Has Bad Economic News in 2022 Hurt Your Retirement Plans?

How the right plan now can get you back on track and reduce the risk going forward.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

You know what they say about the best-laid plans going awry, well, with what has been going on in the financial world this year, that’s what has happened to countless retirement plans.

For instance, let’s look at one hypothetical retiree who, until recently, thought she was all set. Our sample investor put off formalizing her plan for retirement income until she began taking Social Security at age 70 and making withdrawals from her rollover IRA. It was December of 2021. Inflation seemed to be reasonably under control; the markets were performing well; and with 50% of her $2 million portfolio invested in bonds it was pretty conservative.

Social Security and a pension totaling $60,000 per year helped her meet her starting income goal of $150,000. The balance of $90,000 was coming from her $2 million in retirement savings.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Even after having to draw down part of her personal savings to make her income goal, she also was leaving a solid legacy, assuming historical market returns. She used a traditional income planning approach relying only on her investments. She was fine and felt reasonably secure.

As with many like her, including financial pundits, she didn’t anticipate market gyrations for anything like what happened next.

What happened during the first 6 months of 2022?

Sometimes the consequence of market volatility is that you simply have to cut back oin your spending during unanticipated rocky patches. The same could happen to you after retirement if your plan doesn’t account for real-life possibilities. So, here’s what has happened so far in 2022.

- First, inflation hit, rising over 8%. A recent survey found that in response to higher inflation, 35% of people planning for retirement are cutting back on social activities, and 28% are spending less on travel in order to maintain or increase their retirement contributions. Our investor wasn’t ready to make radical changes to her lifestyle.

- Second, because of market drops, the portion of her investment portfolios in growth stocks fell over 30% since the beginning of 2022. (The portion in high-dividend stocks held up for a while but ended up falling over 8%.)

- Third, the value of her fixed income portfolio fell by around 14%, reducing both her rollover IRA and personal savings accounts. She definitely wasn’t prepared for that.

- Fourth, the combined effect was that the savings she was using to draw down income (rollover IRA plus part of personal savings) were down over 20%. Her bonds didn’t hadn’t protected her.

What did these developments do to her plan for retirement income?

A lot of individuals become shy at times like these and won’t even discuss what the long-term results might do to their plan, but our investor wanted to fully update her plan to current market conditions. Here is what she discovered.

As she looked at inflation, our investor figured her living expenses were up $10,000 per year, bringing her income goal to $160,000. (She did believe that there might be a lower rate of inflation going forward.) Her Social Security and pension will still contribute $60,000 a year (good for that) so her retirement goal from savings is now $100,000.

With her retirement savings down below $1.6 million, using the previous strategy will produce only $74,000 per year as her starting income — $26,000 short of her new budget. If she believes in a lower rate of inflation going forward, say 1%, her plan income would be $82,000 — still $18,000 short. Drawing down more of her savings to make up this shortfall reduces her legacy and even increases the risk of running out of money.

Let’s turn back the clock and see how a Go2Income plan would have fared instead.

What you can get from a Go2Income plan

The key differences between Go2Income and traditional income planning are:

- Annuity payments as a source of income.

- Lower allocation to stocks overall but with a higher allocation to high-dividend stocks.

- An algorithm that integrates all sources of income.

So, let’s see how this plan would have worked.

Her starting income from savings in December 2021 would have been over $100,000, giving her a $10,000 cushion against her original $90,000 from savings. And because of annuity payments in the mix, more of the income would be safe and less would be taxable.

At the end of June 2022 with the different allocation to stocks under the Go2Income plan, the value of her invested savings would have fallen only $245,000, vs. $400,000 under a traditional plan. Her income under an updated plan supported by the lower savings has fallen, but only to $91,000.

To meet her new goal of $100,000 from savings she’s willing to assume a lower inflation rate of 1%, figuring she can gradually adjust, and her new income is $100,000 – bringing the total back above $160,000.

Of course, she can’t go back in time.

Converting her traditional plan to a Go2Income Plan?

While kicking herself about not adopting Go2Income earlier, she doesn’t want to compound her problems. So, what would a new Go2Income plan look like starting with the $1.6 million from the original plan? She was pleasantly surprised to find out she would still be OK. The reasons why include those stated above, plus one more — annuities are even more attractive now because of an increase in interest rates.

