Empty Cubicles? Many Workers Want to Stay Home

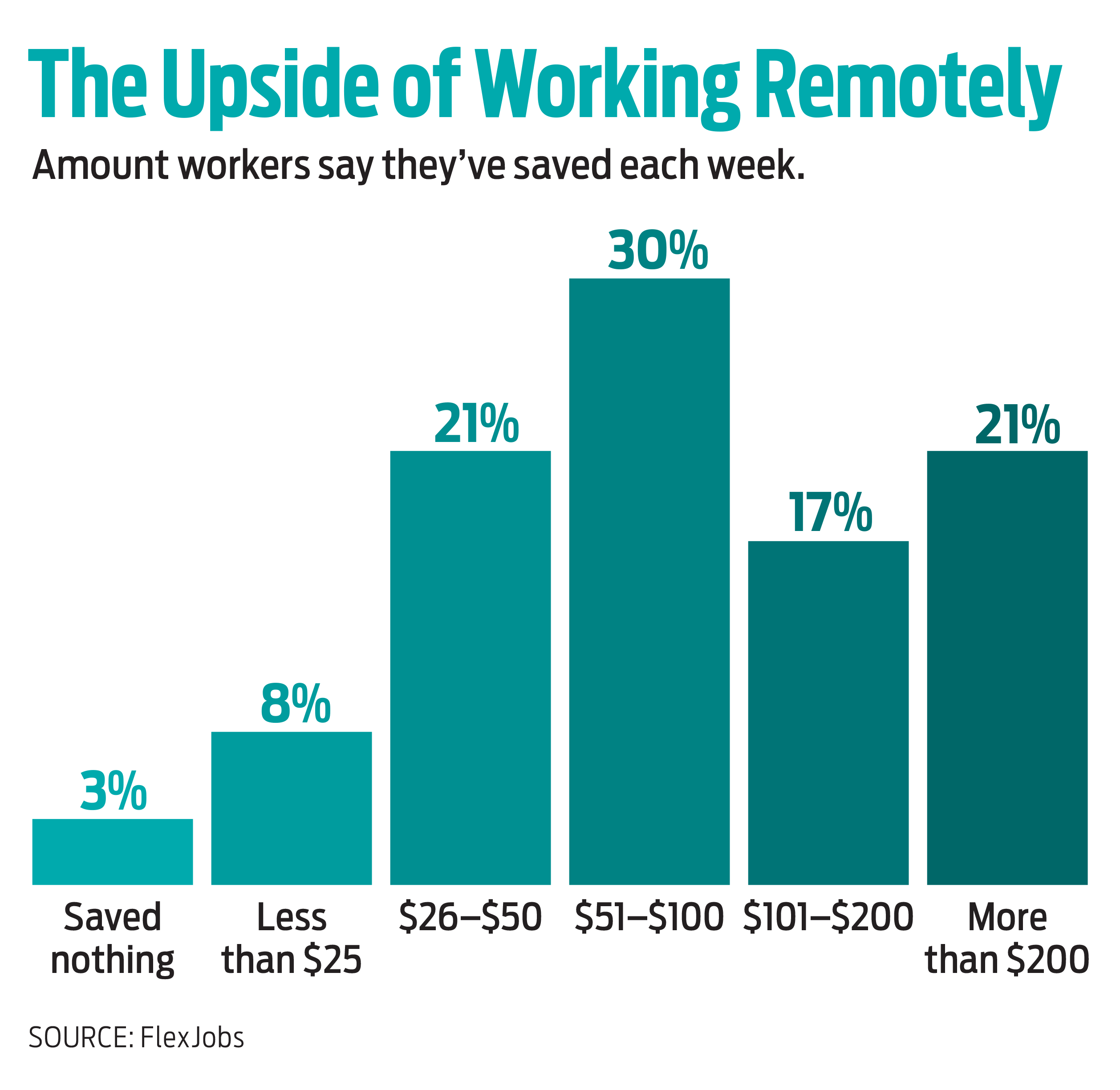

Saving money is one reason employees prefer remote work.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

September marks the beginning of a new school year, and children who have been learning remotely won’t be the only ones adjusting to a new environment. Millions of employees are returning to work as companies reopen their physical offices. But many employees are hesitant to return to the office—either because of pandemic-related concerns or because they’ve discovered they prefer working from home.

A survey by FlexJobs.com found that 58% of workers said they’d look for a new job if they cannot continue remote work in their current role. But before you give notice, there are steps you can take to navigate changes to your workplace—and your budget.

If you want to continue working from home, you’ll need to negotiate that with your supervisor. But first, prepare talking points that highlight how your remote work will benefit your employer, says Toni Frana, a career coach at FlexJobs. Instead of explaining how working from home will help you, she says, focus on how it will increase your productivity.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Your employer may also be more receptive to an arrangement in which you work remotely part of the time rather than full-time. In May, Google announced that it would adopt a hybrid work week, requiring in-person office work for only three out of five days starting in September. Other companies—especially in the technology sector—are also developing hybrid work models.

Still, while some companies are open to hybrid work schedules, others want their employees back in the office full-time. If your employer falls into that group, leverage your bargaining power, says Alison Green, founder of the Ask a Manager website and author of Ask a Manager: How to Navigate Clueless Colleagues, Lunch-Stealing Bosses and Other Tricky Situations at Work. At a time when many companies are struggling to fill open jobs, managers may be forced to be more receptive to your concerns, she says.

Anticipating a changing budget. Nearly 60% of Americans who worked from home at some point during the pandemic said it had a positive effect on their personal finances, according to a survey by Bankrate.com. People who were able to work remotely saved money on expenses such as transportation, lunches, workplace attire and child care, says Bankrate analyst Ted Rossman. To cut your back-to-work costs, ask your employer if it plans to offer (or reinstate) subsidies for parking or mass transit. If you have unused funds in a pretax commuter benefits account, make sure to use them. And now that you’ve learned how much money you can save by cooking at home, you may be inspired to start bringing your lunch to work.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Korsh is a recent graduate and incoming graduate student at Northwestern University’s Medill School of Journalism. He majored in journalism with a minor in psychology, and his graduate degree will be in the Medill Investigative Lab specialization of the MS in journalism program. He has previously interned for Injustice Watch, the Medill Investigative Lab and Moment Magazine, and he served as the print managing editor of North by Northwestern student newsmagazine. Korsh became a Kiplinger intern through the American Society of Magazine Editors Internship Program.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you may be wasting your money. Here's what you need to know.

-

My Four Pieces of Advice for Women Anxious About Handling Money

My Four Pieces of Advice for Women Anxious About Handling MoneyTalking about money can help you take control of your finances.

-

What You Learn Becoming Your Mother's Financial Caregiver

What You Learn Becoming Your Mother's Financial CaregiverWriter and certified financial planner Beth Pinsker talks to Kiplinger about caring for her mother and her new book.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Five Ways to a Cheap Last-Minute Vacation

Five Ways to a Cheap Last-Minute VacationTravel It is possible to pull off a cheap last-minute vacation. Here are some tips to make it happen.

-

How Much Life Insurance Do You Need?

How Much Life Insurance Do You Need?insurance When assessing how much life insurance you need, take a systematic approach instead of relying on rules of thumb.