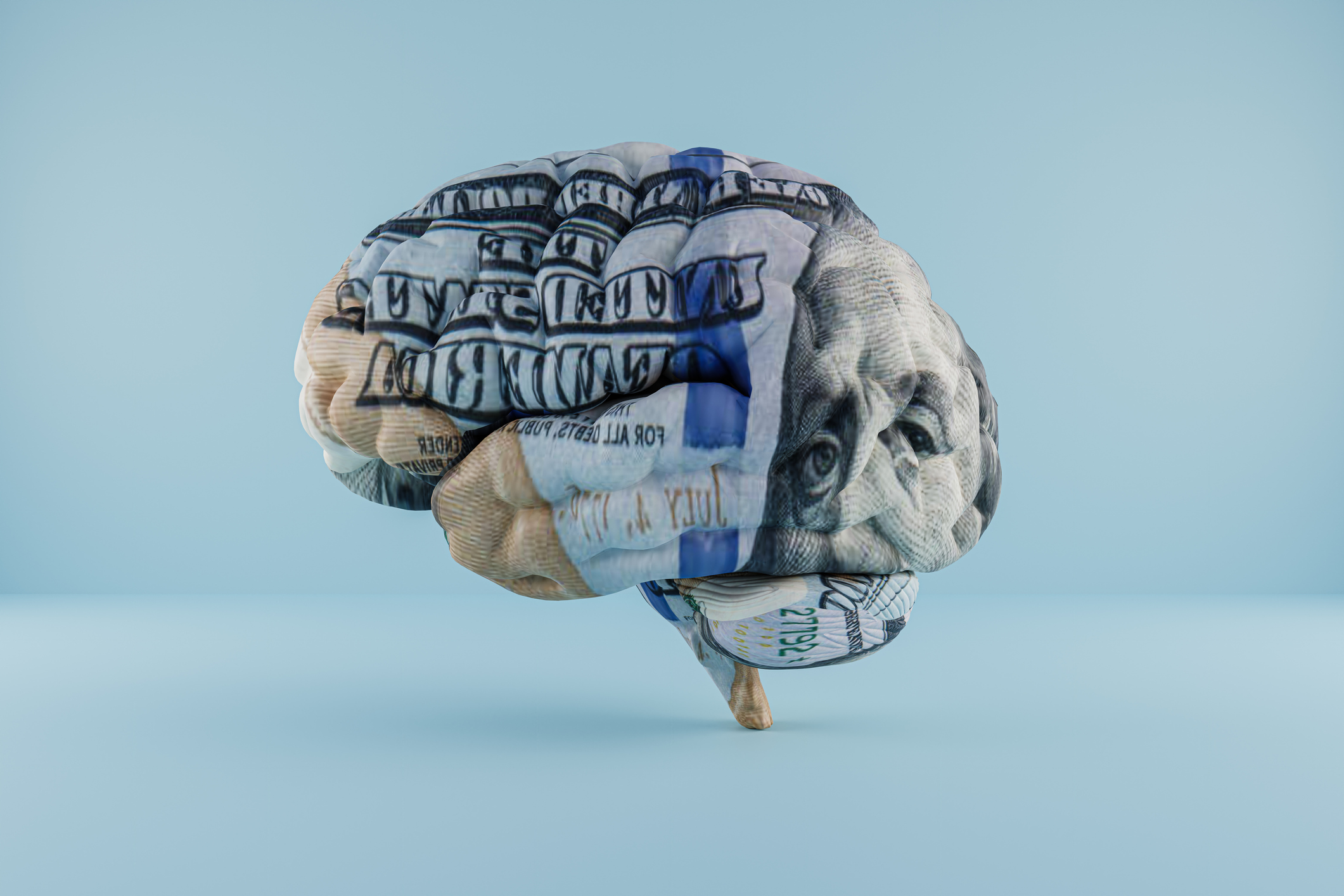

World Mental Health Day 2024: Mental Health and Money Problems, How to Take Care of Both

Today is World Mental Health Day. Experts share how you can safeguard your mental health and money — and leave depression and anxiety in the dust.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Today, October 10, is World Mental Health Day. According to the World Health Organization (WHO), the goal of today is to raise awareness of mental health issues around the world and mobilize efforts in support of mental health.

