Why a 15-Year Mortgage Could Be the Key to a Larger Nest Egg

Your mortgage payments would be higher, yes, but you'd save quite a lot on interest and be mortgage-free 15 years sooner, freeing assets for other investments.

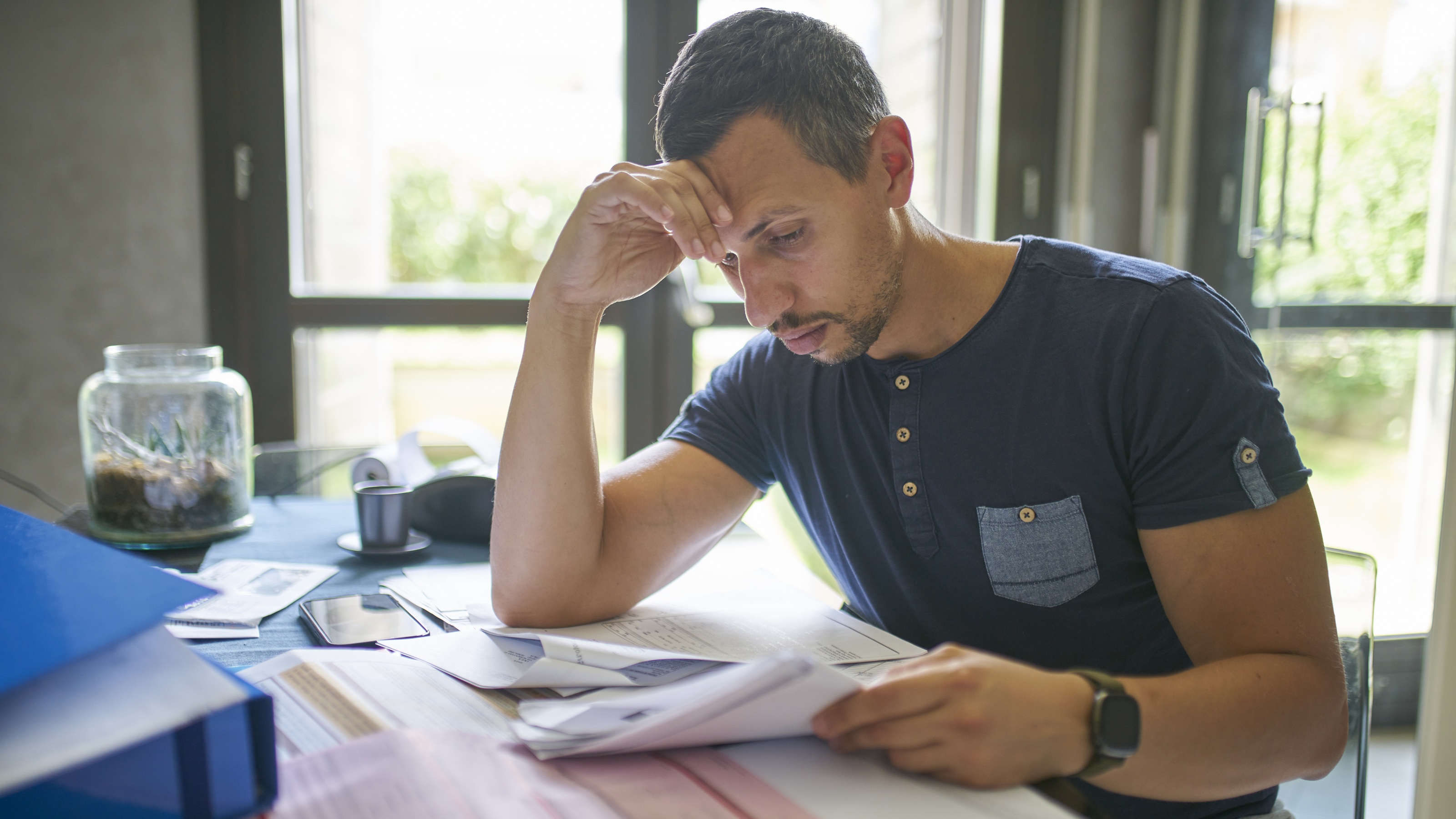

When shopping for a new home, it's wise to invest as much time in exploring mortgage options as you do in finding the right property. A 15-year mortgage, which is often overlooked by first-time buyers, can significantly impact your long-term financial outcomes and nest egg.

Personal finance typically evolves from a lower income in your 20s to higher earnings later in your career. In your 20s, saving can seem impossible due to responsibilities like marriage, children or student loans. This challenge often continues into your 30s and 40s with new expenses such as college tuition or elder care. Many people experience a wake-up call around age 50, realizing they should have started saving earlier.

