Moderna Stock Pops on Surprise Earnings Beat

An unexpected profit and promising news on a deal with the EU boosted Moderna stock.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Shares in Moderna (MRNA) rose smartly Thursday after the COVID-19 vaccine maker reported better-than-expected earnings and said it was in "active supply discussions" with the European Union.

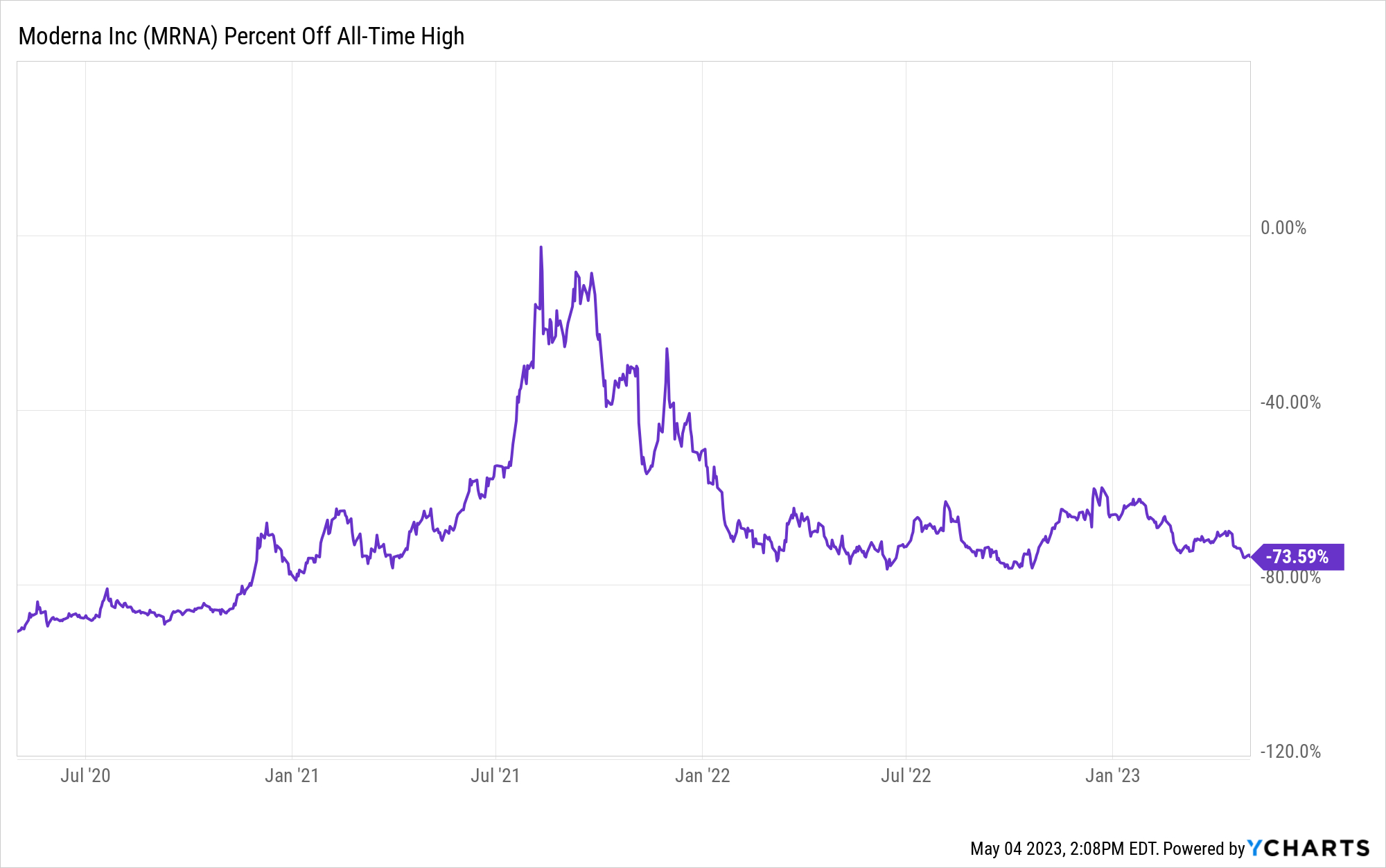

Explosive demand for the biotechnology firm's coronavirus vaccine allowed MRNA stock to generate outstanding returns during the first year-and-a-half of the pandemic. Shares peaked almost two years ago, however, as global vaccination rates rose and new COVID-19 cases tapered off. As a result, Moderna stock has lost about a quarter of its value in 2023 alone.