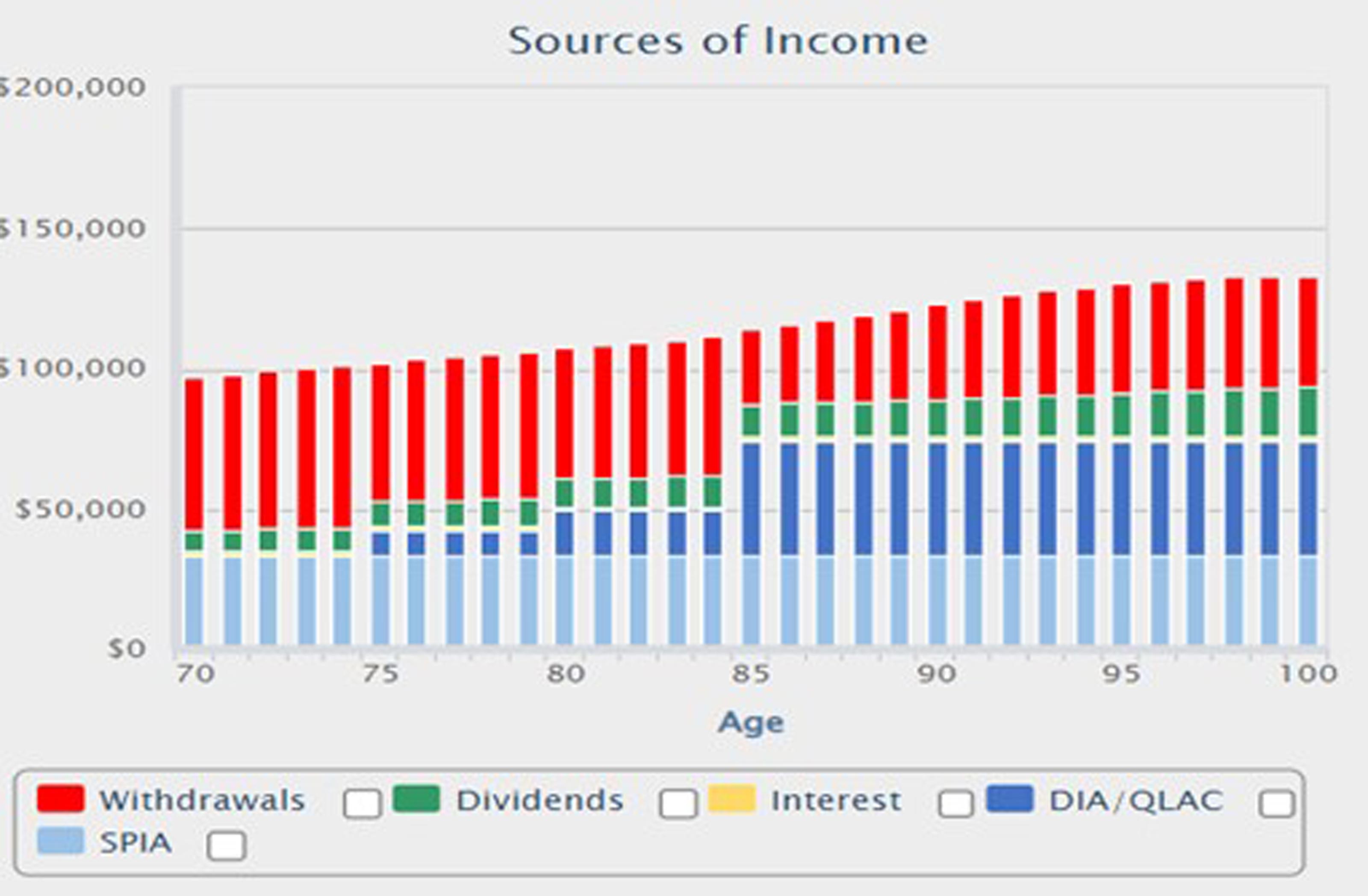

Without any change in assumptions, her income under a new Go2Income plan as of June 30, 2022, would be $88,000, even starting with savings under $1.6 million; if she lowers her inflation expectation to 1% per year her income is back to $97,000. Here’s a picture of her new plan.

Note: DIA stands for dividends, interest and annuity payments; SPIA stands for single premium immediate annuity.

In thinking about making a change in her planning method, she should make sure that where possible she considers the tax consequences of such a move. She can, of course, stay with her current investment advisers or manage the money herself if she prefers.

It was a very tough six months — and it might continue. She is thankful that she could make her retirement plans more secure.

Final thoughts

Ever the thoughtful investor, however, she asked whether the annuity rates might go up even further in the future. While that’s highly likely there is a risk of delay, lower cash flow, greater risk exposure and worse tax treatment. The smart compromise may be to implement the immediate annuity payments now and delay future annuity payments.

By the way, she shouldn’t scold herself too much for not adopting a Go2Income plan earlier. While there was an economic loss to having delayed, the real loss was a loss of sleep. As we’ve said, Go2Income is built to deliver a more secure retirement.

We can help if you have a similar situation. Visit Go2Income for a complimentary personalized plan that delivers both a high starting income and growing lifetime income, as well as long-term savings.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.