Poor mental health affects more people than you may think. One out of every two people in the world will develop a mental health disorder in their lifetime, according to a large-scale study co-led by researchers from Harvard Medical School and the University of Queensland.

Financial stress is one of the main factors that harms mental health, and in light of World Mental Health Day, it’s worth acknowledging. According to Bankrate, 47% of U.S. adults say money harms their mental health, “causing anxiety, stress, worrisome thoughts, loss of sleep, depression or other effects.” And 34% of people indicated they have depression due to debt-related stress, according to Forbes Advisor.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

“Money is one of the most common causes of poor mental health. Our research has shown more than half of people worry about money at least once a week and 25% have said their mental health has suffered as a result," Tim Perkins, CEO of Nudge Global, tells Kiplinger.

If you’re one of the many people struggling to maintain a healthy relationship between your finances and mental health, here’s what you need to know.

The neuroscience behind mental health and money problems

The stress and depression arising from financial problems can quite literally change your brain and wreck your health. And there's nothing fair about it; if you are poor or from a disadvantaged group, you're even more likely to have mental health problems, according to a study published in the journal Science. But even wealthier people may have these troubles, especially if they or a loved one faces job loss or additional mental or physical health problems.

Depression is both a cause and consequence of financial difficulties, creating a vicious cycle. Poor mental health due to financial strain can, in turn, lead to poor financial choices — making you feel even more stuck. A study by the Money and Mental Health Policy Institute asked participants if they tend to spend more money when they're depressed, and 93% of them answered yes, as reported by The Ascent.

“Being in this mindset is what the majority of households are experiencing, especially those who identify as minorities and middle-class Americans and are barely making ends meet," Rodney Williams, co-founder of SoLo Funds shares with Kiplinger. “When you’re feeling low or depressed, you may lack the motivation to manage your finances — you can feel helpless and resort to believing that it’s not worth trying. You might also make impulsive financial decisions when you’re experiencing financial strain to escape and experience a brief high.”

He warns individuals to avoid this at all costs, as it’ll only worsen their problems in the long run.

Financial stress can also wreak havoc on your physical well-being. If you have high levels of financial stress, you’re more likely to experience headaches, high blood pressure, sleep problems, heart arrhythmia and digestion issues. Additionally, Nuvance Health reports that prolonged exposure to stress hormones can cause inflammation and dysfunction in the brain that affect mood and memory and an increased risk of developing serious neurological conditions. Research has even found significant links between socioeconomic status and changes in brain structure.

How to take care of both mental health and finances

Strengthening your mental and financial health can be tricky "since more Americans than ever before are living paycheck to paycheck with little to no savings and are unable to take on an emergency expense," Williams tells Kiplinger. "With that said, there are things that can be done to lower the uneasiness.”

Here are seven ways you can make a positive change in both your finances and mental health.

1. Get educated and make a plan:

“Education empowers people to take control of their finances, build wealth, and achieve financial security,” says Perkins. For example, the Wounded Warrior Project’s financial education program is designed to help "warriors" (veterans and active duty service members) with individualized budget planning, saving and debt management. Deborah Olvera, WWP financial education manager, tells Kiplinger that in seven months, one client "had not only completed the financial readiness program but tackled his debt, closed on a house, bought a car, put money in savings and now manages his finances independently" — showing just how valuable financial education can be.

Once you understand your financial situation, you can begin making a budget and planning ahead. "One of the responses that we often hear from warriors is that having a plan made them feel 100 times better," says Olvera. One place to start is by using an easy-to-follow budgeting method, like the 60/30/10 budgeting method, or opting for a budgeting app to get better control over your finances.

