Stock Market Today: Stocks Climb Ahead of Crucial CPI Report

The major market indexes continued to rally on Monday, nabbing a fourth straight win.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The stock market's recent rally continued Monday, with the major market indexes closing today at their highest levels since late August.

The gains came ahead of tomorrow morning's release of the August consumer price index (CPI) – the last key piece of economic data for the Federal Reserve to consider ahead of its policy meeting next week. "The U.S. consumer price index, to be released on Tuesday, will likely show that August prices rose at an 8.1% pace over the year, compared to the July print at 8.5%," says Jon Maier, chief investment officer at Global X ETFs. "If this number comes to pass, it will show that inflation is slowing some, albeit from very high levels."

However, even with better CPI numbers, the Federal Reserve is likely "to continue on its path for another 75 basis-point hike later this month," Maier adds. "The Fed is in a tough spot because employment reports suggest labor demand and employment growth have not slowed that much due to Fed actions thus far."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Investor sentiment was also boosted by reports of Ukraine's successful counteroffensive against Russian troops in the country's northeastern Kharkiv region. "The start of the trading week was supposed to be all about the August inflation report, but Kyiv's sudden momentum has many hoping that this moment is a turning point with the war against Russia," says Edward Moya, senior market strategist at currency data provider OANDA.

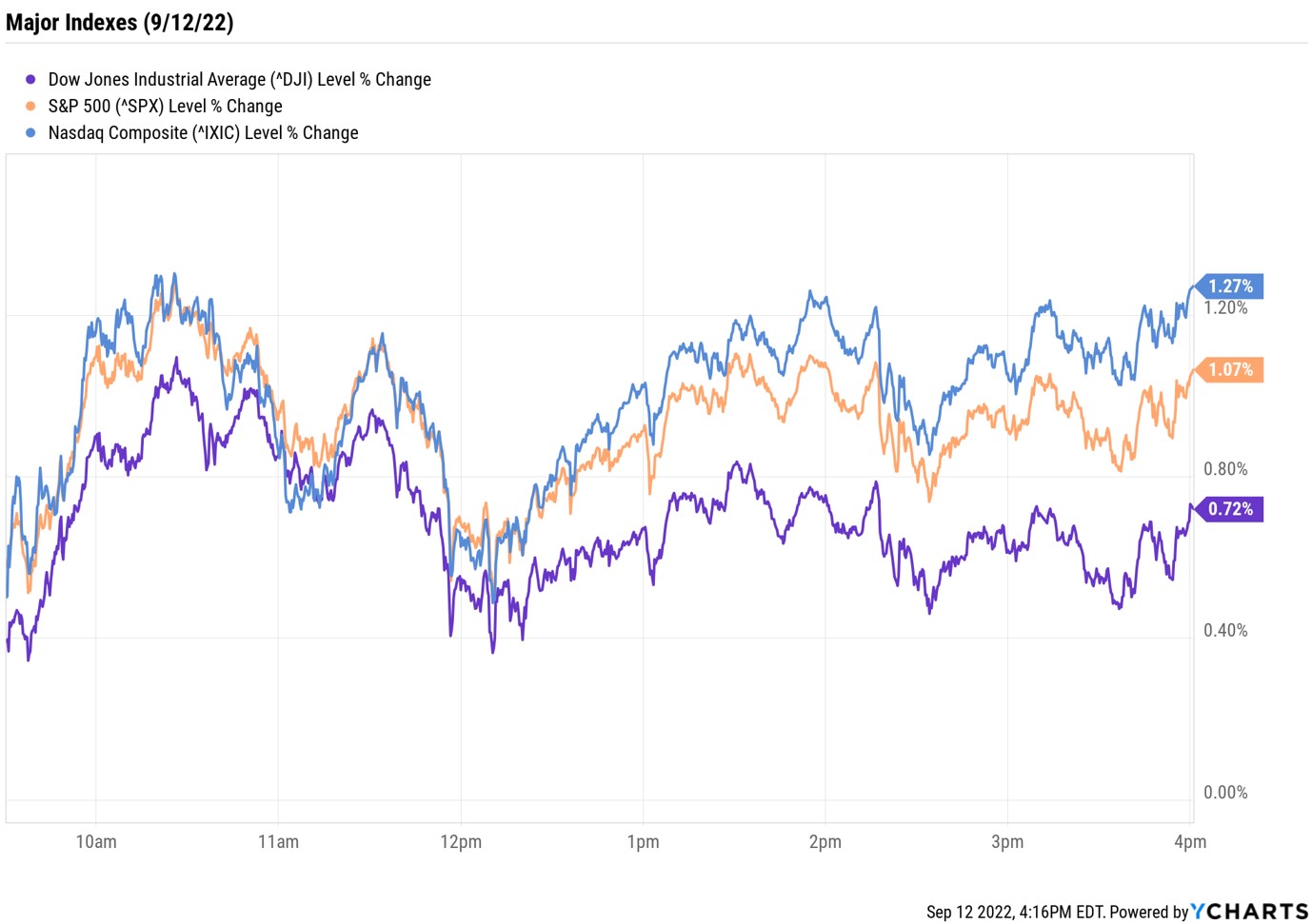

By the close, the Nasdaq Composite was up 1.3% at 12,266, the S&P 500 Index gained 1.1% to 4,110, and the Dow Jones Industrial Average added 0.7% to 32,381. It was the fourth straight day of gains for all three indexes.

Other news in the stock market today:

- The small-cap Russell 2000 rose 1.2% to 1,906.

- U.S. crude futures climbed 1.1% to $87.78 per barrel.

- Gold futures edged up 0.7% to $1,740.60 an ounce.

- Bitcoin gained 5.3% to $22,406.20. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Bristol Myers Squibb (BMY) jumped 3.2% after the Food and Drug Administration (FDA) on Friday approved Sotyktu, the company's oral treatment for moderate-to-severe psoriasis. "Most importantly, the much-debated label had no black-boxed warning, instead including a section titled 'Potential Risks Related to JAK Inhibition,'" says UBS Global Research analyst Colin Bristow, who has a Neutral (Hold) rating on BMY stock. Black-box warnings are required by the FDA on drugs that have serious safety risks.

- Carvana (CVNA) spiked 15.4% after Piper Sandler analyst Alexander Potter upgraded the online auto retail stock to Overweight from Neutral, the equivalents of Buy and Hold, respectively. The analyst acknowledged that "bankruptcy is a real possibility" and that "used vehicle prices are falling," but said the stock has "so much potential upside," and that "investors should consider owning at least some CVNA." Even with today's pop, shares are down nearly 82% for the year-to-date.

Finding the Best Growth Stocks

As we've mentioned in this space more than once recently, markets are likely to stay volatile for the time being. In addition to three more Fed meetings this year, midterm elections are right around the corner. Therefore, it's a safe assumption that many investors are taking a more defensive stance with their portfolios, leaning toward sectors like healthcare or utilities that tend to hold up better than others during times of uncertainty.

However, we've also made note of the fact that amid the broad market's stiff selloff so far in 2022, notable discounts lurk – particularly among tech stocks, which have taken an outsized hit this year. But, "all tech is not created equal," says Nancy Tengler, CEO and chief investment officer of asset management firm Laffer Tengler Investments. "There are times to chase cheap and times to stick with what's working." And for Tengler, what's working now are cloud and cybersecurity stocks, which she believes will produce "reliable growth," as companies ramp up their IT spending in both areas.

But these aren't the only two areas of the beaten-down tech sector that create potential opportunities for investors right now. These 15 growth stocks have solid fundamental prospects and attractive valuations, and each are well-liked by analysts. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.