What the Election Could Mean for Student Loan Forgiveness: Harris vs Trump

As the presidential election heats up, here’s a closer look at each candidate’s plans to address student loans.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As the 2024 presidential election nears, the fate of student loan forgiveness is at the forefront of many borrowers' minds, particularly as Vice President Harris and former President Trump have such wildly differing viewpoints. In the first half of this year, federal student loan debt increased by $17.9 billion, bringing total student loan debt in the United States to over $1.75 trillion.

Approximately 43 million Americans have student loan debt as of 2023, with borrowers owing $37,853 on average in federal student loans, according to the Education Data Initiative. And college is only getting more expensive. Between 2000 and 2021, average tuition and fees jumped by 65%, to $14,307 per year from $8,661, according to BestColleges.com. Not to mention the impact of rising interest rates on student loans — 6.53% for the 2024–2025 academic year, the highest rate since 2007–2008.

Student loan forgiveness has become an increasingly hot topic over the last several years as legal battles over debt relief initiatives leave millions of borrowers in limbo.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In 2023, Biden’s plan for widespread student loan forgiveness, which would forgive up to $10,000 of student loan debt for eligible borrowers, was struck down by the Supreme Court. In August 2024, the court temporarily blocked the administration’s Saving on a Valuable Education (SAVE) repayment plan.

In September, U.S. District Judge James Randal Hall issued an order blocking the Biden administration’s latest student loan forgiveness plan, which would have provided debt relief to over 30 million Americans. And just one day after Hall decided to let the restraining order expire, Biden's forgiveness plan was temporarily blocked again by a Missouri judge.

One study from Bankrate found that nearly 1 in 5 Americans say student loan debt will have a major influence on their vote in the 2024 presidential election. Considering each candidate has very different ideas on how student loans should be handled, many borrowers are anxious to learn how the election will impact them.

Here’s a closer look at each candidate’s plans regarding student loan debt.

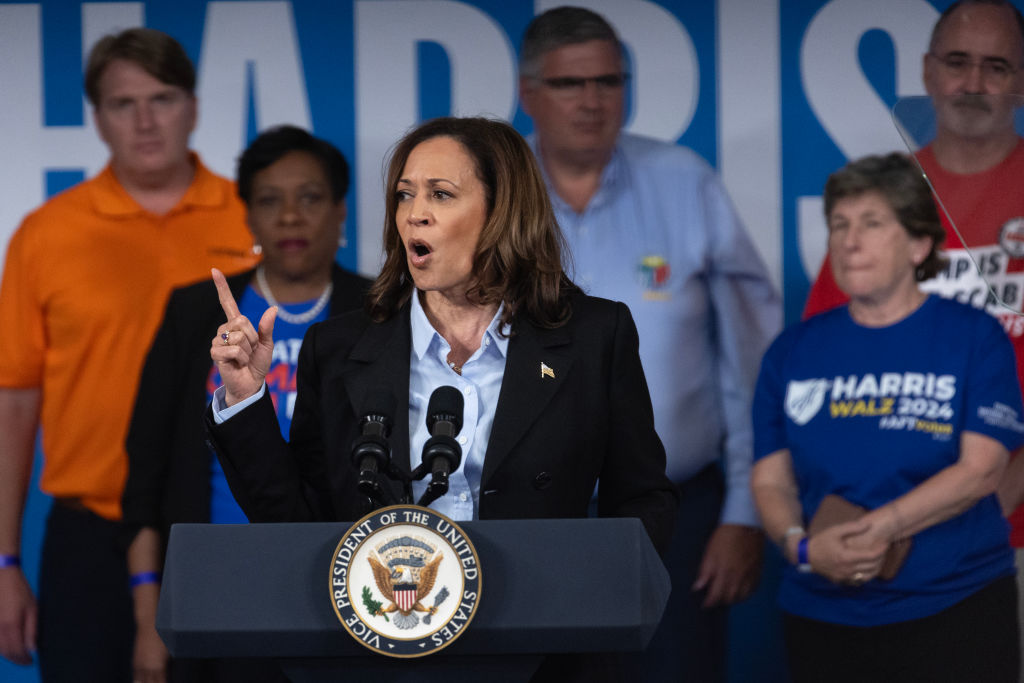

Harris on student loans

The Biden-Harris Administration has implemented several aid programs that have contributed to total debt relief, despite strong opposition. And if Kamala Harris becomes president, she will build on these policies, working to provide widespread student debt relief for millions of borrowers by expanding programs like income-driven repayment plans and Public Service Loan Forgiveness.

“We see a future where every student has the support and the resources they need to thrive,” Harris stated in a speech made in July. “And a future where no teacher has to struggle with the burden of student loan debt.” She noted that the Biden-Harris administration has forgiven student loan debt for nearly five million Americans. Nearly $160 billion in federal student loan debt has been forgiven since Biden took office, according to the U.S. Department of Education.

