Stock Market Today: Energy Dampens Dow, FAANGs Elevate Nasdaq

Recessionary fears weighed on oil and economically sensitive sectors Tuesday, while declining Treasury yields lifted tech-esque stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

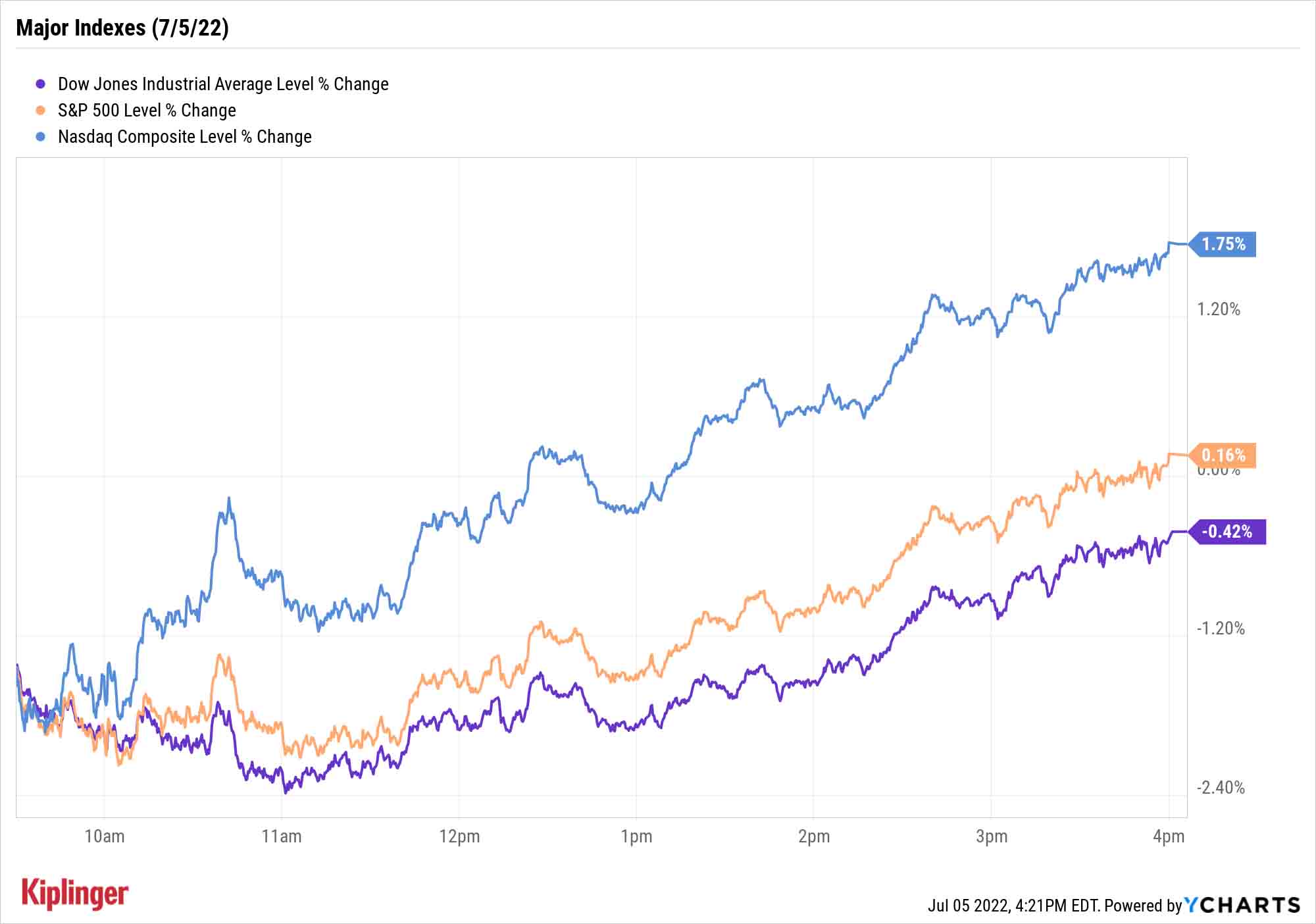

The first session of the holiday-shortened week was a wild one, as a deep Tuesday morning dip evolved into a severely split market featuring pockets of red and green alike.

On one side, you had big dips in economically sensitive sectors. Energy (-4.0%) fared the worst thanks to a drastic decline in U.S. crude oil futures, which plunged 8.2% to $99.50 – the commodity's lowest finish in more than two months.

"This move came on the back of an ever-increasing number of economic indicators (Goldman Sachs US Financial Conditions Index, Citi US Economic Surprise Index, ISM orders) now pointing to sustained weakening of financial conditions as well as Street expectations," says Michael Reinking, senior market strategist for the New York Stock Exchange.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also weighing on oil was a strengthening U.S. dollar, which closed the session at a 19-year high. (Remember: Oil is priced in U.S. dollars, so a strong dollar will weigh on oil prices, and vice versa.) The aforementioned worries of weakness hampered other sectors, too, including materials (-2.0%) and industrials (-1.5%).

"Shifting to a more near-term view, with commodity prices coming a bit back down to reality, some investors may view this as a welcome sign that inflation is beginning to cool – the main driver of recent volatility," adds Chris Larkin, managing director of trading for E*Trade.

However, other parts of the market – namely, those pinned to the ground by rising interest rates – came off the mat as recent weakness in Treasury yields continued.

The 10-year T-note yield fell as low as 2.78% on Tuesday, sending communication services (+2.4%) and consumer discretionary (+2.2%) stocks higher. Facebook parent Meta Platforms (META, +5.1%), Google parent Alphabet (GOOGL, +4.2%) and Amazon.com (AMZN, +3.6%) – all members of the "FAANGs" – were among the session's noteworthy winners.

That resulted in markedly divergent results among the major indexes, which all finished well off their morning lows. The Dow Jones Industrial Average, led lower by Chevron (CVX, -2.6%), dipped 0.4% to 30,967, while the S&P 500 finished with a tame 0.2% uptick to 3,831. The Nasdaq Composite, however, popped 1.8% to 11,322.

Other news in the stock market today:

- The small-cap Russell 2000 gained 0.8% to 1,741.

- Gold futures, also weighed down by a strong dollar, closed off 2.1% to $1,763.90 per ounce, marking their lowest settlement of 2022.

- Bitcoin strengthened as the day went on, recovering by 5.4% to $20,397.00. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

Buy the Dip in Emerging Markets?

Inflationary pressures (and related stock-market pain) are hardly exclusive to investors in U.S. equities. For instance, the iShares MSCI Emerging Markets ETF (EEM) – one of the most popular funds holding emerging markets stocks – entered bear-market territory this year and is currently off 19% year-to-date.

Like with anything that's down, investors might put EMs on their buy-the-dip list. BofA Securities does warn that a comeback isn't necessarily imminent – but emerging markets won't be down forever.

"We stay bearish into the summer but see emerging long-term value. Don't turn bullish before central banks panic about recession more than inflation," say BofA's David Hauner and Claudio Irigoyen. But they add that "2023 is starting to come into focus: it might get better for EM. The EM-US growth differential is one of the more reliable top-down indicators. For 2023, our mid-year forecast update implies the best such number in a decade."

Thus, investors would do well to at least start building their EM wish lists.

But if you find individual names to be a bit too risky, emerging markets mutual funds allow you to enjoy some of this category's explosive upside while decreasing the chances that a single-stock blow-up will torpedo your portfolio. We look at five top emerging market funds.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.