Stock Market Today: Stocks Erase Early Lead to End Lower

A round of well-received bank earnings boosted the stock market to start Monday, but investors' enthusiasm waned as the day wore on.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

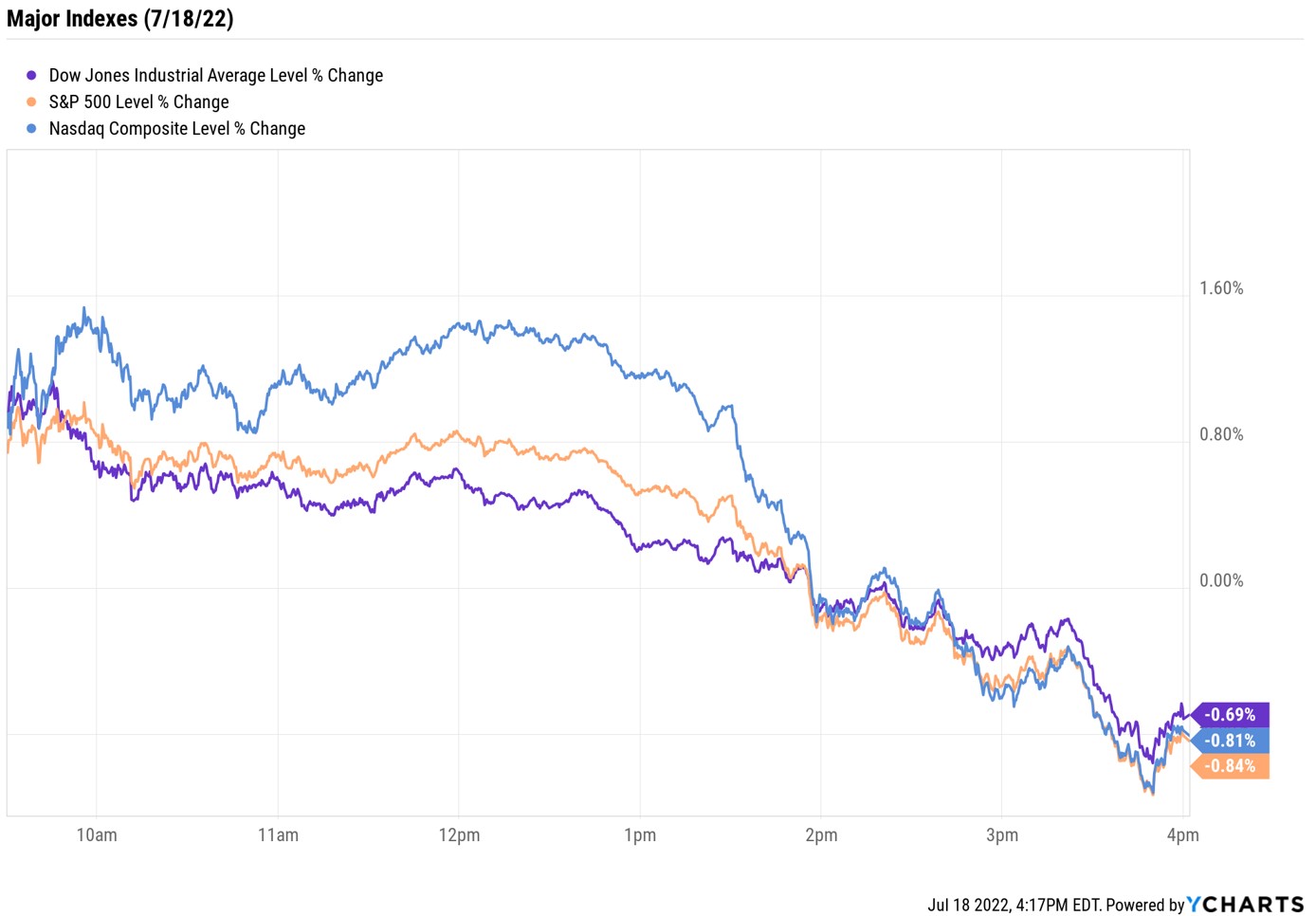

The major indexes opened Monday solidly higher amid a round of well-received bank earnings, but chipped away at these gains to eventually end lower.

