States With the Highest, Lowest Student Loan Payments

New student loan study identifies which states are impacted most by the resumption of payments.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

More than 40 million student loan borrowers received a rude awakening when the Supreme Court struck down President Biden's student loan forgiveness plan back in June. Those borrowers are now grappling with the reality of resuming their student loan payments as of October 1.

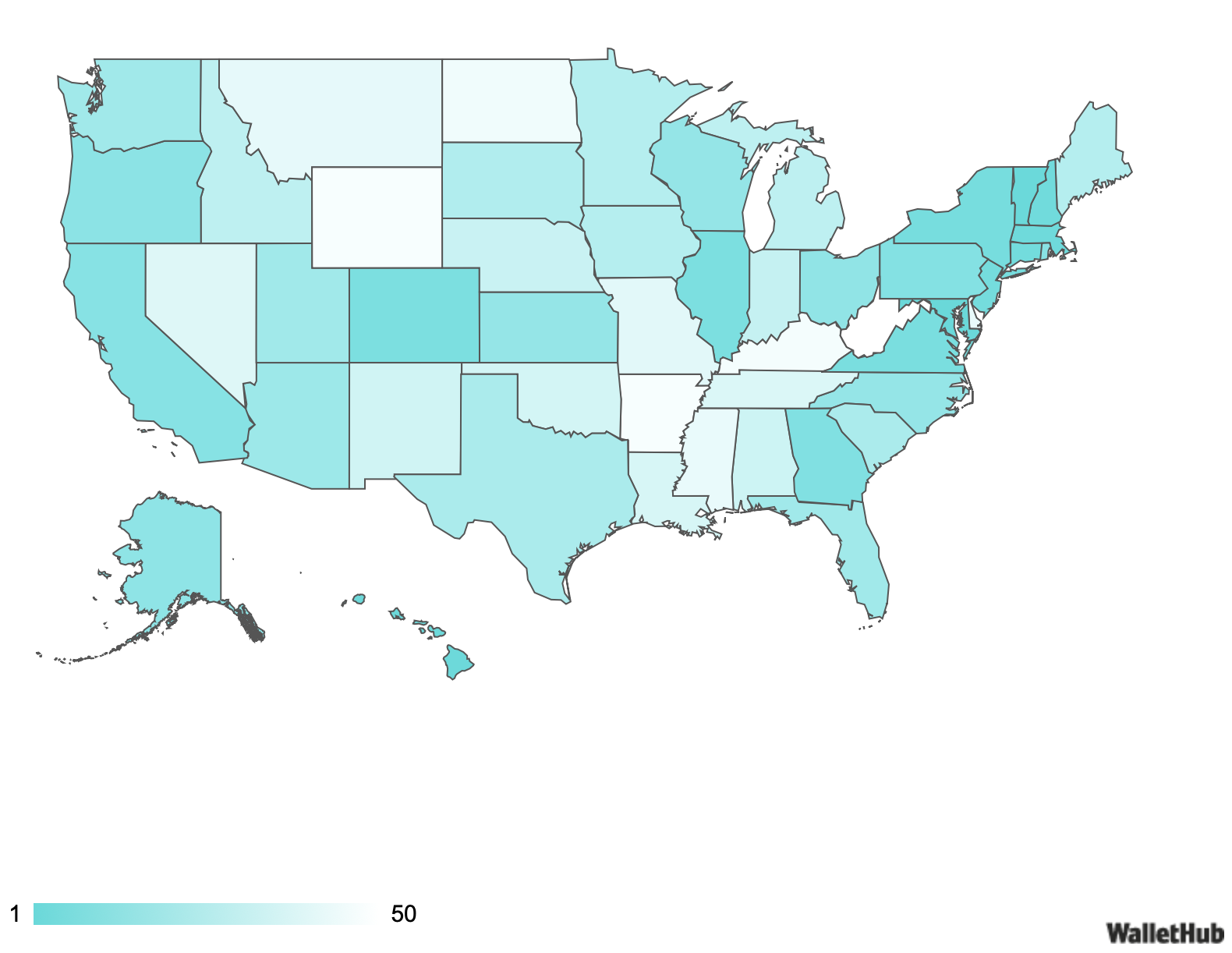

WalletHub's new national student loan debt study reveals the states where the payment reality check is hitting the hardest, as well as those where borrowers are in much better shape.

Student loan debt, state by state

According to WalletHub, student loans are the largest component of Americans' household debt after mortgages. Total college-loan balances topped $1.64 trillion after the second quarter of 2023. This burden is spread unevenly throughout the country, however.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

WalletHub used its latest consumer finance data to rank all 50 states by median student loan payment per user, from highest to lowest. Oddly, they excluded Washington, DC, despite including the district in a previous edition of their student debt state rankings.

The resulting state by state rankings defy clear regional patterns, outside the general over-performance of states to the west of Kansas.

Highest student debt burden

The ten states likely to be hit hardest by the resumption of monthly student loan payments are clustered on the East Coast, with one Mountain and one Pacific state thrown in for variety.

| Overall Rank | State | Median Student Loan Payment |

| 1 | Maryland | $232/month |

| 2 | Vermont | $225 |

| 3 | Hawaii | $223 |

| 4 | Massachusetts | $222 |

| 5 | New Hampshire | $218 |

| 6 | Connecticut | $218 |

| 7 | New Jersey | $216 |

| 8 | New York | $212 |

| 9 | Virginia | $208 |

| 10 | Colorado | $207 |

Lowest student debt burden

On the other end of the ranking, the bottom 10 states' residents and economies could weather the resumption of loan payments more easily, given their lower debt burdens for students.

| Overall Rank | State | Median Student Loan Payment |

| 41 | Nevada | $168/month |

| 42 | Missouri | $167 |

| 43 | Montana | $166 |

| 44 | Delaware | $166 |

| 45 | Mississippi | $163 |

| 46 | North Dakota | $160 |

| 47 | Kentucky | $159 |

| 48 | Arkansas | $158 |

| 49 | Wyoming | $158 |

| 50 | West Virginia | $139 |

Borrowers' best next moves

It's important to note that these rankings only reflect the raw monthly payments flowing from borrowers to lenders from across the country. According to WalletHub's own data, many states offset their high median loan payments with plentiful student loan grants and higher-paying job opportunities.

If you're a borrower, hopefully you've already reviewed your loan details and made your October payment (if necessary). Now is the time to revisit your budget, review repayment options, and take other key steps to brace for financial impact.

Many things have changed since the loan pause began in 2020, including 17 million borrower accounts changing loan servicers or platforms, according to the Consumer Financial Protection Bureau.

Consider our full breakdown of steps to adjust to the end of the payment pause.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ben Demers manages digital content and engagement at Kiplinger, informing readers through a range of personal finance articles, e-newsletters, social media, syndicated content, and videos. He is passionate about helping people lead their best lives through sound financial behavior, particularly saving money at home and avoiding scams and identity theft. Ben graduated with an M.P.S. from Georgetown University and a B.A. from Vassar College. He joined Kiplinger in May 2017.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.