The administration's efforts have been focused on targeting areas for forgiveness for borrowers who are most in need, Stacey MacPhetres, senior director of education finance for EdAssist by Bright Horizons told Kiplinger. Borrowers most in need have included those facing financial hardship, holding balances greater than the initial amount borrowed due to accrued interest, those who are eligible for forgiveness but have not yet applied, those who have been in repayment for 20 years and borrowers who attended institutions that show low financial value.

Here’s a closer look at various loan forgiveness programs Harris will likely continue expanding if she takes office.

- Borrower Defense loan discharge: If your college misrepresented details that led you to enroll there, you may have grounds to apply for borrower defense loan discharge. The administration says this has led to the discharge of over $28 billion in debt for 1.6 million borrowers.

- Income-Driven Repayment plans: These plans base your monthly student loan payment amount on your income and family size. There are four plans:

- Public Service Loan Forgiveness (PSLF): This program forgives federal student loans of borrowers employed by the government or certain non-profit organizations after ten years of on-time payments or 120 qualifying monthly payments. These efforts have reportedly led to the forgiveness of over $62 billion in student loan debt.

- Total and Permanent Disability (TPD) discharge: More than half a million borrowers with disabilities have received over $14 billion in relief through the Total and Permanent Disability Discharge program, according to the White House.

"The Harris campaign would be trying to extend the same types of programs and maybe repackage those in a way that they can get those through either Congress or get them through the court system without being struck down," said Shane Cummings, wealth advisor & director of technology/cybersecurity at Halbert Hargrove.

Trump on student loans

Trump stands firmly in opposition to student loan forgiveness. If he becomes president, his efforts will likely be focused towards getting student loan forgiveness programs enacted by the Biden administration repealed or restricted.

During Trump's presidency, he proposed significant cuts to student aid programs and called for eliminating Public Service Loan Forgiveness (PSLF), Federal Supplemental Educational Opportunity Grant (FSEOG) programs and subsidized federal student loans.

And while Trump has made no statements regarding his specific plans to revoke student loan forgiveness initiatives if elected president, he is very vocal about how he views these initiatives. He has referred to Biden’s plans to cancel student loan debt as "not legal" and “vile.”

"He got rebuked, and then he did it again,” Trump stated at one of his rallies back in June, referring to the Biden administration's 2023 attempt at widespread student loan forgiveness that the Supreme Court shut down. “It’s going to get rebuked again even more so.”

In the September 10th presidential debate with Kamala Harris, Trump stated, as per Politico: "They didn't even come close to getting student loans. They taunted young people and a lot of other people that had loans, they can never get this approved.”

Kimberly Weihbrecht, CSLP®, Senior Associate at Fearless Finance tells Kiplinger that although the Trump administration would likely try to repeal programs like SAVE, PSLF and income-driven repayment, "big rollbacks like this would be difficult to do via regulations for the same reason SAVE is struggling now. Regulation-based programs are more likely to get contested in court and potentially struck down."

Ultimately, whether or not loan relief programs are actually repealed during a Trump presidency could heavily depend on whether or not there is a Republican majority in Congress. A set of conservative policy proposals developed by The Heritage Foundation, called Project 2025, calls for significant changes to how student loans are managed, including the phasing out of existing income-driven repayment (IDR) plans. And while Trump has tried to distance himself from the project, according to Reuters, many of his closest policy advisers and those likely to take high-ranking positions in his administration are heavily involved in the project.

Bottom line

Ultimately, it's still too early to determine exactly how the election will impact student loans. And because of the uncertainty of whether or not loans will be forgiven, it's difficult for many borrowers to make long-term plans concerning their debt, according to Cummings. This is why he advises borrowers to focus on repayment and plan conservatively.

For borrowers who are struggling to meet loan obligations, MacPhetres urges them to communicate with their loan services to review any repayment options or hardship opportunities available.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Erin pairs personal experience with research and is passionate about sharing personal finance advice with others. Previously, she was a freelancer focusing on the credit card side of finance, but has branched out since then to cover other aspects of personal finance. Erin is well-versed in traditional media with reporting, interviewing and research, as well as using graphic design and video and audio storytelling to share with her readers.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?Learn how timing matters when it comes to choosing the right account.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

My First $1 Million: Retired From Real Estate, 75, San Francisco

My First $1 Million: Retired From Real Estate, 75, San FranciscoEver wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

To Love, Honor and Make Financial Decisions as Equal Partners

To Love, Honor and Make Financial Decisions as Equal PartnersEnsuring both partners are engaged in financial decisions isn't just about fairness — it's a risk-management strategy that protects against costly crises.

-

Top 5 Career Lessons From the 2026 Winter Olympics (So Far)

Top 5 Career Lessons From the 2026 Winter Olympics (So Far)Five lessons to learn from the 2026 Winter Olympics for your career and finances.