigate the everyday struggles and ups and downs of life through his soul-searing lyrics and music.

Through the years, the working man of rock and roll has also shown us how to age with grace and pizazz. Springsteen's latest global tour — which ran through mid-2025 — proved that he has no intention of fading away. There is a powerful message that anyone retiring can take from that: The end of a career is simply the start of a new show.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But that's not all retirees can learn from the 76-year-old storyteller. From lyrics in his songs to quotes from his best-selling autobiography, here are five words of wisdom from "The Boss" that every retiree should live by.

5 Bruce Springsteen quotes retirees can rock out to

"I got something in my heart I been waitin' to give / I got a life I wanna start, one I been waitin' to live"

Leah, Devils & Dust

"Never stop living" is the message Springsteen drives home in this song from the early 2000s. While retiring marks the end of the 9-to-5 grind and the daily commute, it isn't the finish to your life.

There is always a next chapter, and that's what retirement is — starting the life you've been "waitin' to live." It's the time to pursue a hobby, travel the world or launch a new career.

When it comes to retirement planning, it requires more than having a comfortable bank account. You also need to determine how you'll spend your time. Not sure? Here's our guide to planning for your passion in retirement.

"You can't be afraid of getting old. Old is good, if you're gathering in life."

Guardian interview, Sept. 23, 2010

Getting old is often a tough pill to swallow, but it shouldn't be — especially if you have a lifetime of living behind you. In this Guardian interview, Springsteen recognized that while hardcore fans appreciated his new music, they were really there for the old hits.

Rather than fighting that, he embraced it. He found a way to honor his past while continuing to create and live in the present, finding space for both.

Aging isn't about losing your edge; it's about "gathering" new experiences and memories while enshrining the old ones. "Gathering in life" looks different for everyone, but one thing is certain: Staying healthy is the key to truly experiencing it. To find ways to do that, check out our story on aging well.

"You better start savin' up for the things that money can't buy."

Savin' Up, The End of the Road

You can't put a number on your health, relationships and happiness, which is what ultimately matters in retirement. You can have all the money in the world, but if your health is suffering or if you are all alone, wealth won't matter. Sure, we need to save to cover our bills, but not at the expense of actually living.

That said, don't forget to account for longevity in your retirement planning. You could easily live 20 or 30 years out of the workforce, which requires a sizable nest egg. A longer life also increases the likelihood of needing long-term care at least once. Given the sheer cost, having a plan for how you’ll pay for it is vital — this guide on paying for long-term care can help.

Even excluding long-term care, Fidelity Investments estimates that as of 2025, a 65-year-old retiree with Medicare will spend $172,500 in out-of-pocket health care expenses in their lifetime. You can see why it’s so important to have a financial plan that supports the one thing money can’t buy: more time.

"All I do know is as we age the weight of our unsorted baggage becomes heavier ... much heavier. With each passing year, the price of our refusal to do that sorting rises higher and higher."

Born to Run

Springsteen was discussing his own struggles with mental health in this excerpt from his autobiography, but his words hit home for many retirees. For the first time in decades, the noise of the 9-to-5 fades away, leaving you to stop and reflect.

Without the distraction of a career, you’re often left to sit with your "unsorted baggage" — and if you don't find a way to work through it, that weight can become overwhelming.

To find true happiness in this chapter, Springsteen suggests you have to become "light." That means doing the work to mend old relationships or finally chasing the passions and dreams you put on the shelf while you were working.

For some, that "sorting" even involves taking on a part-time job or an encore career to stay engaged. Whatever it looks like for you, the goal is to unpack that baggage now so you can move forward without the weight of the past holding you back.

"I'll meet you further up the road."

Further On (Up the Road), The Rising

Whether retirement is 10 years away or just coming down the pike, one thing is certain: Without a plan, you'll have a hard time reaching your destination. It can be difficult to look that far into the future, but Springsteen's lyrics remind us that the road is always unfolding.

Retirement might be "further up the road" for now, but if you don't prepare today, you're looking at a rocky path — and one you might not have the resources to afford tomorrow.

It's not just how much you need to save, it's how you'll spend your money once you are in retirement. Without a plan, retirees face the real risk of running out of money, especially if retirement lasts more than 20 years.

Never stop living

"The Boss" of rock and roll wants everyone to age gracefully and to never stop living. Through his words and music, he has taught us that you can't put a price tag on our health, our relationships and our experiences.

Getting old is OK, retirement is a journey, and we should never stop rocking — those are the key takeaways we can all learn from the life and lyrics of Bruce Springsteen.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Donna Fuscaldo is the retirement writer at Kiplinger.com. A writer and editor focused on retirement savings, planning, travel and lifestyle, Donna brings over two decades of experience working with publications including AARP, The Wall Street Journal, Forbes, Investopedia and HerMoney.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

8 Ways Mahjong Can Teach Us How to Manage Our Money

8 Ways Mahjong Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

A Financial Book That Won't Put Your Young Adult to Sleep

A Financial Book That Won't Put Your Young Adult to Sleep"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.

-

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial Planner

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial PlannerRetirement planning is less about hitting a "magic number" and more about an intentional journey — from understanding your relationship with money to preparing for your final legacy.

-

5 Mistakes to Avoid in the 5 Years Before You Retire, From a Financial Planner

5 Mistakes to Avoid in the 5 Years Before You Retire, From a Financial PlannerWhen retirement is in reach, financial planning gets serious — and there's a heightened risk of making serious mistakes, too. Here are five common slipups.

-

I'm a Financial Planner: This Retirement Strategy Helps Plot a Stress-Free Path to Cash Flow

I'm a Financial Planner: This Retirement Strategy Helps Plot a Stress-Free Path to Cash FlowDividing funds into a safety bucket, an income bucket and a growth bucket can help to cover immediate expenses, manage cash flow and promote growth.