Stock Market Today: Relief Rally Fizzles for Dow, S&P 500

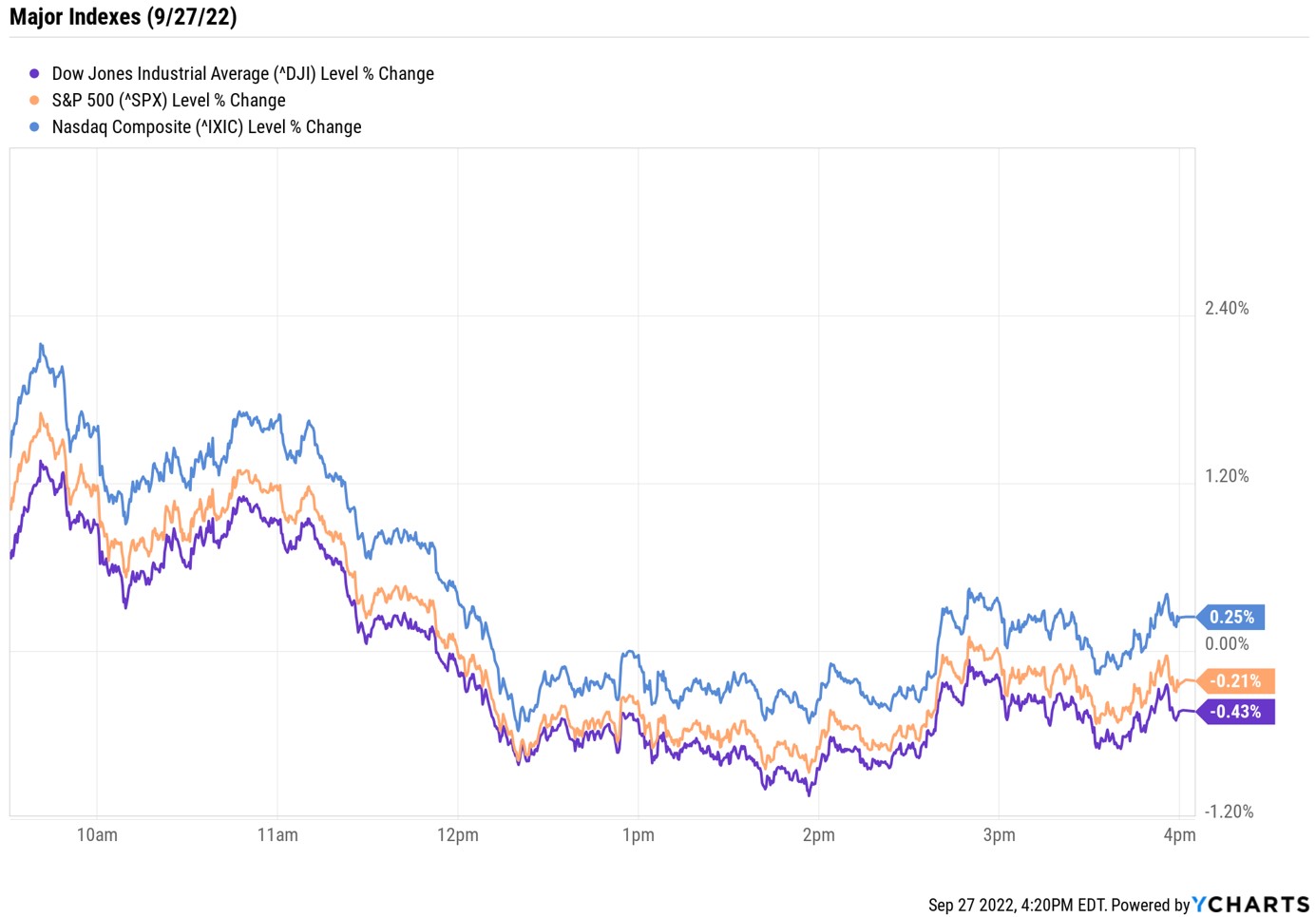

A pair of "good news is bad news" economic reports had the stock market turning lower in afternoon trading on Tuesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The stock market roared out of the gate Tuesday, with all three major market indexes up at least 1% in early action. However, the rebound attempt quickly ran out of steam, with stocks sliding into negative territory by lunchtime.

Comments from Chicago Fed President Charles Evans helped give stocks an initial lift. The central bank official told CNBC's "Squawk Box Europe" this morning that he is a "little nervous" that the Fed's aggressive rate-hike efforts are "not leaving much time to sort of look at each monthly release."

However, markets began to ease back after a couple of "good news is bad news" economic reports. The Commerce Department said that new home sales were up 28.8% month-over-month in August. The report points to signs of continued strength in the economy, suggesting the Fed still has a lot of work to do to slow growth.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Additionally, the Conference Board's consumer confidence index hit a five-month high of 108 in September. "Stocks pared some gains after an impressive consumer confidence report suggested the Fed could remain aggressive a lot longer," says Edward Moya, senior market strategist at currency data provider OANDA. "The end to the Fed tightening cycle is in view, the question is how restrictive will rates get."

The Dow Jones Industrial Average extended its slide into bear-market territory, shedding 0.4% to 29,134. The S&P 500 Index also ended in the red, down 0.2% at 3,647, while the Nasdaq Composite held on for a 0.3% gain to 10,829.

Other news in the stock market today:

- The small-cap Russell 2000 added 0.4% to 1,662.

- U.S. crude futures gained 2.3% to settle at $78.50 per barrel as Hurricane Ian shut down production across several Gulf of Mexico production platforms.

- Gold futures stabilized, adding 0.2% to finish at $1,633.40 an ounce.

- Bitcoin edged up 0.7% to $19,053.30. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Energy stocks rose alongside oil prices. Among the day's notable gainers were Exxon Mobil (XOM, +2.1%), Marathon Petroleum (MPC, +3.7%) and Shell (SHEL, +2.7%).

- Keurig Dr Pepper (KDP) fell 3.5% after Goldman Sachs analyst Bonnie Herzog downgraded the consumer staples stock to Neutral (Hold) from Buy. "KDP continues to execute well in a challenging environment, and we have been encouraged by the strong underlying momentum in both its coffee and packaged beverage businesses as well as its ongoing initiatives to expand/enhance its distribution capabilities," Herzog says. However, the analyst now sees "a more balanced risk/reward," as well as an increased risk to margins due to elevated commodity inflation.

The Best Bond Funds for Income Investors

Rising Treasury yields have kept investors on edge for much of September. The yields on the two-year and 10-year notes are set to end the month at their highest levels since 2007 and 2010, respectively. But while climbing bond yields have sparked volatility in the equities market, they have also created an opportunity for income-oriented investors.

"Now that interest rates have moved substantially higher, we believe opportunities in fixed income have improved and are looking to add back to certain areas within fixed income that may benefit," says Lawrence Gillum, fixed-income strategist at independent broker-dealer LPL Financial. Gillum adds that along with higher yields, the central bank's commitment to stave off "continuing inflationary pressure – even at the expense of an economic contraction" could have bonds acting like bonds again, and providing "the ballast for equities" within a diversified portfolio.

Investors seeking out portfolio protection via the fixed-income market can take a look at these bond exchange-traded funds (ETFs), which cover a variety of strategies. Additionally, these top bond funds look attractive from both a value and yield perspective. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.