2. Practice open communication and get support:

Although there's a stigma around both financial and mental struggles, talking about your situation with your peers can help relieve some of the burden. A solid support system can help you feel less isolated and alone. These people can also assist you in sticking to your savings goals.

"Don’t be afraid to ask for help. You can reach out to a financial counselor, financial therapist, non-profit organization or even a knowledgeable and trusted friend or family member to help you connect to someone and find a financial readiness plan that fits your needs," shares Olvera.

3. Financial therapy:

If money problems have negatively impacted your mental health, you could benefit from financial therapy, which aims to tailor the way individuals think about and behave with money. There's a strong connection between human emotions and money, so it's important to build a good relationship with your finances.

Dr. Traci Williams, a clinical psychologist and certified financial therapist, told Kiplinger in a story about financial therapy, "Common reasons to seek financial therapy include experiencing financial abuse, trauma or fraud; over- or under-spending; and recovery from debt, gambling addiction or divorce. People also often seek financial therapy for prenup guidance, estate planning, navigating wealth acquisition and to become empowered with financial decisions."

4. Quit chasing rewards and pay down debt:

Chasing credit card rewards even though you're in debt? Bad idea. While chasing those rewards feels good in the short term — the section of the brain responsible for pleasure lights up when you use a credit card (drugs like cocaine and amphetamines have the same effect) — it can lead to more debt, which negatively impacts your mental health in the long run. “People with unmet loan payments are more likely to suffer from depression than those without such financial problems," says Perkins.

Instead, focus on the mood improvements associated with paying off debt. Studies have shown that paying off debt can ease your anxiety, help you perform significantly better on cognitive tests and improve your decision-making.

5. Take advantage of free support from your workplace:

Check your benefits package to see if you have access to an employee assistance program (EAP). These free, confidential services provide mental health counseling and financial coaching access. EAPs may also direct you to professionals who can help find other services to lighten your load, like caregiving for a family member or a lawyer if you are filing for a divorce.

6. Find out if other issues are complicating your situation:

Depression, anxiety and financial problems may be worsened by other mental health issues like attention-deficit/hyperactive disorder, frequently abbreviated as ADHD or ADD. Several coping mechanisms may help those with ADHD manage their finances, according to the Attention-Deficit Disorder Association. For example, body doubling — having a friend or partner sit beside you while you pay bills — may help you focus. Whether it's ADHD or another problem like post-traumatic stress disorder (PTSD), getting the correct diagnosis may be a relief.

7. Use Medicare to see a mental health professional:

According to Medicare.gov, Medicare has expanded its coverage to include mental health care services provided by marriage & family therapists and mental health counselors. Coverage now also applies to intensive outpatient program services provided by hospitals, community mental health centers, federally qualified health centers and Rural Health Clinics.

If you or someone you care about is in a mental health crisis, call or text 988 or chat 988lifeline.org for help.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Erin pairs personal experience with research and is passionate about sharing personal finance advice with others. Previously, she was a freelancer focusing on the credit card side of finance, but has branched out since then to cover other aspects of personal finance. Erin is well-versed in traditional media with reporting, interviewing and research, as well as using graphic design and video and audio storytelling to share with her readers.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?Learn how timing matters when it comes to choosing the right account.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

My First $1 Million: Retired From Real Estate, 75, San Francisco

My First $1 Million: Retired From Real Estate, 75, San FranciscoEver wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

To Love, Honor and Make Financial Decisions as Equal Partners

To Love, Honor and Make Financial Decisions as Equal PartnersEnsuring both partners are engaged in financial decisions isn't just about fairness — it's a risk-management strategy that protects against costly crises.

-

Top 5 Career Lessons From the 2026 Winter Olympics (So Far)

Top 5 Career Lessons From the 2026 Winter Olympics (So Far)Five lessons to learn from the 2026 Winter Olympics for your career and finances.