One way young homebuyers can break this cycle is by choosing a 15-year mortgage over a 30-year term. Though monthly payments are higher, this option accelerates loan repayment and results in significant long-term savings. A 15-year mortgage can set you on the path to financial independence at a younger age while also freeing up funds for reinvestment in assets like stocks, bonds or additional real estate.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Here are some pros and cons of a 15-year mortgage to consider:

Advantages:

- Long-term savings

- Faster accumulation of home equity

- Mortgage-free 15 years sooner

Disadvantages:

- Larger monthly payments

- Potentially tougher qualification requirements

- Less flexibility for other goals

When determining how much mortgage payment you can afford, consider the 28/36 rule. This guideline suggests spending no more than 28% of your gross monthly income on home-related costs and no more than 36% on total debts, including mortgage, credit cards and other loans. For example, if you earn $5,500 a month and have $500 in existing debt payments, your monthly mortgage payment should not exceed $1,480.

Additionally, be prepared for emergencies by keeping three months' worth of payments — including your mortgage and other debts — in reserve.

What to know about a 15-year fixed-rate mortgage

Typically, 15-year fixed-rate mortgages offer lower interest rates than 30-year loans. To illustrate potential lifetime savings, consider this hypothetical comparison from Rocket Mortgage: On a $300,000 home with a 20% down payment ($60,000) and a 6% interest rate (the same for both loans), the monthly payment for a 30-year mortgage is $1,439, while a 15-year mortgage costs $2,025. Despite the $500 higher monthly payment, a 15-year mortgage saves over $153,000 in total loan costs and eliminates mortgage debt 15 years sooner.

Most homebuyers can qualify for a 15-year mortgage, depending on their financial situation and lender criteria. Those with stable income and a solid financial foundation are more likely to secure this loan.

Opting for a 15-year mortgage can be a strategic choice for those who can manage the higher payments and seek substantial long-term financial benefits. Evaluate your financial situation carefully and consult a mortgage expert to determine if this option aligns with your goals.

Related Content

- Five Tips for Nabbing Your Dream Home in a Tough Market

- The 10 Best Cities for New Home Seekers

- 13 Tax Breaks for Homeowners and Home Buyers

- Should You Pay Cash When You Downsize? Here Are Three Scenarios

- Five Big Steps to Buying Your First Home

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dave Liniger is the co-founder of RE/MAX, the Denver-based global real estate franchise that he co-founded with his wife, Gail, in 1973. Since its founding, RE/MAX has become the leading franchisor of real estate offices throughout the world and has expanded to over 9,000 offices in 110 countries, with 140,000+ sales agents. Dave Liniger is well respected internationally for his vast knowledge of the real estate and franchising industries.

-

Stock Market Today: Stocks Slip Ahead of Big Earnings, Inflation Week

Stock Market Today: Stocks Slip Ahead of Big Earnings, Inflation WeekPerhaps uncertainty about tariffs, inflation, interest rates and economic growth can only be answered with earnings.

-

Ask the Editor — Tax Questions on "The One Big Beautiful Bill Act"

Ask the Editor — Tax Questions on "The One Big Beautiful Bill Act"Ask the Editor In this week's Ask the Editor Q&A, we answer tax questions from readers on the new tax law.

-

Stock Market Today: Stocks Slip Ahead of Big Earnings, Inflation Week

Stock Market Today: Stocks Slip Ahead of Big Earnings, Inflation WeekPerhaps uncertainty about tariffs, inflation, interest rates and economic growth can only be answered with earnings.

-

I'm a Financial Planner: Here Are Some Long-Term Care Insurance Tips for Every Age

I'm a Financial Planner: Here Are Some Long-Term Care Insurance Tips for Every AgeStrategies include adding riders to life insurance for younger individuals and considering hybrid or traditional long-term care policies for those in their mid-50s and 60s.

-

Engineering Reliable Retirement Income in 2025: An Expert Guide

Engineering Reliable Retirement Income in 2025: An Expert GuideFor dependable income, consider using a bucket strategy and annuities in tandem to promote structure, flexibility and peace of mind.

-

Crazy Markets Shouldn't Derail Your Retirement if You Follow This Financial Pro's Plan

Crazy Markets Shouldn't Derail Your Retirement if You Follow This Financial Pro's PlanBeing nervous about retiring in a volatile market is a red flag that you're relying too heavily on your investment portfolio, rather than a comprehensive plan.

-

Stock Market Today: Solid Signals Lift Stocks Despite Tariff Noise

Stock Market Today: Solid Signals Lift Stocks Despite Tariff NoiseMarkets are whistling over the White House in an ongoing display of corporate America's enduring ability to survive and advance.

-

Florida Revives Popular Home-Hardening Program With $280M in New Funding

Florida Revives Popular Home-Hardening Program With $280M in New FundingA major infusion of state funds revives Florida's flagship home-hardening grant program to protect homeowners and potentially lower insurance costs.

-

Dividend Increases: 7 Stocks With Rising Payouts

Dividend Increases: 7 Stocks With Rising PayoutsWhile dividend growth has been slowing, certain stocks have raised their dividend payouts. These are some selections.

-

Key to Financial Peace of Mind: Think 'What's Next?' Rather Than 'What If?'

Key to Financial Peace of Mind: Think 'What's Next?' Rather Than 'What If?'Even if you've hit your magic number for retirement, it's hard to stop worrying about money. Giving it a clear purpose is one way to reduce financial anxiety.