The company's coronavirus vaccine is its only marketable product. As such, Moderna is racing to develop and bring new drugs to market in order to find growth in the post-pandemic era.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

For the first quarter ended March 31, Moderna reported net income of $79 million, or 19 cents per share. Although that represented a 98% decrease from net income of $3.7 billion, or $8.58 per share, recorded in last year's Q1, the results easily topped Wall Street estimates. Indeed, analysts surveyed by S&P Global Market Intelligence forecast Moderna to post a net loss of $1.75 a share.

Total revenue fell 69% to $1.9 billion from $6.1 billion in last year's first quarter. Analysts were looking for Moderna to report revenue of $1.2 billion. The company beat the Street's top-line forecast thanks to revenue deferred from 2022.

Moderna vaccine launches on tap

Moderna has next generation COVID-19 vaccines under development, as well as vaccinations for influenza and respiratory syncytial virus (RSV). Other areas of research include immuno-oncology, rare diseases, autoimmune diseases and cardiovascular diseases.

"Importantly, Moderna is preparing for six major vaccine launches from its respiratory franchise, with expected annual sales of $8 billion to $15 billion by 2027," notes Lee Brown, global sector lead for healthcare at research firm Third Bridge. "The company also plans to begin a Phase 3 trial of mRNA-4157, an individualized neoantigen therapy (INT) in combination with Keytruda for melanoma. mRNA-4157 has the potential to profoundly change the treatment of melanoma."

For now, however, Moderna remains a one-trick COVID-19 vaccine pony. Helpfully, it gave investors a shot of good news on that front following its earnings report.

Moderna CEO Stéphane Bancel said the company is in discussions with the European Union to supply Europe with vaccines for the fall of 2023 – a time when new coronavirus cases are expected to pick up. MRNA shareholders were deeply concerned by media reports surfacing early this week that Moderna could be shut out of the European COVID-19 vaccine market.

MRNA stock added more than 6% at one point in early intraday trading, but it still has a long way to go to reclaim anything like its all-time highs. Shares have lost almost three-quarters of their value since setting a record close in August 2021.

Although the selloff has made the valuation more attractive, Wall Street remains somewhat split on whether MRNA stock offers a good entry point. Of the 21 analysts covering the stock surveyed by S&P Global Market Intelligence, six call it a Strong Buy, five say Buy, nine have it at Hold and one says Sell. That works out to a consensus recommendation of Buy, with mixed conviction.

Analysts' price targets also reflect widely different outcomes. Although the Street's average price target of $218.88 gives MRNA stock implied upside of 60% in the next year or so, those targets range from a high of $430 a share to a low of $93. Should the Street's most bearish forecast come to pass, MRNA would fall roughly 30% from current levels.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market Today

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market TodayOracle stock boosted the tech sector on Friday after the company became co-owner of TikTok's U.S. operations.

-

Stock Market Today: Dow Leads as UnitedHealth Stock Pops

Stock Market Today: Dow Leads as UnitedHealth Stock PopsUnitedHealth was the best Dow Jones stock Monday on reports that Medicare Advantage payments could rise in 2026.

-

Stock Market Today: Stocks End Mixed After FOMC Minutes

Stock Market Today: Stocks End Mixed After FOMC MinutesThe minutes from the December Fed meeting signaled central bankers' uncertainty over potential Trump administration policies.

-

Moderna Stock Is Volatile Amid Bird Flu Developments

Moderna Stock Is Volatile Amid Bird Flu DevelopmentsModerna stock has been volatile this week as the first death in the U.S. connected to bird flu was reported. Here's what you need to know.

-

Stock Market Today: Stocks Are Mixed Ahead of the Fed

Stock Market Today: Stocks Are Mixed Ahead of the FedTwo of the three main equity indexes closed higher on the first day of the final Fed Week of 2024.

-

Stock Market Today: Stocks Rise in Choppy Day for Markets

Stock Market Today: Stocks Rise in Choppy Day for MarketsModerna was the worst S&P 500 stock today after the vaccine maker slashed its R&D budget.

-

Moderna Stock Plunges as Vaccine Maker Slashes R&D Budget: What to Know

Moderna Stock Plunges as Vaccine Maker Slashes R&D Budget: What to KnowModerna stock is plunging Thursday after the COVID-19 vaccine maker announced plans to drastically cut its R&D spending to focus on new product approvals.

-

Should You Invest In IPOs? It's Still A Risky Prospect

Should You Invest In IPOs? It's Still A Risky ProspectInvesting in IPOs may sound exciting, but it's often better to wait for newly public stocks to mature before buying.