Planning a Summer Road Trip? Here's How to Cut Costs

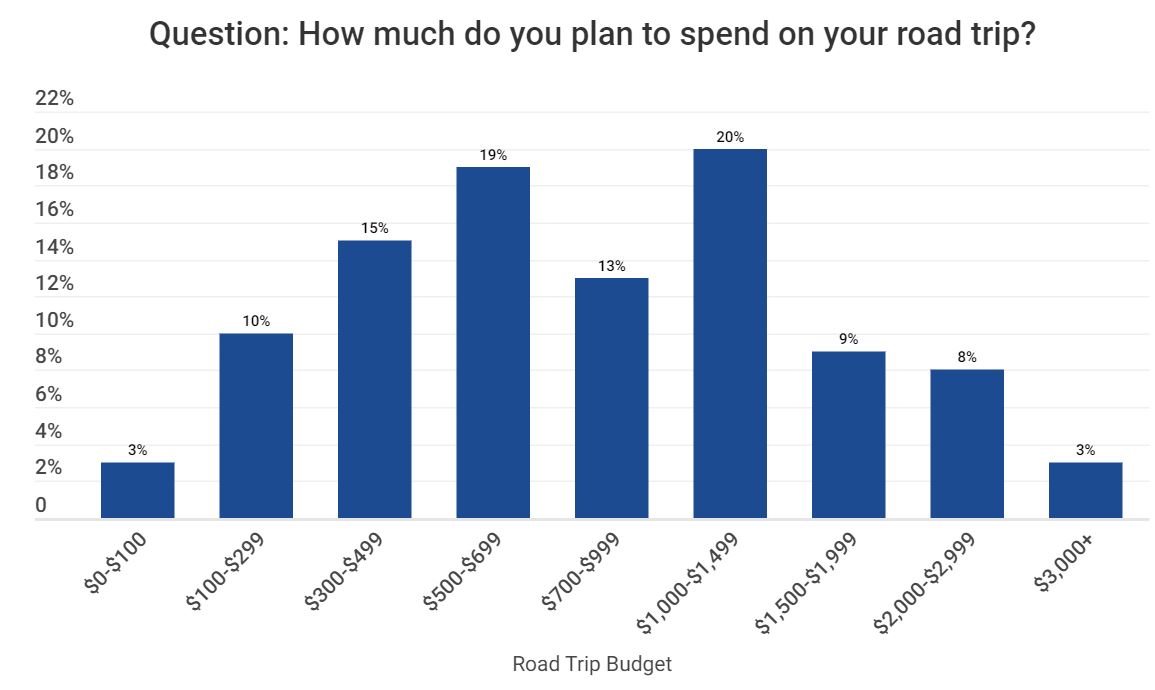

Drivers expect to spend about $2 per mile on average, or about $1,000 on road trips this summer, according to an Experian survey.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Summertime — warm weather, t-shirts, concerts in the park… and budget-friendly road trips. Errr, not so fast. And it looks like summer 2025 is shaping up to be the year of the road trip. According to a new GSTV survey, 84% of responders plan to use their own vehicle for a road trip this summer, and 56% plan to travel by car more than they did last summer.

There are a few different reasons while this seems to be the case for this year. Both higher flight prices and cheaper gas prices are root causes. According to the Bureau of Transportation Statistics (BTS), the average domestic flight cost for 2024 was $384 per person. Although this isn't a drastic change from previous years, the rising cost of other household items like groceries and rent doesn't leave much wiggle room. For a family of four, that can quickly add up.

Average gas prices in America have slightly gone down: it's currently $3.18 per gallon, while 2024 prices averaged at $3.49.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

“Consumers may not have much control over some of the costs of their vacation, but there are many ways to prepare in advance so that they can save more,” says Rod Griffin, senior director of consumer education and advocacy for Experian. “I always suggest consumers make a budget before finalizing their vacation plans, then research costs for different accommodations, activities and experiences, and book those accordingly.”

Additionally, Griffin suggests leveraging credit cards to earn reward points and discounts to apply toward vacation plans.

How far will you go?

According to GSTV, 60% of people polled plan to drive over 300 miles this summer. Domestic beaches and/or resorts are at the top of their travel lists this summer; 58% call it their top destination versus the 23% of people who said they were visiting a National Park this summer.

Top three road trip expenses

A 2024 Experian survey noted that most road trippers said they expect gasoline (76%) and lodging (61%) to be the biggest expenses on their road trip, and another 47% say food will be one of their big-ticket items this summer.

Indications in 2024 were that gas prices were expected to be below average as a result of the U.S. releasing some of its fuel reserves, but they are not likely to fall below $3 per gallon. The same is shaping up to be true for summer 2025. Honestly, unless you're driving an electric car this summer, you’re looking for ways to save on gas.

Fuel your road trip and earn rewards faster with Kiplinger’s top gas and transit credit cards, powered by Bankrate. Advertising disclosure.

Other anticipated costs

Other expected costs, according to Experian, while on the road are entertainment (18%), car maintenance (10%) and vehicle rental (6%). Understandably, 15% of those surveyed also mentioned insurance premium costs for their own vehicle or, if they rent, the additional coverage they'll either use or purchase for their rental.

Insurance costs have climbed more than 26% since 2023. As such, they have become a constant pain point among many motorists, even on vacation.

Griffin points out that, “consumers can consider splitting costs with friends or family members, sharing hotel rooms and packing food instead of eating out at restaurants for all of their meals to help cut back on some of these expenses.”

Test drive insurance premiums

According to Bankrate’s True Cost of Auto Insurance Report, the average cost of full coverage car insurance reached $2,638 in 2025. This was a pretty steep 12% increase from 2024.

"So, if you think this summer’s road trip may break your budget, Griffin adds, "it may be time to compare car insurance quotes online from top auto insurance carriers."

If you're rethinking your auto insurance, check out the tool below to help you compare rates, powered by Bankrate.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

For the past 18+ years, Kathryn has highlighted the humanity in personal finance by shaping stories that identify the opportunities and obstacles in managing a person's finances. All the same, she’ll jump on other equally important topics if needed. Kathryn graduated with a degree in Journalism and lives in Duluth, Minnesota. She joined Kiplinger in 2023 as a contributor.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?Learn how timing matters when it comes to choosing the right account.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

My First $1 Million: Retired From Real Estate, 75, San Francisco

My First $1 Million: Retired From Real Estate, 75, San FranciscoEver wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

To Love, Honor and Make Financial Decisions as Equal Partners

To Love, Honor and Make Financial Decisions as Equal PartnersEnsuring both partners are engaged in financial decisions isn't just about fairness — it's a risk-management strategy that protects against costly crises.

-

Top 5 Career Lessons From the 2026 Winter Olympics (So Far)

Top 5 Career Lessons From the 2026 Winter Olympics (So Far)Five lessons to learn from the 2026 Winter Olympics for your career and finances.