Garnering the most attention from this morning's earnings calendar was Goldman Sachs (GS, +2.5%), which reported double-digit percentage declines in its top and bottom lines, though both figures beat analysts' consensus estimates. The blue-chip financial firm also said Q2 trading revenue soared 32% year-over-year to $6.5 billion – offsetting a 41% decline in investment banking revenue.

Also in focus today was the National Association of Home Builders (NAHB)/Wells Fargo housing market index – a measure of builder confidence – which fell to 55 in July from 67 in June, its seventh-straight decline and biggest month-over-month drop since April 2020.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Most concerning, traffic of prospective buyers fell to the lowest since May 2020, suggesting that the housing market has more downside to go as interest rates trek higher and inflation chisels away consumer purchasing power," says Jeffrey Roach, chief economist for independent broker-dealer LPL Financial.

A continued slowdown in the residential real estate market "hinges on the duration of historic inflationary pressures for homebuilders from high raw material prices and a tight labor market," Roach says.

After being up as much as 1.5% earlier, the Nasdaq Composite ended the day down 0.8% at 11,360. The Dow Jones Industrial Average and S&P 500 Index also erased early leads to close lower (-0.7% at 31,072; -0.8% at 3,830).

Other news in the stock market today:

- The small-cap Russell 2000 fell 0.3% to 1,738.

- U.S. crude futures jumped 5.1% to settle at $102.60 per barrel.

- Gold futures rose 0.4% to finish at $1,710.20 an ounce.

- Bitcoin climbed 2.2% to $21,600.70. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Bank of America (BAC, +0.03%) reported a 32% year-over-year decline in earnings to 73 cents per share in its second quarter, due in part to a $523 million credit-loss provision. On an adjusted basis, the bank recorded earnings of 78 cents per share. Revenue rose 5.6% to $22.8 billion, while net interest income jumped 22% to $12.4 billion. "We were positive on the net interest income, which was driven by higher net interest margin," says David Wagner, portfolio manager at investment firm Aptus Capital Advisors. "While trading and investment banking revenues appear a little light relative to peers that have reported already, positive year-over-year operating leverage (even including the regulatory charges) supports our belief that the advantages of scale will differentiate BAC in the medium-term."

- Energy stocks rallied alongside crude oil prices today. Among the big gainers were ConocoPhillips (COP, +2.6%), Devon Energy (DVN, +3.6%) and Marathon Oil (MRO, +3.5%).

What to Watch For This Earnings Season

The second-quarter earnings calendar really gets rolling this week. While financial stocks like Goldman have been the main focus so far, over the next several weeks, we'll begin to see how other sectors fared during a period that included inflation rising at its fastest pace in 40 years and the Federal Reserve initiating its most aggressive rate-hiking cycle in almost three decades.

Megan Horneman, chief investment officer for independent financial firm Verdence Capital Advisors, highlights several things investors should watch for this earnings season, including updates on the supply chain. "The global supply chain has been a hamper to earnings as materials are not available to make products to sell," she says. "What we will be watching closely is sentiment around the global supply chain and any more indication of companies that may have overstocked and face an inventory overhang."

Horneman adds that the impact of the foreign exchange markets on Q2 earnings will also be noteworthy, particularly as the U.S. dollar index climbed 6.5% over the three-month period. "Currency markets are an important factor to consider when analyzing earnings, especially for those multinational corporations," she says. "A strong U.S. dollar not only makes American goods less competitive, but when the foreign currency is converted back into U.S. dollars, it can serve as a drag on earnings."

Indeed, forex headwinds could be the "swing factor" for healthcare giant Johnson & Johnson's (JNJ) Q2 earnings report says BofA Global Research analyst Geoff Meacham. JNJ reports before tomorrow's open and is one of several companies whose quarterly earnings we're previewing, including Twitter (TWTR), which has been at the center of much drama over Elon Musk's aborted takeover attempt.

Karee Venema was long BAC as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.