Stock Market Today: S&P, Nasdaq Rack Up Longest Weekly Win Streak of 2022

Preliminary data from the University of Michigan indicated consumer sentiment is improving in August.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Stocks closed out the week with a bang Friday, boosted by an encouraging reading on consumer sentiment.

Ahead of today's opening bell, the University of Michigan said its preliminary consumer sentiment index rose to 55.1 in August from July's final reading of 51.5. However, the data also showed that 48% of survey respondents believe inflation is negatively impacting their living standards.

"Consumers are nervous about spending on big ticket items and are increasingly convinced that now is a bad time to buy a vehicle or a major household item," says Jeffrey Roach, chief economist at independent broker-dealer LPL Financial. "Consumer spending will likely slow in the near term."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Investors will get a closer look at consumer data next week with July's retail sales figures due out Thursday morning, and a heavy dose of retailers on the earnings calendar. While their quarterly results will reveal details on consumer spending during the second quarter, post-report earnings calls with analysts could shed more light on current conditions.

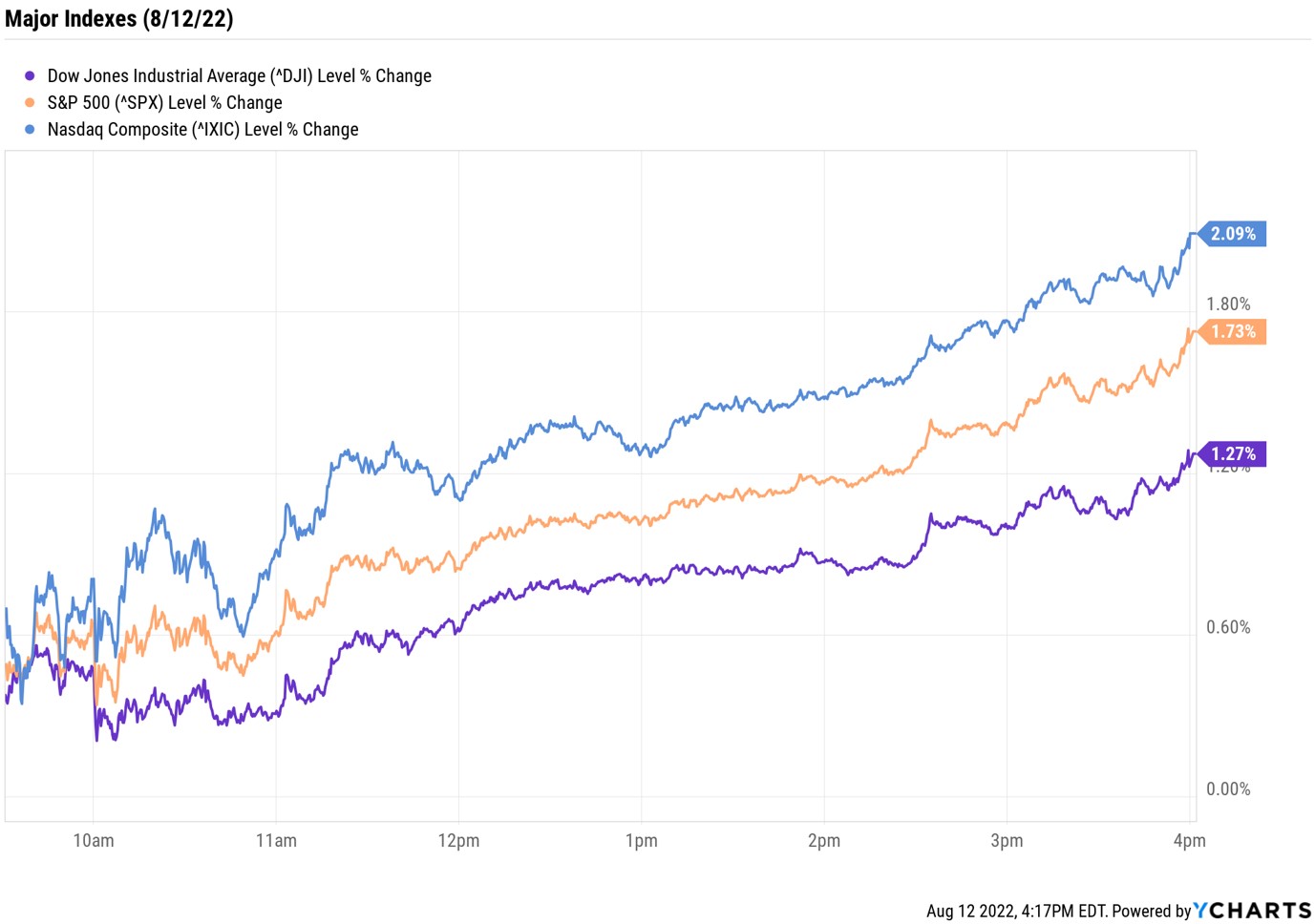

Today's broad-based rally was led by strong performances in the technology (+2.0%) and communication services (+1.8%) sectors. As such, the tech-heavy Nasdaq Composite outpaced its peers, jumping 2.1% to 13,047. The S&P 500 Index gained 1.7% to 4,280 and the Dow Jones Industrial Average added 1.3% to 33,761. The Nasdaq and S&P closed higher for a fourth straight week, the longest such streak since November.

Other news in the stock market today:

- The small-cap Russell 2000 surged 2.1% to 2,016.

- U.S. crude futures fell 2.4% to finish at $92.09 per barrel.

- Gold futures rose 0.5% to end at $1,815.50 an ounce.

- Bitcoin slipped 0.1% to $24,175.21. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Peloton Interactive (PTON) jumped 13.6% after the treadmill maker said it is cutting almost 800 jobs and closing stores across North America in order to cut costs. "These are hard choices because we are impacting people's lives," Peloton CEO Barry McCarthy wrote in a memo that was released to several media outlets, include CBS News. "We simply must become self-sustaining on a cash flow basis." McCarthy, who took over the top spot in February, also said PTON is raising prices on both its Bike+ and Peloton Tread.

