Stock Market Today: Stocks Resume Rally on Strong Earnings, Economic Data

The ISM services index and the latest reading on factory orders both came in higher than expected.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

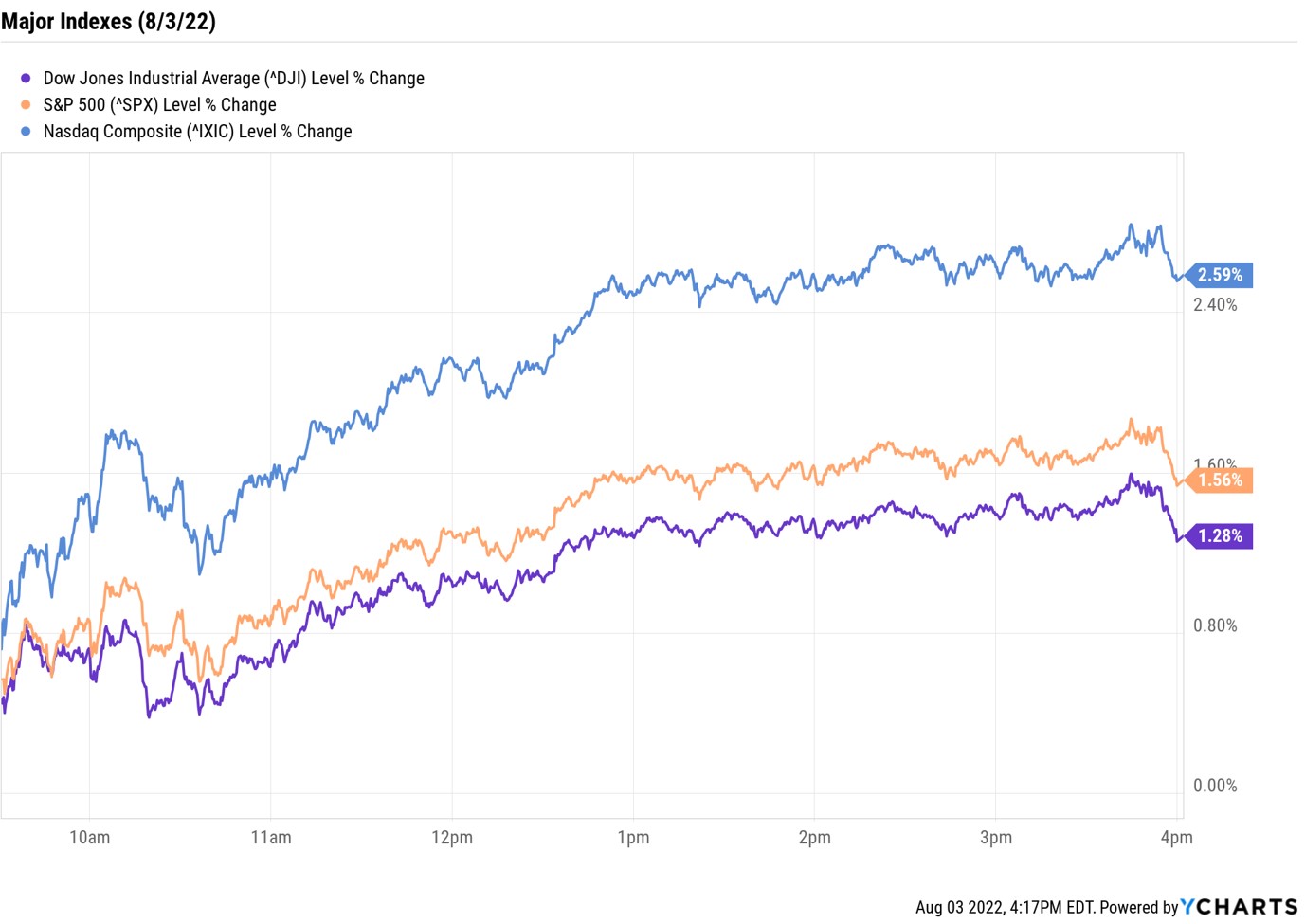

The major market indexes ran higher right from the start on Wednesday – and never looked back.

