Stock Market Today: Stocks Snap Weekly Losing Streak

Energy was one of the best-performing sectors today as oil prices rebounded.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

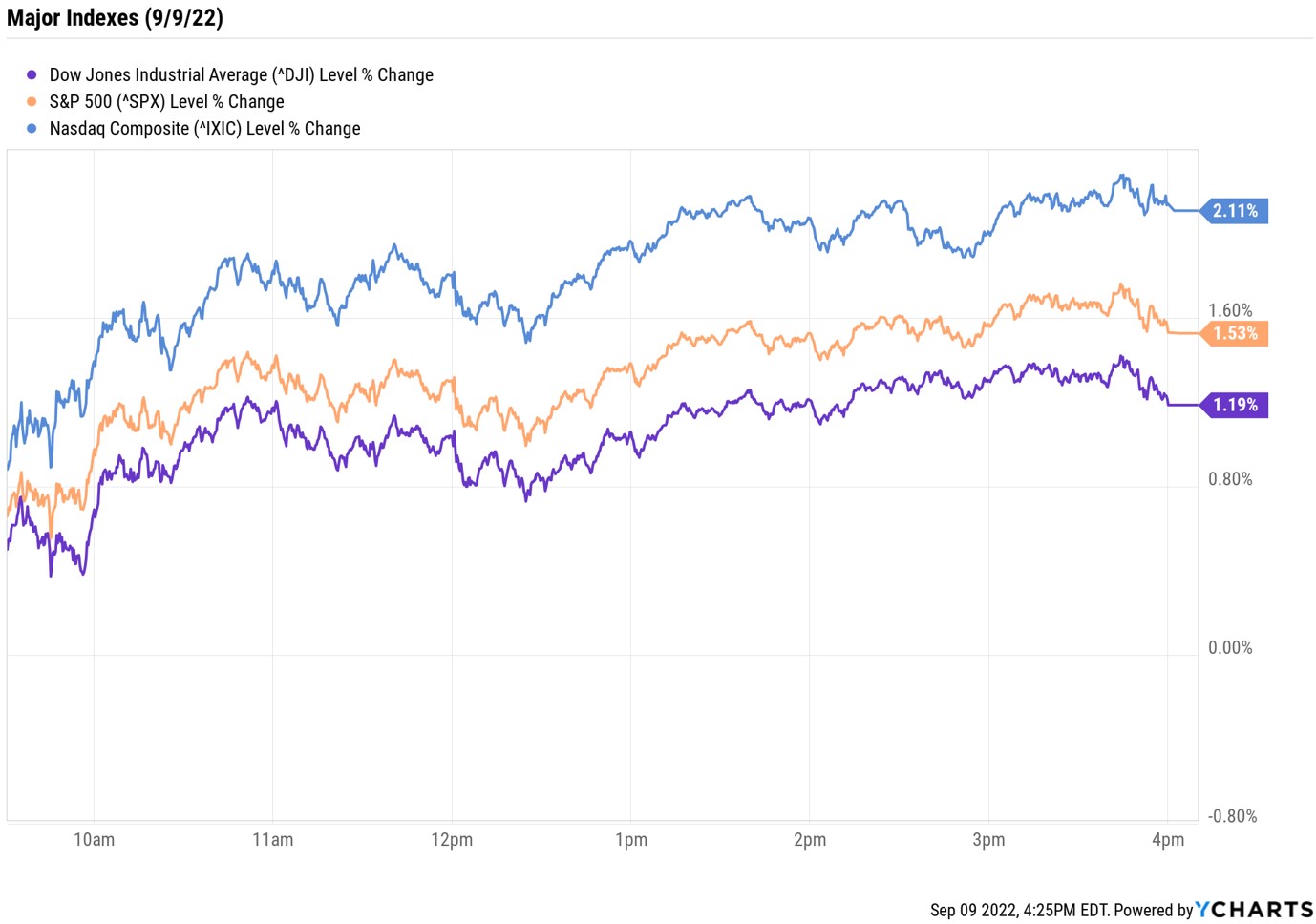

Stocks continued their push higher Friday, with today's gains helping the major market indexes snap a three-week losing streak.

There was nothing particularly new today to boost investor sentiment. Both the economic and earnings calendars were thin. And early afternoon speeches from Kansas City Fed President Esther George and Fed Governor Christopher Waller echoed the hawkish tone struck by central bank officials in recent weeks. It could just be that Wall Street has come to terms with the fact that the Fed will almost certainly issue a third-straight 75 basis point rate increase at its policy meeting later this month. Or perhaps investors are simply taking advantage of bargains from the late-August selloff.

Whatever the reason, today's rally was broad-based, with all 11 sectors finishing higher. Leading the pack was communication services, which jumped 2.8% on strong gains for components Meta Platforms (META, +4.4%) and Netflix (NFLX, +2.7%). Energy (+2.5%) also outperformed as U.S. crude futures bounced 3.9% to $86.79 per barrel.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

As for the major indexes, the Nasdaq Composite's 2.1% rally to 12,112 outpaced its peers. Still, the S&P 500 Index (+1.5% to 4,067) and the Dow Jones Industrial Average (+1.2% at 32,151) ended with solid gains as well.

Other news in the stock market today:

- The small-cap Russell 2000 spiked 2% to 1,882.

- Gold futures rose 0.5% to finish at $1,728.60 an ounce.

- Bitcoin surged 9.9% to $21,278.60. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Kroger (KR) gained 7.4% after the grocery store chain reported earnings. In its second quarter, KR recorded higher-than-expected earnings of 90 cents per share and revenue of $34.6 billion. Same-store sales jumped 5.8%, beating the consensus estimate. Still, CFRA Research analyst Arun Sundaram kept a Sell rating on KR stock, saying its recent outperformance is unsustainable. "Fuel margins will likely normalize over time, while KR's major top-line benefit over the last several quarters (i.e., higher food prices) will likely fade as comps get tougher and promotional activity increases," Sundaram says. "We see wage pressures continuing in fiscal 2023, which, along with weaker identical sales growth, will likely lead to weaker operating margins next year."

- DocuSign (DOCU) was another post-earnings winner, jumping 10.5% after its results. The e-signature company reported second-quarter earnings of 44 cents per share on $622.2 million, more than analysts were expecting. DOCU also said billings were up 9% in the three-month period to $647.7 million. But it wasn't enough to convince UBS Global Research analyst Karl Keirstead, who kept a Neutral (Hold) recommendation on DOCU. "In our view, DocuSign's valuation multiples don't look compelling yet given the single-digit growth outlook and high total addressable market penetration," Keirstead says.

4 Ways to Spend $1,000

How would you spend $1,000? We took this question to the editors of Kiplinger's Personal Finance Magazine to see what advice they would give on how to spend, save and invest a thousand bucks. For those wanting to level up their philanthropy game, there are plenty of ways to use that money, including donating to Kiva, an impact investing platform that facilitates crowdfunded loans to entrepreneurs.

Opportunities for investors are also abundant. Those just getting started on their investment journeys might consider opening roboadviser accounts. These services, which are offered by most banks and brokerage firms, offer low-cost, computer-driven investment management. For those looking to put $1,000 straight into to their portfolios, we've got you covered, too. One option is to take advantage of stock slice programs that let folks buy fractional shares of expensive companies. Investors might also want to consider small-cap stocks. It's been a rough year for this corner of the market, but history shows that stocks with smaller market values can still outperform for patient investors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.