- It was a volatile session for Rivian (RIVN) which was up more than 4% at one point and down more than 4% at another, before shares settled with a modest 0.1% loss. This was in reaction to the electric vehicle (EV) maker's second-quarter earnings report which showed a narrower-than-expected loss of $1.62 per share on higher-than-anticipated revenue of $364 million. The company also said it will likely post a wider loss than initially anticipated in its full fiscal year, as well as capital expenditures totaling $2 billion versus the $2.6 billion it previousy guided for. "RIVN and other EV names have gotten a boost from the expected passage of the Inflation Reduction Act, but it is unclear how many customers would be able to claim the proposed $7,500 federal tax credit given RIVN's recent price hikes and a requirement that electric trucks/SUVs have MSRPs under $80K," says CFRA Research analyst Garrett Nelson. "We remain at a Hold, seeing risks to its 2022 production guidance and have concerns about its cash burn."

The Best Value in REITs Right Now

Although the real estate sector struggled in the first half of 2022, it – like the rest of the stock market – is attempting to recover some of its steep year-to-date losses. Since July 1, the sector is up more than 9%, which is great news for those invested in real estate investment trusts (REITs).

Investors should also be encouraged by the attractive yields on offer by the sector. At the end of July, REITs sported an average dividend yield of 3.2% – more than double that of the S&P 500 – according to Nareit, a leading global producer of REIT investment research.

And thanks to a selloff early in the year, there are plenty of bargains to be found among these high-yielding real estate stocks. Investors stand to benefit in two ways by scooping up value REITs. For starters, discounted shares have the potential to generate outsized price appreciation on a rebound. At the same time, dividend-paying stocks can further juice total returns. With that in mind, we took a look at 10 REITs that have experienced significant share price declines in 2022, yet still offer sturdy fundamentals and healthy dividends. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.