Helping boost investor sentiment were a pair of economic reports that indicated the U.S. economy is still growing. Data from the Institute for Supply Management this morning showed business activity in the services sector hit a three-month high of 56.7% in July.

"The ISM services index not only defied the consensus expectation for a decline, but rose by the most in five months in July," says Wells Fargo senior economist Tim Quinlan. "A jump in new orders bodes well for coming demand, and an array of measures suggests supply chain pressures continue to ease."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A separate report showed factory orders were up 2% month-over-month in June, more than economists were expecting.

A heavy dose of well-received corporate earnings reports added to the bullish buzz. Among the day's big post-earnings winners were drugmaker Moderna (MRNA, +16.0%) and fintechs PayPal Holdings (PYPL, +9.3%) and SoFi Technologies (SOFI, +28.4%).

Technology was the best-performing sector today, surging 2.7%. As such, the tech-heavy Nasdaq Composite outpaced its peers, rising 2.6% to 12,668. Still, the S&P 500 Index (+1.6% at 4,155) and Dow Jones Industrial Average (+1.3% at 32,812) posted solid gains. It was the first win this week for all three indexes.

Other news in the stock market today:

- The small-cap Russell 2000 spiked 1.4% to 1,908.

- U.S. crude futures plummeted 4% to finish at $90.66 per barrel after the Energy Information Administration posted a surprise rise in U.S. crude and gasoline inventories.

- Gold futures snapped their five-day winning streak, shedding 0.7% to end at $1,776.40 an ounce.

- Bitcoin rose 2.2% to $23,462.92. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Robinhood Markets (HOOD) jumped 11.7% today after the financial services platform said it was slashing its global workforce by roughly 23%, with most of the layoffs occurring in the operations, marketing and program management divisions. CEO Vlad Tenev said the cuts come amid a "deterioration of the macro environment, with inflation at 40-year highs accompanied by a broad crypto market crash." The company also reported a slimmer-than-expected per-share loss of 34 cents in its second quarter, while revenue of $318 million came in above the consensus estimate. While the layoffs are the headline of the report, says Mizuho Securities analyst Dan Dolev (Buy), the fundamentals show more positives than negatives – including higher quarter-over-quarter sales and average revenue per user. "We believe that once the market digests the 'shock' from the layoff's sheer size, investors will shift focus to fundamentals and path to profitability, which may even result in the stock trading higher tomorrow," Dolev adds.

- Not all of today's earnings reactions were positive. Match Group (MTCH) tumbled 17.6% after the online dating app provider reported lower-than-anticipated revenue of $795 million for its second quarter. The company also gave weak current-quarter revenue guidance and said Tinder CEO Renate Nyborg is leaving. Still, Jefferies analyst Brent Thill maintained a Buy rating on MTCH stock. "In our view, third-quarter revenue guidance is likely conservative to account for potential disruptions," Thill says. "We believe the new [Match Group] CEO Bernard Kim's heightened focused on faster product innovation, an expedited Hinge international rollout and improving monetization at Tinder will be key catalysts for driving accelerating revenue growth in fiscal 2023."

Don't Give Up on Bonds Just Yet

Long live the 60-40 portfolio! So says Douglas Beath, global investment strategist for Wells Fargo Investment Institute.

Many pundits have declared the traditional portfolio structure – which dictates you allocate 60% to stocks and 40% to bonds – as obsolete following a more than 16% decline in both the S&P 500 and the Bloomberg U.S. Aggregate Bond Index in the first half of 2022.

But Beath says that while "this year in capital markets is unusual," such calls are "greatly exaggerated," and in fact the 60-40 portfolio "will continue to be an effective strategy for investors." The strategist points to historical returns of bonds, which have provided a "significant hedge" during periods of market volatility, as well as attractive valuations following the recent downturn. And this is why the model is alive and well and continues "to serve as a solid foundation for long-term investors."

While investing in individual bonds is impractical for most retail investors, bond funds and bond ETFs allow them to gain exposure to fixed-income assets. Here, we've compiled a list of the 10 bond funds to buy now that cover a wide variety of categories and create diversification for income investors.

Karee Venema was long HOOD as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.